Estate Planning

advertisement

Professor Robin Klomparens

Spring 2016

916-996-2811 (cell)

916-920-5286 (work)

robin@wkblaw.com

SYLLABUS

ESTATE PLANNING

REQUIRED COURSE MATERIALS:

Federal Taxation of Wealth Transfers 3rd Edition by Stephanie Wilbanks

Federal and State Gift Taxes (Internal Revenue Code and Regulations). If a student prefers, he

or she can print the relevant sections online. There also may be some reference to income tax

sections which similarly can be obtained online.

The Professor will also be supplementing the materials and these will be passed out during class.

OPTIONAL TEXTBOOKS:

CCH US Master Estate and Gift Tax Guide 2016

READING AND PROBLEM ASSIGNMENT:

The reading assignments are stated in the syllabus. There may be additional reading assigned as

additional materials are distributed. The problems for each week will be assigned the prior week

unless otherwise stated. Oral participation is helpful per the grading discussed below.

EXAMINATION AND GRADING

Your grade will be based on one anomalously graded final exam. The final will be taken in class

and will be three hours long. For the exam, you will be allowed to use any of the course

materials, the Code, Regulations and anything you have prepared including class notes. A

simple calculator may also be used. Your grade may be raised or lowered by 1 grade (for

example, i.e., from an A to an A+ or B+) for class participation and attendance.

MEETINGS:

If any of the students desire to have a meeting that can be arranged by contacting the professor.

{99999.RLK / 01015476.DOCX.2 }

1

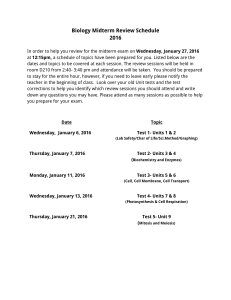

Class No.

Date

1

Wednesday, January 13, 2016

Topic

Overview of course and transfer taxes.

Chapter 1: Introduction to the Federal Tax

System, pages 1-22.

Chapter 2: Income Taxation of the Transfer of

Wealth, pages 23-38.

Skim all problems.

2

Wednesday, January 20, 2016

Chapter 4: The definition of a gift, pages 99134.

Chapter 5: Completion, pages 135-150.

3

Wednesday, January 27, 2016

Chapter 5: Completion, pages 151-164.

Chapter 6: The Annual Exclusion, pages 167194.

4

Wednesday, February 3, 2016

Chapter 9: Retained Interests, pages 281-330.

5

Wednesday, February 10, 2016

Chapter 9: Retained Interests (continued),

pages 281-330.

6

Wednesday, February 17, 2016

Chapter 3: Valuation, pages 39-98. There will

also be a discussion about the valuation of

“good will” and other recent case law.

7

Wednesday, February 24, 2016

Chapter 7: Property Owned at Death, pages

195-208.

Chapter 8: Joint Ownership, pages 209-2__.

8

Wednesday, March 2, 2016

Chapter 10: Annuities and Employee Death

Benefits, pages 331-363

9

Wednesday, March 9, 2016

Spring Break

10

Wednesday, March 16, 2016

TBD

11

Wednesday, March 23, 2016

Chapter 11: Powers of Appointment, pages

365-390.

Chapter 12: Life Insurance, pages 391-411.

12

Wednesday, March 30, 2016

TBD

13

Wednesday, April 6, 2016

Chapter 13: Expenses, Claims, Debts, Taxes

and Losses, pages 419-438.

Chapter 14: Transfers to Charity, pages 439458.

{99999.RLK / 01015476.DOCX.2 }

2

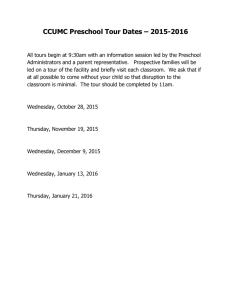

Class No.

14

Date

Wednesday, April 13, 2016

Topic

Chapter 15: Transfers to the Surviving Spouse,

pages 459-504. There will also be a discussion

of QDOTS and portability.

Chapter 16: Credits, pages 507-518.

15

Wednesday, April 20, 2016

Chapter 17: Generation Skipping Transfer Tax,

pages 519-540.

Final Exam is on May 4, 2016, in room 452

{99999.RLK / 01015476.DOCX.2 }

3