invisible hand

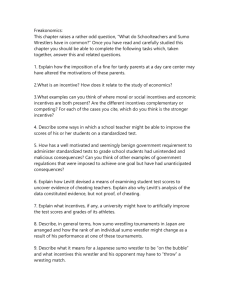

advertisement

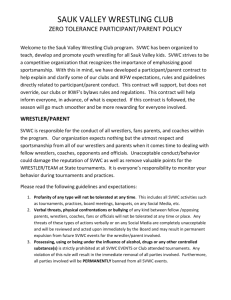

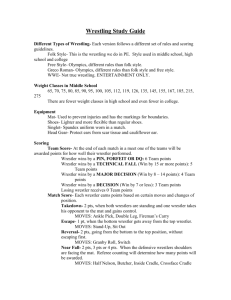

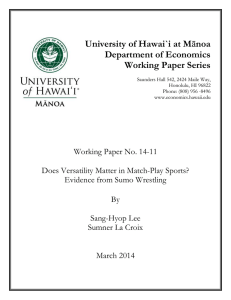

“Textbook definition” of economics: The study of how society manages its scarce resources. “Resources” means anything that can be used in a productive way: natural resources, human labor, environmental amenities, and “capital:” human-made tools of production: machines, factories, computers. Who decides how resources are used (allocated) and how goods and services are distributed? For example: In the Soviet Union (now defunct), resources were allocated by decree of government authorities. “Command economy.” “Market economy:” An economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services. Microeconomics: The study of how households and firms make decisions and how they interact in markets. Macroeconomics: The study of economy-wide phenomena, including inflation, unemployment, and economic growth. (Econ 102) To put it another way: Micro is the study of how individuals make decisions . . . and how those decisions are coordinated by the market mechanism. Macro is the study of the aggregate consequences of those decisions. What economics is not: It’s not a “how-to manual” for success in business or personal finance. Objective of economics is government policy analysis. One quick example from my research: State “anti-corporate” farming laws Do they lead to smaller average farm sizes? If so, is there a downside to smaller farms? Mankiw’s Ten Principles of Economics First 4 principles relate to how people make decisions. 1. People face trade-offs. Choosing one desirable alternative usually means forgoing another. 2. The cost of something is what you give up to get it. The point: In many cases, the cost of some action is not as obvious as it may first appear. For example: The cost of a college education. Obvious costs: tuition, books, student fees, transportation (probably not room and board) Not-so-obvious costs: Forgone earnings. If you weren’t in college, you’d be in the labor force, working and earning. For many students, forgone earnings represent the single largest component of college costs. Opportunity cost: The cost of an action measured in terms of what you give up to get it. 3. “Rational people think ‘at the margin’.” Marginal changes: Small, incremental adjustments to a plan of action. The point: To understand what decisions are best, it often helps to consider the impact of a marginal change. Example: A firm trying to decide how much output to produce. Currently producing 100 widgets/day. Is this the profit-maximizing output level? Consider a marginal change from 100 widgets/day to 101 widgets/day. Revenue (money from sale of output) will go up. Cost will go up. Revenue increase more or less than cost increase? Effect on profit? The effect of a marginal change is closely related to the calculus concept of a derivative. Calculus is an indispensable tool of (higher-level) economic analysis . . . . . . I’ll give a few illustrations of the usefulness of calculus as we proceed. 4. People respond to incentives (like changing prices). The point: In many cases, the response to incentives is more far-reaching than we might first assume. Example: An increase in the level of gasoline excise taxes raises the price consumers pay for gasoline. Responses: People drive less. Prefer more fuel efficient cars. Choose car-pooling, public transit. Spur development of “alternative” technologies for car engines. “Freakonomics – A Rogue Economist Explores the Hidden Side of Everything” by Steven D. Levitt and Stephen J. Dubner (http://www.freakonomics.com/) One theme: Explaining behavior in terms of the incentives people face. The “dark side” of incentives: Cheating. Cheating to lose in sports. (1919 “Black Sox” scandal) Sumo wrestling in Japan “Sumo wrestling” in USA In Japanese sumo wrestling, ranking is everything. Each wrestler’s ranking based on performance in elite tournaments – 15 matches per tournament. Finishing with a winning record is very important. 8-7 is much better than 7-8 . . . . . . but not much worse than 9-6. An 8-6 wrestler enters final match against a 7-7 opponent. Might he “cheat to lose” – allowing opponent to win? “Freakonomics” looked at the data from hundreds of matches in which a 7-7 wrestler faced an 8-6 opponent. 7-7 wrestler’s expected winning percentage: 48.7% 7-7 wrestler’s actual winning percentage: 79.6%! What about next meeting of same two wrestlers, when neither one is “on the bubble”? 7-7 wrestler’s expected winning percentage: 7-7 wrestler’s actual winning percentage: Is Japanese sumo wrestling rigged? about 50% 40%! Principles 5, 6, and 7 pertain to how people interact (how markets “work”). 5. Trade can make everyone better off. Poker and other “zero sum” games. (Winners’ gains are exactly offset by losers’ losses.) Trade is a positive sum game. (Both parties to exchange can “come out ahead.”) Briefly in chapter 3, “Interdependence and the gains from trade,” . . . . . . and in detail in chapter 9, “International Trade.” Note: Political candidates differ in the extent to which they believe in . . . “free trade” (make it easy for foreign firms to sell their products here . . . and for our firms to sell their products abroad), or “protectionism” (shield U.S. firms from foreign competition). 6. Markets are usually a good way to organize economic activity. Remember: In a market economy, resource allocations result from the interaction of millions of independent decision-makers (households and firms). No one is in charge! Chaos results? -- no, usually the outcome is pretty good. (We’ll see why later.) Adam Smith’s The Wealth of Nations, 1776. (http://www.econlib.org/LIBRARY/Smith/smWN.html) (Try “Search book” for “invisible hand.”) Individual market participants motivated by own selfinterest, not the greater good of society. Yet, the result of their actions is usually pretty good for society as a whole. Market participants act as if “guided by an invisible hand” that leads them to desirable market outcomes. 7. Governments can sometimes improve market outcomes. Sometimes the “invisible hand” doesn’t work! Market failure: A situation in which a market, left on its own, fails to allocate resources efficiently. One example: Externality: the impact of one person’s actions on the well-being of a bystander. One kind of externality: A person responsible for an action doesn’t bear the full cost of the action. The possibility of market failure creates a role for government intervention in markets . . . . . . and a role for economists to analyze government economic policy! Principles 8, 9, and 10 pertain to how the economy as a whole works. (Review on your own -- they relate to macroeconomics.)