Risk Management System

advertisement

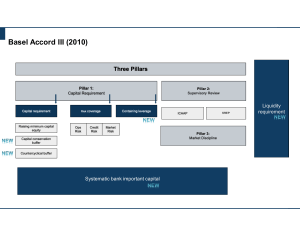

The Risk Management of Commercial Banks: Thailand’s Experience Suchada Dejtrakul Bank of Thailand ASEAN+3 Workshop on Reform and Development of Banking Sector in China Shanghai National Accounting Institute, Shanghai, P.R. China 24-26 May 2005 1 Financial Institutions Performance Financial Institution Thai Banks Foreign Branches Stand-alone IBFs Finance Companies Credit foncier Companies Total Loans of Financial Institutions (billion baht) 5,500 % YoY Loan outstanding Loan growth 15 4,970.3 4,757.7 4,000 8.6 4.5 4,500 -4.4 -11 2004 13 18 5 18 5 59 12 18 4 18 5 57 Non-Performing Loan (NPL) 50 5,395.3 20 17.1 5,135.5 5,000 % 2003 4,251.7 4,064.6 3,500 5 0 38.9 30 17.9 20 15.7 12.7 -5 10.8 10 10.5 -15 -20 1999 2000 2001 2002 2003 2004 NPL 10 -10 -17.2 40 0 1999 2000 2001 2002 2003 2 2004 Development of Risk Management in Thailand 1993 Basel I (Credit risk) was applied to financial institutions 1999 BOT’s supervision and examination of financial institutions has focused on risk management Sep 2002 Issued policy statements on liquidity risk management Dec 2003 Issued the market risk supervision policy Published risk-based examination manuals covering strategic, credit, market, liquidity, and operational risks Aug 2004 Issued standard template for collection of operational loss data and supporting guidelines on operational risk management Dec 2004 Issued a supervision policy on interest rate risk in banking book Feb 2005 Published prudential guidelines on Internal Rating System, Credit Scoring System, Market and Credit Risk Stress Testing, Risk Model Validation, and Loan Portfolio Management 3 Risk Management System The BOT assesses financial institutions risk management system in 5 areas • Strategic Risk • Credit Risk • Market Risk • Liquidity Risk • Operational Risk 4 Supporting Factors for Risk Management. 1 Involve of the board of directors and high level management 4 Set up risk management system 2 Effective Risk Management Establish a unit to operate risk management Formulate risk management policies and procedures 3 5 Limitations to Risk Management Limitations Involve of the board of directors and high level management Formulate risk management policy and procedures Establish a unit to operate risk management Set up risk management system Not enough cooperation Low qualification Lack of independence to make a decision Not transparence Policies/ procedures not match with risks Underdevelopment Infrastructure Rigid to implement Communication failure Lack of adequate structure Staff has less experience Lack of independence No follow up and control system Not enough risk assessment/ management instruments Database and IT system 6 1. Market Risk Interest rate risk, Equity price risk, Exchange rate risk and Commodity price risk Guidelines Board of Director Approve and review risk strategies and policies Risk assessment Have adequate risk measurement and reliable tools Risk report Effective follow up and report Risk control Establish risk limits Limitations • Not enough instruments to manage market risk • Limitation of market players and types of instruments • Market risk is complex. The understanding is limited to a small group of people • Lack of staff who are expert in both products and management => high turnover 7 2. Liquidity Risk Guidelines Board of Director Authorize the policy and action plan as well as monitor the implementation Risk control Have internal control system that can track and monitor the liquidity risk management system Must monitor exposure in domestic and foreign currencies under relevant scenarios. Risk report Set up an effective and efficient reporting system that generates sufficient information for management to make a decision in a timely manner Limitations • No emergency plans to support liquidity risk or have but not well developed • Never test emergency plan 8 3. Credit Risk Guidelines Board of Director Assign acceptable risk limit Risk assessment Develop model to assess risk (statistic, expert opinion) Assess risk amount and component (sensitivity analysis, stress test) Risk report Risk analysis and report, have early warning indicators Risk control Internal control and examination Limitations • Lending remain concentrate in some specific areas => concentrate risk • Do not have system to assess risk • Use traditional approach to manage risk • Slow development of statistical based approach (lack of IT and data management) 9 4. Strategic Risk Guidelines Board of Director Have experience, responsibility and good governance Risk assessment Strategic plan in line with FI’s main objective Risk report Have independence unit to assess and report risk Precise and up to date data and support decision making Limitations • Have not establish a unit to manage strategic risk or set up only a committee • Assign only executives from core department to conduct strategic plan which should include support department as well • Board of director should not only approve but should participate in conducting strategic plan • Set up unrealistic goals 10 5. Operational Risk Limitations • Lack of effective information systems information disruption • No regulations or policies delay report of defaults delay problems solving • No self-assessment policy or survey of training need 11 Basel II implementation Milestones Year Description 2005 Issue series of consultative papers, conduct industry hearing and finalize the Basel II framework June 2006 Banks to submit Basel II implementation plans for approval Year end 2007 Begin Parallel calculation of Basel I & Basel II (one year for simple approaches, two for advanced) Year end 2008 Year end 2009 Begin new Basel II capital charge (SA, FIRB) Continue parallel calculation (AIRB, AMA) Begin new Basel II capital charge (AIRB, AMA) 12 Approach to calculate capital requirement under Basel II Financial Institutions are require to maintain capital funds against Credit Risk (improved) Market Risk (same as Basel I) Operational Risk (additional) Credit Risk 1. Standardised Approach 2. Internal Ratings-Based Approach 2.1 Foundation Internal Ratings-Based Approach 2.2 Advanced Internal Ratings-Based Approach Market Risk 1. Standardised approach 2. Internal model approach 3. Mixed approach between standardised and internal approaches Operational Risk 1. Basic Indicator Approach 2. Standardised Approach 3. Advanced Measurement Approach 13