MICROECONOMIC THEORY

advertisement

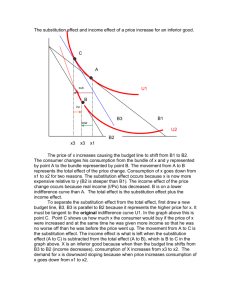

Chapter 5 INCOME AND SUBSTITUTION EFFECTS 1 Objectives • How will changes in prices and income influence influence consumer’s optimal choices? – We will look at partial derivatives 2 Demand Functions (review) • We have already seen how to obtain consumer’s optimal choice • Consumer’s optimal choice was computed Max consumer’s utility subject to the budget constraint • After solving this problem, we obtained that optimal choices depend on prices of all goods and income. • We usually call the formula for the optimal choice: the demand function • For example, in the case of the Complements utility function, we obtained that the demand function (optimal choice) is: I I x* px 0.25 py y* 4 p x py 3 Demand Functions • If we work with a generic utility function (we do not know its mathematical formula), then we express the demand function as: x* = x(px,py,I) y* = y(px,py,I) •We will keep assuming that prices and income is exogenous, that is: –the individual has no control over these parameters 4 Simple property of demand functions • If we were to double all prices and income, the optimal quantities demanded will not change – Notice that the budget constraint does not change (the slope does not change, the crossing with the axis do not change either) xi* = di(px,py,I) = di(2px,2py,2I) 5 Changes in Income • Since px/py does not change, the MRS will stay constant • An increase in income will cause the budget constraint out in a parallel fashion (MRS stays constant) 6 What is a Normal Good? • A good xi for which xi/I 0 over some range of income is a normal good in that range 7 Normal goods • If both x and y increase as income rises, x and y are normal goods Quantity of y As income rises, the individual chooses to consume more x and y B C A U3 U1 U2 Quantity of x 8 What is an inferior Good? • A good xi for which xi/I < 0 over some range of income is an inferior good in that range 9 Inferior good • If x decreases as income rises, x is an inferior good As income rises, the individual chooses to consume less x and more y Quantity of y C B U3 U2 A U1 Quantity of x 10 Changes in a Good’s Price • A change in the price of a good alters the slope of the budget constraint (px/py) – Consequently, it changes the MRS at the consumer’s utility-maximizing choices • When a price changes, we can decompose consumer’s reaction in two effects: – substitution effect – income effect 11 Substitution and Income effects • Even if the individual remained on the same indifference curve when the price changes, his optimal choice will change because the MRS must equal the new price ratio – the substitution effect • The price change alters the individual’s real income and therefore he must move to a new indifference curve – the income effect 12 Sign of substitution effect (SE) SE is always negative, that is, if price increases, the substitution effect makes quantity to decrease and conversely. See why: 1) Assume px decreases, so: px1< px0 2) MRS(x0,y0)= px0/ py0 & MRS(x1,y1)= px1/ py0 1 and 2 implies that: MRS(x1,y1)<MRS(x0,y0) As the MRS is decreasing in x, this means that x has increased, that is: x1>x0 13 Changes in the optimal choice when a price decreases Suppose the consumer is maximizing Quantity of y utility at point A. If the price of good x falls, the consumer will maximize utility at point B. B A U2 U1 Quantity of x Total increase in x 14 Substitution effect when a price decreases Quantity of y To isolate the substitution effect, we hold utility constant but allow the relative price of good x to change. Purple is parallel to the new one The substitution effect is the movement from point A to point C A C U1 The individual substitutes good x for good y because it is now relatively cheaper Quantity of x Substitution effect 15 Income effect when the price decreases The income effect occurs because the individual’s “real” income changes (hence utility changes) when the price of good x changes The income effect is the movement from point C to point B Quantity of y B A C U2 U1 If x is a normal good, the individual will buy more because “real” income increased Quantity of x Income effect How would the graph change if the good was inferior? 16 Subs and income effects when a price increases Quantity of y An increase in the price of good x means that the budget constraint gets steeper The substitution effect is the movement from point A to point C C A B U1 The income effect is the movement from point C to point B U2 Quantity of x Substitution effect Income effect 17 How would the graph change if the good was inferior? Price Changes for Normal Goods • If a good is normal, substitution and income effects reinforce one another – when price falls, both effects lead to a rise in quantity demanded – when price rises, both effects lead to a drop in quantity demanded 18 Price Changes for Inferior Goods • If a good is inferior, substitution and income effects move in opposite directions • The combined effect is indeterminate – when price rises, the substitution effect leads to a drop in quantity demanded, but the income effect is opposite – when price falls, the substitution effect leads to a rise in quantity demanded, but the income effect is opposite 19 Giffen’s Paradox • If the income effect of a price change is strong enough, there could be a positive relationship between price and quantity demanded – an increase in price leads to a drop in real income – since the good is inferior, a drop in income causes quantity demanded to rise 20 A Summary • Utility maximization implies that (for normal goods) a fall in price leads to an increase in quantity demanded – the substitution effect causes more to be purchased as the individual moves along an indifference curve – the income effect causes more to be purchased because the resulting rise in purchasing power allows the individual to move to a higher indifference curve • Obvious relation hold for a rise in price… 21 A Summary • Utility maximization implies that (for inferior goods) no definite prediction can be made for changes in price – the substitution effect and income effect move in opposite directions – if the income effect outweighs the substitution effect, we have a case of Giffen’s paradox 22 Compensated Demand Functions • This is a new concept • It is the solution to the following problem: – MIN PXX+ PYY – SUBJECT TO U(X,Y)=U0 • Basically, the compensated demand functions are the solution to the Expenditure Minimization problem that we saw in the previous chapter • After solving this problem, we obtained that optimal choices depend on prices of all goods and utility. We usually call the formula: the compensated demand function • x* = xc(px,py,U), • y* = yc(px,py,U) 23 Compensated Demand Functions • xc(px,py,U0), and yc(px,py,U0) tell us what quantities of x and y minimize the expenditure required to achieve utility level U0 at current prices px,py • Notice that the following relation must hold: • pxxc(px,py,U0)+ pyyc(px,py,U0)=E(px,py,U0) – So this is another way of computing the expenditure function !!!! 24 Compensated Demand Functions • There are two mathematical tricks to obtain the compensated demand function without the need to solve the problem: – MIN PXX+ PYY – SUBJECT TO U(X,Y)=U0 • One trick(A) (called Shephard’s Lemma) is using the derivative of the expenditure function • Another trick(B) is to use the marshallian demand and the expenditure function 25 Compensated Demand Functions • Sheppard’s Lema to obtain the compensated demand function E ( p x , p y , u ) x dp x y E ( p x , p y , u ) dp y Intuition: a £1 increase in px raises necessary expenditures by x pounds, because £1 must be paid for each unit of x purchased. Proof: footnote 5 in page 137 26 Trick (B) to obtain compensated demand functions x x( p x , p y , I ), demand function I E ( p x , p y , U ), expenditur e function Substituin g ... x x( p x , p y , E ( p x , p y , U )) x( p x , p y , U ) that is, the compensate d demand function because it depends on prices and utility 27 Trick (B) to obtain compensated demand functions • Suppose that utility is given by utility = U(x,y) = x0.5y0.5 • The Marshallian demand functions are x = I/2px y = I/2py • The expenditure function is E 2 px0.5 p 0y.5 U I 28 Another trick to obtain compensated demand functions • Substitute the expenditure function into the Marshallian demand functions, and find the compensated ones: x Up0y.5 p x0.5 Upx0.5 y 0.5 py 29 Compensated Demand Functions x Vpy0.5 px0.5 Vpx0.5 y 0 .5 py • Demand now depends on utility (V) rather than income • Increases in px changes the amount of x demanded, keeping utility V constant. Hence the compensated demand function only includes the substitution effect but not the income effect 30 Roy’s identity • It is the relation between marshallian demand function and indirect utility function V dpx x( px , p y , I ) ; y ( px , p y , I ) V dI Proof of the Roy’s identity… V dp y V dI 31 Proof of Roy’s identity V ( px , p y , I ) u V ( p x , p y , E ( p x , p y , u )) u Taking derivatives wrt p x : V px '(.) VI '(.) E ' px 0 Using previous trick: E E ' px x dpx Substituting: V px '(.) VI '(.) x 0 and solving for x, we find the Roy's identity 32 Demand curves… • We will start to talk about demand curves. Notice that they are not the same that demand functions !!!! 33 The Marshallian Demand Curve • An individual’s demand for x depends on preferences, all prices, and income: x* = x(px,py,I) • It may be convenient to graph the individual’s demand for x assuming that income and the price of y (py) are held constant 34 The Marshallian Demand Curve Quantity of y As the price of x falls... px …quantity of x demanded rises. px’ px’’ px’’’ U1 x1 I = px’ + py x2 x3 I = px’’ + py U2 U3 Quantity of x I = px’’’ + py x x’ x’’ x’’’ Quantity of x 35 The Marshallian Demand Curve • The Marshallian demand curve shows the relationship between the price of a good and the quantity of that good purchased by an individual assuming that all other determinants of demand are held constant • Notice that demand curve and demand function is not the same thing!!! 36 Shifts in the Demand Curve • Three factors are held constant when a demand curve is derived – income – prices of other goods (py) – the individual’s preferences • If any of these factors change, the demand curve will shift to a new position 37 Shifts in the Demand Curve • A movement along a given demand curve is caused by a change in the price of the good – a change in quantity demanded • A shift in the demand curve is caused by changes in income, prices of other goods, or preferences – a change in demand 38 Compensated Demand Curves • An alternative approach holds utility constant while examining reactions to changes in px – the effects of the price change are “compensated” with income so as to constrain the individual to remain on the same indifference curve – reactions to price changes include only substitution effects (utility is kept constant) 39 Marshallian Demand Curves • The actual level of utility varies along the demand curve • As the price of x falls, the individual moves to higher indifference curves – it is assumed that nominal income is held constant as the demand curve is derived – this means that “real” income rises as the price of x falls 40 Compensated Demand Curves • A compensated (Hicksian) demand curve shows the relationship between the price of a good and the quantity purchased assuming that other prices and utility are held constant • The compensated demand curve is a twodimensional representation of the compensated demand function x* = xc(px,py,U) 41 Compensated Demand Curves Holding utility constant, as price falls... Quantity of y px p ' slope x py slope …quantity demanded rises. px ' ' py px’ px’’ slope px ' ' ' py px’’’ xc U2 x’ x’’ x’’’ Quantity of x x’ x’’ x’’’ Quantity of x 42 Compensated & Uncompensated Demand for normal goods px At px’’, the curves intersect because the individual’s income is just sufficient to attain utility level U2 px’’ x xc x’’ Quantity of x 43 Compensated & Uncompensated Demand for normal goods At prices above p’’x, income compensation is positive because the individual needs some help to remain on U2 px px’ px’’ x xc x’ x* Quantity of x As we are looking at normal goods, income and substitution effects go in the same direction, so they are reinforced. X includes both while Xc only the substitution effect. That is what drives the relative position of44 both curves Compensated & Uncompensated Demand for normal goods px At prices below px2, income compensation is negative to prevent an increase in utility from a lower price px’’ px’’’ x xc x*** income x’’’ Quantity of x As we are looking at normal goods, and substitution effects go in the same direction, so they are reinforced. X includes both while Xc only the substitution effect. That is what drives the relative position of45 both curves Compensated & Uncompensated Demand • For a normal good, the compensated demand curve is less responsive to price changes than is the uncompensated demand curve – the uncompensated demand curve reflects both income and substitution effects – the compensated demand curve reflects only substitution effects 46 Relations to keep in mind • Sheppard’s Lema & Roy’s identity • V(px,py,E(px,py,Uo)) = U0 • E(px,py,V(px,py,I0)) = I0 • xc(px,py,U0)=x(px,py,I0) 47 A Mathematical Examination of a Change in Price • Our goal is to examine how purchases of good x change when px changes x/px • Differentiation of the first-order conditions from utility maximization can be performed to solve for this derivative 48 A Mathematical Examination of a Change in Price • However, for our purpose, we will use an indirect approach • Remember the expenditure function minimum expenditure = E(px,py,U) • Then, by definition xc (px,py,U) = x [px,py,E(px,py,U)] – quantity demanded is equal for both demand functions when income is exactly what is needed to attain the required utility level 49 A Mathematical Examination of a Change in Price xc (px,py,U) = x[px,py,E(px,py,U)] • We can differentiate the compensated demand function and get x c x x E px px E px x x c x E px px E px 50 A Mathematical Examination of a Change in Price x x x E px px E px c • The first term is the slope of the compensated demand curve – the mathematical representation of the substitution effect 51 A Mathematical Examination of a Change in Price x x x E px px E px c • The second term measures the way in which changes in px affect the demand for x through changes in purchasing power – the mathematical representation of the income effect 52 The Slutsky Equation • The substitution effect can be written as x c x substituti on effect px px U constant • The income effect can be written as x E x E income effect E p x I p x E Using trick A : x p x x E x income effect x I p x I 53 The Slutsky Equation • A price change can be represented by x substituti on effect income effect px x x px px U constant x x I 54 The Slutsky Equation x x px px U constant x x I • The first term is the substitution effect – always negative as long as MRS is diminishing – the slope of the compensated demand curve must be negative 55 The Slutsky Equation x x px px U constant x x I • The second term is the income effect – if x is a normal good, then x/I > 0 • the entire income effect is negative – if x is an inferior good, then x/I < 0 • the entire income effect is positive 56 A Slutsky Decomposition • We can demonstrate the decomposition of a price effect using the Cobb-Douglas example studied earlier • The Marshallian demand function for good x was 0 .5 I x ( p x , py , I ) px 57 A Slutsky Decomposition • The Hicksian (compensated) demand function for good x was x c ( px , py ,V ) Vpy0.5 px0.5 • The overall effect of a price change on the demand for x is x 0 .5 I px px2 58 A Slutsky Decomposition • This total effect is the sum of the two effects that Slutsky identified • The substitution effect is found by differentiating the compensated demand function x substituti on effect px c 0.5Vpy0.5 p 1.5 x 59 A Slutsky Decomposition • We can substitute in for the indirect utility function (V) substituti on effect 0.5 x 1.5 x 0.5(0.5Ip p p 0.5 y )p 0.5 y 0.25 I px2 60 A Slutsky Decomposition • Calculation of the income effect is easier 0.5I 0.5 x 0.25I income effect x 2 I px px px • By adding up substitution and income effect, we will obtain the overall effect 61