Estates (ways to own it now) Fee simple absolute (absolute

advertisement

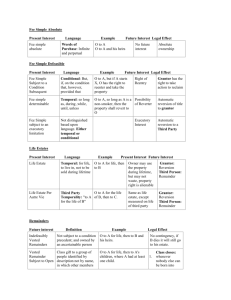

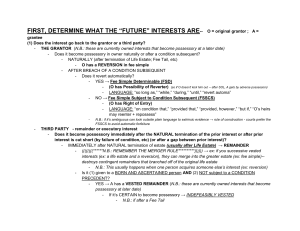

1. 2. Estates (ways to own it now) a. Fee simple absolute (absolute ownership. Cannot be divested. Alienable, descendible, transferrable) i. Johnson v. Witton, grantor cannot restrict who inherits from grantee (numerous clauses) ii. Cannot be divested by anyone but owner b. Life estate (after death back to owner. Creates future interest – reversion or remainder) 1. Alienable during life but not descendible (creates life estate pur autre vie) 2. Baker v. Wheaton, life estate possessor cannot sell in fee simple b/c future interests have stake c. Defeasible estates i. Fee Simple Determinable “so long as” 1. Definition: A fee simple that ends automatically if some event comes to pass. 2. Created: O to A so long as [X] a. Interests: A = Fee Simple Determinable; O = Possibility of Reverter 3. Created: O A for life, so long as he never preaches a sermon. a. Interests: A: determinable life estate; O: both a possibility of reverter and reversion ii. Fee Simple Subject to Condition Subsequent “but if” 1. Definition: A fee simple that may be cut short if some event comes to pass 2. Created: O to A, but if [X], then O may re-enter a. Interests: A = Fee Simple Subject to Condition Subsequent; O= Right of Entry 3. Create: O A for life, but if he ever preaches a sermon, O retains the right to enter and retake possession a. Interests: A= life estate subject to condition subsequent; A = both right of entry and reversion iii. Fee Simple Subject to Executory Limitation “then to” 1. Definition: A fee simple that, if cut short, passes to a third-party transferee 2. Created: O to A, but if [X], then to B. a. Interests: A = FSSEL; B = Executory Limitation; O= Nothing 3. Created: O A for life, but if she ever commits an act of piracy, then to B. a. Interests: A=life estate subject to executory limitation, B = EL; O = reversion and right of entry 4. Automatically taken, no need to enter 5. Only thing that can cut short a vested remainder 6. Future interest: a. Shifting: 3rd party divests grantee b. Springing: 3rd party divests an original owner i. Future: grantor imposes limitation himself on own fee simple, and if met, goes to 3rd party ii. Gap conveyance: back to owner during brief gap before condition fulfilled (e.g., funeral) Future Interests (rights to something in someone’s will) a. Grantor i. Reversion (from life estate); ii. Possibility of reverter: automatic (from FSD) iii. Right of entry: requires retaking (from FSSCS) b. Grantee (all remainders) i. Vested remainder (known and no condition precedent) 1. Indefeasibly vested a. After a life estate, remaindermen certain to become and remain possessory 2. Subject to partial divestment/open a. Remaindermen definitely but may take less than whole b/c new class members may arise i. O A for life, then to B’s kids 3. Subject to complete divestment a. Remaindermen may never become possessory may or may never take if not, back to O i. O A for life, then to B, but if A stops using it as a farm, then instead to C ii. Contingent remainder 1. A remainder that may never vest because either: a. (1) relevant person has never come to exist i. O A for life, then to A’s children. Assume A has no children b. (2) conditional event may not occur i. O A for life, then to B if B is at least 21 yrs old when A dies. B is currently 20. 2. Condition must occur or person must come into existence before the remainder vests (precedent) 3. Normally if a contingent remainder does not vest, the property will stay in O’s estate a. Exception: Alternative Contingent Remainders: when a contingent remainder that does not vest goes to a 3rd party instead of O. i. O A for life, then to B if he survives A, and if B does not survive A, then to C RAP: interest must vest or terminate within 21 years after death of life in being (at time of creation). Interest needs to vest or terminate within 21 years (policy: alienability, avoid litigation, too much dead hand control) 1. 2. 3. 4. Interests subject to the RAP: a. Contingent remainder b. Executory limitation c. Vested subject to open Find measuring life: alive + effect that taking (note: can’t be part of open class) Trigger the condition: Will vesting occur w/in 21 years after measuring life dies Examples: 1. O A for life, remainder to A’s kids who reach 25. A(70), X(35), Y(37) Interest: vested subject to open ML: A What makes it vest: kids reaching 25 How do we determine this: After A dies; all kids reach. 25 within 21 years? 2. O A for life, then to first of A’s kids to reach 22. X(23), y(24) 3. 4. interest: indefeasibly vested remainder O A for life, then to A’s widow, then to A’s issues then living. Widow interest: contingent remainder in life estate A needs to die valid A’s issue: contingent remainder A’s widow dies invalid Alerts: “then living”, “A’s widow O A so long as no liquor served, then to B A: FSSEL B: Shifting exec. Limitation Measure life: A Trigger: liquor served