D3 Financial Counselors - Eastern Illinois University

advertisement

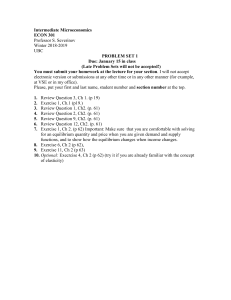

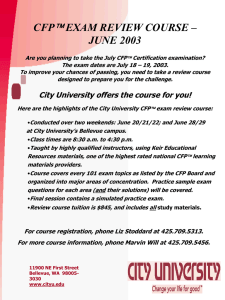

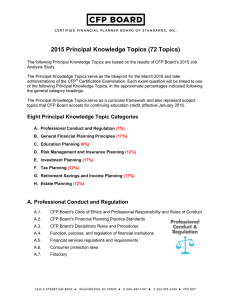

D3 Financial Counselors What we do for our Clients Adam Glassberg 2008 Eastern Illinois University Graduate Majored in Finance Passed March 2009 CFP® Exam Currently Studying to become Enrolled Agent Independent, Fee-only Financial Planning & Investment Management Advantages for the Client Adviser acts as a fiduciary legally requiring him or her to act in the best interest of the client Straight forward relationship void of conflicts of interest Transparent fees and expenses Advantages Less for the Advisor conflicts resulting in fewer compliance issues and less paperwork No external pressures from product providers Products & Services Hourly-Based Or Project-Based Financial Planning Hourly consulting sessions focus on topic specific financial advice Common hourly topics include Clarifying Tax Issues New Business Formation & Analysis Cash Management & Budgeting Investment Reviews Mortgage Refinancing and Pension Analysis Products & Services Financial Planning Clients pay a flat fee for a comprehensive financial plan Plan can serve as a resource for years EGADIM Plan analyzes a client's needs and goals in the areas of Insurance Taxes Retirement & Estate Planning Employee Benefits Investments Products & Services Investment Management Clients pay a percentage of assets under management every quarter % of AUM fee model gives us additional incentive to perform well Portfolios are adjusted to anticipate market changes, and are monitored daily For people who already have an idea of their investment goals Products & Services Comprehensive Financial Planning & Investment Management Charge a percentage of assets under management or retainer fee Ongoing service combines financial plan with investment management January-February March-April Discuss performance and update investment objective based on plan update October-November Update financial plan based on new tax information and client input on life changes July-September Prepare tax returns & look for potential tax saving strategies May-June Discuss Performance and begin to collect tax information Analyze tax situation to maximize after tax income and review estate plan. December Review insurance situation and host annual client appreciation dinner Why I Enjoy My Job Learn a lot from well rounded staff CPA, CFP®, CPA, MBA Work face to face with clients Income does not rely on selling investment products Dynamic work environment CFP® Exam Tips Take the CFP® Exam ASAP Study Early & Often Take Review Course Prior to Exam Remember, you will not know everything Don’t bother studying the night before the exam Questions?? Thank you for your time More information on our firm at http://www.d3financialcounselors.com