Recent Financial Turmoil - What's New by Dr Peter

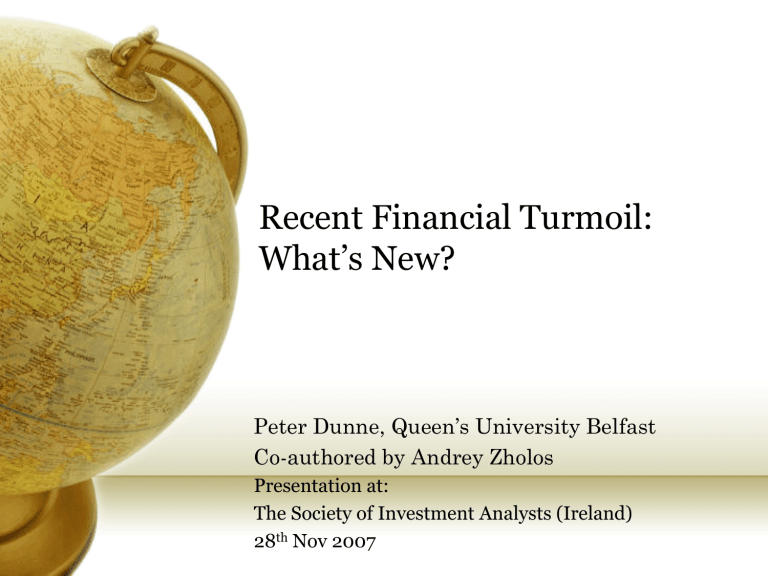

Recent Financial Turmoil:

What’s New?

Peter Dunne, Queen’s University Belfast

Co-authored by Andrey Zholos

Presentation at:

The Society of Investment Analysts (Ireland)

28 th Nov 2007

A Role for Financial Structure?

Traditionally ‘money’ was at the centre of macro theory of crashes

Gertler (1988) blames the Keynesian revolution and monetarists for redirecting attention.

Gurley and Shaw (1955) focused on Credit supply rather than monetary aggregates.

Revisionists

Bernanke (1983) on the relative importance of monetary versus financial factors in the Great Depression.

“The breakdown in banking affected real activity by choking off financial flows to certain sectors of the economy, sectors consisting of borrowers who did not have easy access to non-intermediated credit.”

“..worsening of balance sheets resulting from the jump in debt service shrank borrowers’ collateral…”

Revisionists

Bernanke (1983) found that financial variables were important determinants of output

Liabilities of failed banks and businesses and spreads between risky and safe bond rates added considerable explanatory power to

Barro-type output equations.

Disruption of credit markets was not simply a response to anticipations of future output decline.

Hamilton (1987) and many others provide further evidence supporting this view.

Information asymmetry

Moral hazard

Akerlof's (1969) ‘market for lemons’ influenced Jaffee

& Russell (1976) and Stiglitz & Weiss (1981)

Lemons theory explains how unobserved differences in borrower quality induces credit rationing.

Mankiw (1986) analyzes a credit market plagued by lemons problems……a small rise in the riskless interest rate can lead to collapse.

The increase in the loan rate reduces the average quality of borrowers.

This forces the loan rate up further to offset the lemons effect.

If the lemons problem is severe enough, the market will collapse.

Information asymmetry

Myers & Majluf (1984) and

Greenwald, Stiglitz & Weiss (1984)

Equity financing effects of information asymmetry regarding the value of a firm's existing assets.

Bernanke and Gertler (1986)

Resurrect ‘balance sheet effects’ also known as ‘collateral

effects’, ‘financial capacity’ effects or ‘debt deflation’.

Gan(2007)

Shows such effects in the Japanese economy after the property decline of the late 1980s.

Lessons from recent panics/crashes

Seeds of a moral hazard problem?

Japan – late 1980s……BoJ too slow!

A warning to other monetary authorities

.

Crash of 1987

The beginning of the Greenspan put?

South-Asian currency and bank crises 1997&1998

Is the current turmoil just a repeat of this but with Western banks now at the centre of the storm?

Russian debt moratorium 1998

Unobserved exposures through derivatives mkts

LTCM

Bailing out of LTCM inviting moral hazard problem

Spread of systemic risk through collapse of markets

Particularly derivatives mkts

Any difference this time?

Low interest rates, cheap money, yield chasing?

Not so different from before

Too few investment opportunities.

Was the macro environment too loose given that inflation was been kept under control by other factors?

Inefficient credit ratings – not a new problem?

Peek and Rosengren (1998) report that throughout 1995 and 1996 Libor quotes for major Japanese banks for eurodollar and euroyen borrowing rarely differed by more than a few basis points, even though there were substantial differences in their credit ratings provided by the major rating agencies.

Any difference this time?

More concentrated and more integrated markets?

More Bank Regulation

Stronger bank balance sheets following Basel I?

More off-balance sheet activity!

More systemic reaction to crisis….all trying to beef-up liquidity at the same time

More transparency….MiFID, NMS etc.

Increasing the risks in financial intermediation

Any difference this time?

Sovereign funds

Complications arising from politics of BRIC K current account surpluses in dollars.

Bad taste resulting from DPW sell-off of ports to AIG and some reluctance to invest in US colateralized debt.

Slide of dollar could transmit problems to BRIC K

Collateralized Debt Obligations

All the lemons problems you could wish for!

But not that new! The tail has wagged the dog before.

During LTCM crisis derivative positions threatened other markets

US EU

Market integration - volatility

Granger causality tests (daily data for 2 years)

Variables

VIX………..S&P volatility from options

EUR10 ……iTRAXX Euro 10Y CDS prem

VOL10 ……iTRAXX High Vol 10Y CDS prem

SEN10 ……iTRAXX Sen Financial 10Y CDS prem

SUB10 ……iTRAXX Sub Financial 10Y CDS prem

Cross10 ……iTRAXX Cross 10Y CDS prem

USV2 ……UST 2year yield volatility

USV10….. UST 10year yield volatility

What causes what?

Shock variable

VIX

EUR10

VOL10

SEN10

SUB10

CROSS10

USV2

USV10

VIX

F-Signif

0.000

0.311

0.680

0.008

0.005

0.290

0.541

0.615

EUR10

F-Signif

0.000

0.000

0.051

0.000

0.023

0.004

0.753

0.694

0.304

0.000

0.087

0.135

0.011

Dependent variable

VOL10

F-Signif

0.000

SEN10

F-Signif

0.006

0.000

0.070

0.000

0.005

0.024

SUB10

F-Signif

0.001

0.012

0.146

0.029

0.000

0.010

0.934

0.739

0.692

0.232

0.760

0.271

0.408

0.000

0.181

0.207

CROSS10

F-Signif

0.000

0.516

0.022

0.282

USV2

F-Signif

0.004

0.264

0.134

0.576

0.758

0.643

0.027

0.243

Points of interest? (1) VIX driven by iTRAXX Financials

(2) VIX feedsback to iTRAXX

USV10

F-Signif

0.192

0.474

0.202

0.664

0.851

0.729

0.389

0.001

Interaction of Volatility & Market Quality

Granger causality tests (daily data for 5 years)

Variables

VIX……………S&P volatility from options

USV2 ………..Volatility of UST yields

ITV2 …………Volatility of Italian yields spra_10Y_US ……Bid-ask spread in UST mkt spra_10Y_IT………Bid-ask spread in IT(MTS)

What causes what?

Shock variable

VIX

USV2

ITV2

SPRA_10Y_US

SPRA_10Y_IT

VIX

F-Signif

0.000

0.228

0.329

0.839

0.992

USV2

F-Signif

0.000

0.000

0.314

0.069

0.051

Points of interest!

Dependent variable

ITV2 SPRA_10Y_US

F-Signif

0.612

0.254

0.000

0.189

0.002

F-Signif

0.116

0.036

0.757

0.000

0.146

(1) VIX drives UST volatility

(2) US Bid-Ask drives EU Bid-Ask

SPRA_10Y_IT

F-Signif

0.742

0.548

0.687

0.002

0.000

Recent warnings

Giddy(1981) comment regarding the functioning of the interbank eurocurrency market

“Indeed, if it is true that the market places great store on central bank support, it will continue to grant credit without discrimination to large banks. In effect the market will test central banks’ mettle, and if ever the rule of central bank rescues is broken, severe credit rationing will occur.”

Mervin King threatened such a rule break!

Recent warnings

G10 central banks report 1992

“… the heightened concern with credit risk, reflecting both a perception of increased default risk and greater difficulties in assessing counterparties’ strength, has led many banks to reduce the size of interbank credit exposures that can be authorised, to shorten the maturity of the business they are willing to take on, and to limit dealing activities that yield low profits but give rise to large counterparty exposures ”

0.05

0.04

0.03

0.02

0.01

0

Yields at the short and long maturities

Long and short yield Italian Bonds y_10_YEAR_IT y_2_YEAR_IT

Liquidity provision at the short and long maturities

8000000000

7000000000

6000000000

5000000000

4000000000

3000000000

2000000000

1000000000

0

Liquidity 10Year

Liquidity 2Year

Recent warnings

Bernard & Bisignano (BIS, 2000)

“Interbank lending to Asia grew enormously prior to the Asian crisis, at times with arguably little recognition of the quality of the borrowing institution. International interbank credit also declined dramatically after the crisis erupted, contributing to a major collapse in economic activity.”

Short term IIBM borrowing was funding low quality sovereign debt.

Giddy (1981) and Clarke (1983) pointed to the widespread belief among market participants that central banks would step in to support the market if it came under stress.

Clarke reported that inquiries about counterparties’ balance sheets were considered to be in “rather bad taste”. Particularly if the bank in question was a very large bank – more likely to be bailed out.

Effects already

Liquidity effects

Feedback from dollar concerns

Sovereign funds worry

Higher yields on even govies in Europe

Having a futures market helped Bunds

Better functioning markets also means more concentration in activity and therefore more direct linkages between banking organizations and therefore more systemic risk.

Towards solutions

What drives the assumption that central banks will provide a safety-net?

Is it worthwhile trying to reduce moral hazard and how can it be done?

Can bubbles be detected? …viewed as a dead science in academia and policy circles.

Would it be possible to coordinate CB policy so as to reduce cheap fuelling of leveraged investments internationally?

Towards solutions

By-pass the intermediary (Sell direct to surplus countries)

This assumes intermediaries add nothing

Can high real interest rates be good?

In very well developed economies…

Should central banks monitor the type of investment going on.

Towards solutions

Can transparency help?

Counterparty transparency is problematic.

No incentive to reveal debt positions so lemons problem.

If revealed it would reduce the costs of credit analysis and counterparty risk but increase position risk

Would it reduce moral hazard risk?

Bester (1985) suggested that simultaneously offering loan rates and collateral requirements would help.

Good borrowers would then prefer lower rates and greater collateral given their lower probability of potential default.

But the ‘tail can wag the dog’ unless transparency abounds.

Hold on to your hat!

Still a rough ride ahead!

We may be spared a Japanese style finish

Deflation is rather unlikely