Texas Real Estate Law - PowerPoint - Ch 11

advertisement

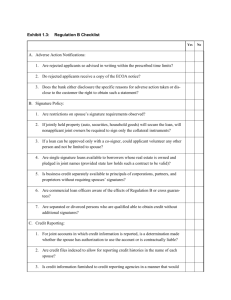

TEXAS REAL ESTATE LAW 11E Charles J. Jacobus Chapter 11 Involuntary Conveyances • Involuntary conveyances are generally categorized as those conveyances over which the grantor has little or no control. • Such as eminent domain, escheat, and intestacy, tax sales and foreclosures. 2 Eminent Domain • A complicated and multifaceted issue. • Involves litigation and damage issues and substantive real estate law. • A procedure whereby property may be taken for a public purpose. • Eminent domain is exercised through a process called condemnation. • Does not require the balancing of the interests of the parties involved. • The test is to see if some definite right results for the public benefit. • There must, of course, be just compensation. 3 Public Purpose • What constitutes public purpose to justify the taking of the property? • Court cases (Kelo vs. New London) have determined that condemning authorities can take property for public use even if the ultimate purpose of the property is to convey it to a private developer. • However, in 2009, we amended the Texas Constitution regarding a government or private entity taking private property for the use of eminent domain. • Property cannot be taken in Texas if it confers a private benefit on a particular private party, is for economic development purposes, and is not for public use. 4 SUPREME COURT OF THE UNITED STATES Eminent Domain and Condemnation Kelo v. City of New London Decided June, 2005 5 Kelo vs. New London In 2000, the city of New London approved a development plan that, in the words of the Supreme Court of Connecticut, was “projected to create in excess of 1,000 jobs, to increase tax and other revenues, and to revitalize an economically distressed city.” In assembling the land needed for this project, the city’s development agent has purchased property from willing sellers and proposes to use the power of eminent domain to acquire the remainder of the property from unwilling owners in exchange for just compensation. The question presented is whether the city’s proposed disposition of this property qualifies as a “public use” within the meaning of the Takings Clause of the Fifth Amendment to the Constitution. 6 United States Constitution - Amendment V No person shall be held to answer for a capital, or otherwise infamous crime, unless on a presentment or indictment of a Grand Jury; nor shall any person be subject for the same offense to be twice put in jeopardy of life or limb; nor shall be compelled in any criminal case to be a witness against himself, nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation. 7 Justice STEVENS delivered the opinion of the majority joined by Justices KENNEDY, SOUTER, GINSBURG and BREYER. “The city’s proposed disposition of petitioners’ property qualifies as a public use within the meaning of the Takings Clause. Though the city could not take petitioners’ land simply to confer a private benefit on a particular private party, the takings at issue here would be executed pursuant to a carefully considered development plan, which was not adopted “to benefit a particular class of identifiable individuals,”. Moreover, while the city is not planning to open the condemned land—at least not in its entirety—to use by the general public, this Court long ago rejected any literal requirement that condemned property be put into use for the public. Rather, it has embraced the broader and more natural interpretation of public use as “public purpose.” 8 Justice O’CONNOR dissented, joined by Chief Justice REINQUIST and Justices SCALIA, and THOMAS. “Under the banner of economic development, all private property is now vulnerable to being taken and transferred to another private owner, so long as it might be upgraded. To reason, as the Court does, that the incidental public benefits resulting from the subsequent ordinary use of private property “for public use” is to wash out any distinction between private and public use of property and thereby effectively deletes the words “for public use” from the Fifth Amendment.” 9 Just Compensation • Compensation rights are founded in the U.S. and Texas Constitutions. • U.S. Constitution requires due process of law. A court decides on the amount of compensation when the parties cannot reach an agreement. • Texas Constitution specifies that adequate compensation be made. • Value is the value at the time of the taking and cannot reflect potential value, or value as a result of the condemnation. • Texas Property Code provides for owners to repurchase land if that public use is not utilized within 10 years of the date of the acquisition. • The governmental entity is required to offer to sell the property to the previous owner or the owner’s heirs. • The governmental entity must offer to sell the property interest to the person for the price paid to the owner. 10 Adverse Possession • An actual and visible appropriation of real property, commenced and continued under a claim of right inconsistent with and hostile to the claim to another person. • The adverse possession statutes are intended to settle and support land titles. • Not designed to create a method by which someone may deviously appropriate property for his own use. • Possession must be such open and unambiguous acts that knowledge on the part of the owners is presumed. • Texas has provisions for 3-, 5-, 10-, and 25-year statutes under which an adverse claimant can gain title of the property. 11 Three-Year Statute • A person must bring suit to recover real property held by another in peaceable and adverse possession under title or color of title not later than three years after the day the cause of action accrues. • Title refers to a regular chain of transfers from or under the sovereignty of the soil, and color of title is meant as a consecutive chain of such transfers. • Does not include any documents obtained through fraudulent or dishonest means. • The cause of action is presumed to have accrued upon entry of the adverse claimant to the property. 12 Five-Year Statute • A person must bring suit not later than five years after the day the cause of action accrues to recover real property held in peaceable and adverse possession by another who: (1) cultivates, uses, or enjoys the property. (2) pays applicable taxes on the property. (3) claims the property under a duly registered deed. • This section does not apply to a claim based on a forged deed. • Does not require a title or color of title requirement. • A quitclaim deed is not sufficient. 13 10-Year Statute • A person must bring suit not later than 10 years after the day the cause of action accrues to recover real property held in peaceable and adverse possession by another who cultivates, uses, or enjoys the property. • Without a title instrument, peaceable and adverse possession is limited to 160 acres, including improvements, unless the number of acres actually enclosed exceeds 160. • Peaceable possession of real property held under a duly registered memorandum of title other than a deed that fixes the boundaries of the possessor’s claim extends to the boundaries specified in the instrument. 14 25-Year Statute • A person may not maintain an action for the recovery of real property held for 25 years before the commencement of the action in peaceable and adverse possession by another who holds the property in good faith and under a deed or other instrument recorded in the records of the county where the property is located. • The only thing required is any instrument purporting to convey the property to the adverse possessor that has been recorded in the deed records of the county in which the real estate is situated. • The 25-year statute is the only statute that runs against title holders who may be minors, insane, or suffering from other disability. 15 Other Issues - Recording • One issue is the question as to the time of recordation of the deed and conflicting interests between various deed holders. • The law in Texas is that title given by adverse possession of the property is equivalent to that of constructive notice. • Actual possession of the property is equivalent to recording. • There is no requirement that the adverse possessor be openly defiant. 16 Other Issues – Nature of Claim • Adverse claim must be peaceable, which means possession of real property that is continuous and is not interrupted by an adverse suit. • The adverse possessor cannot sit with a rifle, gun, or other military paraphernalia to try to establish the adverse claim. • The mere fact that the claim is against the wishes of the landowners is enough. • A tenant is occupying the premises with the landlord’s consent is not an adverse possessor. • If a tenant wants to assert an adverse possession claim, he must put the owner on notice of the hostile nature of the claim. 17 Other Issues – Tacking • Anyone in adverse possession may tack on his years of adverse possession with those of his predecessor in interest so that the adverse possessions can cumulatively total the requisite number of years to acquire title by limitation. • The tacking only requires a privity of estate and not a privity of title. 18 Other Issues – Encroachments • There has been a common misconception that when a fence is a few feet (or inches) on somebody else’s property, there is a claim by adverse possession. • Most small misalignments of fence are cosmetic or “casual” fencing. • Such casual fencing is not adverse possession. • In rural environments such casual fencing is not adverse possession. 19 Intestate Succession • When a person dies leaving no will, it is said she has died intestate. • Therefore, all of her property passes purely by operation of statutory law, often called the statutes of descent and distribution. 20 Intestate Leaving No Husband or Wife 1. To his children and their descendants. 2. If there be no children nor their descendants, then to his father and mother, in equal portions. But if only the father or mother survive the intestate, then his estate shall be divided into two equal portions, one of which shall pass to such survivor, and the other half shall pass to the brothers and sisters of the deceased, and to their descendants; but if there be none such, then the whole estate shall be inherited by the surviving father or mother. 3. If there be neither father nor mother, then the whole of such estate shall pass to the brothers and sisters of the intestate, and to their descendants. 4. If there be none of the kindred aforesaid, then the inheritance shall be divided into two moieties, one of which shall go to the paternal and the other to the maternal kindred. 21 Intestate Leaving Husband or Wife 1. If the deceased have a child or children, or their descendants, the surviving husband or wife shall take one-third of the personal estate, and the balance of such personal estate shall go to the child or children of the deceased and their descendants. The surviving husband or wife shall also be entitled to an estate for life, in one-third of the land of the intestate, with remainder to the child or children of the intestate and their descendants. 2. If the deceased have no child or children, or their descendants, then the surviving husband or wife shall be entitled to all the personal estate, and to one-half of the lands of the intestate, without remainder to any person, and the other half shall pass and be inherited according to the rules of descent and distribution; provided, however, that if the deceased has neither surviving father nor mother nor surviving brothers or sisters, or their descendants, then the surviving husband or wife shall be entitled to the whole of the estate of such intestate. 22 Community Estate On the intestate death of one of the spouses to a marriage, the community property estate passes to the surviving spouse if: (1) no child or other descendant of the deceased spouse survives the deceased spouse. (2) all surviving children and descendants of the deceased spouse are also children or descendants of the surviving spouse. (b) On the intestate death of one of the spouses to a marriage, if a child or other descendant of the deceased spouse survives the deceased spouse and the child or descendant is not a child or descendant of the surviving spouse, one-half of the community estate is of the deceased spouse. 23 Community Property • When someone dies intestate, the heirs must have the estate probated. • Court normally appoints an administrator to oversee the estate. • The estate is generally split amongst heirs, depending on whether or not there is a spouse, or children, or both, and whether or not the property was separate or community property. • Distribution of intestate succession is graphically shown in Figure 11.1. • On the death of one spouse, the community property of the deceased passes to the surviving spouse if all of the children are the children of that marriage. • If the child is not a child of the surviving spouse, one-half of the community estate is retained by the surviving spouse and the other one-half passes to the children of the deceased. 24 Separate Property • This is in contrast to separate property, where the spouse does inherit a life estate in one-third of the deceased spouse’s property. • For instance, if a husband and wife own 100 shares of stock and the husband dies, 1/3 shares of the stock would go to the spouse and the other 2/3 shares would be divided equally among the children. • An illegitimate child may petition court to determine rights of inheritance. • Obviously wise to be absolutely sure that all the legal aspects are properly taken care of through the courts before taking any action. 25 Foreclosure • The Texas standard deed of trust form, used in the great majority of mortgage transactions, contains a “power of sale” clause. • The procedure for the foreclosure proceedings is codified under the Texas Property Code, §51.002. 26 Texas Foreclosure Statute www.capitol.state.tx.us 27 Foreclosure Generally, all sales by execution conferred by any deed of trust or other lien shall be made: 1. At the door of the county courthouse. 2. In the county in which the land is located. 3. At public venue between 10:00 a.m. and 4:00 p.m. of the first Tuesday of any month. 4. After proper notice has been posted at said courthouse door, and notice of sale has been mailed by certified mail to each debtor at least 21 days preceding the date of sale. 28 Foreclosure • The lender acts through a trustee, who holds the public auction. • Anyone can buy the real estate for cash. • Purchaser buys whatever interest the lien holder has in the property. • Conceivably, the lien holder can sell the property for $10 and take a judgment against the debtor for the deficiency. • Providing there is no irregularity, the foreclosure sale will not be avoided merely because of inadequacy of price. • The mortgagee can purchase the property so long as the sale is conducted fairly and in accordance with the terms of the deed of trust. • Any excess funds are forwarded to borrower after expenses are paid. • The mortgagee often has more interest in the land than the debtor, and the lender needs to be protected. 29 Tax Sales • The only sale of real property for property taxes in Texas is for ad valorem taxes. • It is sufficient to say that the federal government can sell virtually anything to recover its tax debt. • Statutorily, the homestead cannot be sold for taxes other than the taxes due on such homestead. • If the homeowner is older than 65 years of age, no sale can take place while the person still owns the house. • The debtor has a right of redemption; that is, the debtor has the right to buy back his property if he pays the statutory penalties for doing so. (Discussed in Chapter 21.) 30 Escheat • Provides for the transfer of real estate belonging to any person who dies without a will and has no heirs. • Such real estate shall escheat to and vest in the State of Texas. • This simply provides for the State of Texas to get title to real estate so that no parcels of property will be unaccounted for. • It is a tool to effect valid conveyance of real estate when there are no other possible means of conveyance. • The process of escheating land is done through a court proceeding in a district court in the county in which the land is located. • Title to the land is dedicated to the Permanent Free School Fund for the State of Texas. 31 Gain or Loss of Title by Natural Causes The natural causes that may affect title are evidenced by accretion, alluvion, reliction, erosion, avulsion, and subsidence. When these natural forces occur, sometimes one loses title and sometimes one does not. Accretion Alluvion Reliction Erosion Avulsion Subsidence 32 Accretion and Alluvion • Accretion is the increase in land area by the gradual and imperceptible deposition of solid material from the operation of natural causes. • Alluvion normally applies to the solid material that is deposited, although the terms are often used interchangeably. • Title may be acquired by accretion or alluvion. 33 Reliction • Reliction applies to an increase in land area caused by the withdrawal of waters contiguous to it. • This is contrasted with alluvion or accretion where the silt, mud, or other material is deposited. • In reliction, the waters gradually withdraw from the subject property, perhaps through the change of a bed of a river, creek, or stream. • Title may be acquired by reliction. 34 Erosion • Erosion is defined as the gradual washing away (decrease in area) of land bordering on a stream or body of water by the action of the water. • Title to the eroded land is lost as long as the erosion is imperceptible. 35 Avulsion • Avulsion is the sudden and perceptible loss of or addition to land by the action of water due to the sudden change in the bed or course of a stream. • In the case of avulsion, the dividing line between the property owners remains in accordance with the former boundaries and not in accordance with the boundaries created by the avulsion. • Title is neither lost nor acquired. 36 Fast or Slow? • The general rule appears to be that if the loss of the land is gradual or imperceptible, title is lost. • “Gradual” or “imperceptible” has been characterized as a change that a person could not notice while it was happening but could, from time to time, notice the result of the process. • The more difficult question is defining “gradual.” Does a hurricane gradually erode a coastline and result in loss of title? • Additional questions of gaining title are posed when the property of a riverbed is owned by the State of Texas. • If reliction occurs and the streambed is owned by the state, Texas law generally favors retention of title of the streambed by the State. 37 Subsidence • Subsidence or submergence occurs when the water advances to cover the previously dry land. • This is accomplished by the rising level of water or by lowering the elevation of the land. • Title is not lost through submergence. 38 Texas General Land Office www.glo.texas.gov 39 Questions for Discussion 1. Mark the following statements concerning eminent domain in Texas as true or false: 2. List the terms often used to describe the characteristics of adverse possession claims in Texas? 3. When a person dies intestate (without a will) the deceased’s property will be distributed by the probate court under intestate succession (descent and distribution). What are the three most important questions to be answered in distributing the deceased’s property? 4. Generally, what are the requirements for a foreclosure sale in Texas? 5. What is escheat? 40