University of Minnesota Office of External Sales

advertisement

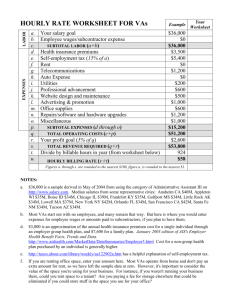

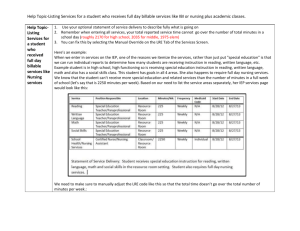

University of Minnesota Internal/External Sales Rate Development – Advance Internal/External Sales Objectives for Rates • • • • Fully recover but not exceed costs Include all subsidies in rate development Set to breakeven Based on total cost See Handout: “What would be included in an Internal Sales Rate Development?” Checklist before submitting rates. 2 Agenda • • • • • • Productive Time for Salaries Productive Time for Equipment Capital Equipment Capital Lease Operating Lease Partial Assignments 3 Agenda (cont.) • • • • • Surplus & Deficit Balances Prepaid Expenses Discounted rates After Hours rates Assisted vs. Unassisted rates 4 Productive Time - Salaries • Productive time (billable hours) is total time, less non-productive time such as vacation, sick leave, holiday, breaks, equipment downtime, certification and training time. See handout: “Vacation and Leaves to consider when calculating productive (billable hours) 5 Billable Hours Calculation - Salaries • There are 40 hours in a work week or 52 weeks in a year. • 40 X 52 = 2,080 hours in a year Example: • Salary $74,403 per year • Fringe for academic faculty (FY14) 33.6% or $25,597 • Total salary & fringe for the year $100,000 6 Billable Hours Calculation - Salaries Inaccurate assumption/calculation: • Total salary & fringe of $100,000 divided by 2,080 working hours in a year: • $100,000 / 2,080 = $48.08 per hour This is the per hour salary paid to an employee. 7 Billable Hours Calculation - Salaries Employees don’t work all 2080 hours in a year. Holidays, vacation leave, sick leave, other types of leave Training, administrative or non-productive time, breaks These activities can be billed to the customer and will not be if the basis of the rate is 2080 hours. 8 Billable Hours Calculation - Salaries Salary& Fringe recovered using hours available to actually work and invoice (Billable Hours) Billable hours is unique to each individual - develop one schedule per person Description Full year hours paid Paid holidays (not available to work) Paid vacation (not available to work) Paid sick time (not available to work) Total hours available to work Rate based on Billable Hours 2080 (88) (176) (88) 1728 Any other non-billable hours (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) Labor Rate = Salary & fringe/billable hours Salary & fringe (216) Details in determining hours (52 weeks * 40 hours per week) based on 100% appt. (11 days * 8 hours per day) FY14 est. by campus (22 days * 8 hours per day) est. vacation expected (11 days * 8 hours per day) est. sick expected 216 working days (1 hour per day * working days) (30 minutes a day for breaks) 1,512 $ 100,000 Billable hours Salary + Fringe/Billable Hours = Rate per hour Billable Hours (hours worked & invoiced) $ 1512 66.14 X 1512 Salary & fringe cost recovered $ 100,000 Note #1: To fully recover total labor cost on a annual basis the billable hours method must be used. Note #2: Underestimated billable hours (hours lower and hourly rate is higher) will cause a surplus. Note #3: Overestimated billable hours (hours higher and hourly rate is lower) will cause a deficit. 9 Billable Hours Calculation - Salaries • The worker will only be available to work 1512 hours, not 2080 • The rate for 1512 hours is $66.14 per hour • $48.08 vs. $66.14 • $48.08 X 1512 hours = $72,692 • Recover the actual cost of the salary and fringe cost of $100,000 • At a rate of $48.08, there will be a deficit of $27,308 at the end of the year. A 27% unfavorable variance. 10 Billable Hours Calculation - Salaries Why is this important? If there are 5 people working in this ISO department example, there would be a deficit of ($134,855) at the end of the year because rate calculated does not recover all of the costs. ($27,308 X 5 = $136,540) 11 Billable Hours - Salaries Salary& Fringe recovered using hours paid (2080) vs. hours available to actually work and invoice (billable hours) Rate based on Rate based Hours Rate based Rate on Hours Paid on Billable based on Paid Salary & HoursBillable Salary only Fringe Salary only Hours Description Definition Full year hours paid 2080 2080 2080 2080 (52 weeks * 40 hours per week) Paid holidays (not available to work) (88) (88) (11 days * 8 hours per day) Paid vacation (not available to work) (176) (176) (22 days * 8 hours per day) Paid sick time (not available to work) (88) (88) (10 days * 8 hours per day) Total hours available to work 2080 2080 1728 1728 216 working days Any other non-billable hours (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) 2,080 - (216) (216) 2080 1512 1512 Labor Rate = Salary & fringe/billable hours Salary & fringe $ $ 100,000 $ Salary only at .336 fringe rate $ 74,403 $ Billable hours 2080 2080 Rate per hour $ 35.77 $ 48.08 $ Billable Hours (hours worked & invoiced) X 1512 X 1512 Amount desired to recover Salary & fringe cost recovered Amount not recovered $ 100,000 74,403 1512 1512 49.21 $ 66.14 X 1512 X 1512 (1 hour per day * working days) Hours VarinanceDays 312 15% 39 208 10% 26 104 5% 13 $ 100,000 $ 100,000 $ 100,000 $ 100,000 $ 54,085 $ 72,692 $ 74,403 $ 100,000 $ (45,915) $ (27,308) $ (25,597) $ -46% -27% -26% 0% Note: In order to fully recover total labor cost on a annual basis the billable hours method should be used. 12 Productive Time Equipment Productive time (billable hours) is total time, less operator productive time, maintenance, repairs, recalibration, replacement, storage, seasonality, set-up time plus ability to run without operator See Handout: “Equipment availability (downtime) to consider when calculating productive time (billable hours) 13 Billable Hours Calculation Equipment Inaccurate assumption/calculation: • Total annual depreciation of $10,000 divided by 2,080 working hours in a year: • $10,000 / 2,080 = $4.80 per hour This is the per hour depreciation based on total hours in a work week. 14 Billable Hours Calculation Equipment Employees don’t work and equipment operate all 2080 hours in a year due to the non-productive time of the operator and equipment These activities can be billed to the customer and will not be if the basis of the rate is 2080 hours. 15 Billable Hours Calculation - Equipment • The equipment will only be available to work 1512 hours, not 2080 • The rate for 1512 hours is $6.61 per hour • $4.80 vs. $6.61 • $48.08 X 1512 hours = $7,269 • Recover the actual cost of the depreciation cost of $10,000 • At a rate of $4.80, there will be a deficit of $2,736 at the end of the year. A 27% unfavorable variance. 16 Billable Hours Calculation - Equipment Equipment recovered using hours available to actually work and invoice (Billable Hours) Billable hours is unique to each individual - develop one schedule per person Operator Description Full year hours paid - Operator of Equipment 2080 Paid holidays (not available to work) (88) Paid vacation (not available to work) (176) Paid sick time (not available to work) (88) Total hours available to work 1728 Any other non-billable hours (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) Labor Rate = Salary & fringe/billable hours Salary & fringe $ Equipment Depreciation Total Billable hours Salary + Fringe/Billable Hours = Rate per hour $ Equipment 2080 (88) (176) (88) 1728 (216) (216) 1,512 Salary & fringe cost recovered 100,000 $ 1512 66.14 100,000 25,000 $ 125,000 $ 82.67 $ 125,000 1512 X 1512 $ (1 hour per day * working days) (30 minutes a day for breaks) 1,512 $ Total Rate Billable Hours (hours worked & invoiced) Details in determining hours (52 weeks * 40 hours per week)100% appt. (11 days * 8 hours per day) FY14 by campus (22 days * 8 hours per day) est. vacation expected (11 days * 8 hours per day) est. sick expected 216 working days 16.53 X 1512 $ 25,000 Note #1: To fully recover total labor & depreciation cost on a annual basis the billable hours method must be used. Note #2: Underestimated billable hours (hours lower and hourly rate is higher) will cause a surplus. Note #3: Overestimated billable hours (hours higher and hourly rate is lower) will cause a deficit. 17 Billable Hours Calculation - Equipment Why is this important? If there are 5 machines working in this ISO department example, there would be a deficit of ($13,684) at the end of the year because rate calculated does not recover all of the costs. ($2,736 X 5 = $13,684) 18 Capital Equipment • Depreciation associated with capital equipment should be included in the rate development. • Annual depreciation is calculated in the Asset Management module and reported in the UMReport. • Total purchase price, installation and transportation expenses are included in the acquisition cost and are capitalized. Capitalized Expense = Annual Depreciation Expense Useful Life 19 Capital Equipment - Example Capitalized Expense = Annual Depreciation Expense Useful Life $100,000 = $20,000 per year 5 years $20,000 = $13.22 per hour 1512 Hours 20 Capital Lease • Depreciation associated with capital lease may be included in the rate development is based on capitalized cost of the equipment, not the monthly lease payments. • Depreciation is calculated in the Asset Management module. • Total purchase price, installation, transportation, interest charges and fee expenses are included in the acquisition cost. Capitalized Expense = Annual Depreciation Expense Useful Life 21 Capital Equipment - Example Capitalized Expense = Annual Depreciation Expense Useful Life $105,000 = $21,000 per year 5 years $21,000 = $13.88 per hour 1512 Hours 22 Operating Lease • Expense associated with operating lease may be included in the rate development based on lease payments as a basis for equipment usage. • Total lease payments include a charge for use of the equipment, interest and fees and may include installation, transportation, maintenance expenses. 23 Operating Lease - Example Lease Expense = Annual Lease Expense Term of Lease $100,000 = $20,000 per year 5 years $20,000 = $13.22 per month 1512 Hours 24 Partial Assignment 67% -100% assignments: Fringe Rate: 33.8% P&A, 26.3% CS, Nonproductive time: prorated based on % worked 0% -67% assignments: Fringe Rate: reduced rate 7.7% Partial, 16.6% for GA Nonproductive time: reduced benefits & no time off paid 25 Partial Assignments Hourly Rates Salary& Fringe recovered using (Billable Hours) 100% vs. 75% appt. Billable hours is unique to each individual - develop one schedule per person Description Full year hours paid Paid holidays (not available to work) Paid vacation (not available to work) Paid sick time (not available to work) Total hours available to work Rate based on Billable Hours 100% 2080 (88) (176) (88) 1728 Any other non-billable hours (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) Labor Rate = Salary & fringe/billable hours Salary & fringe $ Billable hours Salary + Fringe/Billable Hours = Rate per hour $ Billable Hours (hours worked & invoiced) Salary & fringe cost recovered $ Rate based on Billable Hours 75% 1560 (66) (132) (66) 1296 (216) (162) 1,512 100,000 1512 66.14 X 1512 100,000 Details in determining hours (52 weeks * 40 hours per week) 100% appt. (11 days * 8 hours per day) FY15 est. by campu (22 days * 8 hours per day) est.vacation expecte (11 days * 8 hours per day) est. sick expected 216 working days (1 hour per day * working days) (30 minutes a day for breaks) 1,134 $ 75,000 $ 1134 66.14 X 1512 $ 75,000 Note #1: To fully recover total labor cost on a annual basis the billable hours method must be used. Note #2: Underestimated billable hours (hours lower and hourly rate is higher) will cause a surplus. Note #3: Overestimated billable hours (hours higher and hourly rate is lower) will cause a deficit. 26 Partial Assignments Hourly Rates Salary& Fringe recovered using (Billable Hours) 67%-74% vs. 66% or Less appt. Billable hours is unique to each individual - develop one schedule per person Description Full year hours paid Paid holidays (not available to work) Paid vacation (not available to work) Paid sick time (not available to work) Total hours available to work Rate based on Billable Hours 67%1539 (65) (130) (65) 1279 Any other non-billable hours (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) 1,119 Labor Rate = Salary & fringe/billable hours Salary & fringe $ 74,000 Billable hours Salary + Fringe/Billable Hours = Rate per hour $ Billable Hours (hours worked & invoiced) Salary & fringe cost recovered $ Rate based on Billable Hours 66% 1394 (59) 1335 (160) (167) Details in determining hours (52 weeks * 40 hours per week) 100% appt. (11 days * 8 hours per day) FY15 est. by campus (22 days * 8 hours per day) est.vacation expected (11 days * 8 hours per day) est. sick expected 160 working days 167 (1 hour per day * working days) (30 minutes a day for breaks) 1,168 $ 67,000 1119 66.14 X 1119 $ 1168 57.37 X 1050 74,000 $ 67,000 Note #1: To fully recover total labor cost on a annual basis the billable hours method must be used. Note #2: Underestimated billable hours (hours lower and hourly rate is higher) will cause a surplus. 27rate is lower) will cause a deficit. Note #3: Overestimated billable hours (hours higher and hourly Excess Surplus & Deficits Balances in Rates A acceptable operating variance: • Within 15% and due to variance in costs or volumes from original estimates • Rates are calculated to breakeven • Reconcilable items like maintenance contracts, tuition payments, materials and supplies, material for resale, (items paid for but not matched to revenue recognized). 28 Excess Surplus & Deficits Balances in Rates A operating variance that require adjustments: • Subtract unallowable costs, adjust salary expense based on actual usage, recorded depreciation expense, and add revenue not recognized, subsidies not recorded, etc.. 29 Excess Surplus & Deficits Balances in Rates If a surplus results from overcharging customers will need to be refunded Therefore, it’s important to be able to separately identify External and Internal Sales and expenses & reconcile balance at year end 30 Excess Surplus & Deficits Balances in Rates A deficit balance may develop from: – sales < expected – costs > expected If a deficit is due to expenses that are not recoverable, a subsidy will be required 31 Rate Development (cont.) Determine the per-unit rate Direct costs +/- allowable surplus or deficit Per unit rate = ------------------------------------------Estimated volume of work 32 Prepaids Expenses paid but not used in current year because the value received for those resources are in the future beyond current fiscal year • Charged at the purchase price Example: $25,000 service agreement = $8,333 current year 3 years $16,667 for future years or $8,333 per year will be included in the rates for the next two fiscal years 33 Prepaids • • • • • • • Maintenance Contracts Service Contracts Consulting or Professional Services Insurance Materials for Resale, Stores and Supplies Postage Subsidies applied in advance 34 Discounting Discounting is allowed if the increase in volumes decreases the per unit cost • The decrease in cost is directly related to the activity • All discounts are applied equally • One customer can’t pay for the discount of another Example: 100 units cost $1.00 per unit 1000 units cost $0.75 per unit 35 Discounting • Charge labor, supplies and equipment on a hourly basis vs. by units. If there is a benefit to processing more units the discount will be applied by fewer hours charged. • If activities have a different cost structure (set up time versus run time for equipment) develop a rate for each and charge accordingly. 36 After Hours Rates can be different if the cost associated with the activity is different • All support costs and non-productive time are applied over entire base • One customer can’t pay for the reduced cost of another (Net revenue is the same for the ISO) 37 After Hours Example: $93,750 (includes operator, support and equipment) cost divided by 1522 hours equals $61.60 per hour $31,250 (includes support and equipment ) cost divided by 1000 hours equals $31.25 per hour 38 After Hours Equipment recovered using hours available to actually work and invoice (Billable Hours) Billable hours is unique to each individual - develop one schedule per person (After Hours) Operator Description Full year hours paid - Operator of Equipment 1560 Paid holidays (not available to work) (66) Paid vacation (not available to work) (132) Paid sick time (not available to work) (66) Total hours available to work 1,296 Any other non-billable hours (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) Labor Rate = Salary & fringe/billable hours Salary & fringe $ Equipment Depreciation Total Billable hours Salary + Fringe/Billable Hours = Rate per hour$ Equipment 1560 (53) (106) (53) 1349 Operator 520 (22) (44) (22) 432 Equipment 1040 (35) (70) (35) 899 (162) (54) (54) 378 845 (162) 1,134 1,187 75,000 $ $ Salary & fringe cost recovered $ $ $ Total Rate Billable Hours (hours worked & invoiced) 15,000 1187 10,000 378 66.14 12.64 $ $ 75,000 $ X 1187 X 392 15,000 $ 90,000 $ 25,000 $ 125,000 $ 77.97 $ 78.49 $ 35,000 $ 125,000 11.83 X 845 $ 10,000 Note #1: To fully recover total labor & depreciation cost on a annual basis the billable hours method must be used. Note #2: Underestimated billable hours (hours lower and hourly rate is higher) will cause a surplus. Note #3: Overestimated billable hours (hours higher and hourly rate is lower) will cause a deficit. 39 $ 35,000 845 $ 78.77 X 1134 (1 hour per day * working days) (30 minutes a day for breaks) 25,000 $ 90,000 1134 66.14 (52 weeks * 40 hours per week)100% appt. (11 days * 8 hours per day) FY15 by campus (22 days * 8 hours per day) est. vac. expected (11 days * 8 hours per day) est. sick expected 162 54 working days Assisted vs. Unassisted Rates can be different if the cost associated with the activity is different • All support costs and non-productive time are applied over entire base • One customer can’t pay for the reduced cost of another (net revenue is the same) Example: $100,000 (includes support and operator) cost divided by 1522 hours equals $65.70 per hour $40,000 (includes support less operator) cost divided by 1000 hours equals $40.00 per hour 40 After Hours Equipment recovered using hours available to actually work and invoice (Billable Hours) Billable hours is unique to each individual - develop one schedule per person - (Assisted vs. Unassisted) Operator Description Full year hours paid - Operator of Equipment 1820 Paid holidays (not available to work) (77) Paid vacation (not available to work) (154) Paid sick time (not available to work) (77) Total hours available to work 1,512 Equipmen 1560 (66) (132) (66) 1296 Operator 260 (11) (22) (11) 216 Equipmen 520 (22) (44) (22) 432 Any other non-billable hours (189) (training, breaks, administration, meetings etc.) Billable hours (estimated volume of work) 1,323 (189) (27) (27) 189 405 Labor Rate = Salary & fringe/billable hours Salary & fringe $ 87,500 Equipment Depreciation Total Billable hours 1362 Salary + Fringe/Billable Hours = Rate per hour $ 64.24 1,107 Salary & fringe cost recovered (1 hour per day * working days) (30 minutes a day for breaks) $ 12,500 $ 18,750 $ 6,250 $ 106,250 1102 $ Total Rate Billable Hours (hours worked & invoiced) (52 weeks * 40 hours per week)100% appt. (11 days * 8 hours per day) FY15 campus (22 days * 8 hours per day) est. vac. Exp. (11 days * 8 hours per day) est. sick exp. 189 27 working days 189 $ 66.14 17.01 X 1102 $ 87,500 $ 18,750 $ 125,000 $ 81.57 $ $18,750 $ 125,000 405 $ 15.43 $ X 1362 $18,750 81.26 X 189 $ 106,250 $ 12,500 X 405 $ 6,250 Note #1: To fully recover total labor & depreciation cost on a annual basis the billable hours method must be used. Note #2: Underestimated billable hours (hours lower and hourly rate is higher) will cause a surplus. Note #3: Overestimated billable hours (hours higher and hourly rate is lower) will cause a deficit. 41 81.26 Questions? Office of Internal Sales website http://finsys.umn.edu/sales/iso.html This presentation is posted on the site. 42