Co-Tenants Speech

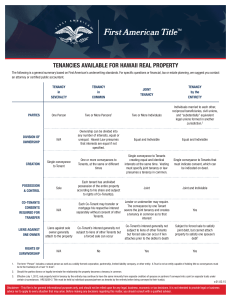

advertisement

Co-Tenants OWNERSHIP IN COMMON Defined – where owners of undivided fractional interest own shares and have unity of possession. The common right of several different owners to possess and use the same property. Not an estate in land, but a relationship between persons. Starr v. Dunbar, 69 S.W. 2d 86, (Tex.Civ.App.—Texarkana 1934, writ ref’d) Example – Owner dies leaving three children: A, B, and C. A, B, and C each own a one-third undivided interest. If 100 acre tract, their ownership extends to every portion of the property, but it is not a “divided” ownership 1/3 1/3 1/3 YES 1/3 1/3 NO 1/3 ORIGINATES •Intestate succession •Last Will and Testament •Two or more grantees at the same time (presumption of equal ownership) •Lessee of co-tenant becomes a co-tenant •Life tenant/remainderman are not cotenants •Conveyance of co-tenant of west third of 100 acre tract from A to E. •What does this mean? A conveys his one-third interest in 100 acres. Does not bind B or C’s rights. POWERS •Sell or mortgage interest without knowledge or consent of other cotenants •Possession of entire tract (without rent) •Can rent land out to third party (must account to other co-tenants for income) •All have duty to preserve the common property (not to commit waste) •Right to seek partition ADVERSE POSSESSION Possession by one co-tenant is not adverse to another co-tenant absent some repudiation, notice of adverse claim or ouster. This is because each co-tenant has unlimited right of possession Evans v. Covington, 795 S.W.2d 806, (Tex.Civ.App.-Texarkana 1990). Repudiation is any declaration or act clearly hostile to other co-tenants and inconsistent with their rights. Condra v. Grogan Mfg., Co., 233 S.W.2d 565, (Tex. 1950). Repudiation by a co-tenant in possession constitutes a trespass against the other co-tenants from which a cause of action for trespass to try title arises and recovery may include judgment for the right of possession. Ouster is a notorious and unequivocal act by which one co-tenant deprives another of common and equal possession and enjoyment of property. Sadler v. Duvall, 815 S.W.2d 285, (Tex.App.-Texarkana 1992). When a party acquires title which purports to convey the entire title to common land, such a conveyance constitutes ouster. Ouster requires more than simply possessing the land; it must be a hostile act and unequivocal so that the co-tenants become aware one co-tenant is claiming their interest. WASTE A co-tenant in possession who fails to properly protect the common property commits waste. Each co-tenant has a duty not to commit waste and is liable to his or her co-tenants for loss resulting from a breach of this duty. The failure of a co-tenant in possession to properly protect the common property amounts to an act of waste. Guffey v. Stroud, 16 S.W.2d 527, (Tex.Comm.App. 1929 Opinion Adopted) TIMBER RIGHTS Any co-tenant can sell or convey timber growing on the commonly held property and thereby pass good title to the timber. Green v. Crawford, 662 S.W.2d 123, (Tex.App.-Tyler 1984, writ ref’d n.r.e.) The seller has no duty to first acquire the consent of the other co-tenants because if consent were required, the seller would be denied the benefit of his/her use of the timber and would be required to have the property partitioned before exercising individual control over his/her interest. MINERAL CO-TENANT (TEXAS) General – State recognizes right of co-tenant to lease his undivided interest in, or to prospect and produce minerals from the common property without the consent of his co-tenants, and the production of oil and gas does not constitute waste. Burnham v. Hardy Oil Co., 147 S.W. 330 (Tex.Civ.App.-San Antonio 1912), aff’d 195 S.W. 1139 (Tex. 1917). Tynes v. Mauro, 860 S.W.2d 168, 176 (Tex.App.-El Paso 1993 writ denied). Hamman v. Ritchie, 547 SW2d 698 (Tex. App. – Fort Worth 1977, writ ref’d n.r.e.) Any co-tenant can lease his undivided interest. The lessee receives the estate from the lessor and takes the place of the lessor as the co-tenant. Does not owe non-joining co-tenants a fiduciary duty. Donnan v. Atlantic Richfield, 732 S.W.2d 715, 715 (Tex.App.-Corpus Christi 1987, writ denied). Reasoning “fugitive” nature of oil and gas permits development even though all cotenants have not been located owner of small interest cannot veto mining or drilling each co-tenant can fully exercise the incidents attached to his fractional share State of Texas encourages exploration of natural resources DRILLING ISSUES The non-leasing co-tenants have no right to oust the lessee or prevent the drilling although they can demand an accounting for their share of the net profits from the lessee, just as they can from an original cotenant. Garcia v. Sun Oil Co., 300 S.W.2d (Tex.Civ.App.Beaumont 1957) EXAMPLE NO. 1 A – 1/3 B – 1/3 C – 1/3 A and B lease to X Oil Company C is unleased X Oil Company can drill without C’s consent. X must initially pay all costs in connection with drilling and producing and must account to the other co-tenant (C) for the value of C’s respective interest in production. If dry hole, X is not entitled to reimbursement from C; even if production does result, non-participating co-tenant has no personal duty to pay his share of costs; drilling co-tenant may recoup only out of production. White v. Smyth, 214 S.W.2d 967, 975 (Tex. 1948). Can C get production in kind? Texas courts have not addressed that issue. Courts however have consistently indicated a nonjoining co-tenant can share in proceeds, but not production itself. Cox v. Davison, 397 S.W.2d 200 (Tex. 1965). The distinction is significant because the language seems to imply that the operating co-tenant must market the non-consenting co-tenant’s share along with its own mineral production. White v. Smyth, 214 S.W.2d 967 It is therefore doubtful the operating cotenant can refuse to market the non-joining co-tenants’ minerals. WHAT ARE C’S OPTIONS? C can choose to ratify A and B’s lease, assuming their lease purports to lease full interest. If C ratifies A and B’s lease, he gives up his right to share in net profits, but is entitled to share in the benefits provided in the oil and gas lease. Whether it is to a co-tenant’s benefit to ratify such a lease depends on the profitability of the well in question and the terms of the lease in question. It is unclear how long a co-tenant may wait before deciding to ratify the lease. Likely the courts will require the decision to be within a reasonable time period and will not allow the cotenant to wait to determine whether a well will be unprofitable before opting to ratify the lease. Nugent v. Freeman, 306 S.W.2d 167 (Tex.Civ.App.-Eastland 1957, writ ref’d n.r.e.). If C on the other hand chooses to accept his fractional share of the net production, is he affected by the lessee’s joinder of other tracts to form a pooled unit? NO. The lessee cannot dilute the non-joining cotenant’s interest by pooling with other tracts. Wagner & Brown v. Sheppard, 198 S.W.3d 369 (Tex.App.-Texarkana 2006). EXAMPLE NO. 2 Blackacre 100 acres A – 1/3 B – 1/3 C – 1/3 A and B lease to X Oil Company C is unleased Well drilled on Blackacre. X pools/unitizes Blackacre into 600 acre gas unit. C’s share of production remains at one-third. Accounting for Oil/Gas Production General – The drilling co-tenant must account to non-joining co-tenant for proportionate share of net profits from sale of production. Byron v. Pendley, 717 S.W.2d 602, 605 (Tex. 1986). Non-joining co-tenants are not personally responsible for the costs of drilling and producing. The developing party has the right to deduct the co-owner’s proportionate share of expenses from their proportionate share of production. Allowed Expenses The lessee can deduct only those expenses which are reasonable and necessary. Some costs are rarely challenged, such as drilling, casing, labor. Specific expenses that may be challenged are the following: •Depreciation •Operator’s machinery/equipment These are probably allowed, even if contested. As to those costs which are questionable, they are: oOperating co-tenant’s personal services oSupervisory/managerial costs Those are probably defendable, if they would be incurred otherwise by another service provider. Expenses only allowed on a well-by-well basis. Expenses Generally Not Allowed Overhead charges for other wells Costs of money used (interest) Field offices Warehouse charges Any other charges not attributable to that well Any costs associated with drilling dry holes or otherwise non-productive wells, even if there is other production by the operating co-tenant Is payout determined on a lease basis or a per well basis? Courts have not decided this issue specifically, but language in several cases indicate the better rationale is development and production expenses will be considered on a per well basis, not on a lease basis. Burnham v. Hardy Oil Co., 147 S.W. 330 (Tex.Civ.App.-San Antonio 1912) Pipelines/Easements The well-settled general rule is that each owner in a co-tenancy acts for himself, and no one is an agent for the others or has any authority to bind other co-tenants merely because of co-tenancy relationship. Absent consent or subsequent ratification by the other co-tenants, the general rule is that one co-tenant cannot impose an easement upon the common property in favor of a third party. Elliott v. Elliott, 597 S.W.2d 795, 802, (Tex.Civ.App.-Corpus Christi 1980, no writ). Lee v. Phillips Petroleum, 329 F.Supp. 579 (S.D.Tex. 1971) held as a matter of law that a pipeline company that obtained a pipeline right of way easement from only a portion of the owners was a trespasser as a matter of law. Texas courts have routinely held granting a pipeline easement by a co-tenant constitutes waste. Seismic Development In almost every state, all co-owners of minerals own the right to explore, and any co-tenant may explore and develop the minerals without the consent of the other co-tenants, subject to an obligation to account to the other co-tenants for net profits. Burnham v. Hardy Oil Co., 147 S.W.2d 330, (Tex.1912). Presumably then, a single co-tenant may grant the necessary consent to conduct geophysical operations regardless of how small the co-tenants fractional interest might be. The cases dealing with the rights of co-tenants generally are in the context of drilling and production activities. The issue has not been directly addressed in the context of geophysical operations by Texas courts. The two exceptions, Louisiana and Oklahoma both required a consent of all co-owners of the minerals, but both states have far different laws regarding the rights of oil and gas operators than does Texas. The better rules seems to be consent from any of the co-tenants would be sufficient to conduct geophysical operations.