Chapter 7 Outline Day 9 Product Diversification Corporate Level

advertisement

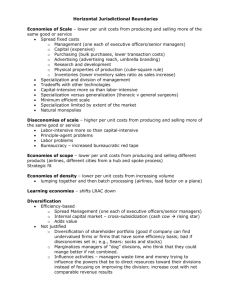

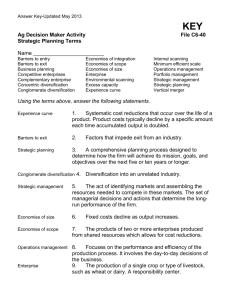

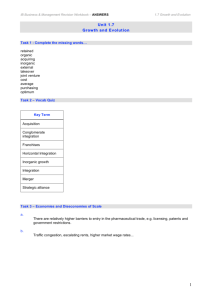

Chapter 7 Outline Day 9 Product Diversification I. II. Corporate Level Strategy a. Corporate Level Strategy should create value: i. Such that businesses forming the corporate whole are worth more than they would be under independent ownership. ii. That equity holders cannot create through portfolio investing b. Therefore i. Corporate level strategy must create synergies between divisions that create value that couldn’t be created by independent ownership ii. Economies of scope differentiation Diversification a. The difference between integration and diversification: i. Integration-value chain of current products/ business ii. Diversification-different products/ businesses b. Five Types of Corporate Diversification i. Limited Diversification 1. Single business: > 95% of revenues in single business 2. Dominant business: 70% to 95% in single business ii. Related Diversification (less than 70% of revenues in single business) 1. Related Constrained: all businesses related on most dimensions (customers, technology, distribution, brand) 2. Related Link: some businesses related on some dimensions iii. Unrelated Diversification (less than 70% of revenues in single business) 1. Businesses are not related c. Value of Diversification i. If a diversification strategy meets the VRIO criteria 1. Is it Valuable? 2. Is it rare? 3. Is it costly to imitate? 4. Is the firm organized to exploit it? a. May create competitive advantage ii. Two Criteria 1. There must be some economy of scope (exist when the value of the product or service that a firm sales increases as a function of the number of businesses that a firm operates in by increasing revenue or decreasing costs 2. The focal firm must have a cost advantage over outside equity holders in exploiting any economies of scope d. Economies of Scope- 4 types of Scope i. Operational Economies of Scope 1. Sharing Activities a. Exploiting efficiencies of sharing business activities; cost born by many businesses 2. Spreading core competencies a. Exploiting core competencies in other businesses b. Competencies bust be strategically relevant ii. Financial Economies of Scope 1. Primary reason for conglomerate boom in 60s-70s 2. Financial advantages were a. Internal capital market i. Premise: insiders can allocate capital across divisions more efficiently than the external capital market ii. Works only if managers have better information iii. May protect proprietary information iv. May suffer from escalating commitment v. However, external capital markets may have more discipline and avoid escalation of commitment b. Risk Reduction i. Counter cyclical businesses may provide decreased overall risk, and thus more stable returns ii. However, individual investors can usually do this more efficiently that a firm risk may also spread c. Tax Advantages i. Transfer pricing policy allows profits in one division to be offset by losses in another division ii. This is especially true internationally iii. Can be used to smooth income iii. Anticompetitive Economies of Scope 1. Multipoint Competition a. Mutual forbearance—a firm chooses not to compete aggressively in one market to avoid competition in another market 2. Market Power a. Using profits from one business to compete in another business b. Using buying power in one business to obtain advantage in another business iv. Managerialism (Employee Reasons) Economies of Scope 1. An economy of scope that accrues to managers at the expense of equity holders 2. Managers of larger firms receive more compensation (larger scope/firm size=more compensation) 3. Therefore, managers have an incentive to acquire other firms become even larger although difficult to detect. v. Rareness of Diversification 1. Diversification per se is not rare 2. Underlying economies of scope may be rare a. Relationships that allow an economy of scope to be exploited may be rare b. An economy of scope may be rare because it is naturally or economically limited vi. Imitability of Diversification 1. Duplication of Economies of Scope a. Less likely to duplicate (codified/tangible) i. Employee compensation ii. Tax advantages iii. Risk reductions iv. Shared activities (may be costly depending on relationships) b. Costly to duplicate (tacit/intangible) i. Core competencies ii. Internal capital allocation iii. Multipoint competition iv. Exploiting market power 2. Substitutions of Economies of Scope a. Internal Development i. Start a new business under the corporate whole ii. Avoids potential cross firm integration issues b. Strategic Alliances i. Find a partner with the desired complementary assets ii. Less costly than acquiring a firm c. Competitors may use these strategies to arrive at a position of diversification without buying another firm.