here - College of Social Sciences

advertisement

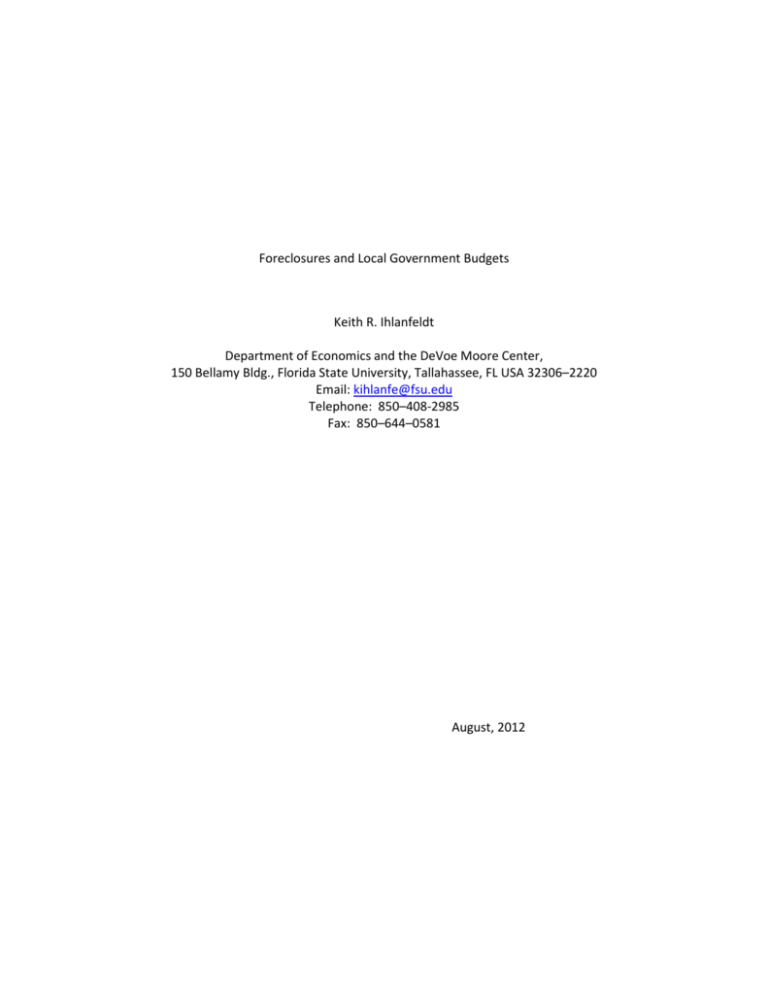

Foreclosures and Local Government Budgets Keith R. Ihlanfeldt Department of Economics and the DeVoe Moore Center, 150 Bellamy Bldg., Florida State University, Tallahassee, FL USA 32306–2220 Email: kihlanfe@fsu.edu Telephone: 850–408-2985 Fax: 850–644–0581 August, 2012 Abstract Foreclosures and Local Government Budgets Home mortgage foreclosures are a public policy concern chiefly because of their social costs. One social cost that has been well documented in recent studies is that foreclosures lower the value of nearby homes. Other possible social costs that are suspected but that have not been documented are the effects that foreclosures have as a result of affecting local government budgets. Using unique panel data sets for Florida cities and counties, two–way fixed effects models are estimated that relate local government budget characteristics to foreclosures. The results show that foreclosures raise millage rates and alter the composition of local public services. Citizens, therefore, pay a “foreclosure price” in the form of higher property taxes and a less preferred bundle of public goods. Key words: Foreclosures, Property Taxes, Local Governments 1. Introduction Expansion of mortgage credit in the early 2000s and the precipitous decline in housing prices have led to an unprecedented increase in foreclosures since 2006. From a public policy perspective, the seriousness of these foreclosures depends on their social costs. One possible social cost is that their blighted condition and association with crime reduce the value of nearby properties. This potential cost has received considerable attention by economists and the clear consensus that emerges from the empirical evidence is that this cost exists and it is nontrivial in magnitude.1 Another possible set of social costs attributable to foreclosures, which has frequently been mentioned but on which there exists little empirical evidence, is the effects they may have on citizens as a result of impacting local government budgets.2 Foreclosures may affect city budgets in a number of important ways. First, they may require a city to spend more on selected services. For example, a default notice may cause a homeowner to vacate the property and abandoned properties are known to breed crime, requiring the city to spend more on police services. Second, as noted above, foreclosures reduce the value of nearby properties, which may reduce a city’s property tax base.3 This loss in tax base may require a city to raise its millage rate, cut its services, or seek out other non–ad valorem sources of revenue. Finally, even if the property tax base is largely unaffected (as is well known, assessed values do not always follow market values due to assessment lags and/or assessment errors), foreclosures may reduce property tax revenues because borrowers in financial distress stop paying property taxes, thereby increasing the number of properties that are tax delinquent. While none of these possible budget effects has actually been documented, 1 For a review of the literature see Frame (2010). He reviews eight recent studies and reports that all find that foreclosures create negative spillover effects. He also concludes, however, that the evidence suggests that foreclosure–related discounts likely dissipate quickly the farther away the foreclosed property is from the sale in space and time. 2 Although I will be studying the effects of foreclosures on cities and counties separately, for expositional convenience I will refer just to cities rather than to local governments or cities/counties. 3 The base may also decline because foreclosures may sell at a discount and may drive down the overall level of property values by expanding the supply of homes on the market. 1 Apgar and Duda (2005) have done some hypothetical cost–accounting for the city of Chicago which suggests a single foreclosure may cost a city as much as $34,000.4 This paper explores the relationships that exist between foreclosures and selected characteristics of city budgets using data from the state of Florida. As is well known, Florida has been one of the states that have been hit the hardest by the foreclosure crisis. Two–way fixed effects models (by year and place) are estimated, allowing for lagged effects. The rich panel data sets utilized to estimate these models include annual city data on expenditures by budget category, the millage rate, property tax revenues, the property tax base, and the number of new lis pendens and REOs.5 The results confirm that defaults and REOs have important effects on the average city’s expenditures, millage rate, property tax base, and property tax receipts. The key findings are that defaults raise millage rates and move levels of public services away from citizens’ preferred package, which implies that foreclosures create a city–wide negative externality effect. Hence, along with the extant evidence on foreclosure– related neighborhood–level externalities, this paper documents additional social costs associated with home mortgage foreclosures that stem from the impact they have on city governments and provides further justification for government programs aimed at keeping families in their homes.6 In the next section the construction of the panel data sets which link city and county government budget characteristics to defaults and REOs is described. Section 3 presents the theoretical framework that serves to guide the empirical work and discusses some findings that are expected based upon the results of previous research. In Section 4 the fixed effects models that are estimated are 4 Apgar and Duda (2005) estimate prices for each of 26 individual foreclosure–related activities. These estimates are based on interviews with city officials as well as budget and administrative data. They then sum the costs of selected activities to estimate the total municipal cost associated with seven different foreclosure scenarios, ranging from a simple foreclosure with no complications to a foreclosure that results in a vacant building that burns down with whatever remains requiring demolition. 5 Lis pendens is the Latin phrase for pending litigation. In the present context it refers to the lender sending the borrower a notice that he/she had defaulted on their mortgage. For ease of exposition, I will simply refer to new lis pendens filings as defaults. REO is an abbreviation for a REAL ESTATE OWNED property. REO indicates the property in question has been foreclosed on and has been taken back by the mortgage lender or trustee. 6 Two such existing programs are the U.S. Treasury’s Home Affordable Modification Program and Neighborhood Stabilization Program. 2 described. The results from the estimation of these models are presented in Section 5. Section 6, which concludes the paper, provides the policy implications. 2. Data The panel data sets, one for Florida cities and the other for Florida counties, are based on data that are available for the years 2005—2010. The data come from three sources: the Florida Department of Financial Services (FDFS) City and County Annual Financial Reports, the Florida Department of Revenue (FDOR) Annual County Property Tax Rolls, and RealtyTrac data at the zip code level on new defaults and REOs. Each of these data sources is described in turn. The FDFS data come from budgetary reports that each city and county is required to submit to the FDFS after each fiscal year (s. 208.32, F.S.). In these reports, local governments are required to list aggregate amounts for various sets of defined revenue sources and expenditure categories. In constructing my panel data sets, I take from these reports the following variables for each year and government unit: total ad valorem revenue and expenditures for each of the nine budget categories listed in Appendix Table A.1. The FDOR data set comprises county tax rolls from each of Florida’s 67 county property appraisers. Annual preparation is required by statute (s. 193.114, F.S.) and supervised by the FDOR (s. 195.002, F.S.). Tax rolls are collected by the FDOR for the purpose of monitoring the performance of county tax assessors. Two crucial tasks are accomplished with these rolls. First, each individual parcel on a roll has a tax authority code that can place it within a city or unincorporated portion of a county. The tax authority codes identify local jurisdictions according to fiscal boundaries. Postal addresses are much less accurate for fiscal purposes. Second, by aggregating across the assessed values of all properties located within a particular city or county, the annual size of its property tax base is obtained. 3 RealtyTrac is one of the more commonly referenced sources of foreclosure data in the housing industry and the data have been previously employed in research studies.7 The first year for which these data are available is 2005, which defines the beginning year of my panel data sets. The data provide the number of new defaults and new REOs for each year (2005 through 2010) at the zip code level.8 To obtain counts for cities and counties I utilized a publicly available program from the U.S. Census Bureau that assigns zip codes to jurisdictions. Because zip codes sometimes cross city and county boundaries, an assignment rule was needed. The most defensible method is to allocate foreclosure counts based upon the share of the land area of the zip code falling within each place. To illustrate, if a zip code is split between City A and City B, with City A containing 80 percent and City B containing 20 percent of the zip code’s area, then City A and City B receive 80 percent and 20 percent of the zip code’s foreclosure counts, respectively. While this assignment algorithm is reasonable, the fact that assignment is necessary means that my test variables (defaults and REOs) are subject to some unknown amount of measurement error. However, I can think of no reason why this error would be anything other than random; hence, only attenuation bias is expected. This suggests that the magnitudes of the estimated effects I obtain of defaults and REOs on local government budgets may be understated. While the data are available for six years, the length of the panel is four years, because, as explained below, foreclosures are lagged one and two years. The potential number of city/year observations is four times the number of cities. There are 422 cities in Florida. Many of these cities are small; for example, almost 40 percent have fewer than 3,000 residents. Primarily because of their small size, many cities have had little foreclosure activity. Budgets are unlikely to be affected by foreclosures in these cities. Hence, if a city had five or fewer defaults and five or fewer REOs in each year of the 7 See, for example, Arnio et al. (2012). Foreclosure data are also available for 2011 but are not used because city budgetary data are only available through 2010. However, as described below, the 2011 foreclosure data are used to test my models for strict exogeneity. 8 4 panel, it was dropped from the sample. This brought the number of cities down to 287. Other cities were deleted either because they levied no property tax (25 cities) or displayed no temporal variation in key variables (for example, the millage rate) over the panel (35 cities). After all exclusions, the city panel contained 227 cities, which yielded 908 potential city/year observations. However, a number of these observations, especially in the early years for which foreclosures are measured (2005 and 2006), contained only a few new foreclosures. As described below, my models related changes in a city’s budget characteristics to changes in its flow of new foreclosures. A change from a couple to a few new foreclosures is not expected to have an impact on a city’s budget. To deal with these cases, if a city/year observation had fewer than five new defaults and five new REOs it was dropped from the sample. This left a total of 738 city/year observations. Regarding the county panel, Florida has 67 counties. Because the city of Jacksonville encompasses the entirety of Duval County, Duval is dropped from the county panel and Jacksonville is included in the city panel. The estimated equations typically include 64 to 66 counties and about 230 county/year observations, depending on missing values and temporal variation in key variables. 3. Theoretical Framework and Expected Findings The effects that defaults have on a city’s budget are assumed to depend on the number of properties that are currently in default. The data, however, measure the annual flow of new defaults and not the extant stock. This limitation is overcome by recognizing that default is a transitional phase of the foreclosure process. At some point after a default notice is issued a foreclosure auction occurs and a property in default is either sold to a third party or becomes an REO.9 In Florida, the prescribed statutory timeline between the issuance of a default notice and the foreclosure auction is 131 days 9 Florida is a judicial foreclosure state, which means that the lender has to file a lawsuit in order to foreclose. A foreclosure is awarded to the lender only if he can prove to a judge that the foreclosure is justified. 5 (Cutts and Merrill, 2008).10 Hence, a property in default one year typically transitions out of default by the following year. If the flow of defaults (i.e., the number of new defaults) remains unchanged from one year to the next, the assumptions are that the stock of current defaults remains the same and there is no effect on a city’s revenues or expenditures. An increase in the flow expands the stock and it is the impact of this change in flow on a city’s budget that is empirically investigated. The estimated models, therefore, relate percentage changes in a city’s flow of new defaults to percentage changes in its budget characteristics. Percentage rather than absolute changes are measured because impacts are assumed to be greater if new defaults grow from lower initial levels; for example, an increase from 100 to 200 is expected to have a greater impact than an increase from 5,000 to 5,100. As in the case of defaults, REOs are a transitional phase that a property goes through, where here the time in state is between the date of the foreclosure auction and when the bank sells the REO to a third party. Based upon a large, private national data base of mortgages (the Lender Processing Services Inc. Applied Analytics data), Immergluck (2010) estimates that in Florida the mean (standard deviation) number of months for a bank to sell an REO is 7.4 (4.0). Again, therefore, a new REO in one year typically transitions out of this state by the following year, providing basis for measuring a change in the stock of REOs by observing the change in the flow of new REOs. The estimated models, therefore, relate percentage changes in a city’s flow of new REOs to percentage changes in its budget characteristics.11 Both the average city and county in Florida experienced a dramatic rise in defaults between 2005 and 2009, with new defaults increasing by more than sevenfold over this period (see Table 1). The 10 This time may be lengthened somewhat by backlogs in the court system, bankruptcy filings by borrowers or borrowers who contest the foreclosure, but these delays seldom extend the timeline to more than 12 months. 11 While inflows and outflows of defaults and REOs may be closely matched, these are not perfectly matched. This measurement error may cause my estimated impacts to understate the true impacts that foreclosures have on cities’ budgets. Therefore, they should be interpreted as lower bound in nature. It is also worth noting that I analyze foreclosure activity from 2005—2009, which precedes the robo–signing scandal that unfolded at the end of 2010. 6 fall in defaults after 2009 was equally dramatic, with the number in 2011 being only about one–third as large as in 2009 for both types of government. Not surprisingly, the time pattern in REOs matches that of defaults (see Table 1), except that they peaked one year later, which is also not surprising since the lion’s share of defaults transition into REOs within a year after the default is issued. Although not observable in Table 1, there is considerable variation in the time pattern of defaults and REOs across Florida’s individual cities and counties, which facilitates the identification of the models I estimate. The budget characteristics I investigate are the city’s millage rate, property tax base, expenditures by category, and property tax receipts. Based upon prior research, a number of expected findings are suggested. First, the results obtained from estimating hedonic price models suggest that foreclosures sell at a discount (Campbell et al., 2011; Forgey et al., 1994; Shilling et al., 1990; Sumell, 2009). Also, as noted above, there is considerable evidence that foreclosures reduce nearby property values. Hence, I expect to find that defaults and REOs reduce a city’s property tax base, ceteris paribus.12 There is, however, a reason to believe that these effects may not be observed. Property tax assessors must account for these effects in assigning their assessed values. Whether the mass appraisal systems they employ are sensitive enough to capture what otherwise might be marginal effects is an empirical question. Turning to expenditures, according to Apgar and Duda’s (AD, 2005) survey of the municipal costs associated with foreclosures, there are four types of costs that are most likely to have an impact on a city’s budget. First and foremost are greater expenditures on policing and fire suppression. Foreclosures result in vacant properties, which are havens for gang–related criminal activity, are ripe for vandalism, and are frequently the locations of fires set by vandals or squatters (as a source of warmth or 12 It should be noted that the evidence provided by the above studies does not suggest that property values fall uniformly throughout the jurisdiction, but only in those neighborhoods where foreclosures rise above a certain threshold. There is also the possibility that foreclosures, by expanding the supply of homes on the market, could negatively impact the property tax base by lowering the overall level of housing prices. Of the above studies, only Campbell et al. offer any evidence and they fail to find any effect. 7 for cooking). I expect therefore that an increase in foreclosures will raise a city’s expenditures in the budget category labeled by the FDFS “Public Safety.” A second set of likely costs identified by AD are those related to the condition of the property. Foreclosures may raise what cities spend on such activities as building inspections, trash removal, weed control, and demolitions. These expenses largely fall within the budget category labeled by the FDFS “Other Uses.” Third, AD suggest that foreclosures raise municipal costs by increasing human suffering. Losing one’s house is a traumatic event that can result in the need for the city to provide more in the way of “Human Services.” This latter FDFS budget category covers expenditures on hospitals, health, and public assistance services. Finally, AD’s survey reveals that there are significant legal costs associated with foreclosures. While the lion’s share of these costs is borne by private parties, there is an associated rise in court activity in Florida because all foreclosures must be ruled upon by a judge. In Florida, circuit courts handle foreclosure proceedings and these courts are part of a county government’s budget. Hence, I expect that an increase in foreclosures will raise what counties spend on what the FDFS labels “Court Administration.” In addition to their municipal costs, AD’s survey suggests that foreclosures increase the number of property tax delinquencies. Upon receiving a default notice, homeowners have little incentive to pay the taxes owed. Another source of tax delinquencies identified by AD they label as “walkaways.” These occur when the loan fails but the lender does not foreclose on the property, resulting in uncertainty regarding who it is that is responsible for paying the property tax bill. Anecdotal evidence suggests that even after the bank takes possession of the property as an REO there may remain this uncertainty (O’Matz and Maines, 2012). Some banks shift the responsibility of paying the taxes to another bank or company, known as a “loan servicer.” In part, they are able to delay or evade accountability because they are large institutions, based in other states or even other countries. Florida, however, is a “tax certificate” state, which means that local governments can recover unpaid property taxes by selling at auction a certificate equal to the sum of the unpaid amount, interest or the delinquent amount, a tax 8 collector’s commission, and a newspaper advertising charge. The winner at the auction is the investor who makes the lowest interest rate bid. Upon redemption of the delinquent taxes, the certificate holder receives the total taxes due including interest earned. However, not all certificates are sold at auction and an auction cannot occur until after the tax liability is clearly established. Moreover, even if the certificate is sold, the unpaid taxes are recovered sometime following the year in which the tax is levied. Hence, even with Florida’s tax certificate program, if foreclosures increase tax delinquencies they may also reduce property tax receipts. If foreclosures reduce the property tax base, raise city expenditure levels, or increase the number of tax delinquencies, cities may be forced to raise their millage rates in order to balance their budgets. If this is the case, this would constitute a second type of externality effect associated with foreclosures (the first type is the effect that foreclosures have on nearby property values that has been documented in recent studies). Property owners throughout the jurisdiction are forced to pay higher property taxes with no commensurate benefits having been received. There may also be a third type of externality effect if foreclosure–induced changes in expenditures alter the package of public services that caused residents to buy into the community.13 4. Estimated Models The advantage of using panel data with jurisdictional fixed effects for the purpose at hand is that there are numerous factors that may impinge on a city’s budget characteristics that are likely to be fairly constant over the relatively short duration of my panels and otherwise be difficult to measure; for example, the condition of the housing stock, citizen preferences for public services, and the efficiency of local government. The other fixed effect that enters the models I estimate is for “year” which controls for factors that vary over time but uniformly affect all local governments; such as changes in general price levels and state policies or programs. 13 While moving to another jurisdiction to obtain a more preferred bundle of public services is always an option, moving is far from costless. 9 Separate city and county models are estimated that relate the millage rate, the property tax base, expenditures by category, and property tax revenues to defaults and REOs. Each model includes, along with the fixed effects and test variables (i.e., REOs and defaults), an appropriate set of control variables.14 In addition to the control variables included, there may be omitted variables that change over time that have an impact on the budget characteristics that I analyze. But omitted variable bias will only result if changes in an excluded variable affecting the budget characteristics are somehow commonly correlated with changes in the test variables within cities (counties). This is the strong advantage provided by the fixed effects models that I estimate to study the effects of foreclosures on city and county budgets. The specification of each model is described in the remainder of this section. 4.1 Millage Rate Models The estimated millage rate equation is: (1) 𝑀𝑖,𝑡 = 𝛼𝑖 + 𝛾𝑡 + 𝛽0 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−1 + 𝛽1 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−2 + 𝛽2 𝑅𝐸𝑂𝑖,𝑡−1 + 𝛽3 𝑅𝐸𝑂𝑖,𝑡−2 + 𝛽4 𝑋𝑖,𝑡−1 + 𝛽5 𝑊𝑖,𝑡−2 + 𝜀𝑖,𝑡 , where 𝑀𝑖,𝑡 is the natural log of the millage rate of the ith city (county) in year t; 𝛼𝑖 is a vector of city (county) fixed effects; 𝛾𝑡 is a vector of year fixed effects; 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 is the natural log of the number of new defaults lagged one and two years; 𝑅𝐸𝑂 is the natural log of the number of new REOs lagged one and two years; 𝑋 are the natural logs of control variables lagged one year; and 𝑊 are the natural logs of control variables lagged two years. 𝑋 and 𝑊 include the log of the property tax base, the log of population and the log of county per capita income.15 Because both the dependent and independent variables of equation (1) are in logs, the estimated coefficients on the test variables can be interpreted as elasticities. 14 See Appendix Table A.2 for the average annual means and standard deviations of the control variables. Both the city and county models include the county level of per capita income because city income data are not available on an annual basis. Annual values for city and county population and county per capita income are provided by the Bureau of Business and Economic Research at the University of Florida. They are reported each year in the Florida Statistical Abstract. 15 10 Note that equation (1) includes the property tax base, so if foreclosures are found to increase the millage rate the effect must be driven by the need to raise expenditures or by shortfalls in property tax receipts resulting from unpaid taxes. Because any ill effects associated with foreclosures do not occur immediately and the length of delay is a priori unknown, I include defaults (REOs) lagged one and two years. Whether a control variable falls into the 𝑋 or 𝑊 vector (i.e., with a one or two year lag) is determined by selecting the lag that minimized Akaike’s AIC Criterion (Akaike, 1973). Equation (1) relates annual percentage change movements in the millage rate to annual percentage changes in new defaults (REOs). However, a threshold absolute change in these variables may be required in order to register an effect on the millage rate. For example, if a city’s flow of defaults is a small number, it may experience a relatively large percentage change in new defaults from one year to the next but still be below the threshold necessary to produce an effect. To allow for this possibility, each of the four test variables (Defaulti, t—1, Defaulti, t—2, REOi, t—1, and REOi, t—2) is interacted with the average annual number of the variable over the length of the panel. This serves to differentiate places with little foreclosure activity from those with greater levels of activity. If the t–statistic on the estimated interaction coefficient is larger than one, the interaction is retained in final estimation because a threshold effect is suggested.16 If the t–statistic is less than one, the importance of a threshold effect is discounted and the interaction is dropped from the final model.17 4.2 Property Tax Base Models The estimated property tax base equation is: (2) 𝐵𝑖,𝑡 = 𝛼𝑖 + 𝛾𝑡 + 𝛽6 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−1 + 𝛽7 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−2 + 𝛽8 𝑅𝐸𝑂𝑖,𝑡−1 + 𝛽9 𝑅𝐸𝑂𝑖,𝑡−2 + 𝛽10 𝑋𝑖,𝑡−1 + 𝛽11 𝑊𝑖,𝑡−2 + 𝜀𝑖,𝑡 , 16 Support for the use of a t–statistic greater or less than one in deciding to retain an insignificant variable in the final estimated model is provided by Maddala (1977, p. 121). 17 These interactions are only included in the models estimated for cities. Foreclosure counts are sufficiently large for counties that a threshold effect is not expected. 11 where 𝐵𝑖,𝑡 is the natural log of the property tax base of the ith city (county) in year t and the control variables are the log of the city (county) house price level, the log of the total number of properties on the tax roll in the city (county), and the log of county per capita income. A city’s (county’s) tax base may change over time for two reasons: the total number of properties on the roll can change (hence, its inclusion as a control variable) and the assessed values of the properties on the tax roll can change. Assessed value should reflect market value.18 The market value of a property depends on the general level of property prices. Some cities, especially those in South Florida, experienced a greater run–up and subsequent crash in property values over the turbulent years covered by my panels. To control for changing prices, equation (2) includes for each year an estimate of the house price level obtained by estimating for each city (county) a repeat sales price index.19 While it would have been preferable to also include a non–residential property price level, the number of repeat sales of commercial properties is too small at the city level to compute a price index. However, within places residential and non–residential price levels tend to move in tandem over time, so including just the housing price level may avoid omitted variable bias.20 Per capita income is included because higher incomes raise commercial sales which in turn increase the market value of commercial properties. Market values may also depend on defaults (REOs) because, as noted earlier, these properties sell at a discount and they also lower the value of nearby properties. To allow the estimated elasticities on the test variables to vary between places with different absolute levels of foreclosure 18 Florida statutes require that all properties on the tax roll be assessed at fair market value every year on January 1. 19 The details of the construction of these indices can be found in the Appendix of my 2011 paper with Will Doerner (Doerner and Ihlanfeldt, 2011). 20 The price indices are based only on non–distressed, arms–length sales. As such, they should not be directly affected by foreclosures. However, an increase in foreclosures expands the supply of homes on the market and this may drive down the overall price level within the community. Hence, in addition to their possible direct effects on the tax base, foreclosures may indirectly lower the tax base by affecting the price level variable which in turn affects the tax base. To investigate this possibility, auxiliary two–way fixed effects models are estimated which relate percentage changes in price levels to percentage changes in defaults and REOs. 12 activity, the test variables are again interacted with the annual average number of defaults (REOs). The criterion for including the interaction variable in the final estimated model is the same as before. 4.3 Expenditure Models The estimated expenditure equations are: (3) 𝑗 𝐸𝑖,𝑡 = 𝛼𝑖 + 𝛾𝑡 + 𝛽12 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−1 + 𝛽13 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−2 + 𝛽14 𝑅𝐸𝑂𝑖,𝑡−1 + 𝛽15 𝑅𝐸𝑂𝑖,𝑡−2 + 𝛽16 𝑋𝑖,𝑡−1 + 𝛽17 𝑊𝑖,𝑡−2 + 𝜀𝑖,𝑡 , 𝑗 where 𝐸𝑖,𝑡 is the natural log of the per capita amount of the jth expenditure category in the ith city (county) in year t and the control variables are the logs of the property tax base, population, and county per capita income.21, 22 Income is included because it may register changes over time in the overall demand for public services as well as changes in the composition of public service demands. Ihlanfeldt (2011) has found that increases in a city’s tax base result in greater spending only within selected budget categories (General Government, Public Safety, Physical Environment, and Culture/Recreation). Population is included because there may be scale economies and diseconomies in the provision of public services that affect per capita expenditure levels. As before, the estimated elasticities on the test variables are allowed to vary with the annual average level of foreclosure activity. 4.4 Property Tax Revenue Models The estimated property tax revenue equations are: (4) 𝑇𝑖,𝑡 = 𝛼𝑖 + 𝛾𝑡 + 𝛽18 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−1 + 𝛽19 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−2 + 𝛽20 𝑅𝐸𝑂𝑖,𝑡−1 + 𝛽21 𝑅𝐸𝑂𝑖,𝑡−2 + 𝛽22 𝑋𝑖,𝑡−1 + 𝛽23 𝑊𝑖,𝑡−2 + 𝜀𝑖,𝑡 , 21 The expenditure equations could be estimated as a system rather than individually. However, estimating the equation as a system only has the benefit of improving the efficiency of the estimates if the independent variables are different across equations, which is not the case here. 22 Some cities do not have all of the budget categories listed in Table A.1. Hence, the number of observations varies depending on the expenditure category. 13 where 𝑇𝑖,𝑡 is the total tax revenue of the ith city (county) in year t, 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 and 𝑅𝐸𝑂 are the absolute number of new defaults and REOs, and the control variables are the millage rate, the property tax base, population, and county per capita income. Note that, in contrast to the earlier models, equation (4) is not estimated in logs. In the absence of tax payment delinquencies there exists a mechanical relationship between property tax revenues, the millage rate, and the property tax base: the product of the millage rate and the property tax base equals property taxes received. Tax revenues will not equal this product if there are unpaid taxes. Other variables that may affect the number of delinquencies that are included as control variables are population and per capita income. Larger cities have a greater number of potential nonpayers while lower incomes decrease the ability to pay. Given the controls included in equation (4), especially the property tax base and millage rate, it is reasonable to assume that the estimated effects of the foreclosure variables on property tax receipts reflect unpaid taxes. This, however, is a second–best approach. The preferable approach is to directly relate tax delinquencies to defaults and REOs. Unfortunately, these data are not available from FDOR or any alternative source that I am aware of.23 In the absence of actual tax delinquency data, the results from the estimation of equation (4) should be interpreted as only suggestive in nature. A number of specification issues arise in estimating the models presented in this section. First, rather than using city (county) fixed effects (FE) to control for time–invariant unobserved heterogeneity across places, first differencing (FD) could be used to accomplish this same objective. As described by Wooldridge (2000, p. 447), for wide and short panels like the ones used here, the choice between FE and FD hinges upon the relative efficiency of the estimators, which is revealed by the serial correlation in the idiosyncratic errors. While it is hard to test whether the errors are serially correlated after FE estimation, it is easy to test whether the differenced errors are serially correlated after FD estimation. 23 To put together a state–level data base on property tax delinquencies, each city and county would need to be contacted to obtain information on their tax certificates for current and past years. 14 Therefore, the rule of thumb advocated by Wooldridge (2000, p. 447) is to use FE if the FD errors display substantial negative serial correlation. In the limit, if serial correlation of the differenced errors equals –0.5, the errors in the FE model are uncorrelated and FE is the most efficient estimator. When the models presented in this section are estimated by FD, the serial correlation of the errors is substantially negative. FE is therefore the preferred estimator. Another issue is whether defaults and REOs are endogenous. For example, a greater property tax burden (as caused by a higher millage rate) or less expenditure on certain services (like public safety) may result in more foreclosures. However, the budget characteristics I investigate should not affect the lagged values of defaults and REOs that I use as independent variables. That is, because they are lagged, the test variables are contemporaneously exogenous in the models that are estimated. Inconsistent estimates, however, may still occur if the test variables are not strictly exogenous (Wooldridge, 2002, p. 146). Strict exogeneity requires that the budget characteristics in time t do not feedback and affect foreclosures in time t + n. This is unlikely to be much of a problem for the models I estimate given the short length of my panel data sets. Also, the FE model has the advantage of being less sensitive to the violation of the strict exogeneity assumption (Wooldridge, 2000, p. 447). Nevertheless, each of the models estimated was tested for strict exogeneity. The test involves adding leading values of defaults and REOs to the set of explanatory variables (Wooldridge, 2002, p. 285). The t + 1 values of the variables were used. Because the available foreclosure data includes values for 2011, the inclusion of Defaulti, t+1 and REOi, t+1 do not reduce my sample sizes. In all but one case, the leading variables are not statistically significant at even the 10% level, which supports the assumption of strict exogeneity. The one case where strict exogeneity is not supported is the transportation expenditure model estimated for counties, where Defaulti, t+1 is significant at the 10% level. A final issue is that foreclosures may have, in addition to the direct effects revealed by the estimation of equations (1)—(4), indirect effects on a city’s (county’s) budgetary characteristics if one or 15 more of the control variables entering the equations are themselves functions of foreclosures. The one case where this is most likely is in the millage rate equation. The property tax base enters this equation as a control variable and foreclosures are hypothesized to affect the base. If cities (counties) change their millage rate to offset changes in their base, then foreclosures will have an indirect effect on the millage rate by affecting the base. For example, consider the effect that Defaultt–1 has on the millage rate. Accounting for both direct and indirect effects, the total effect is: (5) 𝜕𝑀⁄𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 = 𝛽0 + 𝜕𝑀⁄𝜕𝐵 ∙ 𝜕𝐵⁄𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 . There may also be a direct and indirect effect of Defaultt–1 on B, because the price level enters equation (2) and it may depend on foreclosures, because they increase the supply of homes on the market: (6) 𝜕𝐵⁄𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 = 𝛽6 + 𝜕𝐵⁄𝜕𝑃 ∙ 𝜕𝑃⁄𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 . Substituting (6) into (5), we have: (7) 𝜕𝑀⁄𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 = 𝛽0 + 𝜕𝑀⁄𝜕𝐵 [𝛽6 + 𝜕𝐵⁄𝜕𝑃 ∙ 𝜕𝑃⁄𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 ]. To obtain estimates of 𝜕𝑃/𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−1 , 𝜕𝑃/𝜕𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑡−2 , 𝜕𝑃/𝜕𝑅𝐸𝑂𝑡−1 and 𝜕𝑃/𝜕𝑅𝐸𝑂𝑡−2 , an auxiliary model was estimated akin to equations (1)—(4): (8) 𝑃𝑖,𝑡 = 𝛼𝑖 + 𝛾𝑡 + 𝛽24 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−1 + 𝛽25 𝐷𝑒𝑓𝑎𝑢𝑙𝑡𝑖,𝑡−2 + 𝛽26 𝑅𝐸𝑂𝑖,𝑡−1 + 𝛽27 𝑅𝐸𝑂𝑖,𝑡−2 + 𝛽28 𝑋𝑖,𝑡−1 + 𝛽29 𝑊𝑖,𝑡−2 + 𝜀𝑖,𝑡 where Pi,t is the natural log of the price level of city (county) i in year t, and the control variables are the logs of population and income. 5. Results The millage rate, tax base, and expenditure model results obtained for cities and counties are reported in Tables 2—4 and Tables 5—15, respectively. Table 16 reports both city and county results from estimating the property tax revenue model. The results are described in the order of the models presented in Section 4: millage rate, property tax base, expenditures, and property tax revenues. 5.1 Millage Rate 16 In terms of social costs, one key issue is whether an increase in foreclosures raises a city’s (county’s) millage rate. A city (county) may raise its millage rate in response to an increase in foreclosures for a number of reasons. First, foreclosures may reduce the property tax base and there is evidence that local governments (especially counties) adjust their millage rates to offset changes in their tax base (Ihlanfeldt, 2011). Second, a city (county) may raise its millage rate to generate the additional revenue needed to cover foreclosure–related costs borne by local governments. Third, if foreclosures increase the level of unpaid taxes, a city (county) may attempt to offset these losses by raising its millage rate. Because equation (1) controls for the property tax base, only the second two channels account for any effects foreclosures might be found to have on the millage rate. The first channel is explored by observing whether foreclosures affect the property tax base (equation 2) and whether the tax base affects the millage rate (equation 1). Both must be true for the first channel to have any importance. Tables 2 and 5 report the results from estimating equation (1) for cities and counties, respectively. For cities, the estimated Defaultt–2 elasticity is .04371, which is statistically significant at the 1% level.24 The property tax base is a control variable in equation (1). Its estimated elasticity is negative (–.01970), but not statistically significant (p value = .44). These results suggest that cities do not adjust their millage rates to offset changes in their property tax base. Hence, foreclosures do not increase a city’s millage rate by reducing its property tax base (but, as reported below, defaults are found to negatively impact the tax base). In the millage rate model estimated for counties, the estimated elasticity of the millage rate with respect to the tax base is –.28489, which is significant at the 1% level (see Table 5). Hence, 24 The interaction effects show that the REOt–2 elasticity is positive and statistically significant only at and above the 95th percentile of the annual average REO level. 17 counties, unlike cities, adjust their millage rates to offset changes in their property tax base.25 Also, as reported below, 1) three of the test variables significantly affect the tax base (see Table 8), 2) the price level significantly affects the base (see Table 8), and 3) all four of the test variables significantly affect the price level (see Table 9). Therefore, foreclosures have indirect effects on the millage rate as described by equations (5) and (6). Table 6 reports the estimated direct, indirect, and total effects (along with the estimated standard error) of each of the test variables on the millage rate. The total effect is measured in two ways—Total Effect–1 (Column 3 of the table) and Total Effect–2 (Column 4 of the table). Total Effect–1 is the sum of the direct and indirect effects. Total Effect–2 equals Total Effect–1 if Total Effect–1 is statistically significant at the 10% level or higher. If Total Effect–1 is not statistically significant, then Total Effect–2 equals either the direct or indirect effect, whichever is statistically significant. The idea is that the total effect is better measured by ignoring the estimated direct or indirect effect that is statistically insignificant. The Total Effect–2 results show that all four of the test variable have positive effects on the millage rate, with Defaul tt–1 and REOt–2 significant at the 1% level , REOt–1 significant at the 5% level and Defaultt–2 significant at the 10% level. The estimated elasticities are all around .01. The small magnitude of these elasticities suggests that the estimated effects, while statistically significant, may not be economically important. However, first note that the estimated long run propensity (LRP) elasticity is 25 Extant evidence on the elasticity of business investment in a community with respect to the community’s property tax rate shows that the elasticity is larger in absolute magnitude intra–regionally than inter–regionally (Bartik, 1991). The explanation that has been provided for this result is that from a firm’s perspective alternative locations within a region are closer substitutes for one another than alternative locations across regions. Because Florida’s counties are large, they can be thought of as the “region” and the cities within them as sub–regional jurisdictions competing against one another for the region’s business investment. This provides an explanation for my findings that counties, but not cities, change their millage rates to offset changes in their property tax base. If the tax base is declining and the city responds by raising its millage rate, it risks losing business investment to the other cities within the county. If the tax base is increasing, a city may look upon this as an opportunity to lower its millage rate and attract business investment away from its neighbors. But a city may be reluctant to lower its millage rate out of a fear that this may precipitate a bidding war among cities within its region, resulting in long– term negative consequences for its property tax revenues. Counties, on the other hand, have more monopoly power than cities and therefore can change their millage rates without as much concern regarding competition from surrounding counties. 18 .020 and .021 for defaults and REOs, respectively. The LRP elasticity is obtained by summing the estimated coefficients on the two lagged variables. It represents the change in the millage rate that would occur if there was a permanent increase in defaults (REOs) within the county. Using these LRP elasticities and the county average annual new defaults and new REOs reported in Table 1, I can simulate the change in property taxes that would occur for a property owner living in the average county from the growth in foreclosures that occurred from 2005 to 2009. Consider a home with a taxable value of $300,000. The county mean millage rate in 2005 (the base year) was 15.000, resulting in property taxes of $4500. Table 7 shows how these property taxes would change as a result of the increases in new defaults and new REOs that occurred in each year. By 2009 the taxes would have grown to $5392, which is a 19.8 percent increase over what they were in the base year. So, clearly the effects that I have estimated are both statistically and economically significant. These results, and to a lesser extent those obtained for cities, indicate that a jurisdiction–wide externality effect exists, as increases in the annual flows of new foreclosures force property owners to pay higher property taxes. 5.2 Property Tax Base The results from estimating the property tax base models (equation 2) are reported in Table 3 for cities and Table 8 for counties. In the city model, the estimated coefficient on Defaultt–2 is negative and statistically significant at the 5% level.26 The estimated coefficient suggests that a one percent increase in new defaults reduces the tax base by .034 percent.27 As in the case of cities, in the property tax base model estimated for counties, the price level variable is highly significant with a positive sign (see Table 8). However, unlike in the cities case, the 26 The interaction effects show that the Defaultt–1 and REOt–1 elasticities become statistically significant at only the 90th and above percentiles of the annual average levels of these variables. 27 Note that the price level has a positive and highly significant effect on the city tax base. However, in the price level model (equation 8) estimated for cities, none of the test variables are statistically significant. (The results are not tabled but are available upon request.) These results are consistent with those of Campbell et al. (2011), who also find that foreclosures, while having an impact on nearby home values, do not affect the general level of house prices. Because the test variables do not affect the price level, they do not have indirect effects on the city tax base. 19 estimation of the auxiliary price variable model (equation 8) for counties shows that increases in REOs depresses the general level of house prices (see Table 9).28 The city (and Campbell et al.) results can be reconciled with those for counties by arguing that the spatial extent of the local housing market extends beyond the boundaries of the individual city (and zip code areas in the case of Campbell et al.) to the entire county. What expands the supply of homes on the market (and, therefore, depresses the price level) are new REOs measured at the county (and not sub–county) level. Because REOs affect the price variable and the latter variable affects the tax base, REOs have indirect effects on the tax base, along with the direct effects reported in Table 8. Estimated direct, indirect, and total (direct plus indirect) tax base effects of REOs (and for completeness defaults) are reported in Table 10. All three sets of effects are negative and statistically significant for both REOt–1 and REOt–2. Based upon the estimated total effects, the elasticities of the tax base with respect to REOt–1 and REOt–2 are –.08 and –.03, respectively. 5.3 Expenditures In the case of cities, models were estimated for the first eight expenditure categories listed in Table A.1. For counties, models were estimated for all nine categories listed, with the ninth being applicable only to counties; namely, “County Court Administration.” Results are tabled for those budget categories showing significant results. With but one exception, the models estimated for cities provide little support for the expenditure hypotheses deduced from Apgar and Duda’s survey of foreclosure-related municipal costs. The exceptional case is the “Human Services” expenditure model, which shows that REOt–1 has a positive effect, which is significant at the 5% level (see Table 4). Note, however, that only 45 cities are included in the sample, because the overwhelming majority of cities in Florida do not provide human services. In Florida this is a county government function. 28 Note that defaults are found to increase the price level. Apparently, there is an unobservable that is correlated with defaults that raises housing demand. One possibility is that an increase in the flow of defaults may serve as a signal to buyers that the county is a good place to start their search for housing. 20 In contrast to the results for cities, the county expenditure models provide support for all four of the Apgar and Duda hypotheses. In the “Public Safety” model the estimated Defaultt–2 elasticity is .03068, which is statistically significant at the 5% level (see Table 11). In the “Human Services” model the estimated Defaultt–1 elasticity is .14126, which is significant at the 1% level (see Table 13). In the “Other Uses” model the estimated Defaultt–2 elasticity is .06182, which is significant at the 5% level (see Table 14). In the “County Court Administration” model the estimated REOt–2 elasticity is .11133, which is significant at the 10% level (see Table 15). The only other expenditure model yielding significant results is “Transportation,” where the estimated Defaultt–2 elasticity is –.05417, which is significant at the 5% level (see Table 12). The latter result suggests that part of the greater expenditures on “Public Safety” and “Other Uses” caused by increases in Defaultt–2 are paid out of reductions in a county’s transportation budget. The importance of defaults in comparison to REOs as a determinant of county expenditures suggests that problems for counties begin in the default stage of the foreclosure process but then taper off after the default transitions into an REO. This is not surprising because 1) it is the defaulted homeowner (and not the REO owner) who requires human services, 2) unlike the defaulted homeowner, the REO owner has an incentive to maintain/improve the condition of the property in order to expedite its sale, and 3) this same motivation to sell results in the REO owner providing better security for the property, which reduces the likelihood of crime and fire. It is also not surprising that only REOs affect court administration expenses because, as noted earlier, in Florida each foreclosure must be ruled upon by a circuit judge. A court ruling is not required for a lis pendens. An explanation for the difference in the expenditure results for cities and counties is that counties may have more opportunity for budget reallocations in response to the problems caused by defaults simply because of the larger overall size of their budgets and their greater expenditures in categories that residents deem less essential. In particular, county transportation budgets on a per 21 capita basis are, on average, about 1.5 times those of cities, which my county results suggest may be a budget category that can be drawn down to support increases in those expenditures raised by greater foreclosure activity.29 5.4 Property Tax Revenues The results from estimating the property tax revenue models are reported in Table 16 for both cities (Columns 1 and 2) and counties (Columns 3 and 4). Controlling for the millage rate and the tax base, Defaultt–2 is negative and highly significant for both cities and counties. In both cases, a unit increase in new defaults reduces property tax revenue by about $4,000. REOt–2 is also negative (–7284) in the counties model, but is significant at only the 10% level. The nontrivial magnitudes of the estimated Defaultt–2 coefficients suggest that most defaulting homeowners do not pay their property taxes and/or the negative spillover effects of defaults cause nearby homeowners to become delinquent on their property taxes. To determine the relative importance of these possibilities (and to confirm the existence of a tax delinquency/foreclosure relationship), data on actual tax delinquencies at the parcel level are necessary. REOt–1 is positive and significant for both cities and counties, which contradicts the findings obtained for Defaultt–2. One explanation for these results is that banks are more likely than defaulting homeowners to satisfy their tax obligations. Hence, when a property transitions out of default into an REO, the property taxes go from being unpaid to paid, thus raising property tax receipts. Again, however, data on actual tax delinquencies are necessary to fully account for the REOt–1 results. 6. Conclusions Pulling together the results obtained for cities, an increase in the flow of new defaults is found to raise the millage rate and reduce the tax base and property tax revenues. The results obtained from the expenditure models do not suggest that cities alter their budget allocations in response to 29 In 2009, average annual per capita expenditures on transportation were $251 and $166 in counties and cities, respectively. 22 foreclosures. The finding that is most indicative of an externality effect for cities is that defaults raise a city’s millage rate. The implication is that all property owners throughout the jurisdiction end up paying a “foreclosure price” in the form of higher property taxes. The results for counties are much the same as those for cities, with two exceptions: 1) millage rate changes occur through all possible channels, including through the impact that foreclosures have on the property tax base, and 2) the evidence is much clearer for counties that defaults increase expenditures in those categories that Apgar and Duda’s (2005) survey of municipal costs suggests are most likely to be impacted by foreclosures. As more properties enter the foreclosure process, county governments must spend more on public safety, property maintenance, human services, and the operation of circuit courts. These changes in how counties spend their revenues in response to defaults suggests that property owners, in addition to the millage rate externality, suffer a second type of externality arising from foreclosure–induced movements away from the bundle of public services that caused them to buy into the community. I limited my analysis to the short–run city and county budgetary effects of home mortgage foreclosures. The problems created by foreclosures in the short–run can worsen these same problems in the long–run. For example, foreclosure–induced increases in millage rates may cause a community to lose tax base in the future by repelling business investment, resulting in the need to further raise rates. As rates continue to rise, the financial burdens on property owners worsen resulting in even more defaults. The future desirability of the community, and therefore the size of its tax base, may also be compromised by foreclosure–induced increases in government costs, leaving less money for community–wide amenities. Again, this may result in the need to raise the millage rate leading to more defaults. These examples serve to illustrate the importance of extending the analysis in this paper to cover longer–run effects of home mortgage foreclosures on city and county budgets. 23 Regarding public policy, this paper provides further justification for government–sponsored programs designed to keep families in their homes. But there is also the implication that higher levels of government provide financial assistance to local governments experiencing a rise in their foreclosure activity, so that they may maintain their current property tax rates. Additionally, as suggested by Apgar and Duda (2005), local governments should not be shy in asking the mortgage industry to share the burden of paying foreclosure–related costs, perhaps in the form of user fees or proceeds from foreclosure sales. 24 References Akaike, H., 1973. Information theory and an extension of the maximum likelihood principle, in: Petrov, B.N., Csaki, F. (Eds.), Proceedings of the Second International Symposium on Information Theory. Akademiai Kiado, Budapest, pp. 267—281. Apgar, W.C., Duda, M., 2005. Collateral Damage: The Municipal Impact of Today’s Mortgage Foreclosure Boom. Homeownership Preservation Foundation: Minneapolis, MN. Arnio, A.N., Baumer, E.P., Wolff, K.T., 2012. The contemporary foreclosure crisis and U.S. crime rates. Soc. Sci. Res. [Internet]. Available May 22, 2012, from http://www.sciencedirect.com/science/article/pii/S0049089X12001159 Bartik, T.J., 1991. Who Benefits From State and Local Economic Development Policies? W.E. Upjohn Institute for Employment Research: Kalamazoo, MI. Campbell, J.Y., Giglio, S., Pathak, P., 2011. Forced sales and house prices. Amer. Econ. Rev. 101, 2108— 2131. Cutts, A.C., Merrill, W.A., 2008. Interventions in Mortgage Default: Policies and Practices to Prevent Home Loss and Lower Costs. Freddie Mac Working Paper #08–01. Doerner, W.M., Ihlanfeldt, K.R., 2011. House prices and city revenues. Reg. Sci. Urban Econ. 41, 332— 342. Forgey, F.A., Rutherford, R.C., VanBuskirk, M.L., 1994. Effect of foreclosure status on residential selling price. J. Real Estate Res. 9, 313—318. Frame, W.S., 2010. Estimating the effect of mortgage foreclosures on nearby property values: A critical review of the literature. Fed. Reserve Bank Atlanta Econ. Rev. 95, 3, 1—9. Ihlanfeldt, K.R., 2011. How do cities and counties respond to changes in their property tax base? Rev. Reg. Stud. 41, 27—48. Immergluck, D., 2010. The accumulation of lender–owned homes during the U.S. mortgage crisis: Examining metropolitan REO inventories. Hous. Policy Debate 20, 619—645. Maddala, G.S., 1977. Econometrics. McGraw Hill: New York. O’Matz, M., Maines, J., 2012. Blame game begins when bank–owned homes decay. Tallahassee Democrat, May 13, 2012, Real Estate Section, p. 7. Shilling, J.D., Benjamin, J.D., Sirmans, C.F., 1990. Estimating net realizable value for distressed real estate. J. Real Estate Res. 5, 129—140. Sumell, A.J., 2009. The determinants of foreclosed property values: Evidence from inner–city Cleveland. J. Hous. Res. 18, 45—61. Wooldridge, J.W., 2000. Introductory Econometrics. South–Western College Publishing: Cincinnati, OH. Wooldridge, J.W., 2002. Econometric Analysis of Cross Section and Panel Data. MIT Press: Cambridge, MA. Table 1 Means (Standard Deviations) of New Mortgage Defaults and REOs In the State of Florida Defaults 2005 2006 2007 2008 2009 2010 2011 Cities 59 (208) 135 (450) 260 (794) 363 (1137) 442 (1311) 307 (918) 142 (447) REOs Counties 665 (1501) 1461 (3606) 3087 (6661) 4805 (8678) 5770 (10708) 3885 (7229) 1831 (3244) Cities 6 (58) 5 (40) 23 (88) 77 (251) 95 (332) 140 (409) 83 (295) Counties 71 (105) 55 (79) 273 (551) 978 (2168) 1176 (2482) 1803 (3415) 986 (1910) Table 2 Estimated City Millage Rate Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_Default_lag1 * Ave_Default Log_Default_lag2 * Ave_Default Log_REO_lag1 Log_REO_lag2 Log_REO_lag1 * Ave_REO Log_REO_lag2 * Ave_REO Log_TaxBase_lag1 Log_Pop_lag1 Log_Income_lag2 Observations Cities R–square Estimated Coefficient .01008 .04371*** Id I –.00164 .00195 .00002 .00002 –.01970 –.04410*** –.39941 716 227 .983 a Estimated Standard Error b .01640 .01369 .00598 .00411 .00002 .00001 .02424 .01063 .39726 Elasticity at 25th Percentile c Estimated Standard Error Elasticity at 75th Percentile Estimated Standard Error –.00146 .00215 .00584 .00768 –.00012 .00367 .00120 .00408 Estimated equation includes city and year fixed effects. Estimated standard error is clustered at the city level. c Percentile refers to the distribution of city average annual defaults (REOs) over the panel. d “I” indicates that interaction had a t–statistic < 1 in preliminary model and was therefore dropped from final model. b *** indicates statistical significance at the 1% level. Table 3 Estimated City Property Tax Base Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_Default_lag1 * Ave_Default Log_Default_lag2 * Ave_Default Log_REO_lag1 Log_REO_lag2 Log_REO_lag1 * Ave_REO Log_REO_lag2 * Ave_REO Log_Price Log_Properties Log_Income_lag1 Observations Cities R–square Estimated Coefficient –.00086 –.03408** –.00002*** Id –.01114 –.00661 I –.00002 .13341*** .83330*** –.28356 738 227 .998 Estimated Standard Error b .02272 .01579 .00000 Elasticity at 25th Percentile c Estimated Standard Error Elasticity at 75th Percentile Estimated Standard Error –.00247 .02470 –.01400 .02059 –.00681 .00698 –.00831 .00659 .00907 .00704 .00001 .02650 .02932 .34207 a Estimated equation includes city and year fixed effects. Estimated standard error is clustered at the city level. c Percentile refers to the distribution of city average annual defaults (REOs) over the panel. d “I” indicates that interaction had a t–statistic < 1 in preliminary model and was therefore dropped from final model. b **, *** indicate statistical significance at the 5% and 1% levels, respectively. Table 4 Estimated City Human Services Expenditure Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_Default_lag1 * Ave_Default Log_Default_lag2 * Ave_Default Log_REO_lag1 Log_REO_lag2 Log_REO_lag1 * Ave_REO Log_REO_lag2 * Ave_REO Log_TaxBase_lag2 Log_Pop_lag1 Log_Income_lag1 Observations Cities R–square Estimated Coefficient –.21138 –.20859 Id I .10085** .03169 I I .05981 .54798*** –4.74455 153 45 .950 Estimated Standard Error b .22829 .17410 Elasticity at 25th Percentile c Estimated Standard Error Elasticity at 75th Percentile .03806 .04733 .04475 .13073 3.67492 a Estimated equation includes city and year fixed effects. Estimated standard error is clustered at the city level. c Percentile refers to the distribution of city average annual defaults (REOs) over the panel. d “I” indicates that interaction had a t–statistic < 1 in preliminary model and was therefore dropped from final model. b **, *** indicate statistical significance at the 5% and 1% levels, respectively. Estimated Standard Error Table 5 Estimated County Millage Rate Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_TaxBase_lag1 Log_Pop_lag1 Log_Income_lag2 Observations Counties R–square Estimated Elasticity .01155*** .00569 –.00585 .00203 –.28489*** –.23585** .55789*** 227 64 .992 Estimated Standard Error b .00376 .00438 .00386 .00375 .06179 .10939 .13248 a Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. The standard errors are obtained by jointly estimating equations (1), (2), and (8), allowing errors to be correlated across equations. b **, *** indicate statistical significance at the 5% and 1% levels, respectively. Table 6 Direct, Indirect, and Total Estimated Effects of Foreclosures on the County Millage Rate Log_Default_lag1 Log_Default_lag2 Log_REO_lag 1 Log_REO_lag2 (1) Direct Effect a .01155*** (.00376) e .00569 (.00438) –.00585 (.00386) .00203 (.00375) (2) Indirect Effect b –.01181 (.00843) .00279 (.00244) .01068** (.00427) .00860*** (.00288) (3) Total Effect–1 c –.00026 (.00721) .00848* (.00505) .00483 (.00488) .01063*** (.00403) a (4) Total Effect–2 d .01155*** (.00376) .00848* (.00505) .01068** (.00427) .01063*** (.00403) Direct effects are those reported in Table 5. Indirect effect = 𝜕𝑀/𝜕𝐵[𝛽6 + 𝜕𝐵⁄𝜕𝑃 ∙ 𝜕𝑃⁄𝜕 𝐹], where F is one of the test variables and all variables are measured in logs. c Total Effect–1 is the sum of Columns (1) and (2). d Total Effect–2 is described in the text in Section 5.1. e Estimated standard errors clustered at the county level in parentheses. The standard errors are obtained by jointly estimating equations (1), (2), and (8), allowing errors to be correlated across equations. b *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively. Table 7 Simulated Growth in County Property Taxes From Foreclosures For a Home with a Taxable Value of $300,000 Percentage Change Baseline (2005) 2006 2007 2008 2009 120 111 56 20 Defaults Millage Rate 15.000 15.360 15.693 15.861 15.921 Property Taxes $4500 $4608 $4708 $4758 $4776 Percentage Change -22 396 258 20 REOs Millage Rate 15.000 14.931 16.178 16.991 17.054 Property Taxes $4500 $4479 $4853 $5097 $5116 Total Property Taxes $4500 $4587 $5061 $5355 $5392 Table 8 Estimated County Property Tax Base Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_Price Log_Properties Log_Income_lag1 Observations Counties R–square Estimated Elasticity .02239 –.01804** –.01689* –.01590** .28750*** .99169*** –.00004 227 64 .999 Estimated Standard Error b .02853 .00767 .00995 .00780 .07738 .02302 .14055 a Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. The standard errors are obtained by jointly estimating equations (1), (2), and (8), allowing errors to be correlated across equations. b *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively. Table 9 Estimated Price Level Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_Pop_lag1 Log_Income_lag1 Observations Counties R–square Estimated Elasticity .06633** .02865** –.07161*** –.04975*** .01458 .19477 227 64 .956 Estimated Standard Error b .02738 .01289 .01684 .01173 .67182 .55526 a Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. The standard errors are obtained by jointly estimating equations (1), (2), and (8), allowing errors to be correlated across equations. b **, *** indicate statistical significance at the 5% and 1% levels, respectively. Table 10 Direct, Indirect, and Total Estimated Effects of Foreclosures on County Property Tax Base Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 a (1) Direct Effect a .2239 (.02853) –.01804** (.00767) –.01689* (.00995) –.01590** (.00780) (2) Indirect Effect .01907* (.01036) .00824* (.00460) –.06266** (.01946) –.01430*** (.00530) (3) Total Effect .04146 (.02961) –.00980 (.00838) –.07955*** (.02502) –.03020*** (.00673) Direct effect = 𝜕𝐵/𝜕𝐹 Indirect effect = 𝜕𝐵/𝜕𝑃 ∙ 𝜕𝑃/𝜕𝐹 Total effect = 𝜕𝐵/𝜕𝐹 + 𝜕𝐵/𝜕𝑃 ∙ 𝜕𝑃/𝜕𝐹, where F is one of the test variables and all variables are measured in logs. b Estimated standard errors clustered at the county level in parentheses. The standard errors are obtained by jointly estimating equations (1), (2), and (8), allowing errors to be correlated across equations. *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively. Table 11 Estimated County Public Safety Expenditure Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_TaxBase_lag1 Log_Pop_lag1 Log_Income_lag1 Observations Counties R–square a b Estimated Elasticity –.00773 .03068** –.02635 –.00832 .03665 .21556 .17023 232 65 .990 Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. ** indicates statistical significance at the 5% level. Estimated Standard Error b .03444 .01476 .01633 .01461 .08544 .62504 .53264 Table 12 Estimated County Transportation Expenditure Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_TaxBase_lag1 Log_Pop_lag1 Log_Income_lag1 Observations Counties R–square a b Estimated Elasticity –.02650 –.05417** –.04111 .01790 –.21323 2.40888 1.73353* 235 66 .829 Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. *, ** indicate statistical significance at the 10% and 5% levels, respectively. Estimated Standard Error b .03784 .02613 .02816 .02144 .21206 1.70986 .95288 Table 13 Estimated County Human Services Expenditure Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_TaxBase_lag1 Log_Pop_lag2 Log_Income_lag2 Observations Counties R–square a b Estimated Elasticity .14126*** –.02443 –.05726 –.01015 –.03888 –1.51987 –5.15391* 231 64 .918 Estimated Standard Error b .04695 .04461 .04321 .03903 .21665 1.10154 2.91143 Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. *, *** indicate statistical significance at the 10% and 1% levels, respectively. Table 14 Estimated County Other Uses Expenditure Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_TaxBase_lag2 Log_Pop_lag2 Log_Income_lag2 Observations Counties R–square a b Estimated Elasticity .00795 .06182** –.01187 –.04001 –.14541 –.37970 1.25797 235 66 .898 Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. ** indicates statistical significance at the 5% level. Estimated Standard Error b .04234 .02864 .03494 .02525 .18568 1.97201 1.96346 Table 15 Estimated County Court Administration Expenditure Elasticities with Respect to Defaults and REOs a Log_Default_lag1 Log_Default_lag2 Log_REO_lag1 Log_REO_lag2 Log_TaxBase Log_Pop Log_Income Observations Counties R–square a b Estimated Elasticity .07490 –.07768 –.13270 .11133* .15500 –1.48994 222 61 .776 Estimated equations include county and year fixed effects. Estimated standard error is clustered at the county level. * indicates statistical significance at the 10% level. Estimated Standard Error b .11110 .06631 .09972 .06324 .27965 2.37722 Table 16 Estimated Effects of Defaults and REOs on Property Tax Revenues a Cities Default_lag1 Default_lag2 REO_lag1 REO_lag2 Millage Rate Tax Base (1000) Population_lag1 Population_lag2 Income_lag1 Observations No. of Jurisdictions R–square a b Counties Estimated Coefficient –667 –4039*** 6326** 471 573530** .83411** Estimated Standard Error b 549 982 2761 2463 249210 .33774 153857** –129 720 227 .999 77987 139 Estimated Coefficient 1011 –4375*** 8447*** –7284* 2733907 1.72708** –302 Estimated Standard Error 801 1134 2666 3698 1657870 .74788 .229 –739 227 66 .999 932 Estimated equations include city (county) and year fixed effects. Estimated standard error is clustered at the city (county) level. *, **, *** indicate statistical significance at the 10%, 5%, and 1% levels, respectively. Appendix Table A.1 Local Government Expenditure Categories Expenditure Category Major Accounts Within Category General Government Services Culture/Recreation Legislative, Executive, Financial and Administrative, Legal, Comprehensive Planning Law Enforcement, Fire Control, Protective Inspections Utilities, Garbage and Solid Waste, Sewer and Wastewater Roads and Streets, Airports, Mass Transit Industry Development, Housing and Urban Development Hospital and Health Services, Public Assistance Services Libraries, Parks and Recreation Other Uses Miscellaneous County Court Administration Administration Public Safety Physical Environment Transportation Economic Environment Human Services a Standard deviation in parentheses. Average Annual Per Capita Mean Cities Counties 567 319 (728) a (127) 585 (512) 746 (923) 173 (145) 106 (132) 41 (131) 189 (143) 318 (264) 447 (166) 182 (132) 237 (121) 62 (56) 76 (121) 73 (46) 356 (204) 26 (10) Appendix Table A.2 Average Annual Means (Standard Deviations) of the Control Variables Property Tax Base ($10,000) County Per Capita Income Population House Price Index Total Properties on the Tax Roll Observations Counties 2417259 (3915802) 32346 (9582) 291963 (435707) 219 (60) 148024 (170605) 226 Cities 389767 (542931) 40212 (8736) 44483 (60105) 211 (86) 19430 (24201) 736