Fundamentals

advertisement

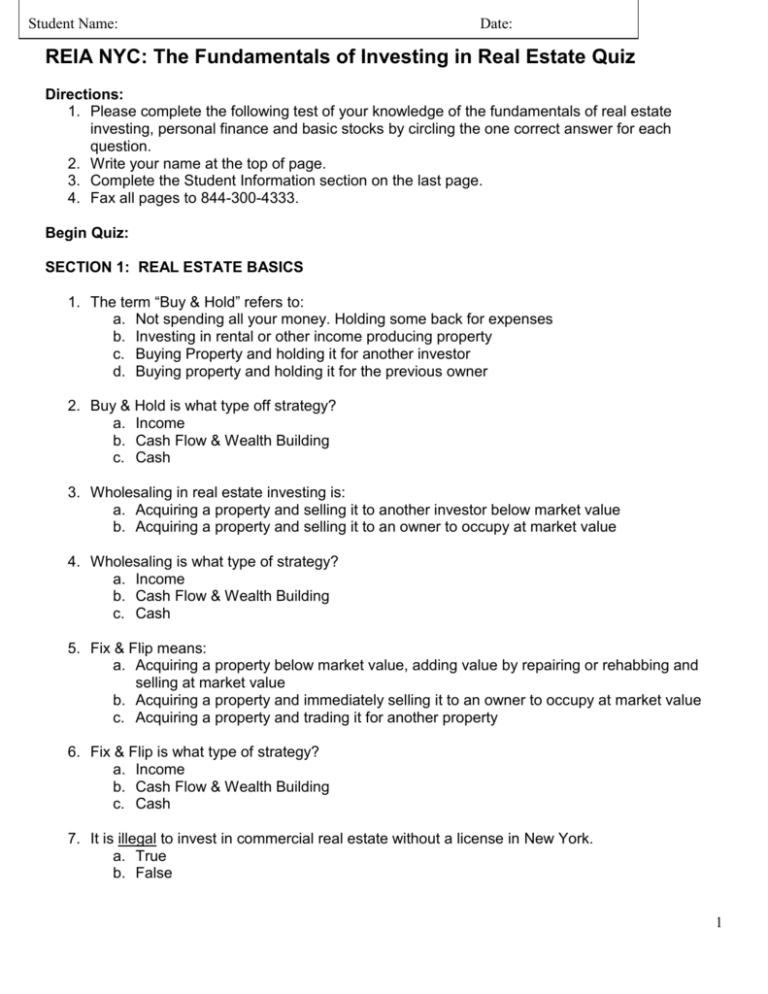

Student Name: Date: REIA NYC: The Fundamentals of Investing in Real Estate Quiz Directions: 1. Please complete the following test of your knowledge of the fundamentals of real estate investing, personal finance and basic stocks by circling the one correct answer for each question. 2. Write your name at the top of page. 3. Complete the Student Information section on the last page. 4. Fax all pages to 844-300-4333. Begin Quiz: SECTION 1: REAL ESTATE BASICS 1. The term “Buy & Hold” refers to: a. Not spending all your money. Holding some back for expenses b. Investing in rental or other income producing property c. Buying Property and holding it for another investor d. Buying property and holding it for the previous owner 2. Buy & Hold is what type off strategy? a. Income b. Cash Flow & Wealth Building c. Cash 3. Wholesaling in real estate investing is: a. Acquiring a property and selling it to another investor below market value b. Acquiring a property and selling it to an owner to occupy at market value 4. Wholesaling is what type of strategy? a. Income b. Cash Flow & Wealth Building c. Cash 5. Fix & Flip means: a. Acquiring a property below market value, adding value by repairing or rehabbing and selling at market value b. Acquiring a property and immediately selling it to an owner to occupy at market value c. Acquiring a property and trading it for another property 6. Fix & Flip is what type of strategy? a. Income b. Cash Flow & Wealth Building c. Cash 7. It is illegal to invest in commercial real estate without a license in New York. a. True b. False 1 8. Any offer to purchase property as an investment must be written on the approved New York Real Estate Purchase Contract. a. True b. False 9. All residential rental property in New York must be registered in the county where the property resides. a. True b. False 10. REO stands for: a. Real Estate Owned b. Residential Equity Objective c. Real Estate Organizations d. Rental Equity Objective 11. Which of the following are common causes of distress? a. Property problems b. Bad health c. Loss of job d. Divorce e. B and C only f. All of the above 12. Which of the following is considered an advantage of buying from the lender AFTER the Trustee’s sale? a. Adequate time to obtain financing to close b. Easy to get an interior inspection c. Many competitors d. Quick purchase with clean title e. Three of the above f. All of the above 13. What is a “short sale”? a. A term applied to any purchaser under five feet tall b. Negotiating a price for less than market value c. Lender agreeing to accept less than what is owed on the property d. A sale completed in less than normal time 14. What is the most significant difference between a “short sale” and a traditional market sale? a. Motivation of buyer b. Condition of title c. Time allowed to obtain financing d. Third party approval of the transaction 15. Which of the following is the most common requirement to a successful short sale? a. Buyer’s overuse of credit cards b. Borrower hardship as an approval condition of the sale c. The title to the property would be an asset to the lender 2 d. None of the above 16. The foreclosure process in New York is primarily a: a. Judicial procedure b. Trustee procedure 17. Title Insurance is required to close escrow on an investment property? a. True b. False 18. Which of the following is NOT true? a. A “short sale” is a price less than is owed b. A “wholesale” sale is a price less than market c. A “trustee” sale is usually at fair market value d. A “pre-foreclosure” sale may require lender approval 19. Which of the following are examples of using “other people’s money” to buy real estate? a. A traditional new mortgage loan b. A seller carry-back c. Assuming the existing financing d. Cash from your IRA e. Three of the above f. All 4 of the above 20. Passive investing usually means that you don’t make the major decisions, such as selection of the renters or tenants. a. True b. False 21. Which of the following services should you ALWAYS use? a. Title insurance b. An attorney c. A real estate agent d. A commercial banker e. A & B 22. Lease Option is a common technique real estate investors use to control property. Which of the following is a viable time to Lease Option? a. On the buying side of the transaction b. On the selling side of the transaction c. On both the buying and selling side of the transaction d. Never, Lease Options are illegal in New York 23. In taking a property “subject to” you are: a. Taking the property subject to the current financing b. Taking the property subject to the property being leased c. Taking the property subject to the property being vacated d. Taking the property subject to the property being re-financed 24. It is illegal in New York to pay a “birddog” to find investment property? 3 a. True b. False 25. Hard Money should be used to finance a real estate transaction when: a. Money is no object b. Time is of the essence c. A low Interest rates is required d. Short term financing is needed e. All of the above f. A & C g. B & D 26. Private Money differs from Hard Money in: a. Interest rates are usually lower b. May come from relatives or people you know c. Can be sourced from self-managed retirement accounts d. Terms are more easily negotiated e. All of the above 27. To depreciate Real Estate: a. It must be paid off b. It must be multi-unit c. It must be used in your business or income-producing activity (rental property) d. It must be improved property 28. Which is the primary lien? a. 1st Mortgage b. Property Tax c. 2nd Mortgage d. IRS 29. When you purchase a tax deed, you are not purchasing the property. You are simply paying the property owner’s taxes and getting the interest and the penalties that the government would normally collect. a. True b. False SECTION 2: CREDIT SCORE BASICS 30.Who collects the information on which credit scores are most frequently based? a. FICO and VantageScore b. Three main credit bureaus – Equifax, Experian and TransUnion c. Individual lenders d. Federal government . 31.Who may make a credit score available to an individual consumer? a. Three main credit bureaus - Equifax, Experian and TransUnion b. Independent websites c. Many individual lenders 4 d. All of the above 32. What is a good generic credit score? a. 600 b. 700 c. 800 d. 900 e. It depends on the scoring system 33. Are generic credit scores free? a. Always b. Sometimes c. Never 34. When are lenders required by federal law to send borrowers a disclosure that includes the credit score the lender used to reach a lending decision? a. After a consumer applies for a mortgage b. On all credit card, auto and other consumer loans when lenders are offering different interest rates to different consumers c. Whenever a consumer is turned down for a loan d. All of the above 35. When will multiple inquiries about getting a mortgage or auto loan or loans from lenders lower one’s FICO or VantageScore? a. Each time one makes an inquiry b. Only when one makes at least five inquiries c. Never during a 1-2 week window d. Never 36. Which of the following might use credit scores? a.Mortgage lender b. Credit card issuer c. Home Insurer d. Cell Phone Company e. Electric Company f. Landlord g. All of the Above 37. When deciding whether to extend a loan, lenders look for which of the following? a. Capacity b. Capital c. Collateral d. Credit e. All of the above f. None of the above SECTION 3: BASIC STOCK INVESTING 38. As a shareholder you are entitled to all of the following except: 5 a. Claim on the company’s assets and earnings b. Voting Rights c. Claim on all furniture, trademarks and contracts of the company. d. Ability to make day to day business decision e. All of the above 39. What happens to shareholders if a company goes bankrupt and liquidates? a. Shareholders must pay creditors their portion of debt with personal assets b. Shareholders lose their entire investment in the company c. All shareholders receive a portion of the liquidated assets d. None of the above e. All of the above 40. Which type of stock pays a fixed dividend, but tends to have no voting rights? a. Common Stock b. Stock Options c. Preferred Stock d. Class A Stock e. None of the above 41. What is the most important factor that affects the value of a company? a. Supply and demand b. Hype c. Cash Flow d. Earnings e. Market capitalization 42. A company’s market capitalization is calculated by which formula? a. Stock price multiplied by the number of shares outstanding b. The number of shares outstanding divided by the stock price c. Stock price divided by earnings per share d. Net income divided by the number of shares outstanding e. There is no formula 43. Dividend Reinvestment Plans, or DRIPS, allow shareholders to: a. Obtain expert advice b. Reinvest dividends c. Purchase shares directly from the company d. B & C e. None of the above 44. If someone is considered to be bearish, where do they think the stock market is heading? a. Higher b. Lower c. Stagnant (flat) d. None of the Above 45. Which of the following does not appear on a stock quote in a financial paper? a. Ticker Symbol b. Dividend Yield 6 c. Close d. Day High and Low e. Number of shares outstanding 46. Historically, what asset has always performed the best over the long term? a. Bonds b. Stocks c. Mutual Funds d. Index Funds e. Savings Accounts Student Information: REIA NYC Member: Yes or Jump Start Program Participant: No Yes or New Investor ______ Experienced Investor ______ Non-Member ______ No First Name: ______________ Last Name: _________________________ Email Address for Quiz Results: __________________________________ Phone Number: _____________________________________ Thank you for completing The Fundamentals of Investing in Real Estate Quiz. Please fax to 844-300-4333 Or email: membership@reianyc.org Passing Score: A minimum of 37 correctly answered is required. 43-46 Review missed questions. 40-42 Study areas of missed questions. 37-39 Study areas of missed questions. Give serious consideration to taking classroom instruction. Less than 37 You must complete either the Furious Fundamentals or Fast Start to Success Class. 7