Ch 13 Tax Practice

advertisement

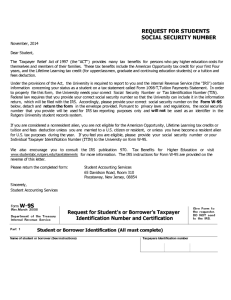

Tax Practice Chapter 13 pp. 533 - 560 2015 National Income Tax Workbook™ Tax Practice p. 533 Issue 1: Recoveries and Tax Benefit Rule Issue 2: Damage Awards and Settlements Issue 3: US Tax Court Appeals Issue 4: IRS E-Signature Authentication Issue 5: IRS Collections Issue 1: Recoveries & Tax Benefit Rule p. 533 When a taxpayer receives a reimbursement, refund, or other compensation for a payment or loss that resulted in a prior-year tax deduction or credit, the result is often taxable income. The income is limited to the amount that created a benefit on the prior-year return. Issue 1: Recoveries & Tax Benefit Rule p. 533 - 534 Most Common type of Refund: ▪ Refund of State or Local Income Tax ▪ 1099-G: Certain Government Payments. NOTE: A recovery received in the same year the expense is paid is not included in income; it simply reduces the amount of the expense. Itemized Deductions p. 534 A recovery is taxable only if the taxpayer owed less tax as a result of the deduction. If the recovery is more than: ▪ The difference between the taxpayer’s potential standard deduction ▪ AND ▪ The itemized deductions that were claimed, ▪ THEN: The recovery will not be fully taxable. Itemized Deductions p. 534 TAX RETURN LOCATION: ▪ A taxable recovery of most itemized deductions is reported on line 21 of Form 1040. ▪ Taxable refunds of state and local income taxes are reported on line 10 of Form 1040. State Income Tax Refunds p. 534 Includable in Income? Several Factors: 1. Did the taxpayer itemize deductions in the prior year? 2. Did the taxpayer deduct state and local sales taxes instead of state and local income taxes in the prior year? 3. How much was the taxpayer’s allowable standard deduction in the prior year? 4. Is the income tax refund for only one year? State Income Tax Refunds p. 534 Includable in Income? 1. Did the taxpayer itemize deductions in the prior year? ▪ A taxpayer who claims the standard deduction did not benefit from deducting state income taxes and has no gross income from a state or local tax refund. State Income Tax Refunds p. 534 Includable in Income? 2. Did the taxpayer deduct state and local sales taxes instead of state and local income taxes in the prior year? ▪ A refund of state or local income taxes that were not deducted is not taxable. State Income Tax Refunds p. 534 Includable in Income? 3. How much was the taxpayer’s allowable standard deduction in the prior year? ▪ The taxable amount of the refund is limited to the excess of total itemized deductions over the allowable standard deduction. State Income Tax Refunds p. 534 Includable in Income? 4. Is the income tax refund for only one year? ▪ If so, the entire refund is attributed to that year….. ▪ UNLESS…..the taxpayer made estimated payments. ▪ If a final estimated tax payment was made in January of the subsequent year, the refund must be allocated. Multiple Recoveries p. 535 A taxpayer may receive a state income tax refund and also recover another itemized deduction in the same year EXAMPLES: ▪ Medical expenses ▪ Real estate taxes ▪ Mortgage interest The taxable portion then must be allocated between lines 10 and 21 of Form 1040, using a three-step formula (see p. 535 of your book for details) Itemized Deduction Floors p. 535 - 536 Some itemized deductions are subject to floors based on a percentage of the taxpayer’s adjusted gross income (AGI). ▪ 10%-of- AGI floor for medical expense deductions ▪ 2%-of-AGI floor for miscellaneous itemized deductions. Because the amount of a recovery included in income is limited to the tax benefit derived from the deduction, recoveries are not includable in income to the extent the expense was never deductible. Pease Reduction of Itemized Deductions p. 536 - 537 I.R.C. § 68 reduces itemized deductions other than medical expenses, investment interest expense, and casualty or theft losses by the lesser of: ▪ 1. 3% of AGI in excess of the thresholds ▪ OR ▪ 2. 80% of all affected itemized deductions. Pease Reduction of Itemized Deductions p. 536 - 537 2015 AGI Thresholds for Pease Limitation: Filing Status Single MFJ or QW HoH MFS AGI $ 258,250 $ 309,900 $ 284,050 $ 154,950 Negative Taxable Income p. 537 A taxpayer does not benefit from negative taxable income created by deductions that cannot result in a net operating loss (NOL). Therefore, if a tax return shows negative taxable income, the negative amount can reduce the otherwise includable recovery. Normally, a zero is entered on line 43, “Taxable income,” of Form 1040 if taxable income is negative, but the actual amount of negative income is needed for this calculation. Alternative Minimum Tax p. 537 A taxpayer who recovers an itemized deduction and was subject to AMT in the prior year must recalculate both regular tax and AMT to determine how much of the recovery is includable in income. If the recomputation does not change the amount of tax due, none of the recovery is taxable. If the tax increases, the recovery is includable to the extent of the deduction that reduced the prioryear tax. Unused Tax Credits p. 537 - 538 If the taxpayer’s available tax credits exceeded his or her tax in the deduction year, that year’s tax liability must be recomputed after a recovery by adding the recovery amount to the prior year’s taxable income and refiguring the tax and credits. If the net tax does not change, none of the recovery is includable in income. If the recomputed net tax is more than the actual tax in the prior year, the recovery is includable in income up to the amount of the deduction that decreased the prior-year tax. Unused Tax Credits (Continued) p. 537 - 538 If the recomputed net tax is more than the actual tax in the prior year, the recovery is includable in income up to the amount of the deduction that decreased the prior-year tax. A change in a credit carryover is considered to have reduced the prior-year tax, even if the net prior-year tax after application of the credits is zero. Other Deductions and Losses p. 538 A recovery of an amount that reduced the taxpayer’s AGI is generally fully includable in income. However, the tax benefit rule still applies. To the extent the taxpayer did not benefit from the deduction, the recovery is excludable from income. Refunds of Business Deductions (PRACTIONER NOTE) p. 538 Refunds of business deductions are generally fully taxable and must be reported as other income on the business income schedule. Restitution received in a later year for an embezzlement or other theft loss, as well as payments received after an accrual basis business has deducted a bad debt, must be included in the business’s income. Credit Recoveries p. 538 When a credit was allowable for a prior tax year, and there is a later downward price adjustment or similar adjustment that reduces the credit, the tax for the adjustment year must be increased by the amount of the credit that is attributable to the adjustment. NOTE: This does not apply to the foreign tax credit or the investment credit, because they have their own recapture rules. Issue 2: Damage Awards & Settlements p. 539 Personal injury damages awarded for any purpose are generally taxable. Exception: ▪ Compensation for physical injury or illness This issue reviews the guidelines for excluding a settlement from gross income. Definitions p. 539 1. Punitive Damages 2. Compensatory Damages 3. Tort Definitions p. 539 1. Punitive Damages ▪ Monetary compensation awarded to an injured party that exceeds the amount that is necessary to compensate the individual for losses. ▪ Intent is to punish the wrongdoer. ▪ Punitive damages are sometimes called exemplary damages. Definitions p. 539 2. Compensatory Damages ▪ A sum of money awarded to indemnify a person for a particular loss, detriment, or injury suffered as a result of the unlawful conduct of another person. Definitions p. 539 3. Tort ▪ A civil wrong recognized by law as grounds for a lawsuit. • Breaches of contract are not included. ▪ Torts can be: • Intentional (intending to do harm) • Negligent (not obeying a law) • Strict liability (selling a defective product). Punitive Damages p. 540 Before the Small Business Job Protection Act of 1996, Pub. L. No. 104-188, was enacted, I.R.C. § 104(a)(2) excluded from gross income damages that were received “on account of personal injury or sickness.” This led to conflicting court decisions about the nature of personal injuries and whether punitive damages were included. Punitive Damages p. 540 In the 1996 legislation Congress amended I.R.C. § 104(a)(2) by adding the word “physical.” This limited the exclusion to awards received “on account of personal physical injuries or physical sickness,” and specifically excluding both punitive damages and most damages for emotional distress from its scope. Punitive Damages p. 540 The House report on the bill stated that punitive damages are intended to punish the wrongdoer rather than to compensate the claimant for lost wages or pain and suffering. It concluded that punitive damages are a windfall to the taxpayer and should be included in gross income. Compensatory Damages p. 540 Compensatory Damages may include amounts for: ▪ Medical expenses, ▪ Pain and suffering, ▪ Emotional stress caused by the injury or illness, ▪ Lost wages, ▪ Loss of consortium, and more, ▪ BUT ▪ NOTE: The entire amount of the award is generally excludable from income. Compensatory Damages p. 540 Definition of Loss of Consortium: ▪ A claim for damages suffered by the spouse or family member of a person…. ▪ Who has been injured or killed…. ▪ As a result of the defendant's negligent or intentional, or otherwise wrongful acts. Compensatory Damages p. 540 An exception applies to the exclusion from income if the settlement reimburses the taxpayer for previously deducted medical expenses. In that instance the rules for recoveries apply, and that portion of the award may be taxable. Wrongful Death Actions p. 540 Wrongful death cases arise when: ▪ An individual or an entity can be held responsible for a death. Wrongful Death Actions p. 540 Each state has its own statute, but all of the statutes have four basic elements: ▪ 1. The death was caused, entirely or in part, by the actions of the defendant. ▪ 2. The defendant is found to be either negligent or strictly liable for the death. ▪ 3. There is a surviving spouse or children, or there are surviving beneficiaries or dependents. ▪ 4. There are monetary damages. Wrongful Death Actions p. 540 Punitive damages generally do not qualify for exclusion from gross income. But some state wrongful death laws provide for only punitive damages to be awarded. Because the recipients cannot receive any other type of compensation for their loss, the exclusion applies if the applicable state law in effect on September13, 1995, allowed only punitive damages. The exception will apply until the state law is changed to allow compensatory damages. Employment Related Actions p. 540 - 541 Employment-related lawsuits are usually filed because a worker was fired or a worker claims that contract obligations were not met. In these cases the settlement is usually specified to be compensation for lost wages or business income. It is includable in income and should be reported by the employer on Form W-2, Wage and Tax Statement. An exception could occur if the worker lost his or her job as the result of a physical injury or illness. Social Security & Medicate Taxes (PRACTIONER NOTE) p. 541 The IRS treats back pay as income in the year paid. If a back pay award is not made under a statute, the Social Security Administration (SSA) also credits it as wages in the year it is paid. However, if back pay is awarded under a statute, the wages will be credited to the year the wages should have been paid. This is important because wages not credited to the proper year may result in lower social security benefits or failure to meet the requirements for benefits. Discrimination Claims p. 541 Age, race, gender, religion, or disability discrimination claims can result in awards of compensatory, contractual, or punitive damages. All such discrimination awards now result in taxable income. Damages to Reputation p. 541 Libel and slander awards arise from harm being done to the taxpayer’s business or professional reputation. Because emotional distress often accompanies these actions, the question is whether the taxpayer incurred medical expense for its treatment and whether the claim or award identifies any damages as being attributable to those expenses. Otherwise, damages for emotional distress are fully taxable. Damages to Property p. 541 Awards for property damage bring in the element of basis reduction as well as income inclusion or exclusion. Generally, compensation for property damage reduces the basis of the property, but not below zero. If the compensation exceeds basis, the excess is taxable unless the funds are spent to restore or replace the property. Damages to Property p. 541 A casualty loss deduction should be deferred for any amount that is expected to be reimbursed. However, if the taxpayer previously deducted a loss and then received compensation in a later year, all or part of the damage award is treated as a recovery. Information Returns p. 542 Taxable damages paid in the course of a trade or business usually must be reported by the payer as “Other income” in box 3 of Form 1099-MISC, Miscellaneous Income. Information Returns p. 542 Form 1099-MISC should not be filed for damages paid on: ▪ Account of personal physical injuries or sickness ▪ Damages that do not exceed the amount paid for medical care for emotional distress ▪ Damages paid on account of nonphysical injuries under a written binding agreement, court decree, or mediation award that was in effect on or issued by September 13, 1995. Information Returns p. 542 Payments that replace capital, such as damages paid to a buyer by a contractor who failed to complete a building, are also not reportable. Failure to Report as Wages (PRACTIONER NOTE) p. 542 Social security and Medicare taxes are generally due when lost wages are paid. An information return is not always issued when taxable damages are paid. Tax practitioners should request supporting information to determine the taxable amounts of damage awards or settlements received by their clients. Structured Settlements p. 542 It is not always beneficial for large settlements to be paid in a lump sum. The alternative, making payments over a period of time, is referred to as a structured settlement. Structured Settlements p. 542 - 543 The tax treatment for the recipient does not change. The IRC excludes qualifying payments from the recipient’s income whether they are paid in a lump sum or in periodic payments. NOTE: Income realized on the sale of a taxable settlement is ordinary income and not capital gain. Attorney Fees p. 543 A specific amount of the settlement may be allocated for attorney fees and court costs. The gross amount of undivided damages paid to the recipient and his or her attorney generally is included in the recipient’s income. There are exceptions and they are notated on p 543. Attorney Fees p. 543 When gross damages of at least $600 are paid to an attorney, the payer is generally required to issue two Forms 1099-MISC: ▪ The gross amount of the taxable settlement is reported in box 3 of the form issued to the individual who was awarded the damages. ▪ The same amount is also reported in box 14 of a Form 1099-MISC issued to the attorney or law firm. Issue 3: United States Tax Court Appeals p. 545 Taxpayers can file a petition in the US Tax Court to appeal: ▪ IRS notices of deficiency ▪ AND ▪ Notices of determination. Taxpayers can appeal a proposed tax liability or determination to the Tax Court prior to paying the tax. Issue 3: United States Tax Court Appeals p. 545 If the Tax Court rules against the taxpayer, the taxpayer must pay interest on the tax due. If instead the taxpayer pays the proposed additional tax prior to the appeal, no additional interest accrues during the appeal. If the taxpayer prevails, the amounts paid are refunded with interest if the appeal was filed within the statute of limitations for refunds. IRS Appeals vs. US Tax Court p. 545 IRS Appeals is part of the IRS. HOWEVER, The US Tax Court is totally independent from the IRS. US Tax Court Appeals p. 545 The Tax Court hears appeals for the following: ▪ Notices of deficiency issued by the IRS ▪ Notices of determination issued by the IRS • Abatement of interest • Worker classification • Innocent spouse, • Lien & Levy cases ▪ Final partnership administrative adjustment for Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) partnerships. US Tax Court Appeals p. 546 Additional jurisdiction includes: ▪ Re-determine transferee liability and/or worked classification. ▪ Make certain types of declaratory judgments ▪ Adjust partnership items ▪ Review awards to whistleblowers US Tax Court Appeals p. 546 Additional jurisdiction includes (CONTINUED): ▪ Order abatement of interest. ▪ Award administrative and litigation costs. ▪ Determine relief from joint liability on a joint return (Innocent Spouse). ▪ Review certain collection actions. Representation before the Court p. 546 - 547 The Tax Court is the only federal court that allows non-attorneys to practice before the court. Taxpayers may represent themselves in a Tax Court proceeding. Attorneys and non-attorneys must apply for admission to practice before the Tax Court. Non-attorneys must pass a four-part written exam administered by the Tax Court. Non-attorney applicants for the exam must be sponsored by two members previously admitted to practice before the Tax Court. Life Cycle of a Tax Court Case p. 547 1. Notice of Deficiency 2. Filing the Petition 3. Pretrial Matters 4. Calendar Call and Trial (If no Settlement) 5. Post-Trial Procedures 1. Notice of Deficiency p. 547 IRS will issue a statutory notice of deficiency, also known as a 90-day notice or Letter 531. The notice of deficiency must explain the IRS’s position on every disputed issue. If the taxpayer misses the deadline for filing with the Tax Court, there is no further appeal to the Tax Court, and the tax will be assessed. 2. Filing the Petition p. 547 - 548 All petitions to the US Tax Court must be filed with the court in Washington, DC. TC Form 2, Petition, is a simplified petition found on the “Forms” tab of the Tax Court website. On the petition the taxpayer must indicate whether he or she wants the case to be heard under the regular tax case procedures OR under the small tax case procedures. Dollar limits apply to the use of the small tax case procedures, and those limits vary slightly depending on the notice being contested. (see book for limits) Appealing Small vs. Regular Tax Cases p. 547 - 548 If the taxpayer chooses the small tax case procedures, then all court determinations are final. ▪ Neither the taxpayer nor the IRS can appeal the findings of the Tax Court. If the taxpayer chooses the regular tax case procedures, then either the taxpayer or the IRS can appeal the decision to the US Court of Appeals for the circuit in which the taxpayer resides. Proof of Filing the Petition (PRACTIONER NOTE) p. 548 To document timely receipt of the petition by the court, the taxpayer should send the petition and accompanying documents by: ▪ 1. Certified or registered mail, or ▪ 2. FedEx, or ▪ 3. UPS. Once the petition is submitted, the Tax Court sends a notice of receipt of the petition and assigns a docket number. 3. Pretrial Matters p. 548 - 549 SETTLING THE CASE – 1ST CHOICE OF THE IRS Once the IRS has filed their petition, the IRS typically attempts to settle the case. The IRS Appeals Office usually contacts the petitioner to try to assess the strength of the petitioner’s case and to determine whether a settlement is feasible. If the taxpayer reaches a settlement with the Appeals Office, the IRS attorney and the taxpayer send the settlement agreement to the Tax Court, and the case is dismissed. Pretrial Matters p. 548 If the parties cannot settle the case, the court sends a notice setting the case on the trial calendar. The notice should be received approximately 5 months before the trial date. Continuances can be requested but are rare and only the judge can approve (not the IRS.) Prior to trial the petitioner and the IRS must each file a pretrial memorandum (it is not mandatory for small tax cases but still recommended.) Taxpayer can also issue subpoenas for witnesses. 4. Calendar Call and Trial p. 549 - 550 On the first morning of the trial session, the taxpayer or the taxpayer’s representative should arrive at the court in time to attend the calendar call. Any witnesses should also be present prior to the calendar call. If you fail to appear, IRS will move to have case dismissed. Taxpayer gets to present their case then the IRS. 5. Post-Trial Procedures p. 550 After the trial the judge may immediately render an opinion (a bench opinion), or the judge will give an opinion at a later date. If the case was handled under the small tax case procedures, the decision is final, and there is no appeal. If the case was handled under the regular case procedures, then either party may appeal the decision to the US Court of Appeals. An appeal must be filed within 90 days of entry of the Tax Court decision. Issue 4: IRS E-Signature Authentication p. 550 New requirements for authentication of e-signatures have raised privacy and other concerns. NOTE: This is not about authorization to E-File a tax return. Rather, this is about authorization to use ESignatures on documents. EXAMPLE: You can sign in person your E-File authorization and there are no additional restrictions. However, you cannot E-Sign the authorization form without additional security measures. Issue 4 – IRS E-Signature Authentication p. 550 Tax preparers must document authorization by the taxpayer to digitally sign the tax return. The tax preparer must maintain paper records of this authorization. ▪ Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350; and/or Form 8879, IRS e-file Signature Authorization) WHY? To protect the return preparer from an allegation that the preparer fraudulently appropriated the taxpayer’s identity in filing. History of E-Filing p. 550 - 551 In 1986 about 25,000 federal tax returns were filed electronically. In 2009 Congress passed legislation requiring tax preparers who file more than 10 individual tax returns to file electronically. The requirement was phased in during 2010 and 2011, and in 2011 more than 100,000,000 tax returns were filed electronically. Signature Authentication Requirements p. 551 In March 2014 the IRS updated Publication 1345, to authorize taxpayers to sign and preparers to accept electronic signatures on the e-file authorization forms. Publication 1345 requires tax professionals to authenticate the identity of taxpayers who sign electronically. Signature Authentication Requirements p. 551 Tax preparers who accept electronic signatures must authenticate the taxpayer’s identity by validating his or her: ▪ Name ▪ Social Security Number (SSN) ▪ Address ▪ Date of Birth ▪ Validate the above with a government-issued ID Preparers must do this authentication every year. Signature Authentication Requirements p. 551 The IRS requires an e-signature authentication that meets Level 2 or higher under the National Institute of Standards and Technology Level 2 entails verifying the taxpayer’s identity through records checks with credit bureaus and other databases. Includes dynamic knowledge-based authentication, which involves generating questions from public data records and credit reports and requiring the taxpayer to correctly answer those questions before the taxpayer can electronically sign the authorization. Signature Authentication Concerns p. 551 The AICPA has identified three primary areas of concern with respect to the requirement to use dynamic knowledge-based authentication. 1. Identity Verification Vendors may have access to private data. 2. Use threatens the trusted advisor relationship if there is a breach of data by vendors. 3. There are many taxpayers for whom the dynamic knowledge based system will note work. ▪ EX: Business Travelers, Expatriates and children E Signature FAQ p. 552 Can all taxpayers use the new e-signature option? E Signature FAQ p. 552 Can all taxpayers use the new e-signature option? ▪ No. The new e-signature option is available only to taxpayers who e-file their tax returns through an Electronic Return Originator (ERO) who uses software that provides identity verification and esignature. E Signature FAQ p. 552 Are taxpayers required to sign Forms 8878 or 8879 electronically? E Signature FAQ p. 552 Are taxpayers required to sign Forms 8878 or 8879 electronically? No. Taxpayers may continue to use a handwritten signature and return the form to the ERO in person, or via US mail, private delivery, fax, e-mail (by scanning), or an Internet website. E Signature FAQ p. 553 Is identity verification a one-time event? E Signature FAQ p. 553 Is identity verification a one-time event? NO Identity verification must be completed every time a taxpayer electronically signs Form 8878 or 8879, with one exception. If a taxpayer e-signs the form in the physical presence of the ERO and the taxpayer has a multiyear business relationship with the ERO, then no further identity verification is needed. E Signature FAQ p. 553 Is identity verification a one-time event? (CONT.) NO A multiyear business relationship is one in which the ERO has originated tax returns for the taxpayer for a prior tax year and has identified the taxpayer using the identity verification process. 5. IRS Collection Procedures p. 554 A client may owe tax due to any of the following: 1. Filing a balance due return 2. An assessment because of an examination determination 3. Imposition of a civil penalty, such as a trust fund recovery penalty. IRS Fresh Start Program (Online Payment Agreement) p554-556 Goal for Today: ▪ Learn How to use the IRS Fresh Start Program Fresh Start Program = Streamline Installment Agreement ▪ IRS Tax Tip 2013-57 – April 17, 2013 ▪ Can use the Online Payment Agreement option on IRS.GOV Must be current filing and must stay current filing and paying ▪ Paying current includes ESTIMATED TAXES. IRS Fresh Start Program (Online Payment Agreement) p554-556 Fresh Start includes personal liability up to $50,000 72 months (6 years) to pay if on Direct Debit (433D) $350/mo at $25,000 $700/mo at $50,000 60 months (5 years) to pay if no Direct Debit $420/mo at $25,000 $840/mo at $50,000 IRS Fresh Start Program (Online Payment Agreement) p554-556 You can pay down to qualify for this program Fresh Start works great with IRS Automated Collections System (ACS) Department Collection Statutes Do Matter: EXAMPLE: Fresh Start will not work over 72 months if a Collection Statute will expire prior to full payment. IRS Fresh Start Program (Online Payment Agreement) p554-556 You Qualify Even If: You have the assets to full pay. Your income would show you with a higher Installment Agreement vs. national standards Interest and penalties continue to accrue throughout Fresh Start CRITICAL: Make sure your clients understand this! IRS Fresh Start Program (Online Payment Agreement) p554-556 Business Fresh Start Program: ▪ Only under $25,000 over 2 years • Very different timeline from personal Fresh Start program • IA at $25K = $1,042/month ▪ Business in payroll tax problems cannot always afford that kind of monthly payment ▪ Only way to know is to do an accurate IRS Form 433B evaluation Power of Attorney (PRACTIONER NOTE) p.555 To initiate any representation for a client, a tax professional must have a valid power of attorney covering all tax periods to be included in the agreement. IRS Collections p. 557 The IRS will not approve any Collection solution if the taxpayer fails to make required federal tax deposits or estimated tax payments. TAKEAWAY: ▪ To get any Agreement: • Must Be CURRENT FILING • AND • Must Be CURRENT PAYING IRS Installment Agreements p. 556 - 557 NOTE: Update to the TaxBook ▪ Automated Collections System (ACS): Only uses IRS Form 433F ▪ Revenue Officer (RO): Use IRS Form 433A IRS uses national standards for expenses: ▪ Food, clothing, housing, transportation, and medical. Deviations from the standards may be allowed if the taxpayer can document that the deviation is reasonable and necessary (but not easy to get.) IRS Offer In Compromise p. 557 - 558 IRS does have a process to compromise tax debt. It is called Offer In Compromise (OIC) IRS Form 656 Booklet – Offer In Compromise contains: ▪ IRS Form 433A-OIC is the financial statement used as part of the individual submission of the OIC. It is a far more extensive financial statement form then the 433F. ▪ Form 656 – The form on which the offer is formally submitted. ▪ Form 433B-OIC (if needed for a Business OIC) OIC – Two Methods of Payment p. 559 Payment Option 1: Lump Sum Offer ▪ Paid within 5 months of the acceptance of the OIC ▪ Requires an initial down payment of 20% of the OIC amount. Payment Option 2: Periodic Payment Offer ▪ Paid within 6 to 24 months of the acceptance of the OIC ▪ 1st of the periodic payment sent with OIC application and must continue each month while application is pending. ▪ NOTE: If you miss 1 periodic payment while OIC is under review by the IRS, your OIC Application can be immediately denied. OIC 5 Minute Evaluation TEST Questions to immediately evaluate OIC chances: (Equity, Equity, Equity) ▪ Equity in Assets • Equity in house? • Equity/Value in Investments? ▪ Whatever is the total of that equity is your minimum for calculating your offer! Only after considering the assets values should you spend the time evaluating income vs. expenses OIC – RISKS TO TAXPAYER p. 560 Downside to Offer In Compromise: Extension of the 10 year statute of collections Time in offer + 1 year Average OIC takes 1 to 1.5 years So if you lose, expect to had 2 to 2.5 years to the Statute of Collections. Small Business Owners: Double the Difficulty Since a small business owner has control over their income in the eyes of the IRS – more difficult to win an OIC than someone who only has a W2. OIC – If you win? p. 560 Must stay current filing and paying tax returns for 5 years or all tax liabilities return from the dead. All refunds due the in the calendar year in which the offer is being reviewed and the year it is accepted are applied to the tax debt. ▪ After that period, the refunds are the property of the taxpayer again. Federal Tax Liens are not released until the payment of the offer is satisfied. IRS Currently Not Collectible (CNC) Status p. 560 Achieving Currently Not Collectible (CNC) status uses the same forms (433F, 433A, 433B) but means that a taxpayer does not have the ability to pay at this time. Temporary Status: This status will last on average 12 to 24 months then IRS can return to re-evaluate…… Penalties and Interest continue to accrue; however, Collection statute continues to count down while in this status. Currently Not Collectible (CNC) Status all called: ▪ “Uncollectable” Status ▪ “Status 53” (represents the code on the IRS Account Transcript that reflects CNC status) Tax Practice – Chapter 13 Thank you.