Net Premium Option Market Value FOR INFORMATION ONLY

advertisement

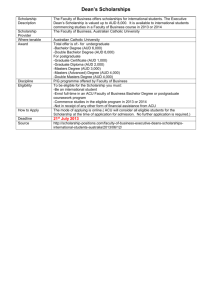

HALIFAX FUTURES & SECURITIES Account Statements Account Statement Explanation There are five main areas 1. Account Details • Account Number 2. 3. Position Summary • Futures • • Futures Options Cash Options Account Financial Summary • Cash Balance • Variation Margin • Total Equity • Initial Margins • Security • Excess / (Shortage) • Forward Dated Journals • Adjusted Excess/Shortage Account Statement Explanation 4. Account Financial Summary - Continued • FOR INFORMATION ONLY • Forward Unrealized P&L • Net Premium Option Market Value • Net Liquidating Value (NLV) 5. 6. Business Done Today Monthly Statement • Commissions & GST Account Details HALIFAX FUTURES AND SECURITIES OPEN POSITION STATEMENT Account Number Must quote to broker each time an order is placed John Smith 1 Johnson St Melbourne VIC 3000 MACQUARIE BANK LIMITED Banking Institution where funds are held Account No: AA001 MACQUARIE BANK LIMITED 24 March 2004 COB Global COB Global Close Of Business on Global markets – Approx 2.00pm AET COB SFE Close Of Business on SFE, ASX AND NZFOE markets – Approx 7.00am AET LEVEL 5, 1 MARTIN PLACE SYDNEY NSW 2000 Enquiries (61-2) 8232 4037 Facsimile (61-2) 8232 4412 A.B.N. 46 008 583 542 Position Summary - Futures Date 24MAR04 Open Position SFE SPI 200 CONTRACT 25 SFE B 1 JUN04 NET +1 JUN04 3411.0 Trade Price Current Price Curr 3411.0 3351.0 AUD On 24 March 2004, 1 June Spi 200 has been bought @ 3411.0 Open Position Value SFE SPI 200 CONTRACT AUD FUTURES Market Revaluation Option P&L or Prem Value (*) -1,500.00 -1,500.00 0.00 The Current Price is an indication of the price you “could” achieve to exit out of this trade. Ie, you could possibly sell these futures back at 3351.0, resulting in a 60 point loss i.e. 25 AUD per contract or $1,500 AUD 85,272 This is the sum of the value of all contracts per series at the traded price(s). Position Summary – Futures Options Date 24MAR04 23APR04 Open Position SFE SPI 200 CONTACT 25 SFE B 1 Jun04 NET +1 JUN04 3411.0 S 20 JUN04 3350.0 Call 17June NET -20 Avg Sold 70.0 On 23 April 2004, 20 Jun 3350.0 Spi 200 Calls have been sold on the SFE market for 70 points Trade Price Current Price Curr Market Revaluation Option P&L or Prem Value (*) 3411.0 3351.0 AUD -1500.00 0.00 AUD “A” 11,000.00 11,000.00 “B” 35,000.00* 35,000.00 70.0 48.0 Where an amount is followed by the asterisk “*” sign, then this represents a futures style option. This implies that figure “B” represents the total value of the option and figure “A” represents the unrealized P&L or “difference” between the value of the option(s) at the traded price and the value of the option(s) at the at the end of day settlement price : Position Summary – Futures Options Date 24MAR04 23APR04 Trade Price Curren t Price 3411.0 3351.0 Open Position SFE SPI 200 CONTACT 25 SFE B 1 Jun04 NET +1 JUN04 3411.0 S 20 JUN04 3350.0 Call 17June NET -20 Avg Sold 70.0 Options Position Value 70.0 48.0 Curr Market Revaluatio n Option P&L or Prem Value (*) AUD -1500.00 0.00 AUD “A” 11,000.00 11,000.00 “B” 35,000.00* 35,000.00 AUD SFE SPI 200 CONTRACT FUTURES 85,275 SFE SPI 200 CONTRACT OPTIONS 35,000 This is the sum total of the open position value grouped by commodity, futures/option and currency In this case, to exit out of the trade you can buy the options back at 48 points for a total P&L of AUD $11,000 being 70 points – 48 points = 22 points * AUD $25 per point * 20 contracts Position Summary – Futures Options Date 24MAR04 23APR04 Open Position SFE SPI 200 CONTACT 25 SFE B 1 Jun04 NET +1 JUN04 3411.0 S 20 JUN04 3350.0 Call 17June NET -20 Avg Sold 70.0 Trade Price Curren t Price Curr Market Revaluatio n 3411.0 3351.0 AUD -1500.00 0.00 AUD “A” 11,000.00 11,000.00 “B” 35,000.00* 35,000.00 70.0 48.0 Option P&L or Prem Value (*) MARKET REVALUATION BREAKDOWN Variation Margins – Fut and Fut Style Options Amount Profit/Loss SPI – FUTURES AUD -1,500 -1,500 SPI – OPTIONS AUD 11,000 11,000 The Market Revaluation report is a summary of the Futures and Options profit and loss. For Futures and Futures style options, the unrealized Profit and loss is shown in both the amount and the P&L columns. These figures will also form part of the client Total Equity or “Above the line” margin amounts in the Account Financial Summary. Position Summary – Cash Options Date Open Position Trade Price 14APR04 DAX OPTIONS ON EUREX 10 ERX S 2 JUN04 3500.0 Putt 17JUN NET –2 AVG SOLD 25.0 25.0 On 14 April 2004, 2 JUN 3500 DAXO Putts have been sold on the EUREX market @ 25 points Current Price Curr 18.0 EUR Market Revaluation Option P&L or Prem Value (*) 180.00 180.00 70.00 70.00 To exit out of this trade you can buy these Calls back for 18 points. Resulting in a 7 point gain on 2 contracts @ 5 EUR per point being EUR 70.00 Options Position Value EUR ERX DAXO Options 250 This is the sum total of the open position value grouped by commodity and futures/option and currency @ the traded price(s) In this case, no * Symbol is present, meaning the figure represents unrealized Option profit and loss, i.e.. The difference between traded and closing price. In this case EUR 70.00. Position Summary - continued Date 14APR04 Open Position DAX OPTIONS ON EUREX 10 ERX S 2 JUN04 3500 Putt 17JUN NET -2 AVG SOLD 25.0 Trade Price Current Price Cur 25.0 18.0 EUR Market Revaluation Option P&L Prem Value (*) -180.00 -180.00 -70.00 -70.00 Market Revaluation Total to Pay or receive back to exit positions – not including brokerage if traded at previous nights close Market Revaluation Breakdown Amount Profit / Loss -180.00 70.00 Net Premium Options Market Value DAXO Options EUR As these options are Premium or “Cash” style options, the Value of the options @ the sale price (25 points or EUR 250.00) will be credited to the cash balance of the account, shown in the Account Financial Summary. The Current Market Value (EUR -180.00 )will then be shown in the “For Information Only” section of the Account Financial Summary Account Financial Summary Cash Balance – Open Positions Total Funds paid/received + Futures P&L + Option Premium + Brokerage + Interest Variation Margins – Open Positions Unrealised profit and loss. For Options, only “futures Style” like those trades on the SFE and NZFOE will be shown as above the line total Equity figures. All other options where premium is paid or received upfront are shown in the “for information only” section. CASH BALANCE AUD EUR NET AUD (0.70230) (1.20180) (0.70230) -80.85 230.20 313.22 VARIATION MARGINS - Futures -1,500 - Options 11,000 TOTAL EQUITY 9,419.15 230.20 9,813.22 INITIAL MARGINS -31,700 -1,080.00 -33,548.80 0.00 0.00 0.00 -22,280.85 -849.80 -23,735.60 SECURITY EXCESS/(SHORTAGE) Total Equity – Open Positions Value of account if all positions are closed for Futures and Futures Style Options. Not including brokerage on closing trades. Please note, if you hold Premium or Cash style options you will need to refer to Net Liquidating Value for the value of the account if all positions are closed. Account Financial Summary Continued Initial Margins – Open Positions Security deposit required by exchange. In a change from previous reporting, Net premium Option Market Value and forward unrealised P&L on offshore exchanges can form part of initial margins. Security – Open Positions Security amounts lodged by client to cover “Initial Margins” only. Can be stock, currency etc. If no Security has been provided then this item will not appear on your statement CASH BALANCE AUD EUR NET AUD (0.70230) (1.20180) (0.70230) -80.85 230.20 313.22 VARIATION MARGINS - Futures -1,500 - Options 11,000 TOTAL EQUITY 9,419.15 230.20 9,813.22 INITIAL MARGINS -31,700 -1,080.00 -33,548.80 0.00 0.00 0.00 -22,280.85 -849.80 -23,735.60 SECURITY EXCESS/(SHORTAGE) Excess / Shortage – Open Positions Sum of Total Equity and Initial Margin. If security covers initial margin then Excess Shortage will equal Total Equity as the client has covered their initial margin requirement. Clients can draw down excess funds but must pay any Shortages. Account Financial Summary Continued Forward Dated Journals – Open Positions Adjustment Journals to be posted at a future date eg, average price adjustment, interest adjustment journals Adjusted Excess/Shortage – Open Positions Sum of Excess/Shortage + Adjustment Journals. For information only. Not to be paid/received. CASH BALANCE AUD EUR NET AUD (0.70230) (1.20180) (0.70230) -80.85 230.20 313.22 VARIATION MARGINS - Futures -1,500 - Options 11,000 TOTAL EQUITY 9,419.15 230.20 9,813.22 INITIAL MARGINS -31,700 -1,080.00 -33,548.80 0.00 0.00 0.00 -22,280.85 -849.80 -23,735.60 SECURITY EXCESS/(SHORTAGE) Account Financial Summary Continued FOR INFORMATION ONLY – Open Positions The For Information Only section provides clients with information regarding, forward variation margins, Net premium Option market Value and NLV (Net Liquidating Value) - PRIMARILY OPTIONS ON OFFSHORE EXCHANGES. CASH BALANCE VARIATION MARGINS - Futures - Options TOTAL EQUITY INITIAL MARGINS SECURITY EXCESS/(SHORTAGE) FOR INFORMATION ONLY Net Premium Option Market Value Net Liquidating Value AUD (0.70230) -80.85 EUR (1.20180) 230.20 NET AUD (0.70230) 313.22 -1,500 11,000 9,419.15 -31,700 0.00 -22,280.85 230.20 -1,080.00 0.00 -849.80 9,813.22 -33,548.80 0.00 -23,735.60 -180.00 9,419.15 50.2 9,505.44 Account Financial Summary Continued Forward Unrealised P&L – Open Positions Unrealised profit and loss for markets that do not realise P&L until prompt dates,or pay interest on P&L till close eg, LME, OM Net Premium Option Market Value – Open Positions Current Market Value of options where premium is paid or received up front. Applies to most options contracts on on offshore exchanges. CASH BALANCE VARIATION MARGINS - Futures - Options TOTAL EQUITY INITIAL MARGINS SECURITY EXCESS/(SHORTAGE) FOR INFORMATION ONLY Net Premium Option Market Value Net Liquidating Value AUD (0.70230) -80.85 EUR (1.20180) 230.20 NET AUD (0.70230) 313.22 -1,500 11,000 9,419.15 -31,700 0.00 -22,280.85 230.20 -1,080.00 0.00 -849.80 9,813.22 -33,548.80 0.00 -23,735.60 -180.00 9,419.15 50.2 9,505.44 Net Liquidating Value – Open Positions Sum of Total Equity + Forward Unrealised P&L + Net Premium Option Market Value. Identifies the value of the account if all positions (offshore and SFE) are closed. Account Financial Summary Continued Currency Conversion – Open Positions As an account trades, all premiums, brokerage, P&L, interest etc are accumulated in the underlying currency of the commodity traded. This is totalled and reported in the base currency of the account (generally AUD). CASH BALANCE VARIATION MARGINS - Futures - Options TOTAL EQUITY INITIAL MARGINS SECURITY EXCESS/(SHORTAGE) FOR INFORMATION ONLY Net Premium Option Market Value Net Liquidating Value AUD (0.70230) -80.85 EUR (1.20180) 230.20 NET AUD (0.70230) 313.22 -1,500 11,000 9,419.15 -31,700 0.00 -22,280.85 230.20 -1,080.00 0.00 -849.80 9,813.22 -33,548.80 0.00 -23,735.60 -180.00 9,419.15 50.2 9,505.44 N.B. No currency exposures are converted to AUD unless an explicit instruction has been received from the client. All currencies remain in the native currency until instruction is sent and confirmation of foreign exchange is received by the client Account Financial Summary Continued CUURENCY CONVERSION As trades are taken on the various markets, premiums, brokerage, variation and initial margins are totaled in the underlying currency These are detailed separately and then totaled to Australian dollars CASH BALANCE AUD EUR USD NET AUD (0.5952) (1.0678) (1.0000) (0.5952) 19,952.50 280.20 680.40 21598.33 -320.00 VARIATION MARGINS - Eurex DAX Options Options - - CME EURO FX Options Options - -574.09 -312.50 -525.03 TOTAL EQUITY 19,952.50 -39.80 367.90 20499.21 INITIAL MARGINS - -1165.00 -842.00 -3504.69 19,952.50 -1204.80 -474.10 16994.52 EXCESS / (SHORTAGE) Business Done Today Cash Options On 14 April 2004, 2 Jun 3500 Puts have been sold on the DAX market for 25 points Date 14APR04 Description Resulting in a credit of 250 EUR 2 contracts x 25 points x 5 EUR Business Done Today EURO Dollars BUSINESS DONE TODAY DAX OPTIONS ON EUREX 10 ERX S 2 JUN04 3500 Putts 17JUN Commission TOTALS BROUGHT FORWARD BALANCE OPTIONS PREMIUM TOTAL COMMISSIONS Commissions excl GST GST on Commissions Bought Price Sold Price 25.0 Commission and Fees Amount Posted 19.80 DR 250.00 CR 19.80 DR 18.00 DR 1.80 DR CARRIED FORWARD BALANCE 0.00 250.00 CR 19.80 DR 230.20 CR Commission and GST are deducted Balance is credited to EUR totals CASH BALANCE Business Done Today Futures On 24 March 2004, 1 June Spi 200 Future has been bought on the SFE market @ 3411.0 Date 24MAR04 Description Business Done Today AUD Dollars BUSINESS DONE TODAY SFE SPI 200 CONTRACT 25 SFE B 1 JUN04 Commission TOTALS BROUGHT FORWARD BALANCE OPTIONS PREMIUM TOTAL COMMISSIONS Commissions excl GST GST on Commissions Bought Price Sold Price Commission and Fees Amount Posted 3.85 DR 3.85 DR 3411.0 3.50 DR 0.35 DR CARRIED FORWARD BALANCE 0.00 0.00 3.85 DR 3.85 DR Commission and GST are deducted Balance is debited to AUD totals CASH BALANCE Business Done Today Futures Style Options On 23 April 2004, 20 June04 Spi 200 3350 Calls have been sold on the SFE market for 70pts Date 23 APR04 Description No option premium posted Business Done Today AUD Dollars Bought Sold BUSINESS DONE TODAY SFE SPI 200 CONTRACT 25 SFE S 20 JUN04 3350.0 Call 17JUN04 Commission TOTALS BROUGHT FORWARD BALANCE OPTIONS PREMIUM TOTAL COMMISSIONS Commissions excl GST GST on Commissions Price Price Commission and Fees 70.0 77.00DR Amount Posted 77.00DR 3.85DR 77.00 DR 70.00 DR 7.00 DR CARRIED FORWARD BALANCE 80.85 CR Commission and GST are deducted Balance is credited to EUR totals Monthly Statement MONTHLY ACCOUNT At the end of each month the GST deducted in each currency during the month is converted to AUD The end of month report should be kept for TAX purposes CALCULATION 1.80 EUR x 1.831 = 3.29 AUD AUD AUSTRALIAN DOLLAR DATE 15 JAN 03 22 JAN 03 DESCRIPTION DAILY POSTING GST PAYABLE TOTAL GST CONVERSION FROM USD @ 0.550 GST CONVERSION FROM EUR @ 1.831 0.00 CR 0.00 CR 4.15 DR 3.29 DR 4.15 DR 3.29 DR TOTALS 0.00 CR 0.00 DR 0.00 DR DAILY POSTING GST PAYABLE TOTAL COMMISSION GST CONVERSION TO AUD 18.00 DR 0.00 CR 1.80 DR 1.80 CR 19.80 DR 1.80 CR TOTALS 18.00 DR 0.00 CR 18.00 DR EUR EURO DATE 22 JAN 03 DESCRIPTION