Student HW Solutions Chap 3 Day 4

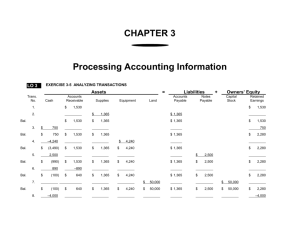

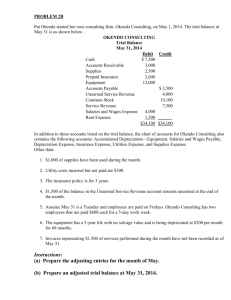

advertisement

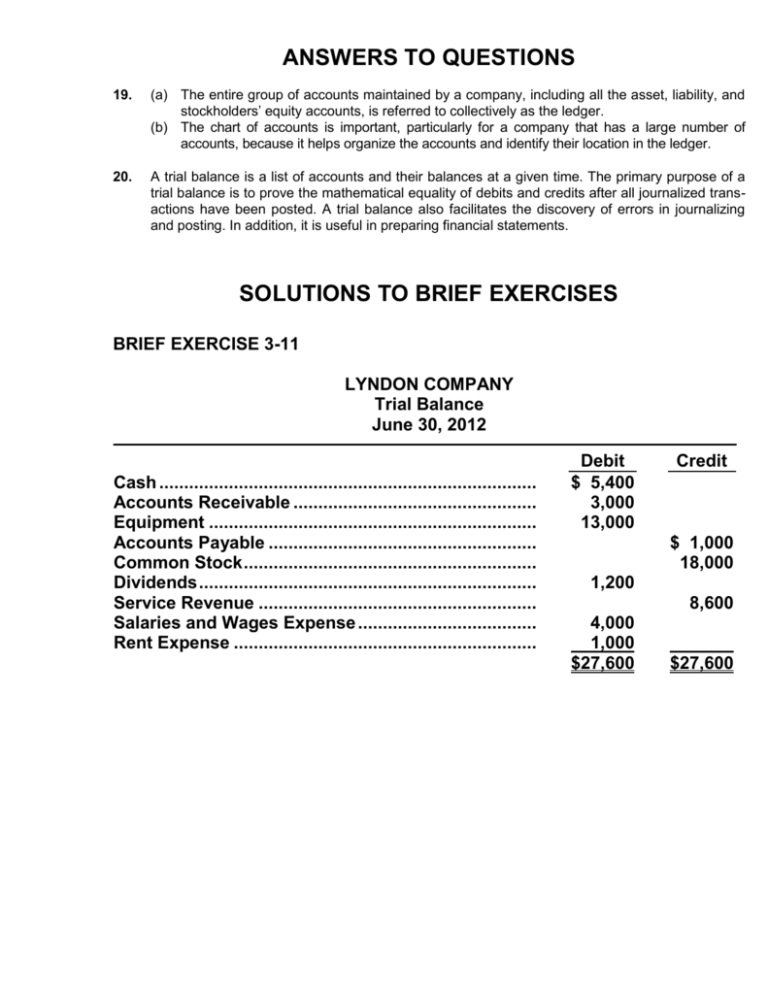

ANSWERS TO QUESTIONS 19. (a) The entire group of accounts maintained by a company, including all the asset, liability, and stockholders’ equity accounts, is referred to collectively as the ledger. (b) The chart of accounts is important, particularly for a company that has a large number of accounts, because it helps organize the accounts and identify their location in the ledger. 20. A trial balance is a list of accounts and their balances at a given time. The primary purpose of a trial balance is to prove the mathematical equality of debits and credits after all journalized transactions have been posted. A trial balance also facilitates the discovery of errors in journalizing and posting. In addition, it is useful in preparing financial statements. SOLUTIONS TO BRIEF EXERCISES BRIEF EXERCISE 3-11 LYNDON COMPANY Trial Balance June 30, 2012 Cash ............................................................................ Accounts Receivable ................................................. Equipment .................................................................. Accounts Payable ...................................................... Common Stock ........................................................... Dividends .................................................................... Service Revenue ........................................................ Salaries and Wages Expense .................................... Rent Expense ............................................................. Debit $ 5,400 3,000 13,000 Credit $ 1,000 18,000 1,200 8,600 4,000 1,000 $27,600 $27,600 SOLUTIONS TO EXERCISES EXERCISE 3-12 (a) Date Apr. 1 4 7 12 15 25 29 30 General Journal Account Titles and Explanation Debit Cash .................................................................. 15,000 Common Stock.......................................... (Issued stock for cash) Supplies ............................................................ Accounts Payable ..................................... (Purchased supplies on account) 5,200 Accounts Receivable ....................................... Service Revenue ....................................... (Billed clients for services rendered) 3,400 Cash .................................................................. Service Revenue ....................................... (Received cash for revenue earned) 700 Salaries and Wages Expense .......................... Cash ........................................................... (Paid salaries) 800 Accounts Payable ............................................. Cash ........................................................... (Paid creditors on account) 3,500 Cash .................................................................. Accounts Receivable ................................ (Received cash in payment of account) 800 Cash .................................................................. Unearned Service Revenue ...................... (Received cash for future services) 900 Credit 15,000 5,200 3,400 700 800 3,500 800 900 EXERCISE 3-12 (Continued) (b) McGREGOR GARDENING COMPANY, INC. Trial Balance April 30, 2012 Cash .................................................................... Accounts Receivable ......................................... Supplies .............................................................. Accounts Payable .............................................. Unearned Service Revenue ............................... Common Stock .................................................. Service Revenue ................................................ Salaries and Wages Expense ............................ Debit $13,100 2,600 5,200 Credit $ 1,700 900 15,000 4,100 800 $21,700 $21,700 PROBLEM 3-6A (a) & (c) 10/1 Bal. 10/5 Bal. Cash 8,200 10/15 1,300 10/20 10/29 10/31 5,700 Common Stock 10/1 Bal. 15,000 Bal. 15,000 1,200 1,900 300 400 10/29 Bal. Accounts Receivable 10/1 Bal. 2,600 10/5 1,300 10/10 5,100 Bal. 6,400 10/1 Bal. Bal. Supplies 2,100 2,100 10/1 Bal. Bal. Equipment 8,000 8,000 10/20 Accounts Payable 1,900 10/1 Bal. Bal. Dividends 300 300 Service Revenue 10/10 10/17 Bal. 5,100 600 5,700 Salaries and Wages Expense 10/15 1,200 Bal. 1,200 10/31 Bal. 4,800 2,900 Unearned Service Revenue 10/17 600 10/1 Bal. 1,000 Bal. 500 Utilities Expense 400 400 PROBLEM 3-6A (Continued) (b) Date Oct. 5 10 15 17 20 29 31 Account Titles and Explanation Cash ................................................................. Accounts Receivable .............................. (Received collections from customers on account) Debit 1,300 Accounts Receivable ...................................... Service Revenue ...................................... (Billed customers for services performed) 5,100 Salaries and Wages Expense ......................... Cash ......................................................... (Paid employee salaries) 1,200 Unearned Service Revenue ............................ Service Revenue ...................................... (Performed services for customers who paid in advance) 600 Accounts Payable ........................................... Cash ......................................................... (Paid creditors on account) 1,900 Dividends ......................................................... Cash ......................................................... (Payment of cash dividend) 300 Utilities Expense ............................................. Cash ......................................................... (Paid utilities) 400 Credit 1,300 5,100 1,200 600 1,900 300 400 PROBLEM 3-6A (Continued) (d) MIMOSA COMPANY Trial Balance October 31, 2012 Cash .................................................................... Accounts Receivable ......................................... Supplies .............................................................. Equipment ........................................................... Accounts Payable .............................................. Unearned Service Revenue ............................... Common Stock ................................................... Dividends ............................................................ Service Revenue ................................................. Salaries and Wages Expense ............................ Utilities Expense ................................................. Debit $ 5,700 6,400 2,100 8,000 Credit $ 2,900 500 15,000 300 5,700 1,200 400 $24,100 $24,100