Expectations from Auditors of NBFCs

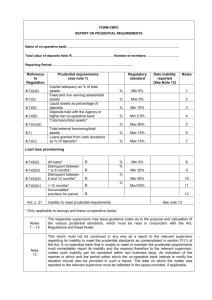

advertisement

A Non-Banking Financial Company (NBFC) is a company • Registered under the Companies Act, 1956 • Its principal business is lending, investments in various types of shares/stocks/bonds/debentures/securities, leasing, hire-purchase, insurance business, chit business An NBFC does not include any institution whose principal business is agricultural activity, industrial activity, trading activity or sale/purchase/construction of immovable property. Entities NOT regulated by RBI Insurance companies, stock broking and merchant banking companies, venture capital companies, Nidhis, housing finance companies and Chit Fund Companies not regulated by the Reserve Bank of India – to avoid dual regulation – Coordination through State Level Coordination Committee (SLCC) between various regulators The Company needs to fulfil the Principal Business Criteria of being an NBFC. The definition of ‘Principal Business’ given, vide, Press Release 1998-99/1269 dated April 8, 1999 (No NBFC shall commence or carry on the business of a NBFI without obtaining a certificate of registration and having the net owned fund of twenty-five lakh rupees or such other amount, not exceeding two hundred lakh rupees) The auditors of all NBFCs are required to report directly to the Reserve Bank the non-compliance by any company of the above statutory provisions.) Based on Liabilities Category ‘A’ companies (Deposit taking) - NBFCs having public deposits or NBFCs-D Category ‘B’ companies (Non-Deposit taking) - NBFCs not having public deposits or NBFCs-ND. The Companies having asset size more than Rs.100 crore considered as NBFCs-ND-SIs (Systemically Important) Based on Activities Loan Companies (LCs), Investment Companies (ICs), Asset Finance Companies (AFCs), Infrastructure Finance Companies (IFCs), Core Investment Companies (CICs), Factor Companies, Micro Finance Institutions, Mortgage Guarantee Companies, RNBCs Chapter III B Section 45-IA - Requirement of registration and net owned fund Section 45IB - Maintenance of percentage of assets (To be invested in unencumbered approved securities not less than fifteen percent of the deposits outstanding at the close of business on the last working day of the second preceding quarter (5% in the form of bank fixed deposits) Penal Interest - @ 3% over Bank Rate in case of shortfall in that quarter @ 5% over Bank Rate for subsequent quarter Section 45IC- Maintenance of Reserve fund (Every NBFC shall create a reserve fund and transfer therein a sum not less than twenty per cent of its net profit every year as disclosed in the profit and loss account and before any dividend is declared) Section 45MA - Powers and Duties of Auditors (Auditors have been assigned greater role in indirect supervision of the NBFCs and made accountable to submit exception reports on violation/contraventions of RBI Directions/Act) Onsite Offsite Market Intelligence Statutory Auditors DNBS (PD) CC No. 334 / 03.02.001 / 2013-14 July 1, 2013 - “Non-Banking Financial Companies Auditor’s Report (Reserve Bank) Directions, 2008.” Press Release April 8, 1999 – Principal Business Criteria DNBS (PD) CC No 331/ 03.02.001 / 2013-14 July 1, 2013 - “Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 1998” DNBS (PD) CC No.332 / 03.02.001/ 2013-14 July 1, 2013 - “Non-Banking Financial (Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2007” DNBS (PD) CC No.333/ 03.02.001 / 2013-14 July 1, 2013 - “Non-Banking Financial (Non - Deposit Accepting or Holding) Companies Prudential Norms (Reserve Bank) Directions, 2007” DNBS(PD).CC.No 344./03.02.001/2013-14 July 1, 2013 - Master Circulars Miscellaneous Instructions to All Non-Banking Financial Companies DNBS (PD) CC No.343/ 03.10.001/2013-14 July 1, 2013 - Master Circulars Miscellaneous Instructions to NBFC- ND-SI DNBS.PD.CC.No.335 /03.10.042/2013-14 July 1, 2013 Master Circular - Returns to be submitted by NBFCs Directions apply to every auditor of an NBFC as defined in Section 45I(f) of the RBI Act, 1934. Auditors to submit Report to the Board of Directors in addition to the Report made under Section 227 of Companies Act, 1956 – Auditor’s Report Matters to be included in Auditor’s Report For all NBFCs (To be submitted within one month from the date of finalization of the balance sheet and in any case not later than December 30th of that year) i) ii) iii) iv) Whether the Company is engaged in NBFI activity and obtained CoR (Section 45-IA – minimum NOF) Whether the NBFC is entitled to hold CoR for its asset/income pattern as on March 31 (PBC) (Press Release) In case of an AFC/MFI/Factor, whether it continues to be classified as per extant guidelines NBFCs not to be partner in partnership firms For Deposit Taking NBFCs i) ii) iii) iii) iv) v) vii) viii) ix) x) The public deposits (PDs) held by the Company are not excluded from the definition of public deposits. In case of AFCs – whether the Company is accepting PD within admissible limits. CRAR – 15% (AFC/LC/IC), whether CRAR has been arrived correctly Default in paying its depositors, both Principal and Interest Compliance to prudential norms on income recognition, accounting standards, asset classification, provisioning and concentration of credit/investments Compliance to maintenance of liquid assets Filing of Returns – NBS-1, Half-yearly returns Opening/Closing Branches – Prior written permission required. AFC not to invest in Land or Building and unquoted shares beyond 10% of owned funds. (LC/IC – 10% & 20%) Rotation of partners of the statutory auditors audit firm - with public deposits/deposits of Rs.50 crore and above i) ii) iii) iv) v) For Non-Deposit Taking NBFCs Board Resolution for non-acceptance of PDs. Whether the Company has accepted PDs. Compliance to prudential norms on income recognition, accounting standards, asset classification, provisioning and concentration of credit/investments In case of NBFCs-ND-SIs (>Rs.100 crore asset size – SA to inform)- CRAR disclosed in NBS_7 correctly arrived and the Company is in compliance to minimum CRAR (15%). Whether the Company has furnished the annual statement of capital funds, risk assets/exposures and risk asset ratio. Disclosures in the balance sheet: Provisions for bad and doubtful debts and depreciation in investments. ND-SIs to disclose Capital to Risk Assets Ratio (CRAR) Exposure to real estate sector, both direct and indirect; and Maturity pattern of assets and liabilities. All ND-SI and deposit taking NBFCs to disclose the amount related to fraud, reported in the Company for the year Exemption from registration In case the Company has been exempted from registration, to confirm whether it is complying with the conditions stipulated as advised by the Bank. Reasons for unfavourable or qualified statements The auditor report shall state reasons, where the auditor is unable to express any opinion the report, the report shall indicate fact together with reasons therefor. Obligation to submit an exception report In case the Company has not complied with a) Provisions of Chapter III B of the RBI Act, b) NBFC Acceptance of Public Deposits Directions c) NBFC (Deposit Accepting or Holding) Prudential Norms d) NBFC (Non-Deposit Accepting or Holding) Prudential Norms The Auditor shall report only contraventions of the provisions of the RBI Act, 1934 and shall NOT contain any statement with respect to compliance of any of those provisions.