THE LOCAL PROPERTY TAX

advertisement

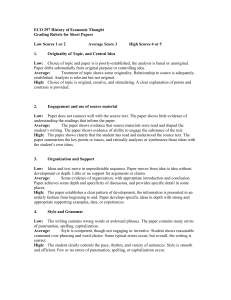

THE LOCAL PROPERTY TAX Advantages Disadvantages Proper Use ADVANTAGES of the PROPERTY TAX I • Transparency: Individual citizens can easily identify the property tax base. Individual citizens can review and challenge their property tax burdens, compare them to those of their neighbors, and directly to the benefits they receive. ADVANTAGES of the PROPERTY TAX II • Equity: Link between payments and government services is direct and unambiguous. Under local property tax, where local government actions increase citizen welfare and where assessments truly reflect the market values of the underlying assets being taxed, the beneficiaries of government action necessarily also pay for it. • Moreover, The tax is hard to evade. ADVANTAGES of the PROPERTY TAX III • Efficiency: Property taxes can have many of the desirable consequences of user charges. • Collection Cost: The costs of property tax administration are much lower than the costs of administering sales and income taxes when compliance costs are taken into account Objections to Property Tax Reflect a Misunderstanding of how it Works? Often people who have the worst understanding are the people who should be best informed -- opinion makers, lawyers, judges, and other public officials JQP (average citizen) knows that decisions about property taxes and service levels directly influence the worth of their homes JQP (average citizen) understands that local action is justified if, and only if, government thereby increases the value of their property (which automatically means that the action also increases citizen welfare more than it increases tax obligations). Why the Property Tax is often Misunderstood 1. Assessments frequently do not reflect the economic value of the asset being taxed: a lot of land is excluded from the property tax base and much of the rest is under or arbitrarily assessed. 2. People often do not understand how capitalization works. Understanding capitalization is central to understanding the property tax. How does capitalization work? Imagine two otherwise identical towns: Alpha and Beta Beta does not. Hence, Alpha has good parks the demand for and Some people value the price of land in parks and will want Alpha will be to live in Alpha to greater than in Beta. be near them. The value of parks will thereby be capitalized into land values More Formally • ”Capitalization" is the process by which a stream of benefits or costs is converted into asset prices. • Benefit streams increase asset values, and cost streams decrease them. The Mathematics of Capitalization I If the benefits and costs flowing from a a asset are constant over time, the following formula shows how capitalization works: (1) P = B / I • This formula says that the price of the land (P) is equal to the annual net benefit flow (rental value) from the piece of property (B) divided by an appropriate discount rate (i). The Mathematics of Capitalization II Since rents (B) must cover both the tax and the normal return on the asset, a tax rate (t) on land price is capitalized as: (2) P = B / (i + t) As t increases, P decreases, but B is unaffected. The logic of capitalization says that local governments that rely on the property tax cannot shift the cost of capital improvements or current operations into the future by borrowing. If municipal debt is also capitalized, land prices will be decreased by an amount equal to the present value of future property tax payments Evidence of Capitalization I • William T. Bogart and Brian A. Cromwell, in an article entitled “How Much More is a Good School District Worth?” reported finding that where other things were held equal (including taxes and school spending per pupil), the reputation of its schools could add up to $50,000 to the average price of homes in a district. Evidence of Capitalization II • Noelwah Netusil, in an article entitled, “Can Public Parks be Self-Financing? Results from Portland, Oregon,” found that homes located within 500 meters of public parks generated additional property tax revenues of over $400,000 for the City of Portland. Evidence of Capitalization III • A. Quang Do and C. F. Sirmans, in an article entitled “Residential Property Tax Capitalization,” said they had found that where other things were again held equal, each dollar paid in property taxes reduced housing prices about $25. • The point is that housing prices, local government services, and property tax rates are interdependent. Problems with the property tax I The property tax can be a real hardship for the elderly, especially those who are retired on fixed or reduced incomes. Most of oldsters own their own homes, many without mortgages. They must, therefore, pay large and inconvenient lump sums once or twice a year or be kicked out onto the streets. Problems with the property tax II Assessments often really are unfair. Often publicly owned land, plus land occupied by religious, educational, and charitable institutions are exempt. Moreover, in some jurisdictions assessments do not even purport to represent market evaluations. Special exemptions are given to some property owners, including high-tech companies, farmers and others. Problems with the property tax III Commercial property is not assessed the same way as private homes are. Assessments on private homes reflect the market value of the property and its improvements, including capitalization of the property tax itself; assessments on commercial property reflect whichever is the less of the capitalized value of the property’s rental stream or its replacement value minus depreciation. Problems with the property tax IV Taxing improvements actually discourages people from maintaining or fixing up their property. Houses in poor condition, for example, are often given a discount on their assessed value. Homeowners who maintain their homes are often assessed at the full rate. These Problems Arise from the way the tax is administered I Most problems could have been fixed by focusing the property tax on land -- away from improvements -- and subjecting all land to the property tax, regardless of ownership or current use. For example: Taxing land rather than improvements would mitigate the incentives to underutilize real property. A 1997 study by Oates and Schwab showed that when the city of Pittsburgh, Pa., restructured its system of property taxation to one in which land was taxed at more than five times the rate on structures, it experienced a dramatic increase in building activity.