Earnings per share for Acct 414

advertisement

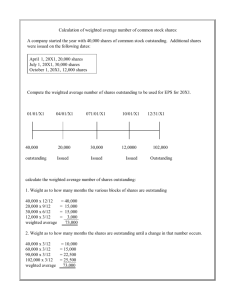

Earnings per Share The Introductory Lecture for Acct 414 With comparison to IFRS 1 The most closely watched statistic on Wall Street Earnings per share (EPS) is an important indicator of the success or failure of a company. 2 Several components of EPS must be disclosed if there are discontinued operations, extraordinary items, or cumulative effects of changes in accounting principles. Earnings Per Share: Continuing operations $3.15 Discontinued operations .67 Extraordinary loss (.15) Cumulative effect of accounting change .17 Net Earnings Per Share $3.84 Cumulative effect item pretty much “gone” after SFAS No. 154 3 There may be two EPS numbers for each item: Basic Considers only common shares outstanding Diluted Reflects the maximum potential dilution from all possible stock conversions that would have decreased EPS. 4 Relation between Basic and Diluted EPS 5 Diluted earnings per share I like to think of it as the ‘worst case scenario’ It is the lowest possible number we’d report for EPS It is a “proforma” number, not a “fact” 6 Capital structure determines reporting Many companies will report basic earnings per share only Other companies must report BOTH basic and diluted earnings per share It depends on whether the capital structure is Simple, or Complex 7 A simple capital structure consists of just common stock. Common Stock The corporation has only common and nonconvertible preferred stock. It has no convertible securities, stock options, warrants, or other rights outstanding. 8 Capital Structures Complex Capital Structure: The corporation has one or more instruments outstanding that could result in issuance of additional Convertible common shares. Preferred Convertible Bonds Stock Options 9 Capital Structures Therefore, a company with potential per share dilution is considered to have a complex capital structure. Note that a potentially dilutive security does not necessarily dilute EPS 10 Dilution of Earnings Dilutive Securities: Securities whose assumed exercise or conversion results in a reduction in earnings per share. Antidilutive Securities: Securities whose assumed conversion or exercise results in an increase in earnings per share. 11 Basic Earnings Per Share Net Income - Preferred Dividends Weighted average number of common shares outstanding 12 Earnings Per Share Example A company has the following capital structure at the end of 2006: 6% Cumulative preferred stock, $100 par value, issued and outstanding 10,000 shares Common stock, $10 par, issued 200,000 shares, outstanding 180,000 shares Treasury stock (20,000 shares at cost of $18) 13 EPS Example During 2006, the following transactions take place: April 1, 2006 – issued 100,000 shares to acquire the assets of another company. Market value of shares was $25 June 30, 2006 – declared and distributed a 2 for 1 stock split effected in the form of a stock dividend September 1, 2006 – sold 10,000 shares of the treasury stock for $28 per share 14 Step 1 – find weighted average shares outstanding Date 1/1 to 3/31 4/1/2003 4/1 to 6/29 6/30/2003 6/30 to 8/31 9/1/2003 9/1 to 12/31 Common Stock 200,000 100,000 Common Shares Outstanding 20,000 180,000 100,000 Treasury Stock Months Split Factor Weighted 3/12 Weighted average 15 Step 1 – find weighted average shares outstanding Date 1/1 to 3/31 4/1/2006 4/1 to 6/29 6/30/2006 6/30 to 8/31 9/1/2006 9/1 to 12/31 Common Stock 200,000 100,000 300,000 Common Shares Outstanding 20,000 180,000 100,000 20,000 280,000 Treasury Stock Months Split Factor Weighted 3/12 3/12 Weighted average 16 EPS Example During 2006, the following transactions take place: April 1, 2006 – issued 100,000 shares to acquire the assets of another company. Market value of shares was $25 June 30, 2006 – declared and distributed a 2 for 1 stock split effected in the form of a stock dividend September 1, 2006 – sold 10,000 shares of the treasury stock for $28 per share 17 Stock Splits & Dividends All stock splits and stock dividends must be incorporated into the computation of weighted average shares outstanding. This must done for all periods presented in the financial statements. 18 Step 1 – find weighted average shares outstanding Date 1/1 to 3/31 4/1/2006 4/1 to 6/29 6/30/2006 6/30 to 8/31 9/1/2006 9/1 to 12/31 Common Stock 200,000 100,000 300,000 280,000 580,000 Common Shares Outstanding 180,000 20,000 100,000 280,000 20,000 280,000 560,000 20,000 Treasury Stock Months Split Factor 3/12 2 3/12 2 2/12 1 Weighted Weighted average 19 Stock Splits & Dividends This year’s EPS figures may have to be changed in the future as a result of stock splits or dividends. Think about what would happen if we did NOT make the adjustment . . . 20 EPS Example During 2003, the following transactions take place: April 1, 2003 – issued 100,000 shares to acquire the assets of another company. Market value of shares was $25 June 30, 2003 – declared and distributed a 2 for 1 stock split effected in the form of a stock dividend September 1, 2003 – sold 10,000 shares of the treasury stock for $28 per share 21 Step 1 – find weighted average shares outstanding Date 1/1 to 3/31 4/1/2006 4/1 to 6/29 6/30/2006 6/30 to 8/31 9/1/2006 9/1 to 12/31 Weighted average Common Stock 200,000 100,000 300,000 280,000 580,000 580,000 Treasury Stock 20,000 20,000 20,000 -10,000 10,000 Common Shares Outstanding 180,000 100,000 280,000 280,000 560,000 10,000 570,000 Months Split Factor 3/12 2 3/12 2 2/12 1 4/12 1 Weighted 12/12 22 Step 1 – find weighted average shares outstanding shares outstanding Multiply by fraction of year and by split factor Date 1/1 to 3/31 4/1/2006 4/1 to 6/29 6/30/2006 6/30 to 8/31 9/1/2006 9/1 to 12/31 Weighted average Common Stock 200,000 100,000 300,000 280,000 580,000 580,000 Treasury Stock 20,000 20,000 20,000 -10,000 10,000 Common Shares Outstanding 180,000 100,000 280,000 280,000 560,000 10,000 570,000 Months Split Factor 3/12 2 90,000 3/12 2 140,000 2/12 1 93,333 4/12 1 190,000 513,333 12/12 Make sure you have accounted for all 12 months and no more than 12 months! Weighted Add ‘em up 23 Step 2 - numerator Net income = $3,000,000 Preferred dividends = 10,000 shares * $100 * 6% = $60,000 Note: Always include preferred dividend if it is cumulative preferred stock. If not cumulative, only include preferred dividend if declared during year Now let’s plug everything into the formula . . . 24 Step 3 – compute basic EPS Net income – Preferred dividends Weighted average shares outstanding $3,000,000 – $60,000 513,333 $5.73 25 What if . . . Taking the same facts, what if the preferred stock was convertible into 10 shares of common stock at the option of the stockholder? This would make it a “complex capital structure” and we’d have to report both the basic EPS we computed plus a “diluted earnings per share” figure. 26 Convertible preferred The 10,000 shares of preferred could become 100,000 shares of common stock (outstanding all year) We would NOT pay the preferred dividend because there would be no preferred stock 27 Diluted EPS Net income – Preferred dividends Weighted average shares outstanding $3,000,000 – $0 513,333 + 100,000 Diluted EPS = $4.89 Both the $5.73 and the $4.89 would be reported on the face of the income statement 28 Diluted Earnings per Share For convertible bonds and convertible preferred stock we use what is called the If Converted Method For options, we use the Treasury Stock Method For computing dilution, the rate of conversion most advantageous to the security holder is used (maximum dilutive conversion rate) 29 The If-Converted Method The conversion of the securities into common stock is assumed to occur at the beginning of the year or date of issue, if later. Convertible bonds: The interest expense (net of tax) is added back to net income. Convertible preferred: No deduction for preferred dividends. The weighted average number of shares is increased by the additional common shares assumed issued. 30 Treasury Stock Method Proceeds from conversion are assumed to be used for purchase of treasury stock at AVERAGE market price. Purpose is to acquire treasury stock that can be reissued to option or warrant holders. If not sufficient, we’d have to issue MORE shares Any additional shares issued, over treasury stock, are added to “weighted- average shares outstanding.” Exercise is assumed to occur on the first day of the year unless issue date is later. 31 Treasury Stock Method-Example: Basic Data Assume the following: Net Income Common Shares Outstanding (entire year) Stock Options Outstanding Exercise Price Per Share on Options Average Price of Common Shares $8,000 6,000 2,000 $30 $40 32 Treasury Stock Method--Example Net income – Preferred dividends Weighted average shares outstanding $8,000 Basic EPS = 6,000 Basic EPS = $1.33 33 Treasury Stock Method-Example: 3 steps 1. Options assumed exercised (2,000*30) = $60,000 cash “received” 2. Shares assumed repurchased with proceeds ($60,000 / $40) = 1,500 3. Additional shares assumed issued: 2,000 from exercise less 1,500 purchased with proceeds = 500 net new shares 34 Treasury Stock Method--Example: Net income – Preferred dividends = average shares outstanding Weighted $8,000 Diluted EPS = 6,000 + 500 = $8,000/6,500 = Diluted EPS = $1.23 35 Short-cut formula: Net new shares = Number of shares to which option holders are entitled 2,000 * * Avg Mkt Price – Option Price Avg Mkt Price $40 - $30 $40 36 Formula for diluted EPS - Preferred dividends if + After-tax Net income preferred bond interest stock is NOT on converconvertible tible bonds Weighted average of common shares assuming maximum dilution (including options) 37 Getting the lowest possible number – an algorithm 1. Compute the per share effect of each potentially dilutive security separately. 2. Make a list from smallest per share number to largest per share number 3. Compute basic earnings per share 4. For diluted EPS, take the securities into EPS computation one at a time until the next item on the list is bigger than the most recent EPS figure. 38 Earnings per Share IAS 33 & FAS 128 “High Level Convergence” versu s Disclosures of EPS IFRS On face of income statement Basic & diluted for income from continuing operations AND profit & loss Profit and loss is the IFRS term for “net income” in the US US GAAP On face of income statement Basic & diluted for income from continuing operations, discontinued operations, extraordinary items and (formerly) cumulative effect of change in accounting principles Both will be changing in the next few years to an entirely different looking set of financial statements! Computing Diluted EPS IFRS Treasury stock method Uses annual stock prices to get weighted average Contracts settled in cash or shares are assumed to be settled in shares and therefore impact diluted EPS US GAAP Treasury stock method Uses quarterly stock prices and quarter by quarter in weighted average computations Contracts settled in cash or shares included if share settlement is anticipated Both standard setters are committed to eliminating these differences