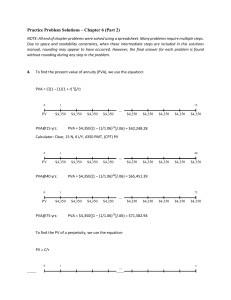

Extra Questions for Chapter 6

advertisement

Q3) Toadies, Inc., has identified an investment project with following cash flows. If the discount rate is

8%, what is the future value of cash flows in Year 4? What is the future value at a discount rate of 11%?

At 24%?

Year

1

2

3

4

Cash Flow

$1,375

1,495

1,580

1,630

The time line is:

0

1

2

3

4

$1,375 $1,495 $1,580 $1,630

To solve this problem, we must find the FV of each cash flow and add them. To find the FV of a

lump sum, we use:

FV = PV(1 + r)t

FV@8% = $1,375(1.08)3 + $1,495(1.08)2 + $1,580(1.08) + $1,630 = $6,812.27

FV@11% = $1,375(1.11)3 + $1,495(1.11)2 + $1,580(1.11) + $1,630 = $7,106.28

FV@24% = $1,375(1.24)3 + $1,495(1.24)2 + $1,580(1.24) + $1,630 = $8,509.52

Notice we are finding the value at Year 4, the cash flow at Year 4 is simply added to the FV of the

other cash flows. In other words, we do not need to compound this cash flow.

Q6) Your company will generate $68,000 in annual revenue each year for the next seven years from a

new information database. If the appropriate interest rate 8.5%, what is the present value of the savings?

The time line is:

0

1

2

3

4

5

6

7

$68,000

C

C

C

C

C

C

C

To find the PVA, we use the equation:

PVA = C({1 – [1/(1 + r) t] } / r )

PVA = $68,000{[1 – (1/1.0857) ] / .085} = $348,058.92

Q39) What is the relation between the value of annuity and the level of interest rates? Suppose you just

bought a 20-year annuity of $7,500 per year at the current interest rate of 10% per year. What happens to

the value of your investment if interest rates suddenly drop to 5%? What if interest rates suddenly rise to

15%?

The time line is:

0

1

$7,500

20

$7,500

$7,500

$7,500

…

$7,500

$7,500

$7,500

$7,500

The relationship between the PVA and the interest rate is:

PVA falls as r increases, and PVA rises as r decreases

FVA rises as r increases, and FVA falls as r decreases

The present values of $7,500 per year for 20 years at the various interest rates given are:

PVA@10% = $7,500{[1 – (1/1.10)20] / .10} = $63,851.73

PVA@5% = $7,500{[1 – (1/1.05)20] / .05} = $93,466.58

PVA@15% = $7,500{[1 – (1/1.15)20] / .15} = $46,944.99

$7,500

Q43) The present value of the following cash flow stream is $8,400 when discounted at 9% annually?

What is the value of the missing cash flow?

Year

1

2

3

4

Cash Flow

$2,000

?

2,600

3,200

The time line is:

0

1

–$8,400 $2,000

2

3

4

?

$2,600

$3,200

We are given the total PV of all four cash flows. If we find the PV of the three cash flows we know, and

subtract them from the total PV, the amount left over must be the PV of the missing cash flow. So, the

PV of the cash flows we know are:

PV of Year 1 CF: $2,000 / 1.09

= $1,834.86

PV of Year 3 CF: $2,600 / 1.093

= $2,007.68

PV of Year 4 CF: $3,200 / 1.094

= $2,266.96

So, the PV of the missing CF is:

$8,400 – 1,834.86 – 2,007.68 – 2,266.96 = $2,290.50

0

1

2

–$2,290.50

3

4

FV

The question asks for the value of the cash flow in Year 2, so we must find the future value of this

amount. The value of the missing CF is:

$2,290.50(1.09)2 = $2,721.34

Q72) What is the value of an investment that pays $25,000 every other year forever, if the first payment

occurs one year from today and discount rate is 9% compounded daily? What is the value today if the first

payment occurs four years from today?

The cash flows in this problem occur every two years, so we need to find the effective two-year rate. One

way to find the effective two-year rate is to use an equation similar to the EAR, except use the

number of days in two years as the exponent. (We use the number of days in two years since it is

daily compounding; if monthly compounding was assumed, we would use the number of months in

two years.) So, the effective two-year interest rate is:

Effective 2-year rate = [1 + (.09/365)]365(2) – 1 = .1972, or 19.72%

We can use this interest rate to find the PV of the perpetuity. Doing so, we find:

PV = $25,000 /.1972 = $126,780.76

This is an important point: Remember that the PV equation for a perpetuity (and an ordinary

annuity) tells you the PV one period before the first cash flow. In this problem, since the cash flows

are two years apart, we have found the value of the perpetuity one period (two years) before the first

payment, which is one year ago. We need to compound this value for one year to find the value

today. The value of the cash flows today is:

PV = $126,780.76(1 + .09/365)365 = $138,718.71

The second part of the question assumes the perpetuity cash flows begin in four years. In this case,

when we use the PV of a perpetuity equation, we find the value of the perpetuity two years from

today. So, the value of these cash flows today is:

PV = $126,780.76 / (1 + .1972) = $105,898.54