Document

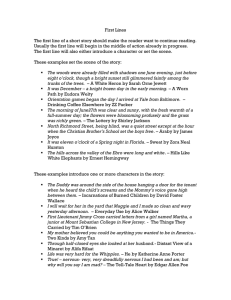

• Convertible Bond https://store.theartofservice.com/the-convertible-bond-toolkit.html

Types of business entity - Peru

1

Those conditions state there must be a primary public offering of shares or convertible bonds in stocks, which are held by more than 750 shareholders, more than 35% of its capital belonging to 175 shareholders, or that all shareholders entitled to vote approve the adjustment to the scheme https://store.theartofservice.com/the-convertible-bond-toolkit.html

SK Telecom - China

1

In 2006, SK Telecom bought $1 billion worth of convertible bonds of China Unicom Hong

Kong, a China Unicom enterprise and agreed to cooperate in joint sourcing of handsets, development of additional services, platform development, marketing and distribution, customer relationship management, and network development. One result of this partnership is jointly developing handsets to be sourced by Samsung, LG, and Motorola.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

ISO 10962 - Structure of CFI Code

1

The second character refers to specific groups within each category. For example, the subdivisions of the Equities category are: ordinary shares, preferred/preference shares, units, and others, while for the

Debt instruments category, the subdivisions are: bonds, convertible bonds, money market instruments, and others. https://store.theartofservice.com/the-convertible-bond-toolkit.html

CBSSports.com - SportsLine

1

In 1998, SportsLine raised $150 million in a secondary offering and in 1999 raised

$150 million in a convertible bond offering https://store.theartofservice.com/the-convertible-bond-toolkit.html

Rio Tinto Group - Chinalco investment

1

The proposed investment structure reportedly involves $12.3billion for the purchase of ownership interests of Rio

Tinto assets in its iron ore, copper, and aluminium operations, plus $7.2billion for convertible bonds https://store.theartofservice.com/the-convertible-bond-toolkit.html

Rio Tinto Group - Chinalco investment

1

Rio Tinto is believed to have pursued this combined asset and convertible bond sale to raise cash to satisfy its debt obligations, which require payments of $9.0billion in

October 2009 and $10.5billion by the end of

2010. The company has also noted China's increasing appetite for commodities, and the potential for increased opportunities to exploit these market trends, as a key factor in recommending the transaction to its shareholders.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

1worldspace - Bankruptcy

1

The company filed for Chapter 11 bankruptcy protection on Friday, October 17, 2008. The reorganization includes a 90-day $13 million debtor-in-possession financing approach, with the hopes of obtaining added funds to repay senior secured notes and convertible bond|convertible notes. The company's wholly owned India affiliate was not covered by the bankruptcy filing.Aviation Week

Space Technology Vol. 169 No. Oct 16, 27.

2008, WorldSpace Bankruptcy, p. 19.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

International Finance Corporation - Investment services

1

The portfolio is widely distributed across all regions including Africa,

East Asia, South Asia, Eastern Europe, Latin America and the

Middle East, and recently has invested in Small Enterprise

Assistance Funds' (SEAF) Caucasus Growth Fund,[ http://www.ifc.org/ifcext/pressroom/IFCPressRoom.nsf/0/2412B48C

EDCF3A1B852579D1004E0DC0 IFC, Partners Support Small and

Medium Enterprises in the Caucasus] Aureos Capital's Kula Fund II

(Papua New Guinea, Fiji, Pacific Islands)[ http://www.ifc.org/ifcext/spiwebsite1.nsf/0/0A26EA152DE53C18852

576BA000E2CA9 IFC Kula Fund II] and Leopard Capital’s Haiti

Fund.[ http://www.ifc.org/ifcext/Pressroom/IFCPressRoom.nsf/0/064AE600

0F1E9D8A852579CD00517278 IFC's First Private Equity

Investment in Haiti Supports Reconstruction and Job Creation]

Other equity investments made by the IFC include preferred stock|preferred equity, convertible bond|convertible loans, and participation loans https://store.theartofservice.com/the-convertible-bond-toolkit.html

Hedge funds - Structure

1

The prime broker acts as a counterparty to

Derivative (finance)|derivative contracts, and lends securities for particular investment strategies, such as Long/short equity|long/short equities and Convertible arbitrage|convertible bond arbitrage https://store.theartofservice.com/the-convertible-bond-toolkit.html

Suzlon Energy - History

1

It has to redeem 500 million worth of

FCCB's(foreign currency convertible bonds)in 2012 in tranches of 300 million in

June and 200 million in October respectively.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Japanese asset price bubble - Changes in the bank behaviour

1

convertible bonds, bonds with Warrant

(finance)|warrants etc.)

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Bain Capital - Sankaty Advisors

1

With $15.7 billion of assets under management, Sankaty invests in a wide variety of securities, including leverage

(finance)|leveraged loans, high-yield bonds, distressed securities, mezzanine debt, convertible bonds, structured products and equity investments https://store.theartofservice.com/the-convertible-bond-toolkit.html

CIBC World Markets - Sale to Oppenheimer Co. (Fahnestock Viner)

1

Investment Banking, Corporate Syndicate,

Institutional Sales and Trading, Equity

Research, Options Trading and a portion of the Debt Capital Markets business which includes Convertible Bond Trading,

Loan Syndication, High Yield Origination and Trading as well as related operations located in the UK, Israel and Hong Kong https://store.theartofservice.com/the-convertible-bond-toolkit.html

KBC Bank - KBC Bank NV

1

KBC Bank also has investment banking operations in Europe, US and Asia. A specialist arm called KBC Financial

Products operates primarily in global convertible bonds; its branch in Japan is called KBC Securities Japan, which specialises in secondary equity broking, convertible bonds, warrants, and equity derivatives.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Private equity - Growth capital

1

PIPE investments are typically made in the form of a Convertible bond|convertible or preferred stock|preferred security that is unregistered for a certain period of time.[http://query.nytimes.com/gst/fullpage.

html?res=9E0CE1DB1031F936A35755C0

A9629C8B63 When Private Mixes With

Public; A Financing Technique Grows

More Popular and Also Raises Concerns] https://store.theartofservice.com/the-convertible-bond-toolkit.html

Société Générale - 1990s 2000s

1

Bolstered by a sound client base and a recognised capacity for innovation borne out by the league tables (the Group is ranked among the global leaders in equity derivatives, convertible bonds, export finance, etc.), Société Générale is looking to develop its MA, advisory and IPO activities through the acquisition of specialised firms

(SG Hambros in the United Kingdom, Barr

Devlin in the United States).

https://store.theartofservice.com/the-convertible-bond-toolkit.html

ISO 10962 - Structure of CFI Code

1

* The second character refers to specific groups within each category. For example, the subdivisions of the Equities category are: ordinary shares, preferred/preference shares, units, and others, while for the

Debt instruments category, the subdivisions are: bonds, convertible bonds, money market instruments, and others. https://store.theartofservice.com/the-convertible-bond-toolkit.html

BNP Paribas CIB - Structure of BNP Paribas CIB

1

* 'Corporate Finance:' BNP Paribas'

Corporate Finance team performs most of the traditional investment banking functions of the group including mergers and acquisitions advisory, and equity raising operations such as Initial Public

Offering|Initial Public Offerings (IPOs), rights issues, and convertible bonds|convertible bond issues.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Mathematical finance - Derivatives pricing: the Q world

1

The goal of derivatives pricing is to determine the fair price of a given security in terms of more market liquidity|liquid securities whose price is determined by the law of supply and demand. The meaning of fair depends, of course, on whether one considers buying or selling the security. Examples of securities being priced are option (finance)|plain vanilla and exotic options, convertible bonds, etc. https://store.theartofservice.com/the-convertible-bond-toolkit.html

Credit rating agency - Ratings use in bond market

1

The process and criteria for rating a convertible bond is similar, although different enough that bonds and convertible bonds issued by the same entity may still receive different ratings https://store.theartofservice.com/the-convertible-bond-toolkit.html

HealthSouth - Recovery and the new HealthSouth

1

Another issue that was immediately addressed by the board was the means by which it obtain the cash for interest payments of senior bonds and principal payments due on a $344 million convertible bond https://store.theartofservice.com/the-convertible-bond-toolkit.html

Income statement - Earnings per share

1

* 'Diluted': in this case “weighted average of shares outstanding” is calculated as if all stock options, warrants, convertible bonds, and other securities that could be transformed into shares are transformed.

This increases the number of shares and so EPS decreases. 'Diluted EPS is considered to be a more reliable way to measure EPS.' https://store.theartofservice.com/the-convertible-bond-toolkit.html

Sino-Forest Corporation - Subsidiaries

1

Sino-Forest Corporation owns an interest of approximately 60% of Omnicorp Limited

(to be renamed Greenheart Group Limited upon shareholder approval), a Hong Kong listed company (HK:0094). In addition,

Sino-Forest owns HK$212 million of convertible bonds of Omnicorp, which if fully converted would increase Sino-

Forest’s interest to nearly 60% of the enlarged issued share capital of

Omnicorp. https://store.theartofservice.com/the-convertible-bond-toolkit.html

Exotic option - Features

1

Even products traded actively in the market can have the characteristics of exotic options, such as convertible bonds, whose valuation can depend on the price and Volatility (finance)|volatility of the underlying Stock|equity, the credit rating, the level and Volatility (finance)|volatility of interest rates, and the correlations between these factors.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Bond (finance) - Types

1

* Convertible bonds lets a bondholder exchange a bond to a number of shares of the issuer's common stock.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Capital structure - Arbitrage

1

If the spread (the difference between the convertible and the non-convertible bonds) grows excessively, then the capitalstructure arbitrageur will bet that it will converge.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Commercial banking - Unsecured loan

1

Some corporate bonds have an embedded call option that allows the issuer to redeem the debt before its maturity date. Other bonds, known as convertible bonds, allow investors to convert the bond into equity.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Securities research

1

Fixed income analysts are also often subdivided by asset class —among the fixed income asset classes with the most analyst coverage are convertible bonds, high yield bonds (see high-yield debt), and distressed bonds (see distressed securities) https://store.theartofservice.com/the-convertible-bond-toolkit.html

Structured products - Origin

1

Investment banks then decided to add features to the basic convertible bond, such as increased income in exchange for limits on the convertibility of the stock, or principal protection https://store.theartofservice.com/the-convertible-bond-toolkit.html

Yield (finance)

1

In finance, the term 'yield' describes the amount in cash (in percent terms) that returns to the owners of a security (finance)|security.

Normally, it does not include the price variations, at the difference of the total Return

(finance)|return. Yield applies to various stated rates of return on stocks (common and preferred, and Convertible bond|convertible), fixed income instruments (bonds, notes, bills, strips, zero coupon), and some other investment type insurance products (e.g. annuities).

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Mezzanine capital - Structure

1

*'Ownership' — Along with the typical interest payment associated with debt, mezzanine capital will often include an

Stock|equity stake in the form of attached warrant (finance)|warrants or a conversion feature similar to that of a convertible bond. The ownership component in mezzanine securities is almost always accompanied by either cash interest or

PIK interest, and, in many cases, by both.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Stock dilution

1

This increase in the number of shares outstanding can result from a primary market offering (including an initial public offering), employees exercising employee stock options|stock options, or by conversion of convertible bonds, preferred shares or warrant (finance)|warrants into stock https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond

1

Convertible bonds are most often issued by companies with a low credit rating and high growth potential.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond

1

These properties lead naturally to the idea of convertible arbitrage, where a long position in the convertible bond is balanced by a short position in the underlying equity.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond

1

From the issuer's perspective, the key benefit of raising money by selling convertible bonds is a reduced cash interest payment. The advantage for companies of issuing convertible bonds is that, if the bonds are converted to stocks, companies' debt vanishes. However, in exchange for the benefit of reduced interest payments, the value of shareholder's equity is reduced due to the stock dilution expected when bondholders convert their Bond

(finance)|bonds into new shares.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Types

1

*'Vanilla convertible bonds' are the most plain convertible structures

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Additional features

1

Any convertible bond structure, on top of its type, would bear a certain range of additional features as defined in its issuance prospectus: https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Additional features

1

*Conversion ratio: The number of shares each convertible bond converts into. It may be expressed per bond or on a per centum (per 100) basis.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Additional features

1

*Coupon: Periodic interest payment paid to the convertible bond holder from the issuer. Could be fixed or variable or equal to zero.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Additional features

1

*Yield: Yield of the convertible bond at the issuance date, could be different from the coupon value if the bond is offering a premium redemption. In those cases the yield value would determine the premium redeption value and intermediary put redemption value.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Additional features

1

*Contingent conversion (aka CoCo):

Restrict the ability of the convertible bondholders to convert into equities https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Additional features

1

*Change of control event (aka Ratchet):

Conversion price would be readjusted in case of a take-over on the underlying company.

There are many subtype of ratchet formula

(e.g. Make-whole base, time dependent...), their impact for the bondholder could be small

(e.g. ClubMed, 2013) to significant (e.g.

Aegis, 2012). Often, this clause would grant as well the ability for the convertible bondholders to put i.e. ask for the early repayment of their bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Structure and terminology

1

Due to their relative complexity, the convertible investors could refers to the following terms while describing a convertible bonds: https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Structure and terminology

1 typical in the case of the Sukuk, Islamic convertible bonds, needing a specific legal setup to be compliant with the Islamic law).

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Structure and terminology

1

*Synthetic: synthetically structured convertible bond issued by an investment bank to replicate a convertible payoff on a specific underlying. Most reverse convertibles are synthetics. Please note the Packaged

Convertibles (e.g. Siemens 17

DE000A1G0WA1) are not considered to be synthetics since the issuer would not be an

Investment Bank: they would only act as underwriter. Similarly, replicated structure using straight bonds and options would be considered as a package structure.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Markets and Investor profiles

1

The global convertible bond market is a relatively small with about 400 bn USD (as of Jan 2013, excluding synthetics), as a comparison the straight corporate bond market would be about 14,000 bn USD.

Among those 400 bn, about 320 bn USD are Vanilla convertible bonds, the largest sub-segment of the asset class.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Markets and Investor profiles

1

*Hedged/Arbitrage/Swap investors:

Proprietary trading desk or hedged-funds using as core strategy Convertible

Arbitrage which consists in, for its most basic iteration, as being long the convertible bonds while being short the underlying stock https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Valuation

1

The 3 main stages of convertible bond behaviour are:

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Valuation

1

From a valuation perspective, a convertible bond consists of two assets: a

Bond (finance)|bond and a warrant

(finance)|warrant. Valuing a convertible requires an assumption of https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Uses for investors

1

*Convertible bonds are usually issued offering a higher yield than obtainable on the shares into which the bonds convert.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Uses for investors

1

*Convertible bonds are safer than preferred stock|preferred or common shares for the investor. They provide asset protection, because the value of the convertible bond will only fall to the value of the bond floor. At the same time, convertible bonds can provide the possibility of high equity-like returns.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible bond - Uses for investors

1

*Also, convertible bonds are usually less volatile than regular shares. Indeed, a convertible bond behaves like a call option. Therefore, if C is the call price and

S the regular share then https://store.theartofservice.com/the-convertible-bond-toolkit.html

Weighted average cost of capital

1

Companies raise money from a number of sources: common equity, preferred stock, straight debt, Convertible bond|convertible debt, Exchangeable bond|exchangeable debt, Warrant (finance)|warrants, Option

(finance)|options, Pension|pension liabilities, executive stock options, governmental subsidies, and so on https://store.theartofservice.com/the-convertible-bond-toolkit.html

Mortgage law - Renaissance and after

1

Attempts by the lender to carry an equity interest in the property in a manner similar to convertible bonds through contract have been therefore struck down by courts as clogs, but developments in the 1980s and

1990s have led to less rigid enforcement of this principle, particularly due to interest among theorists in returning to a freedom of contract regime.Shanker M https://store.theartofservice.com/the-convertible-bond-toolkit.html

Exchangeable bond

1

A convertible bond gives the holder the option to convert bond into shares of the issuer.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Exchangeable bond

1

The pricing of an exchangeable bond is similar to that of convertible bond,[http://faculty.gsm.ucdavis.edu/~bmb arber/Paper%20Folder/FM%20Exchangea ble%20Debt.pdf Exchangeable Debt] splitting it in straight debt part and an embedded option part and valuing the two separately.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Debenture - Convertibility

1

As a result of the advantage a buyer gets from the ability to convert, convertible bonds typically have lower interest rates than non-convertible corporate bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Indenture - Modern usage

1

'Bond indenture' (also 'trust indenture' or

'deed of trust') is a legal document issued to lenders and describes key terms such as the interest rate, maturity date, convertible bond|convertibility, pledge, promises, representations, covenants, and other terms of the bond offering. When the Prospectus

(finance)|offering memorandum is prepared in advance of marketing a bond, the indenture will typically be summarised in the description of notes section.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Trader (finance)

1

According to the Wall Street Journal in

2004, a managing director convertible bond trader was earning between

$700,000 and $900,000 on average.[http://online.wsj.com/article/SB11

3141870174290857.html Street's

Weather: Bonus Showers - WSJ.com] https://store.theartofservice.com/the-convertible-bond-toolkit.html

BNP Paribas - Corporate and investment banking

1

* 'Investment Banking:' BNP Paribas'

Corporate Finance team performs most of the traditional investment banking functions of the group including mergers and acquisitions advisory, and equity raising operations such as Initial Public

Offering|Initial Public Offerings (IPOs), rights issues, and convertible bond issues.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Fortis (finance) - Post-Leterme I developments

1

Het Financieele Dagblad reports that

Hessels, acting chairman of the board of

Fortis, expects additional payments from the Dutch government: it concerns €2 billion worth of convertible bonds, which are due to be converted in 2010 into

Fortis's shares at a fixed price of €18.74 per share https://store.theartofservice.com/the-convertible-bond-toolkit.html

Euronext Paris - Structure and indices

1

The SBF-FCI index is based on a selection of convertible bonds that represent at least 70% of the total capitalization of this market, calculated twice daily https://store.theartofservice.com/the-convertible-bond-toolkit.html

Relative value (economics) - In hedge funds

1

Some hedge funds engage principally in arbitrage strategies in the global equity and corporate debt markets by taking advantage of mispricings between two related and often correlated securities.

Typical arbitrage strategies include: fixed income arbitrage, convertible arbitrage|convertible bond arbitrage, statistical arbitrage, and derivative arbitrage.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible arbitrage

1

The premise of the strategy is that the convertible is sometimes priced inefficiently relative to the underlying stock, for reasons that range from illiquidity to market psychology. In particular, the equity option embedded option|embedded in the convertible bond may be a source of cheap volatility

(finance)|volatility, which convertible arbitrageurs can then exploit.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible arbitrage - Risks

1

In the Black Monday (1987)|1987 stock market crash, however, many convertible bonds declined more than the stocks into which they were convertible, apparently for liquidity reasons, with the market for the stocks being much more liquid than the relatively small market for the bonds https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible security

1

Convertible securities may be convertible bonds or preferred stocks that pay regular interest and can be converted into shares of common stock (sometimes conditioned on the stock price appreciating to a predetermined level) https://store.theartofservice.com/the-convertible-bond-toolkit.html

Bond option - Embedded options

1

*Convertible bond: allows the holder to demand conversion of bonds into the stock of the issuer at a predetermined price at a certain time period in future.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Hybrid security - Examples

1

* A convertible bond is a Bond

(finance)|bond (i.e. a loan to the issuer) that can be converted into common share

(finance)|shares of the issuer. A convertible bond can be valued as a combination of a straight bond and an

Option (finance)|option to purchase the company's stock.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

NYSE Euronext - Euronext

1

Euronext is the first integrated cross-border exchange, combining the stock exchanges of

Amsterdam, Paris, Brussels and Lisbon into a single market. Issuers who meet European

Union regulatory standards are qualified for listing on the regulated markets operated by

Euronext. The company's exchanges list a wide variety of securities, including domestic and international equity securities, convertible bonds, warrants, trackers and debt securities, including corporate and government bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Jacob Little - Market operations

1

What the traders did not know was that

Little had purchased convertible bonds at a company sale in London a few years before; Little entered the premises, apparently unrushed, carrying an oversize bag of what was revealed to be those very bonds, which Little had converted to stocks https://store.theartofservice.com/the-convertible-bond-toolkit.html

Jacob Little - Later life and legacy

1

This did much to give credence to convertible bonds, then still a novelty.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Model risk - Illiquidity and model risk

1

Convertible bonds, mortgage backed securities, and high-yield bonds can often be illiquid and difficult to value. Hedge funds that trade these securities can be exposed to model risk when calculating monthly NAV for its investors.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

List of systemically important banks

1

* Max. 1.5% Additional Tier 1 capital

(Hybrid security|Hybrid capital, i.e.

Convertible bond|Contingent Convertibles aka CoCos).

https://store.theartofservice.com/the-convertible-bond-toolkit.html

List of systemically important banks - SIFI's within each of the EEA member states (both domestic and global)

1

In addition, the new EU rules also requires all instruments recognised in the Additional

Tier 1 capital of any credit institution or investment firm to be Convertible bond|Contingent Convertibles, where it has to be either written down or converted into Common Equity Tier 1 instruments, when the Common Equity Tier 1 capital ratio of the institution falls below 5.125%.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Outstanding bond - Types

1

* Convertible bonds let a bondholder exchange a bond to a number of shares of the issuer's common stock. These are known as Hybrid security|hybrid securities, because they combine Equity

(finance)|equity and debt features.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Callable bond

1

The price behaviour of a callable bond is the opposite of that of puttable bond.

Since call option and put option are not mutually exclusive, a bond may have both options embedded.[http://nd.edu/~zda/TeachingNo te_ConvertibleBonds.pdf Teaching Note on Convertible Bonds] https://store.theartofservice.com/the-convertible-bond-toolkit.html

Reverse convertible - How do reverse convertibles work?

1

Note: Coupon rate is determined by issuer.

Sometimes holders do expect zero coupon bond like reverse convertible bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Convertible note - Additional features

1

*Contingent conversion (aka CoCo):

Restrict the ability of the convertible bondholders to convert into equities https://store.theartofservice.com/the-convertible-bond-toolkit.html

Borsa Italiana - Operations

1

Borsa Italiana has managing responsibility for Italy's derivative (finance)|derivatives markets (IDEM and MIF) and its fixed income market (MOT). On the MOT

(Electronic Government Bond and

Securities Market), buy and sell contracts are traded on government securities and nonconvertible Bond (finance)|bonds; the

EuroMOT is the Euro-Bond Electronic

Market that trades Eurobonds, bonds from foreign issuers and asset-backed https://store.theartofservice.com/the-convertible-bond-toolkit.html

securities.

Borsa Italiana - Structure

1

The stock market is divided into five parts:

1) The electronic share market (MTA) trades Italian share (finance)|shares, convertible bonds, and warrant

(finance)|warrants; the Covered warrant|covered-warrant market is an electronic share market https://store.theartofservice.com/the-convertible-bond-toolkit.html

Diluted Earnings Per Share

1

'Diluted Earnings Per Share (diluted EPS)' is a company's earnings per share (EPS) calculated using fully diluted shares outstanding (i.e. including the impact of stock option grants and convertible bonds). Diluted EPS indicates a worst case scenario, one that reflects the issuance of stock for all outstanding options, warrants and convertible securities that would reduce earnings per https://store.theartofservice.com/the-convertible-bond-toolkit.html

share.

Diluted Earnings Per Share - U.S. GAAP

1

The numerator used in calculating diluted

EPS is adjusted to take into account the impact that the conversion of any securities would have on earnings. For example, interest would be added back to earnings to reflect the conversion of any outstanding convertible bonds, preferred dividends would be added back to reflect the conversion of convertible preferred stock, and any impact of these changes on other financial items, such as royalties and taxes, would also be adjusted.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Banco Popolare

1

In June 2009 the company became the first Italian bank to receive state aid from the Politics of Italy|Government of Italy due to the ongoing Financial crisis of

2007 –2010|financial crisis. It sold €1.5 billion in convertible bonds to the state.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Pecking Order Theory - Profitability and debt ratios

1

That is, they start with debt, then possibly hybrid securities such as convertible bonds, then perhaps equity as a last resort https://store.theartofservice.com/the-convertible-bond-toolkit.html

Aegon - History

1

On October 28, 2008, the Dutch government and

De Nederlandsche Bank agreed to give Aegon a

€3 billion capital injection to create a capital buffer in exchange for convertible bonds to ease the group through the Financial crisis of 2007-

2008|financial crisis.[http://www.dnb.nl/en/newsand-publications/news-and-archive/persberichten-

2008/dnb190201.jsp Government reinforces

AEGON’s capital position by EUR 3 billion] De

Nederlandische Bank, 28 October 2008 On June

15, 2011, Aegon fulfilled its key objective of repurchasing all of the €3 billion core capital securities issued to the Dutch State https://store.theartofservice.com/the-convertible-bond-toolkit.html

Embedded option

1

An 'embedded option' is a component of a bond (finance)|financial bond or other security, and usually provides the bondholder or the issuer the right to take some action against the other party. There are several types of options that can be embedded into a bond. Some common types of bonds with embedded options include callable bond, puttable bond, convertible bond, extendible bond, and exchangeable bond. A bond may have several options embedded if they are not mutually exclusive.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Lobster trap (finance)

1

In a lobster trap, the target firm issues a

Articles of Incorporation|charter that prevents individuals with more than 10% ownership of convertible security|convertible securities (includes convertible bonds, convertible preferred stock, and warrants) from transferring these securities to Voting interest|voting stock https://store.theartofservice.com/the-convertible-bond-toolkit.html

Bond fund - Types

1

Bond funds may also be classified by factors such as type of yield (high income) or term (short, medium, long) or some other specialty such as zero-coupon bonds, international bonds, multisector bonds or convertible bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Puttable bond

1

The price behaviour of puttable bonds is the opposite of that of a callable bond.

Since call option and put option are not mutually exclusive, a bond may have both options embedded.[http://nd.edu/~zda/TeachingNo te_ConvertibleBonds.pdf Teaching Note on Convertible Bonds] https://store.theartofservice.com/the-convertible-bond-toolkit.html

Business organizations - Peru

1

Those conditions state there must be a primary public offering of shares or convertible bonds in stocks, which are held by more than 750 shareholders, more than 35% of its capital belonging to 175 shareholders, or that all shareholders entitled to vote approve the adjustment to the scheme https://store.theartofservice.com/the-convertible-bond-toolkit.html

Equity derivative - Convertible bonds

1

Convertible bonds are bonds that can be converted into shares of stock in the issuing types of companies|company, usually at some pre-announced ratio. It is a hybrid security with debt- and equity-like features. It can be used by investors to obtain the upside of equity-like returns while protecting the downside with regular bond-like coupons.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

International Petroleum Investment Company - Company history

1

:2011 IPIC fulfilled its commitment to subscribe for the remaining mandatory convertible bonds in Aabar and converted those bonds into equity, increasing its stake from 86.2 per cent. to 93.1 per cent.

In addition, IPIC purchased shares of

Aabar in the open market, which further increased its stake from 93.1 per cent. to

95.3 per cent. (now 95.47 per cent.).

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Furuno - 2000s

1

* '2006' Developed the 12.1-inch multi-color

LCD radar FR-8002 series. Developed FCV-

620, a fish finder with a 5.6-inch LCD for the pleasure boat market. Purchased a 49% stake in French company SIGNET S.A. and convertible bonds. Established Furuno

Europe as a local subsidiary in Rotterdam, the Netherlands. Developed S-VDR

(Simplified Voyage Data Recorder) VR-

3000S. Developed ultra sensitive GPS receiver for mobile communication device market.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Citadel LLC - Kensington and Wellington Funds

1

On December 4, 2008, the Wall Street

Journal revealed that the largest Citadel funds lost 13 percent in November, bringing the losses for the year to 47 percent. By comparison the Hedge Fund Research HFRX

US Global Hedge Fund Index is down 22 percent this year. Losses came from positions in convertible bonds, bank loans and investment grade bonds. Citadel rebounded from its 2008 losses to post a $5 billion profit through November

2009.http://www.opalesque.com/55926/citade l/rebounds163.html

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Equity Capital Markets

1

Institutions providing ECM services may be involved in initial public offerings

(IPO),convertible bonds, and other services involving equity.http://www.hsbcnet.com/gbm/produ cts-services/financing/equity-capitalmarkets.html They may also raise money for a company merge or acquisition of another company https://store.theartofservice.com/the-convertible-bond-toolkit.html

Qualified institutional placement - QIPs in India and the US

1

Therefore, to encourage domestic securities placements (instead of Currency|foreign currency convertible bonds (FCCBs) and global or American depository receipts

(GDRs or ADRs)), the Securities exchange|Securities Exchange Board of India

(SEBI) has with effect from May 8, 2006 inserted Chapter XIIIA into the SEBI

(Disclosure Investor Protection) Guidelines,

2000 (the DIP Guidelines), to provide guidelines for Qualified Institutional

Placements (the QIP Scheme).

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Michael Milken - High-yield bonds and leveraged buyouts

1

Before long, the CEOs and CFOs of many smaller and mid-sized companies previously limited to the slow and expensive private-placement market were making early-morning pilgrimages to

Beverly Hills seeking to issue high-yield and/or convertible bonds through Drexel

Burnham https://store.theartofservice.com/the-convertible-bond-toolkit.html

Trading (finance)

1

According to the Wall Street Journal in

2004, a managing director convertible bond trader was earning between

$700,000 and $900,000 on average.[http://online.wsj.com/article/SB11

3141870174290857.html Street's

Weather: Bonus Showers - WSJ.com] https://store.theartofservice.com/the-convertible-bond-toolkit.html

Credit rating agencies - Ratings use in bond market

1

The process and criteria for rating a convertible bond are similar, although different enough that bonds and convertible bonds issued by the same entity may still receive different ratings https://store.theartofservice.com/the-convertible-bond-toolkit.html

Asia Television - Ownership shift

1

Tsai has agreed to inject HK$1 billion in the form of convertible bonds.The Standard HK https://store.theartofservice.com/the-convertible-bond-toolkit.html

Bolsa de Madrid

1

'Bolsa de Madrid' (; Madrid Stock

Exchange) is the largest and most international of Spain's four regional stock exchanges (the others are located in

Barcelona, Valencia (city in

Spain)|Valencia, and Bilbao) that trade shares and convertible bonds and fixed income securities, and both government and private-sector debt. Bolsa de Madrid is owned by Bolsas y Mercados https://store.theartofservice.com/the-convertible-bond-toolkit.html

Españoles.

Aabar Investments - UniCredit

1

In June 2010, Aabar bought a 4.99% stake in UniCredit|UniCredit SpA worth $2.48 billion, becoming the Italian bank’s second biggest shareholder. The investment is in line with the company's strategy to invest in financial services. It first invested in

UniCredit, the biggest lender in Central and Eastern Europe, in the bank's 2008 capital increase through convertible bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Hybrid Investment

1

The two most popular types of Hybrid

Investments are Preferred Stock and

Convertible Bond (finance)|Bonds.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Hybrid Investment

1

'Convertible Bonds' – Bondholders periodically receive interest payments. An exchange of bonds for a specified number of equity shares is acceptable, but only in accordance with the convertible bond covenant.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Finnish banking crisis of 1990s - Government intervention and aftermath

1

In 1992, to stabilize the financial sector and to prevent a credit crunch, the government gave a 7.1 billion Finnish markka|FIM ( €1.2 billion), initially zerointerest convertible bond|convertible loan to Finnish banks. Most of the banks (with the notable exception of SKOP) later paid back this loan.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

Lazard Capital Markets

1

Lazard Capital Markets focuses its activities on equity research, sales and trading; fixed-income and convertible bond sales and trading; and securities underwriting. The firm maintains a business alliance agreement with Lazard that provides for the continuation of certain historical business relationships including origination of transactions.

https://store.theartofservice.com/the-convertible-bond-toolkit.html

For More Information, Visit:

• https://store.theartofservice.co

m/the-convertible-bondtoolkit.html

The Art of Service https://store.theartofservice.com