7 Taxes Human Resources

advertisement

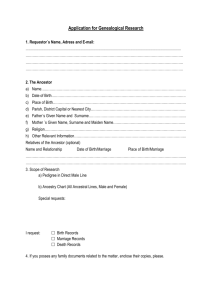

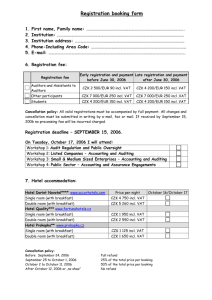

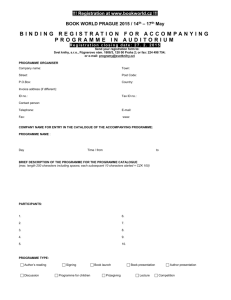

System of taxes in the Czech Republic - our system (1. 1. 1993): A) direct taxes: 1. income taxes, 2. real estate tax, 3. real estate-transfer tax, inheritance tax, gift tax, 4. road tax; B) indirect taxes: 1. value added tax, 2. excise taxes, 3. tax for environment (it hasn´t so far the executive law and isn´t levied). 1 Direct taxes: - in competence of tax offices (they fall within the Ministry of Finance) Indirect taxes and customs: - in competence of customs offices 2 Main features of public finances reform - taxes: a) Direct taxes 1. NATURAL PERSON INCOME TAX Today (until 31.12.2007): Tax base Tax 0 – 10 100 CZK 12 % ≈ (0 – 480 UDS) 10 101 – 18 200 CZK 1 212 + 19 % of base exceeding 10 100 CZK ≈ (480 – 870 USD) ≈ (58 USD + 19 % of base exceeding 480 UDS) 18 201 – 27 600 CZK 2 751 + 25 % of base exceeding 18 200 CZK ≈ (870 – 1 315 USD) ≈ (131 USD + 25 % of base exceeding 870 USD) 27 601 and more CZK 5 101 + 32 % of base exceeding 27 600 CZK ≈ (1 315 USD and more USD) ≈ (243 USD + 32 % of base exceeding 1 315 USD) Tax base = gross wage – insurance (8 % social insurance; 4,5 % health insurance) An employer must pay for each employee 26 % social insurance and 9 % health insurance. 3 - only one rate: 15 % - levy from „super-gross wage“, i. e. gross wage + social payments paid by employer (it corresponds to 20,25 % of current gross wage) - joint taxation of married couple will finish 4 2. CORPORATE INCOME TAX Reducing of rates: • 21 % for year 2008 • 20 % for year 2009 • 19 % for year 2010 Today: 24 % 5 Spain Ireland Malta Poland Slovenia Slovakia Sweden 6 3. PROPERTY TAXES - Real Estate Tax - Tax on land and buildings. - The tax on land depends on the quality of particular land, its location and use (several coefficients). - The tax on buildings is not based on market value but on physical characteristics. - Real Estate Transfer Tax - Tax is at a fixed rate of 3 % on the tax basis. 4. ROAD TAX - Imposed only on vehicles used for business purposes. - Tax rates are assessed as annual fixed rates. - The tax period for vehicles registered in the Czech Republic is the calendar year. A tax return must be filed and tax must be paid by January 31 of the following year. 7 5. INHERITANCE AND GIFT TAX - the tax depends on the price (valuation) of the inheritance or the gift and on the degree of the family relationship between the heir / the recipient of a gift and the testator / the person conferring the gift (=> progressive rate: 7 – 40 % = different for wife, son, cousin, uncle …) - the principle of calculation is the same for both taxes, the difference is only at the end: gift tax * 0,5 = inheritance tax 8 b) INDIRECT TAXES 1. Value Added Tax (VAT) - two rates: 19 % (for most goods and services) 5 % (for certain services and essential goods food, medications, newspapers, books …) VAT Exempt (0% VAT) The following forms of receipts may be numbered among the receipts exempt from VAT: - Postal services - Broadcasting services - radio and television - Financial institutions (banks, insurance companies) - Health services - Welfare services - Non-profit making institutions - increasing of the reduced rate 5 % to 9 % - basic rate stays: 19 % 9 10 2. ExciseTaxes Wine Tax Beer Tax Spirit Tax Tobacco and Tobacco Products Tax 11 Other features of public finances reform: MATERNITY BENEFITS This benefit will be paid out for 28 weeks to married and also to lonely mothers and 37 weeks after the childbirth of twins, triplets, quadruplets … Today: 37 weeks after childbirth also to lonely mothers. 12 BIRTH GRANT Fixed amount according to the sequence of children: • 1st child: 15 000 CZK (≈ 715 $) • 2nd and next child: 13 000 CZK (≈ 620 $) Today: 17 760 CZK (≈ 850 $) SCHOOL BENEFIT (books, pencils, …) 1 000 CZK for new-boys 13 Human Resource Management Personal Management 14 „People are our greatest asset“ 15 Which activities include personal management? 16 … activities: Manpower planning Recruitment, selection and placement Job evaluation, appraisal, merit rating Promotion, transfer, dismissal of people Training and retraining, career development Reward system Conditions of employment, personal affairs 17 Role of personal department in the organisation = management of changes in a structure and a quality of human resources in accordance with needs of economic and social background and also requirements of the employees - includes managerial functions selection, deployment and management of employees 18 1. Manpower planning The objective to find out requirement (lack) of employees, external cooperation (if needed) for the future activities of the organization. There are four dimensions: professional factor – job description – which of the professional category of employees is needed, 19 Manpower planning Job description: document specifying the objectives of a job, the work to be performed, the responsilibilities involved, the skills needed, the relationship of the job to other jobs, working conditions … 20 Manpower planning 2. job specification (man qualification) – written description of special qualification level (rank) for a given profession (experience, education, special skills, other requirements) 21 Manpower planning 3. time factor – when the requirement of this profession in a qualification structure, 4. organisational factor – in which organisational structure are the employees needed. RESULT - plan of employees = manpower plan 22 Manpower plan It is a base for: employees recruitment, regulation of employment (transfer of manpower from department to other dept.), assurance of given qualification or requalification of groups of employees, valuation of cost of wages, social services, increasing of qualification, negotiation with trade (labour) unions about the collective agreement. 23 2. Forms of recruitment Internal recruitment (selection) – more effective form than external selection; uses the information about internal employees (qualification, motivation). The source of information is current valuation of employees. External recruitment (selection) – it is necessary to find suitable candidates (sources: schools, universities, job centres, media, friends). 24 Process of recruitment Job advertisement SELECTION - CV, interviews - adoption, training (on-the-job) and practical position in the organization 25 Recruitment and selection of employees Which candidate is suited fot the job. Equal Employment Opportunity STEPS: 1) Initial contact with job applicants 2) Application form 3) Employment test 4) Interview by Human Resource Department and Supervisor 5) Reference Evaluation 6) Medical Examination 7) Employment 26 3. Job and employee evaluation - the aim is to know and use qualification of employees, develop their career, motivate them and make a good reward system It is important for: valuation of their objectives, nomination to higher positions, changes in work positions, increasing of qualification, termination of the job (cutbacks or firing because of the poor performance). 27 4. Performance criteria of employees - depend on the job position written valuation of an employee work, behaviour during the working process (absence etc.), personal characteristics, prospects for the organisation. 28 5. Training and development Training Retraining 29 Forms of training On-the-job training = learning by doing Off-the-job training = classroom training Management development programs – job rotation, coaching, assessment center … 30 6. Wage and salary administration Compensation - payments of employees for their work Do you know the difference between wage and salary? 31 WAGE x SALARY WAGE – a payment based on calculation of the number of hours the employee has worked; or the number of units he or she has produced The more hours worked, the higher the worker's pay. SALARY – compensation on time, but the unit of time is a week, a month or a year instead of merely an hour Salaried workers normally receive no pay for extra hours, they are seldom penalized for time loss. 32 7. Employee benefits and services Financial benefits other than wages, salaries and supplementary rewards: Insurance plans – health and life insurance Pension plans Health and safety program Credits union … 33 Job application 1. From the side of applicant 2. From the side of employer 34 1. a) Letter of motivation - cover letter - A "letter of motivation" or cover letter (CL) is your opportunity to "sell" yourself, i.e. convince the institution or company that they need to have you. Do not be modest: when applying for a job, explain clearly why you think you are suited for the position. The goal of a CL is to provide a picture of your background and goals that will persuade the admission committee to accept you. 35 Structure of cover letter: Opening Paragraph Identify position you are seeking and what resource you used to find the opening. Indicate that you meet the employer's needs. Keep the first paragraph short and to the point. 36 Structure of cover letter: Middle Paragraph(s) Expand on the purpose of the letter; stress your strongest points as they relate to the position you seek. Communicate specific experiences that demonstrate your qualifications. Demonstrate that you know something about the employer's organization. You should present yourself as eager and enthusiastic about your work. 37 Structure of cover letter: Closing Paragraph Plan of action. Be assertive!! For example, "I would appreciate the opportunity to further discuss my qualifications and the immediate and longterm contribution I could make to your corporation. Please contact me at (+420) 555 - 5555 at your convenience." 38 b) Curriculum vitae - - - - - Personal information (name, address, phone, e-mail, date of birth …) Work experience (firms´ names and their addresses, branch, your tasks and responsibilities …) Education and courses Personal skills and abilities (languages; social, organizational, technical, artistic skills …) Additional information (contact person, references …) Enclosures 39 2. Job position announcement Company (name, address …) Job title Responsibilities Requirements What company offers How to answer, contact, deadline 40