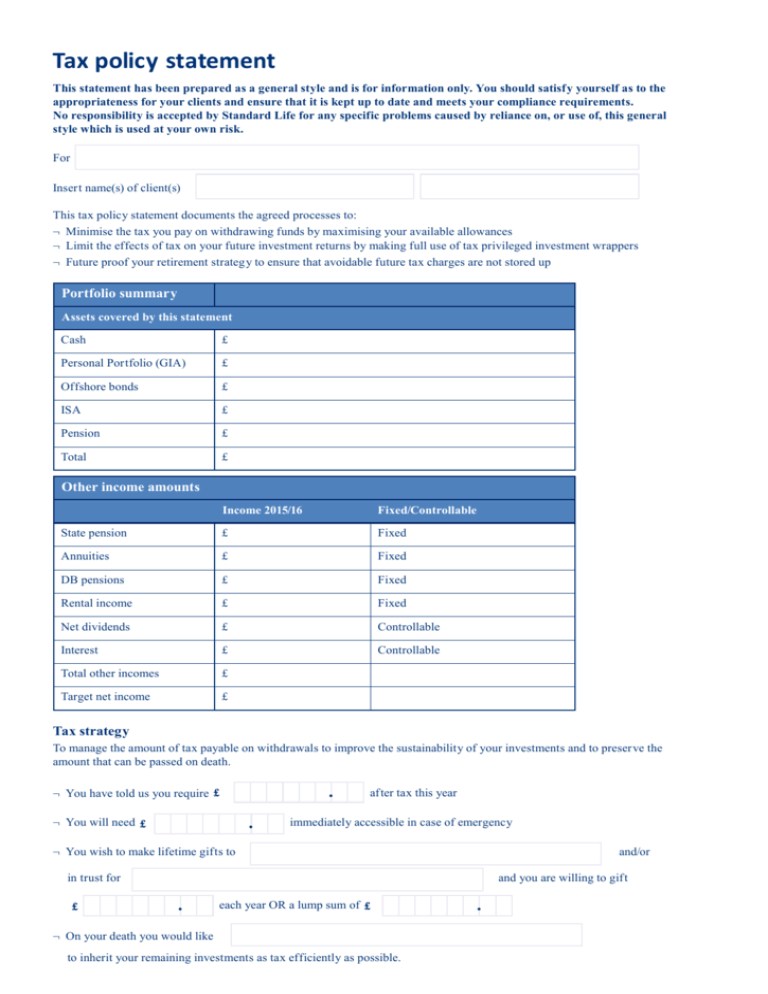

Tax policy statement

advertisement

Tax policy statement This statement has been prepared as a general style and is for information only. You should satisf y yourself as to the appropriateness for your clients and ensure that it is kept up to date and meets your compliance requirements. No responsibility is accepted by Standard Life for any specific problems caused by reliance on, or use of, this general style which is used at your own risk. For Inser t name(s) of client(s) This tax policy statement documents the agreed processes to: ¬ Minimise the tax you pay on withdrawing funds by maximising your available allowances ¬ Limit the effects of tax on your future investment returns by making full use of tax privileged investment wrappers ¬ Future proof your retirement strateg y to ensure that avoidable future tax charges are not stored up Portfolio summary Assets covered by this statement Cash £ Personal Por tfolio (GIA) £ Offshore bonds £ ISA £ Pension £ Total £ Other income amounts Income 2015/16 Fixed/Controllable State pension £ Fixed Annuities £ Fixed DB pensions £ Fixed Rental income £ Fixed Net dividends £ Controllable Interest £ Controllable Total other incomes £ Target net income £ Tax strategy To manage the amount of tax payable on withdrawals to improve the sustainability of your investments and to preser ve the amount that can be passed on death. . ¬ You have told us you require £ ¬ You will need £ . af ter tax this year immediately accessible in case of emergency ¬ You wish to make lifetime gif ts to and/or in trust for £ and you are willing to gif t . each year OR a lump sum of £ ¬ On your death you would like to inherit your remaining investments as tax efficiently as possible. . Emergency fund – provided from tax free amounts . We will keep the agreed amount of £ available to cover emergencies which can be accessed . without incurring a tax charge. We will leave £ . uncr ystallised so that there is £ of ISA funds untouched/of your pension fund tax free cash available. Maximising allowances We will use a strateg y which aims to make full use of your available tax allowances and where agreed/appropriate, the tax allowances of your spouse/civil par tner or other person you name. . Your current fixed incomes use up the following £ . of your personal allowance/savings rate band leaving £ still available. * Allowance (tax year 2015/16) Used Unused Personal allowance £10,600 Savings rate band £5,000 Capital Gains Tax exemption £11,100 Dividend allowance* £5,000 XXXXXXX XXXXXXX Personal savings allowance* £1,000 XXXXXXX XXXXXXX New allowances available from 6 April 2016 1. Personal allowance We will use your personal allowance this year by: 1. Withdrawing funds from your offshore bond by surrendering individual policy segments. Chargeable gains will be kept within your personal allowance so that no income tax is payable. 2. Taking income from your SIPP. This will be flexi-access income and will include 25% tax free cash. The taxable income element will be maintained with your personal allowance so that no tax is payable. We will defer commencing your state pension and/or DB pension until for a year, your income will receive an uplif t of D D M M Y Y Y Y . By deferring this income % from £ to £ . It will also allow chargeable gains from your offshore bond to be taken tax free in the meantime. 2. Savings rate band Any savings income from deposit interest or fixed interest from mutual funds will be tax free up to the available savings rate band. Where any savings rate band is still unused we will withdraw funds from your offshore bond by surrendering individual policy segments. Chargeable gains will be kept within your remaining savings rate band so that no income tax is payable. We will assign segments to your spouse /civil partner. 3. CGT exemption We will withdraw sufficient funds from your mutual funds por tfolio to use any remaining CGT annual allowance. We will transfer units/shares to your spouse /civil partner. Reinvesting excess withdrawals We agreed to maximise the available tax allowances in the current year. We will reinvest the excess withdrawals, over and above your spending needs, in the following order to ensure the best possible future tax efficiency: 1. Pensions. (Subject to available allowances). Basic rate tax relief will be available to contributions at source. There will be no tax applied to income or gains within the fund. A quar ter of the fund can be paid tax-free in the future. In addition the pension will generally not be included within your estate on death. 2. ISA. (Subject to subscription limits). There will be no tax applied to income or gains within the fund and future withdrawals will be tax free. 3. Your spouse’s pension & ISA. Subject to available allowances. 4. Personal Portfolio (GIA). Capital gains can be cr ystallised each year to limit the amount of future CGT payable. Where required income exceeds available allowances Having taken account of: ¬ The level of income needed in excess of your available allowances ¬ How long this level of income will be required ¬ Your current and likely future tax positions We agreed that we would make up the shor tfall in the income required from the following investment(s): Reviews We agreed we will continue to monitor the income and gains produced from your por tfolio and will review your tax policy each year as tax allowances and rules change. Client signature(s) By signing I/we acknowledge that I/we have read and understand this tax policy statement. Specifically I/we realise that UK tax policy may change over time. Should this occur, I/we may be asked to change strateg y and/or investments and I/ we may be asked to accept or reject this advice in writing. I/we understand that tax will have a direct impact upon both the income I/we receive and the long-term sustainability of that income. I/we realise that my por tfolio assets may run out before my/our death(s). Signed: Print Name: Date: (DD/MM/YYYY ) Signed: Print Name: GEN2619 1015 Date: (DD/MM/YYYY )