Spring 2010

advertisement

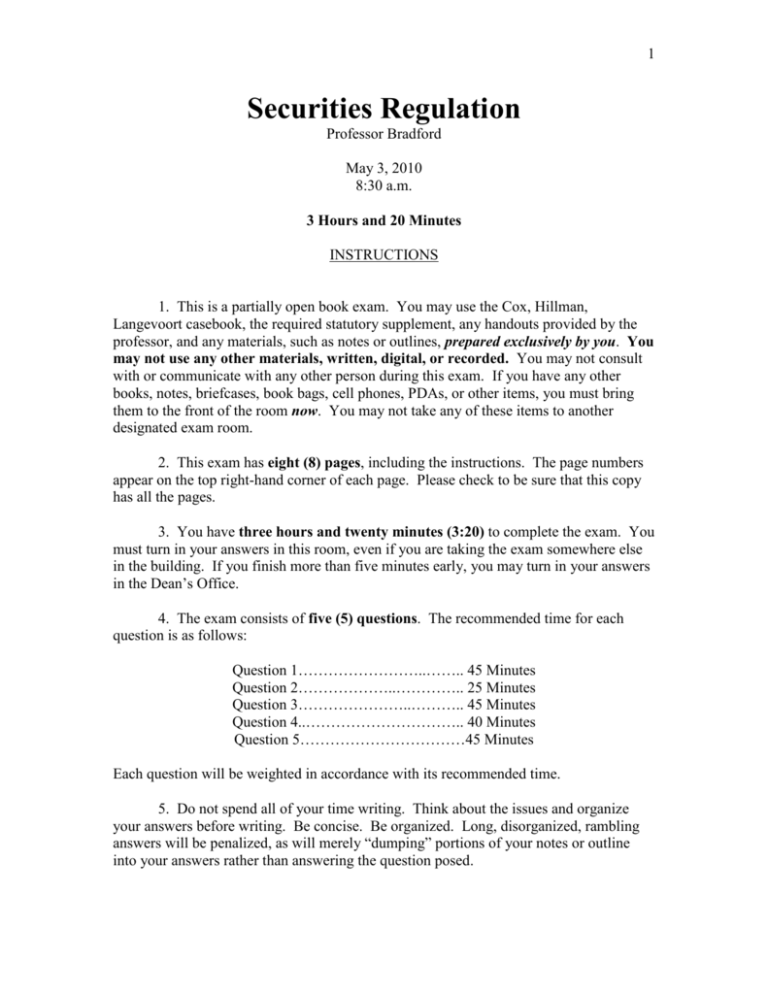

1 Securities Regulation Professor Bradford May 3, 2010 8:30 a.m. 3 Hours and 20 Minutes INSTRUCTIONS 1. This is a partially open book exam. You may use the Cox, Hillman, Langevoort casebook, the required statutory supplement, any handouts provided by the professor, and any materials, such as notes or outlines, prepared exclusively by you. You may not use any other materials, written, digital, or recorded. You may not consult with or communicate with any other person during this exam. If you have any other books, notes, briefcases, book bags, cell phones, PDAs, or other items, you must bring them to the front of the room now. You may not take any of these items to another designated exam room. 2. This exam has eight (8) pages, including the instructions. The page numbers appear on the top right-hand corner of each page. Please check to be sure that this copy has all the pages. 3. You have three hours and twenty minutes (3:20) to complete the exam. You must turn in your answers in this room, even if you are taking the exam somewhere else in the building. If you finish more than five minutes early, you may turn in your answers in the Dean’s Office. 4. The exam consists of five (5) questions. The recommended time for each question is as follows: Question 1……………………..…….. 45 Minutes Question 2………………..………….. 25 Minutes Question 3…………………..……….. 45 Minutes Question 4..………………………….. 40 Minutes Question 5……………………………45 Minutes Each question will be weighted in accordance with its recommended time. 5. Do not spend all of your time writing. Think about the issues and organize your answers before writing. Be concise. Be organized. Long, disorganized, rambling answers will be penalized, as will merely “dumping” portions of your notes or outline into your answers rather than answering the question posed. 2 6. This exam will require you to interpret and apply many of the statutory provisions and regulations we have examined. You should not just state general principles, but should cite the relevant sections and subsections of the statutes and regulations and explain how the language of those rules applies to the facts of the question. An answer that doesn’t cite and analyze relevant statues or regulations is incomplete and will not receive full credit. 7. If you believe that additional facts are needed to answer a question, state exactly what those facts are and how they would affect your answer. If you believe that a question is ambiguous or unclear, note the ambiguity or lack of clarity and indicate how it affects your answer. 8. The Honor Code is in effect. Instructions Concerning Taking the Exam on a Computer 9. You must take the exam on a computer that has the latest version of the Exam 4 software installed. Use the OPEN mode. If you have not previously installed the Exam 4 software, please notify the exam administrator immediately. 10. Be sure to enter your exam number in the Exam ID field. (Do not use your NU Card ID number or your social security number.) You will be required to enter your exam number twice. Select the course name from the drop-down box. Be sure you find the folder for this course, because that is where your exam will be stored. Verify that the information is correct just before you select “Begin Exam.” 11. Do not worry about headers, footers, page numbers, or double spacing your exam; the software does all that for you when the exam is printed. 12. When you are finished, please submit your exam electronically. A pop-up box will show the status of your exam. It should show a black bar with 100% in it and a message that says, “Your file has been successfully stored.” If you do not get this message, please see Vicki Lill in the Dean’s office immediately. After successfully submitting your exam, exit Exam 4 before leaving the classroom. 13. If you have any technical problems during the exam, please report them immediately to the Dean’s Office; we will assume you had no technical problems until when you reported them. Be prepared to finish your exam by writing it. (Regular notebook paper is O.K.) 3 Question One (45 Minutes) Newbie Corporation is preparing for an initial public offering of its common stock. It expects to file a Securities Act registration statement on May 15, 2010. It will use the proceeds of the offering to pay for a new manufacturing facility on which it has already begun construction. Newbie is not an Exchange Act reporting company. On April 25, Newbie sent a brochure to all its customers. It also posted a copy of the brochure on its web site, on a page called “Notices.” The brochure described Newbie’s products in great detail (with large color photos) and solicited new orders from the customers. It indicated that Newbie had broken ground on a modern production facility and said that the new facility would have twice as much capacity as the old facility. On May 1, Newbie published an ad in the business section of several newspapers and magazines. The ad stated that Newbie was about to register a public offering to sell 200,000 shares of its common stock at a price of $25 a share. The ad indicated that Newbie would use the money raised in the offering to build “a state-of-the art production facility that will double Newbie’s production capacity.” The following paragraph appeared at the bottom of the ad: “We are not offering the stock for sale at this time. We expect to start selling the stock around August 15 when our SEC registration statement becomes effective. A copy of this advertisement is available at www.Newbie/Notices.” Newbie’s Notices web page is very simple. It looks like this: Newbie Corporation NOTICES Customer Brochure Notice of Registered Offering of Common Stock The two links on the Notices page are to the brochure and the advertisement described above. Discuss whether Newbie has violated section 5 of the Securities Act. 4 Question Two (25 Minutes) Ten months ago, on July 3, 2009, Alpha, Inc. sold 20,000 shares of its common stock in a Rule 505 offering for $4 million. Alpha needed the money to make the initial payment on a manufacturing facility it was purchasing. Alpha has not issued any stock since last July, but it now wants to sell an additional 2,000 shares of common stock without registration. One thousand shares would be sold to Carla Coin for $600,000 cash and the other 1,000 shares would be sold to Larry Land in exchange for real property recently appraised at $400,000. Carla and Larry are existing shareholders of Alpha. The cash from Carla would be used to make the second and final payment on the manufacturing facility. Discuss whether, based on these facts only, the Regulation A or Rule 505 exemptions are available for the offering to Carla and Larry. (Do not discuss any other exemptions, just Regulation A and Rule 505. And do not discuss any issues not raised by these facts.) 5 Question Three (45 Minutes) Smokestack, Inc. is a manufacturing company whose stock is traded on the New York Stock Exchange. The total market value of Smokestack’s stock is approximately $450 million. Smokestack’s net income is around $45 million a year. Late in 2009, rumors began to circulate that the Environmental Protection Agency (EPA) was investigating Smokestack, and that Smokestack might have committed serious violations of federal environmental law. Smokestack’s stock price fell from its 2009 high of $23 a share to $20 a share. In early January of 2010, Paula Prez, the CEO of Smokestack, hired Marty Mouth, a public relations consultant, to deal with these rumors. Prez told Mouth that the EPA was investigating Smokestack, but that the violations were minor. She told Mouth that the EPA investigation would have no significant impact on the company; at worst, Smokestack would receive a warning. In reality, the EPA investigation involved fairly serious charges. Smokestack had hired Lori Lawyer, a well-known environmental law litigator, to fight the charges, and Lawyer had told Smokestack there was “at least a 50% chance” that Smokestack would have to pay fines in the $10 to $15 million range. Lawyer also told Smokestack that, under the statute, the EPA could force Smokestack to temporarily shut down its plant, although Lawyer considered that unlikely. After talking to Prez, Mouth scheduled a series of three regional press conferences to deal with the rumors. At the first press conference, on January 15, Mouth admitted to the press that the EPA was investigating Smokestack, but said Smokestack did not expect any significant liability. “The violations are minor,” Mouth said, “and the EPA investigation will have no significant impact on Smokestack.” Shortly before the second press conference, Mouth ran into Lawyer at Smokestack’s headquarters. Mouth knew Lawyer was representing Smokestack in the EPA investigation, so he asked Lawyer what she thought about the press conference. “How can you say ridiculous things like that, knowing what’s going on?,” Lawyer replied. “No impact on the company? You have to be kidding!” When Mouth asked what Lawyer meant, Lawyer told him to talk to Prez. Mouth had no further discussions with either Lawyer or Prez. He held the two additional press conferences on February 1 and February 15, and essentially repeated what he had said at the first one. Between January 15 and March 1, Smokestack’s stock price rose from $20 a share to $22 a share. However, in spite of the press conferences, the rumors about the EPA investigation persisted. By March 20, Smokestack’s stock price had fallen back to $20 a 6 share. On April 1, Smokestack issued a press release announcing two things: 1. Smokestack and the EPA have agreed to a settlement of all charges. Smokestack will pay a fine of $10 million and will also make changes to its manufacturing plant, at an additional, one-time cost of $5 million. 2. Smokestack just signed a $30 million contract with a new customer that will increase Smokestack’s net income over the next two years by approximately $10 million a year. Since this announcement, Smokestack’s stock price has remained stable at $20 a share. Purchasers who bought Smokestack stock for $22 a share shortly after the press conferences recently sued Mouth, among others, alleging securities fraud related to the EPA investigation. Discuss the major issues with respect to Mouth’s possible liability under Rule 10b-5. (Do not discuss the liability of Smokestack or any other person, only Mouth.) 7 Question Four (40 Minutes) Delta, Inc. is a reporting company under the Exchange Act. Its stock is traded on the NASDAQ system. Delta has one million common shares outstanding; the average weekly trading volume of its shares on NASDAQ is 40,000 shares. Calvin Client is Delta’s Vice President for Government Relations. Client is responsible for Delta’s lobbying and for keeping people in the company informed about regulatory developments. Client owns 200,000 shares of Delta common stock (20% of the total amount outstanding). He acquired those shares in two Rule 506 offerings Delta made to its officers and directors: (1) 100,000 shares in an offering five years ago; and (2) 100,000 shares in an offering two months ago. Client is preparing to retire as Vice-President this month, and he wants to sell his stock. Client asked his close friend, Frieda Friend, to help him sell it. Frieda is not a broker, but she is a sophisticated investor. Frieda has been negotiating with Bob Buyer, and Bob has tentatively agreed to buy Client’s stock for $3.5 million, but they have not yet signed a contract. Bob is not a sophisticated investor, nor is he very rich; he plans to borrow most of the money from his wealthy grandfather. Discuss whether Client may legally sell the stock to Bob without registration, and what conditions, if any, he must meet to do so. 8 Question Five (45 Minutes) Mel Money loves Mexican food; he is a regular patron of Incomible, a Mexican restaurant in Council Bluffs, Iowa. Lately, Incomible has been having cash-flow difficulties; the restaurant has been unable to afford routine maintenance and upkeep, and the resulting poor appearance of the restaurant has negatively affected its business. José Jones, the owner of Incomible, recently approached Mel seeking money to fix up the restaurant and solve the maintenance issues. He asked Mel to enter into what José and Mel called an “investment contract.” Mel agreed to give the business $100,000 to help it through what both parties believe are “short-term difficulties.” In return, José agreed to the following: 1. Mel is entitled to free dinners at the restaurant up to three nights per week. 2. Mel may go into the kitchen at any time to observe the operations of the restaurant and talk to the chef. 3. José will pay Mel $2,000 a year, and return the full $100,000 at the end of three years. 4. José will not dispose of any of the restaurant’s assets or make any significant changes in the operation of the restaurant without Mel’s approval. Discuss whether Mel has purchased a security from José.