Marginalist Revolution/Marshall

advertisement

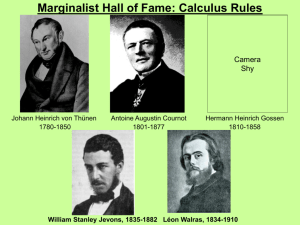

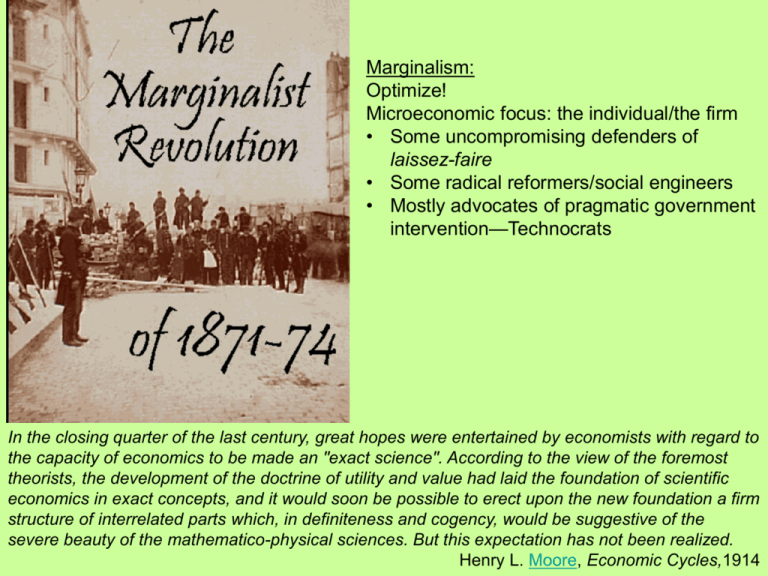

Marginalism: Optimize! Microeconomic focus: the individual/the firm • Some uncompromising defenders of laissez-faire • Some radical reformers/social engineers • Mostly advocates of pragmatic government intervention—Technocrats In the closing quarter of the last century, great hopes were entertained by economists with regard to the capacity of economics to be made an "exact science". According to the view of the foremost theorists, the development of the doctrine of utility and value had laid the foundation of scientific economics in exact concepts, and it would soon be possible to erect upon the new foundation a firm structure of interrelated parts which, in definiteness and cogency, would be suggestive of the severe beauty of the mathematico-physical sciences. But this expectation has not been realized. Henry L. Moore, Economic Cycles,1914 Marginalist Revolution … 1871 • Marx (1868) BIG Picture … Trajectory of capitalism • Capitalism self-destructs • 1871: Jevons, Walras, Menger…professional economists A revolution in thought and approach? Or an evolution? Nothing was overthrown • Utility, not cost-of-production • Allocation/Optimization within circular flow framework • Precursors: von Thünen, Cournot, Dupuit, GOSSEN…amateurs • Optimization in particular applications/partial analysis • Precursors to precursors: • Aristotle: utility value • Bernoulli (1738): diminishing MU of income – Reiterated by Bentham • Galiani (1751): Value ≈ Utility x Scarcity (solves diamond:water “paradox”) • Condillac (1776): Industry & commerce utility (not just agriculture) • Say (1803): Entrepreneur’s concern with consumer wants utility • Senior (1834): diminishing (marginal) utility in consumption as well as diminishing returns in production • Lloyd (1834): Cardinal utility MU Marginalist Hall of Fame: Calculus Rules Johann Heinrich von Thünen 1780-1850 Antoine Augustin Cournot 1801-1877 Jules Dupuit 1804-1866 Camera Shy Hermann Heinrich Gossen 1810-1858 William Stanley Jevons, 1835-1882 Léon Walras, 1834-1910 Marginalist Hall of Fame: Neoclassical Economics Vilfredo Pareto 1848-1923 Philip H. Wicksteed 1844-1927 Francis Ysidro Edgeworth 1845-1926 Knut Wicksell 1851-1926 John Bates Clark 1847-1938 Irving Fisher 1867 – 1947 The Marginalist Revolution: A Short Tour • Johann Heinrich von Thünen, The Isolated State with respect to agriculture and the national economy, 1826. • Explicit optimization: agricultural production/intensity as function of distance Spatial economics • MPL x Pnet of xport cost = w MPL low close to city where Pnet high Land rent declines with distance from “city” • Marginal products and distribution: » von Thünen treats labor & capital symmetrically • If all workers paid MPL of last worker exploitation by employer • “Just” wage ≈ SQRT(ap) … falls between MPL and APL » a = subsistence wage » p = per capita output • August Cournot, Researches into the mathematical principle of the theory of wealth, 1838. • Profit maximization in competition, monopoly, and duopoly: MR = MC • Precursor of non-cooperative game theory: Duopolist acts in anticipation of opponent’s action reaction curves equilibrium between monopoly and competition The Marginalist Revolution: A Short Tour Jules Dupuit Engineer in charge of Paris’ public services On the Measurement of the Utility of Public Works, 1844 On Tolls and Transport Charges, 1849 • Utility measured as maximum money a person is willing to pay for successive quantities of a good (MUmoney assumed constant) downward sloping Demand Curve when MUgood is declining • Absolute utility (area under curve/consumer surplus) maximized when MU = 0 • Toll or tax deadweight loss that increases as square of tax Many small excise taxes (general sales tax) >> One large excise tax • Perfect price discrimination eliminates deadweight loss Practical price discrimination strategies • Railroad could give everyone first class treatment » But make third class passengers suffer • Avoid exploitation Public ownership of natural monopolies • Hermann Heinrich Gossen, Development of the Laws of Exchange Among Men, 1854. On the following pages I submit to public judgment the result of twenty years of meditation. What a Copernicus succeeded in explaining of the relationships of worlds in space, that I believe I have performed for the explanations of men on earth. Hermann Heinrich Gossen, Development of the Laws of Exchange among Men 1854 p.1 – Obscure amateur … Acknowledged by Jevons (Recall: Jevons also recovered Cantillon) • Gossen’s 1st Law: » Diminishing marginal utility allocation of resources, including time • Gossen’s 2nd Law: » Equilibrium where “the last atom of money creates the same pleasure in each pleasurable use.” » MUx/Px = MUy/Py The Marginalist Revolution: The Heavy Hitters • William Stanley Jevons, The Theory of Political Economy, 1871 “… to maximize pleasure is the problem of economics” • Constrained optimization in the face of diminishing marginal utility (the final degree of utility) relative prices depend on relative utilities – MU decreases with quantity (Gossen’s First Law) & with time/uncertainty – Equilibrium: MUx/px = MUy/py = MUz/pz (Gossen’s Second Law) • …the only hope of attaining a true system of Economics is to fling aside, once and for ever, the hazy and preposterous assumptions of the Ricardian School. Our English Economists have been living in a fool's paradise. • If, instead of welcoming inquiry and criticism, the admirers of a great author accept his writings as authoritative…the most serious injury is done to truth. In matters of philosophy and science, authority has ever been the great opponent of truth… In the republic of the sciences, sedition and even anarchy are beneficial in the long run… William Stanley Jevons, Theory of Political Economy, 1871 But • [Jevons's] success was aided even by his faults. For under the honest belief that Ricardo and his followers had rendered their account of the causes that determine value hopelessly wrong by omitting to lay stress on the law of satiable wants, he led many to think he was correcting great errors; whereas he was really only adding very important explanations. Alfred Marshall, Principles of Economics, 1890 Jevon’s World • It’s all pain-and-pleasure, a lá Bentham MU of good Output = Area Under Curve Qty Q* where MUgood = - MUlabor Marginal Disutility of Effort Labor share Capital share MPK Kapital input • Jevon’s capital theory: Output as function of time (roundaboutness) Interest rate: i = F’(t)/F(t) so F’(t) = i F(t)… the marginal product of waiting pays the interest on current output (think of whether to cut down a tree) Marginal productivity theory: Capital is paid MPK • Léon Walras, Elements of Pure Economics,1874,1877 General Equilibrium: Cantillon/Quesnay interdependencies Tâtonnement: “Groping” for equilibrium…solve nonlinear simultaneous eqs. » Fixed coefficient technology…factor substitution not possible » “Auctioneer” announces and revises prices until all markets simultaneously clear » Quantities demanded and supplied equate relative marginal utilities to relative prices: MUx/MUy = px/py Gossen’s 2nd Law • Free competition maximum welfare, given factor endowments » Thems that gots gits Walras—Free market philosopher with socialist leanings: Nationalize Land! • Government roles: provision of public goods/control of natural monopolies/ property tax instead of income tax In fact, the whole world may be looked upon as a vast general market made up of diverse special markets where social wealth is bought and sold. Our task then is to discover the laws to which these purchases and sales tend to conform automatically. To this end, we shall suppose that the market is perfectly competitive, just as in pure mechanics we suppose to start with, that machines are perfectly frictionless. Leon Walras, Elements of Pure Economics, 1874 The Marginalist Revolution: Contributors • Vilfredo Pareto, Manuel d’économie politique, 1906, 1909 • Walras explained • Pareto’s Law of Income Distribution (people, not classes, get shares) » Log (Fraction w/income >= x) = - a Log x • Ordinal, not cardinal, utility for individual can’t compare across individuals • Pareto efficiency: if someone gains and no one loses, do it. Pareto efficient result: when no one can gain without someone else losing • Francis Ysirdo Edgeworth, Mathematical Psychics, 1881 • Indifference curves Edgeworth Box Contract Curves Edgeworth—a terrible lecturer: He didn’t mind an empty lecture room so long as he had a blackboard and a piece of chalk to work out his differential equations. Marginal Productivity Theory of Distribution Under competition, Wage = Marginal Value Productlabor = P x MPPlabor Wage theory strictly from demand side…still need Slabor – John Bates Clark … extended Ricardo’s marginal insight about rent to labor & capital … championed principle: to each according to his contribution (given his endowments) Capitalism Rocks – Phillip Wicksteed … established product exhaustion no exploitation • Wage Bill + Profit Bill = Value of Output wL + rK = (P * MPPLabor ) * L + (r * MPPKapital ) * K = P – Knut Wicksell …did it all first, but in Swedish and German 1880s Academic Controversies Rudolf Auspitz (1837-1906) and Richard Lieben (1842-1919) Researches on the Theory of Price, 1887,1889. – Austrian sugar refiner/Auspitz, Lieben & Co. private bank. • Mathematical formulation of supply and demand – Partial equilibrium analysis assuming constant MU of money – Identify consumer and producer surplus in trade (but not those terms) – Application to micro problems: substitutes and complements, indivisibilities, technical progress, securities markets, derivatives, inventory management • Work independent of Marshall, who had yet to publish – Edgeworth (@ Oxford) credited them above Walras – Highly regarded by Pareto, Fisher – Launhardt (@ Hannover Polytechnic – economics of transportation and location) accused them of plagiarizing Walras – Austrian School rejected their mathematical approach Marginalist Hall of Fame: Austrian School Carl Menger, 1841-1921 Eugen von Böhm-Bawerk, 1851-1914 Friedrich von Wieser, 1851-1926 The Marginalist Revolution: The Austrian School • Carl Menger, Principles of Economics (Grundsätze), 1871 • Civil servant tutor of Crown Prince professor appointed to Herrenhaus • Value established by loss principle: satisfaction of last unit – Subjective basis of value – reject objective basis – Given supply, where does price settle? No S – D adjustments • Realistic decisions about lumpy alternatives, not marginal adjustments • “Causal analysis” … calculus not needed/not welcome in Vienna Grundsätze • Goods of different orders: consumption goods are of 1st order – Need for higher order goods and their values derived from connection to 1st order goods – Subjective values of alternative goods viewed over time horizons and with different degrees of certainty • Allocate budget so last unit of each good bought yields equal satisfaction • Value of a good depends on its last use The Marginalist Revolution: The Austrian School Eugen von Böhm-Bawerk, Capital and Interest, 1884 Civil servantProfessor (Innsbruck)Finance inistryMinisterProfessor (Vienna) “Debate” with Marx: subjective value trumps labor value no exploitation … and Marx’s system doesn’t close: P’ – S’ conundrum B-B’s capital theory the rate of interest Explaining interest • Tendency to underestimate future wants • Tendency to overestimate future resources • Intertemporal role: Roundabout production increased productivity interest rate without reference to time preference The Marginalist Revolution: The Austrian School • Causal vs. mathematical analysis: – debates with Wicksell and Fisher (as well as Auspitz and Lieben) – B-B’s critique of Fisher’s theory of interest: it’s circular • it explains interest based on individual behavior (indifference curves and production possibilities) that itself depends on the rate of interest…while the rate of interest depends on the borrowing and lending behavior of individuals in the aggregate • Fisher’s response: it’s just the solution of simultaneous equations – B-B: Interest jointly determined with output, wages and capital intensity for a given capital stock (that’s implicitly dependent on time preference) • B-B implicitly used the simultaneous equations that he “rejected” • His denunciation of mathematics became a curse that condemned his followers to provincialism. Jürg Niehans The Marginalist Revolution: The Austrian School • Friedrich von Wieser, On the Origin and Principle Laws of Economic Value, 1884 • Marginal utility: Jevon’s “final degree of utility” Grenznutzen MU Austrian cost theory/Pricing factor services • Cost = Utility of 1st order goods foregone…opportunity cost concept • Utility + Technology Values of goods in equilibrium – Essentially demand and supply, but awkwardly avoided – Joint determination of outputs and shadow prices, obscured by causal analysis – Anticipation of linear programming Aside on Linear Programming • Leonid Kantorovich, Soviet “Economist”, Nobel Prize, 1975 • Tjalling Koopmans, Yale Economist, Nobel Prize, 1975 • George Danzig, Stanford Mathematician, No Prize A linear programming problem: Optimize subject to constraints Max 4 x1 + 5 x2 + 9 x3 + 11 x4 s.t. 1 x1 + 1 x2 + 1 x3 + 1 x4 = 15 Laborer-Days 7 x1 + 5 x2 + 3 x3 + 2 x4 = 120 Machine Hours 3 x1 + 5 x2 +10x3 + 15 x4 = 100 Lbs of Raw Material Note: fixed coefficient technology…factor substitution not possible Solution: Optimal program • how much x1, x2, x3 and x4 to produce • shadow prices of resources activities used in the solution operate at zero net profit activities not in solution would operate at a loss. The Marginalist Revolution: The Austrian School • Friedrich von Wieser, On the Origin and Principle Laws of Economic Value, 1884 • Marginal utility: Jevon’s “final degree of utility” Grenznutzen MU Austrian cost theory/Pricing factor services • Cost = Forgone utility…imputed opportunity cost • Utility + Technology Values of goods in equilibrium Essentially demand and supply, but awkwardly avoided Joint determination of outputs and shadow prices, obscured by causal analysis Anticipation of linear programming • B-B “loss principle”: price of commodity lost if factor withdrawn The Marginalist Revolution: The Austrian School • Austrian methodology: • Step-by-step human action, not equilibrium of supply and demand • Market as information processor price signals learning – von Mises – Lange debate: could economic planning work? » Lange won on logic » von-Mises won in fact • Austrians on socialism B-B: Socialist criticism of capitalism is really criticism of the human condition: the central problem of scarcity Wieser: Wants there would still be…the available means would still be insufficient for their full satisfaction; and the human heart would still cling to its possessions. All goods which were not free would be recognized as valuable; they would rank in value according to the relation in which the available stocks stood to the demand; and that relation would express itself finally in marginal utility…The elementary laws of valuation, as we have expressed them, would be effective for the whole community. From Keynes’ eulogy: [An economist] must be a mathematician, historian, statesman, philosopher – in some degree. He must understand symbols and speak in words. Keynes on Jevons – Marshall priority: [Jevon’s final utility] lives merely in the tenuous world of bright ideas … Jevons saw the kettle boil Alfred Marshall, 1842-1924 and cried out with the delighted • Student and teacher at Cambridge voice of a child; Marshall too had seen the kettle boil and sat down • Majored in math silently to build an engine. • Married Mary Paley, an economist • Teacher of teachers: Pigou, Keynes • …cool heads but warm hearts • Insecure in his writings: held back publication • Principles of Economics, 1890 (1st edition), 1920 (8th edition) • Neoclassical economics: marginalist – mathematical framework • Written for intelligent layman: graphs in footnotes; math in appendices • Account for the concrete: biological, not mechanical/mathematical, analogies Marshall’s Principles of Economics: Themes and Contents • • Economics … a study of mankind in the ordinary business of life...pecuniary focus Partial equilibrium analysis … representative agents and firms • Recognition of Walras’ general equilibrium framework • But focus on specific markets…constant MU of money…a “preliminary” analysis » Supply (costs) interact with demand (utilities) » Ceteris paribus conservative tilt: “Nature does not leap” (Marshall) • Supply and demand curves (the Marshallian cross) • Value determined by both blades of the scissors Walras used S-D w/axes reversed • • Consumer and producer surplus Reciprocal demand curves in trade (recall Mill) • Elasticity of demand value • Price decline increase in real income • Anticipates income and substitution effect analysis • Temporary, short-run and long-run supply – fixed and variable costs • Elasticity of supply increases with time » Value in short-run depends on demand » Value in long-run depends on supply • • Internal economies difficulties for competitive market paradigm External economies (of industry scale) quantity Adherent to Say’s Law “Classical” foil for Keynes in General Theory Pigou response: Pigou effect = “Real Wealth” Effect P down (M/P) up Automatic adjustment to full employment (?!?) Arthur Cecil Pigou 1877 - 1959 • Economics of Welfare, 1920 … Reform, not Revolution • Economies and diseconomies of production • Divergence between private and social costs and benefits Role for government » Make railroads liable for damage sparks do to forests » Subsidize smokeless smokestacks » Fine polluters Classical – Neoclassical Economics: An Aside Neoclassical Economics Classical Economics Smith – Ricardo/Malthus – Mill • • • • Labor theory of value Malthusian population Say’s law Quantity theory of money • Marshallian economics • Gossen/Jevons/Edgeworth • Microeconomics Physiocrats – Marx • Balanced growth/imbalance Concern: consequences of capitalist accumulation First Principles: • Price independent of demand » Labor theory of value • Natural (long-run) prices equalize rates of profit • Real wage = “subsistence” » Wage fund – Iron Law Concern: allocation of scarce resources First Principles: • Decision at margin • Prices determined by interaction of supply (costs) and demand (utilities) • Distribution accords with marginal productivities