What is Social Security?

advertisement

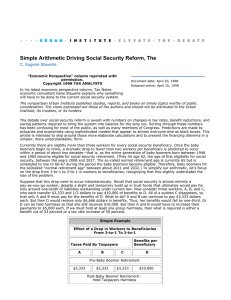

By: Shannon Breedlove, Ayren Burns, Chris Sitzman, & Heather Taylor What is Social Security? History of Social Security Social Security Depletion Problem Supplemental Plans for Social Security American Social Security System Vs. European Social Security System Conclusion National Academy of Social Insurance “Pay-As-You-Go” Program Taxpayers Pay In, Beneficiaries Receive Health Care Disability Retirement 157 Million Taxpayers 6.2% of Income from Employees/Employers Tax-Deductible for Employers 56 Million Beneficiaries 39 Million Retirees & Family Members 10.8 Million Disabled Workers & Family 6.3 Million Survivors of Deceased Workers Social Security Act Signed in 1935 by Franklin D. Roosevelt First Taxes Collected in 1937 Continued Legislation Signed in 1939 for Survivors Established During Times of War (WWII) Early Retirement Benefits Established for Women in 1956 Established for Men in 1961 Job Enrichment & Human Relations 1972: Nixon’s 20% Cost-of-Living Adjustment 1983: Reagan’s Taxation of Benefits Also made the COLA automatic each year Initiated the gradual increase of retirement age 2000: Clinton Eliminates Retirement Earnings Test Earnings Test required beneficiaries to give up partial benefits when earning in excess of a given amount Applies only to beneficiaries above full-benefit age The Social Security Trust Fund began facing the threat of bankruptcy in the early 80s. Again in early 90s, lawmakers, interest groups, and concerned citizens once again realized that Social Security was in trouble of depleting. Hot issue in the media and politics, and a major concern for the American public. Fund will be exhausted if changes to the program are not made. Estimated to deplete by 2037. Why Is It Depleting? The growing budget deficit Increased life expectancy Inflation Growing elderly population The federal government’s “borrowing” of funds. How are recipients affected? The System meets current demands of recipients, but people starting their careers within the next few years may never fully reap the benefits. Benefits will continue to be paid after the fund is depleted, because taxpayers continue to pay taxes. Revenues from the payroll tax will continue to provide enough cash flow to fund benefits at 75% of expected levels. Future qualifiers may receive some money from the program, but it may not be enough to live on comfortably. How can the problem be solved? Raising taxes Lowering benefits Combining actions Privatization Medicare and Medicaid reforms Other measures Workers should plan for their future Social security was never intended to be a primary income source, but rather a supplement to workers’ efforts. Saving, investing, and structuring finances should alleviate the stress of a depleting fund. Social Security income typically amounts to less than half of a recipient’s income. Retirement savings plans and pensions can provide the other income necessary to retire comfortably. Retirement plans can be funded by employers and employees or solely by the employer. Many options are available such as: Money purchase plans Profit-sharing and employee stock ownership plans, Section 401 (k) plans. With these plans, workers are encouraged to take matters into their own hands so that they will not have to rely solely on the government for money in the future. Workers that plan for the future will greatly benefit by being able to retire comfortably. Start planning NOW! Social security applies to national legislation on sickness, maternity, and equivalent paternity benefits, old-age pensions, pre-retirement, and invalidity benefits, survivors’ benefits and death grants, unemployment benefits, family benefits, and benefits in respect of accidents at work and occupational diseases. Does not replace national systems All countries are free to decide who is to be insured under their legislation. People earn entitlement to benefits such as cash benefits for sickness, unemployment, death of partner, retirement, etc. by paying National Insurance contributions to the National Insurance Scheme (NIS) The National Health Service (NHS) provides medical, dental, and optical treatment which is free to people who live in UK and Northern Ireland. National insurance number issued to Natives at age of sixteen. Financing for UK’s social security is from national insurance contributions paid by employers and employees and general tax revenue. Sickness insurance, long-term care insurance, pension insurance, accident insurance, and unemployment insurance. Provides State social support that provides basic provision for jobseekers, in old age, reduced earning capacity, and various family benefits and housing allowances. Financed from national insurance contributions paid by employers and employees, and from general tax revenue. The individual pays 53% of the contribution, employer pays 47%. Basis of Social Security Supplemental Fund Depletion Solutions Raising Taxes Lowering Benefits Privatization Modeling the European system? Saving and Investing