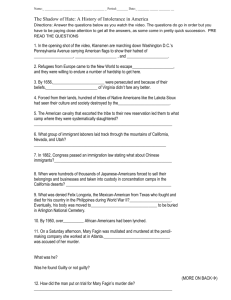

Ford vs. Dell: Suppliers

advertisement

Ford Motor Company: Supply Chain Strategy Spencer Patterson Becky Tibbenham Tatiana Gonzalez David Windle Quinn Gooch Ford’s Model T The Blue Oval Trade Mark Ford Goes Global Lincoln Motor Company acquired in 1922 Ford’s River Rouge Factory 15,767,708 square feet B-24 Bombers Henry Ford Dies in 1947 Ford post WW II post WWII continued.. Ford Expands its Foot Print Ford Turns 100 12 Billion in Losses Matrix Analysis: Ford Motor Company Ford’s Market Position Broad Market Positioning Narrow Low Cost Value - added Product Positioning 14 IT’s Strategic Impact High Factory Impact on Business ops Low Strategic Support Low Turnaround High Impact on Strategy 15 Governance and Ownership Ownership Community Alliance Corporation Market Hierarchy Partnership Governance 16 IT Environment & Enterprise Organization Enterprise Simple Pull system/Low inventory Push system/ high inventory Comple x Stable/Certain Environment Dynamic/Uncertain Where Systems Fall Coupling Loose Tight Linear Interactions Complex Case Questions • What advantages does Dell derive from virtual integration? • How important are these advantages in the auto business? • What challenges must Ford overcome that Dell does not face? • Is the Dell model really relevant to Ford? • How closely should Ford emulate the Dell Model? Auto Industry Industry Sales 2009 2008 2007 2006 2005 US 10.6 13.5 16.5 17.1 17.5 Europe 15.8 16.6 18 17.8 17.6 S. America 4.2 4.3 4.1 3.2 2.7 Asia Pacific Africa 24.5 20.9 20.4 18.6 17.3 US Market Share 2009 2008 2007 2006 2005 Ford 15.3% 14.2% 14.6% 16% 17% GM 19.7 22.1 23.4 24.1 25.8 Toyota 16.7 16.4 15.9 14.9 13 Honda 10.8 10.6 9.4 8.8 8.4 One Ford Strategy • Formed in 2006 • Implemented by CEO Alan Mulally to better align the auto maker’s global resources • Main focus is to impact company’s purchasing operations and its suppliers • Simplify, standardize and reduce the number of vehicle platforms and parts • Simplify vehicle ordering from the customer’s prospective One Ford Objectives Formation of “matched-pairs” system Team product development personnel with those from purchasing Share a common cost objective and improve supplybase interface Identify a single product-development and purchasing contact for a particular commodity Boost profitability of suppliers Longer-term contracts with closer working relationship with select preferred suppliers Profitability/ Efficiency 2006 Profit Margin Asset Turnover Ford -7.88% .56 Toyota 6.52% .79 Dell 6.46% 2.4 2009 Profit Margin Asset Turnover Ford 2.30% .56 Toyota -2.13% .67 Dell 2.71% 1.76 Looking Forward • Conversion of assembly plants to small car production to support consumer preferences • Closing 3 Ford plans in 2010-2011 period • Reduced Suppliers- Target suppliers: 750 – 2004: 3,300 suppliers – 2009: 1,600 suppliers – 2010: 1,500 suppliers • Downsize/Consolidate dealerships – Too many dealers at current and expected US Mkt share What do you do when… • You want to buy a new car? • You want to buy a new computer? Ford’s Model Suppliers Ford’s Plant/Site Operations Ford’s Dealers Customers Dell’s Model Suppliers Dell Customers Ford vs. Dell: Suppliers Suppliers Manufacturing Plants Time to Delivery Ford Ford Dell (2000) (2009) (1998-2010) 30,000 1,600 30+ 180 90 3 45-60 days Goal: 15 days 7-10 days Ford Supply Chain Profile (2008) – Suppliers located in 60+ Countries – Suppliers in Emerging Markets 36 – Supplier Manufacturing Sites 5,500+ – Parts currently being manufactured130,000 – Total Global Purchasing $90+ billion Ford vs. Dell: Supplier Interaction • Ford – Tiered system – Becoming lean – Long-term relationship • Dell – 2-3 suppliers per part – Benchmark-oriented Ford vs. Dell: Customers Ford (USA) Dell (USA) Fleet Business Retail Retail Ford vs. Dell: Selling to Customers • Dell – Customers order online – Shipped directly to their home or office • Ford – Customers purchase through dealer – Customers receive car at the dealer Ford vs. Dell: Selling to Customers • What does a Ford dealer do? – Maintain inventory – Test drives – Trade-Ins – Expertise – Warranty service, recalls, maintenance – Financing, Insurance, Warranties Ford vs. Dell: Customer Care After the Sale • Dell: – Warranty: 90 days to 5 years – Business Customers: Online or On-site Assistance – Retail Customers: Phone or Locally Contracted Service Providers • Ford: – Warranty: 3 to 5 years – All customers served by dealerships IT Progression at Ford Public Internet Site WIPS mid-1995 May 1995 Oracle “Everest” Discontinue Oracle Nov 1999 Aug 2004 Dell IT: Customer Market Internet Call Center Premier.Dell.com IT Management Dell.com Tech Support Dell: Supplier Market • B2B interface • Customer feedback provided to suppliers – “Real-time window” into information systems • Valuechain.dell.com • CAPS • PartMiner Case Questions • What advantages does Dell derive from virtual integration? • • • • • Inventory Expense (Cost reduction) Control of Supply Chain (VMI, EDI, EAM) Efficient Processes (Pull System) Aids Market Oriented Marketing (Customer is King) Creates a competitive advantage Case Questions • How important are these advantages in the auto business? • In context of Lean production…very. • Reduction in inventory and buffer. • Carrying & Transportation costs are reduced (pull system, accurate forecast, lot sizing, potential for mass customization) • As profit margins erode efficiency and waste/redundancies must be eliminated. Case Questions • What challenges must Ford overcome that Dell does not face? • Aligning supply chain sophistication (EAM, XML, legacy architects) • Achieving Lean Sigma in quality control (Safety) • Excellent design, quality and time (lead time) • Size and scope of organization (suppliers, vendors, networks, geography) • Organizational Behavior (Leadership & Management, decentralization) Case Questions • Is the Dell model really relevant to Ford? Case Questions • How closely should Ford emulate the Dell Model?