Appendix - Harvard University

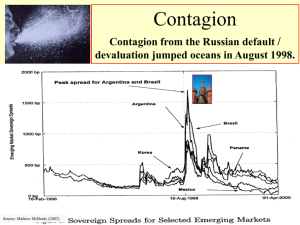

advertisement

Lecture 22: Crises in Emerging Markets Appendices • (1) IMF country programs • (2) An implication of contractionary devaluation • (3) The car crash analogy • (4) Currency wars • (5) More on predicting crises • (6) EM conditions in 2014 Appendix 1: Major IMF Country-Programs Usual 3 components • Country reforms (“conditionality”): – – • macro policy (often devaluation & expenditure-reduction) & perhaps structural (in 1990s; controversial). Financing from IMF. – • “Stamp of approval” is as important as its money, or more so. Private Sector Involvement: “bailing in” lenders rather than “bailing out” – – Rolling over loans, standstills, re-profiling (stretching out maturities), default, haircuts, restructuring, debt-equity swaps, write-downs… Why were the real effects of the East Asia currency crises so severe? • High interest rates raise default probability. The IMF may have over-done it – according to J.Furman & J.Stiglitz; and S.Radelet & J.Sachs; both in Brookings Panel on Ec. Activity (1998). • Devaluation may be contractionary. • Possible channels include: • real balance effect & • balance-sheet effect. Would some other combination of devaluation vs. monetary contraction in the 1990s crises have better maintained internal and external balance? Textbook version: When external balance shifts out, there exists an optimal combination of devaluation and interest rate rise that will satisfy external finance constraint without causing recession. 1998 version: Apparently there existed no such combination, if reserves have been allowed to run low and $ debt to run high. Textbook version: there exists a combination of devaluation and interest rate rise that will satisfy external finance constraint without causing recession. API-120 - Macroeconomic Policy Analysis I . Jeffrey Frankel, Harvard University Lesson-of-1998 version: There may exist no combination that avoids recession, if reserves have already been allowed to run low and dollar debt to run high. ? ? API-120 - Macroeconomic Policy Analysis I , Professor Jeffrey Frankel Harvard University Appendix 3: The Car Crash Analogy [Might cover at end of semester, L25, instead] Sudden stops: “It’s not the speed that kills, it’s the sudden stops” – R.Dornbusch Superhighways: Modern financial markets get you where you want to go fast, but accidents are bigger, and so more care is required. – R.Merton THE CAR CRASH ANALOGY, continued Is it the road or the driver? Even when many countries have accidents in the same stretch of road (Stiglitz), their own policies are also important determinants; it’s not determined just by the system. – L.Summers Contagion also contributes to multi-car pile-ups. THE CAR CRASH ANALOGY, continued Moral hazard -- G7/IMF bailouts that reduce the impact of a given crisis, in the LR undermine the incentive for investors and borrowers to be careful. Like air bags and ambulances. But to claim that moral hazard means we should abolish the IMF would be like claiming that drivers would be safer with a spike in the center of the steering wheel column. – M.Mussa Correlation does not imply causation: That the IMF (doctors) are often found at the scene of fatal accidents (crises) does not mean that they cause them. Reaction time: How the driver reacts in the short interval between appearance of the hazard and the moment of impact (speculative attack) influences the outcome. Adjust, rather than procrastinating (by using up reserves and switching to short-term $ debt) – J.Frankel Optimal sequence: A highway off-ramp should not dump high-speed traffic into the center of a village before streets are paved, intersections regulated, and pedestrians learn not to walk in the streets. So a country with a primitive domestic financial system should not necessarily be opened to the full force of international capital flows before domestic reforms & prudential regulation. => There may be a role for controls on capital inflow (speed bumps and posted limits). -- Masood Ahmed Appendix 4: Currency wars Brazil’s Finance Minister Guido Mantega complained in 2010 about Fed easing. India’s Central Bank Governor Raghuram Rajan complained in 2014 about Fed tightening. Origin of phrase “Currency Wars” • Warning from Mantega: “We’re in the midst of an international currency war, a general weakening of currency. This threatens us because it takes away our competitiveness” (9/27/2010). • I.e., countries everywhere are trying to push down the value of their currencies, to gain exports & employment, – a goal that is not globally consistent. 12 “Currency wars” must be another way of saying “competitive devaluation” • – a kind of beggar-thy-neighbor policy • to use language of the 1930s, • one motive at Bretton Woods for fixed exchange rates; – or “manipulating exchange rates…to gain an unfair competitive advantage over other members…” • to quote from IMF Article IV(1)iii. 13 • If US unemployment is high & inflation low, the Fed will naturally choose an easy monetary policy (low i). • If the macroeconomic situation is the reverse in Brazil, its central bank will naturally choose a tight monetary policy (high i). • Also naturally, capital will flow from the US to Brazil and will in turn appreciate the Real. • But that is the beauty of floating rates. 14 Rajan complains about Fed tightening. • “International monetary cooperation has broken down… The U.S. should worry about the effects of its policies on the rest of the world,” 1/30/14. • “Central banks should assess spillover effects from their own actions… • For example, this would mean that while exiting from unconventional policies, central banks would pay attention to conditions in emerging markets… • [T]he Fed policy statement in January 2014, with no mention of concern about the emerging market situation, and with no indication Fed policy would be sensitive to conditions in those markets sent the probably unintended message that those markets were on their own.” 4/10/2014 (Brookings) US Congressional failure to approve IMF reform • In one respect, at least, China, India & Brazil are right to complain: the lack of proportionate representation in international agencies. • Congress refuses to pass the bill updating the allocations of IMF quotas among member countries. • Quotas allocations in the IMF determine both monetary contributions of the member states and their voting power. • The agreement among the IMF members had been to allocate greater shares to big EM countries, – coming primarily at the expense of European countries. Appendix 5: More on predicting crises (i) Definitions (CA reversal, sudden stop, speculative attack…) (ii) Predicting the 1994 Mexican peso crisis (iii) Studies of Early Warning Indicators (i) Definitions of external financing crises • Current Account Reversal disappearance of a previously substantial CA deficit • Sudden Stop sharp disappearance of private capital inflows, reflected (esp. at 1st) as fall in reserves & (soon) in disappearance of a previous CA deficit. Often associated with recession. • Speculative attack sudden fall in demand for domestic assets, in anticipation of abandonment of peg. Reflected in combination of s - res & i >> 0. (Interest rate defense against speculative attack might be successful.) • Currency crisis Exchange Market Pressure s - res >> 0. • Currency crash s >> 0, e.g., >25%. • But falls in securities prices & GDP are increasingly relevant. References • Current account reversals – Edwards (2004a, b) and Milesi-Ferretti & Razin (1998, 2000). • Sudden stops – References: Dornbusch & Werner (1994), Dornbusch, Goldfajn & Valdes (1995); Calvo (1998), Calvo, Izquierdo & Mejia (2003), Calvo (2003), Calvo, Izquierdo & Talvi (2003, 2006), Calvo & Reinhart (2001), Calvo, Izquierdo & LooKung (2006), Calvo, Izquierdo & Loo-Kung (2006); Caballero & Krishnamurthy (2004); Edwards (2004); Guidotti, Sturzenegger & Villar (2004); Levchenko & Mauro (2006); Arellano & Mendoza (2002), and Mendoza (2002, 2006, 2010). (ii) More on predicting crises The early 1990s Calvo, Leiderman & Reinhart predict the peso crisis In the 1990s, capital inflows financed current account deficits. Calvo, Leiderman & Reinhart: Source of capital flows was low i* at least as much as local reforms (push vs. pull) => Could reverse as easily as in 1982. Dornbusch (1994) said the Mexican peso was overvalued. (iii) Early Warning Indicators of Currency Crashes Sachs, Tornell & Velasco (1996): Combination of weak fundamentals (Δ RER or credit/GDP) and low reserves made countries vulnerable to tequila contagion. Frankel & Rose (1996): Composition of capital inflow matters (more than the total): short-term bank debt raises the probability of crash; FDI & reserves lower the probability. Kaminsky, Lizondo & Reinhart (1998): Best predictors: M2/Res, Real Exchange Rate. Berg, Borensztein, Milesi-Ferretti, & Pattillo (1999), They don’t hold up as well out-of-sample. Edwards (2002): CA ratios of some use in predicting crises (excl. Africa), contrary to earlier research. Rose & Spiegel (2009): No robust predictors for who got hit by GFC in 2008-09. Dominguez & Ito (2012) and Frankel & Saravelos (2012): Reserves do work to predict who got hit, as in earlier studies. Predictive performance of Early Warning indicators in the1990s crises. Berg, et al, (1999) did find that if warning indicator equation sounded an alarm, probability of crisis was 70-89%; but were generally pessimistic on the ability at each round to predict the next crisis. Are big currentaccount deficits dangerous? Neoclassical theory: if a country has a low capital/labor ratio or transitory negative shock, a large CAD can be optimal. In practice: Developing countries with big CADs often get into trouble. Traditional rule of thumb: “CAD > approx. 4% GDP” is a danger signal “Lawson Fallacy” -- CAD not dangerous if government budget is balanced, so borrowing goes to finance private sector, rather than BD. Amendment after Mexico crisis of 1994 – CAD not dangerous if BD=0 and S is high, so the borrowing goes to finance private I, rather than BD or C. Amendment after East Asia crisis of 1997 – CAD not dangerous if BD=0, S is high, and I is well-allocated, so the borrowing goes to finance high-return I, rather than BD or C or empty beach-front condos (Thailand) & unneeded steel companies (Korea). Amendment after GlobalFinancialCrisis of 2008-13 – CAD dangerous. The IMF and Rose & Spiegel (2009) found that countries with more reserves were not less affected by the 2008-09 crisis: IMF Survey Magazine Oct.8, 2009 “Did Foreign Reserves Help Weather the Crisis?” by O. Blanchard, H.Faruqee, & V.Klyuev http://www.imf.org/external/pubs/ft /survey/so/2009/num100809a.htm But Frankel & Saravelos (2012) and Dominguez & Ito (2012) find they were. Appendix 6: EM conditions in 2014 EM stocks fell on fears of higher US interest rates in May-June 2013 & again in January 2014 Source: FT EMs have had to pay higher interest rates since the taper tantrum of 2013, but conditions eased a bit after April 2014. From IMF WEO: Legacies, Clouds, Uncertainties, Oct. 2014. Asia is still doing pretty well. From IMF WEO: Legacies, Clouds, Uncertainties, Oct. 2014. Capital flows recovered after the taper tantrum. From IMF WEO: Legacies, Clouds, Uncertainties, Oct. 2014. IMF WEO, Oct. 2014.