Analysis of a Large On-Farm Grain Storage & Handling

advertisement

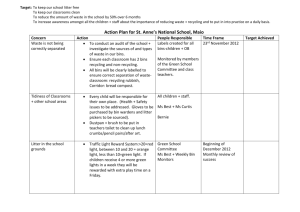

Analysis of a Large On-Farm Grain Storage & Handling Facility By: Jeffrey Berg, ARA, ASA, MRICS 1 Overview This analysis will demonstrate the steps taken, methods used, and information gleaned in the course of the analysis and comparable sale write-up of a large on-farm grain storage and handling facility. 2 Research the sale. Sources used: county assessor county recorder internet searches local appraisers county plat book AgriData, Inc. 3 Information Obtained Sale date: September 2006 Sale price: $900,000 6 acre building site w/improvements USDA payments of over $3,000,000 received from 1995 to 2005. Other information: buyer, seller, property type, document number, assessed value, parcel number, etc. 4 Confirming the sale. Seller interview: Motivation of buyer & seller. 5 Confirming the sale. Seller interview: Motivation - - - of buyer & seller. The seller decided to exit farming after encountering problems with the USDA regarding payment limitation rules. Farm equipment auctioned in 12-06. HQ grain bin site and the HQ home sold in 9-06 along with additional bin site and home. The buyer expanded operations into this area with this purchase. 6 Confirming the sale. Seller interview: Motivation of buyer & seller. Size of the farming operation. 7 Confirming the sale. Seller interview: Motivation of buyer & seller. Size of the farming operation. - As operated by the seller, the farm HQ served an 8,000 acre farming operation. - Buyer was able to lease roughly 1,000 dry tillable land acres and 7,000 irrigated tillable acres. 8 Confirming the sale. Seller interview: Motivation of buyer & seller. Size of the farming operation. Tillable land cash rental agreement & bin site sale. 9 Confirming the sale. Seller interview: Tillable land cash rental agreement & bin site sale. - The sale price reported in the courthouse was $865,000—slight difference due to accountants handling of part of sale. Actual sale price is $900,000 (considered arms-length). Cash rental rates in area at time of sale were $100 per acre for dry tillable and $125 per acre for irrigated tillable (considered fair market). 10 Confirming the sale. Seller interview: Motivation of buyer & seller. Size of the farming operation. Tillable land cash rental agreement & bin site sale. Sale of the house on-site. 11 Confirming the sale. Seller interview: Motivation of buyer & seller. Size of the farming operation. Tillable land cash rental agreement & bin site sale. Sale of the house on-site. - Sale of the farm HQ house was negotiated at the same time as the on-farm grain storage facility but sold in a separate transaction to same buyer for $300,000. 12 Inspection of the facility. Discussion with grain facility supplier/contractor. History of construction, facility age “Farmer” storage vs. “commercial” storage Augers vs. drag conveyors Concrete stem wall height Reclaim tunnels Drying capacity and aeration systems Fill & reclaim capacity Receiving capacity 13 “Farmer” vs. “commercial” storage Centrifugal aeration fans Vane axial aeration fan. 14 “Farmer” vs. “commercial” storage Reclaim gates/sumps & reclaim paddle conveyor in tunnel. Incline unload screw augers 15 “Farmer” vs. “commercial” storage Concrete stem wall, reclaim tunnel, reclaim paddle conveyor. Reclaim tunnel (L), stem wall 16 “Farmer” vs. “commercial” storage Stem wall paddle reclaim conveyor Interior of a “paddle” or chain “drag” conveyor 17 “Farmer” vs. “commercial” storage Screw conveyor Bean ladder in a dry edible bean storage bin. 18 Inspection of the facility. View of farm HQ – house (r) purchased separately. 19 5,000 bu OH Friesen bin 20 Inspection of the facility. Farm headquarters and bin site. 21 Inspection of the facility. Dwelling purchased separately. 22 Inspection of the facility. Buildings and bins constructed from 1995 to 2000. Shop - 50x70x18, heated concrete floor, 24x70 parts lean, 12x40 office lean, pole frame const, insulated, lined, colored steel exterior. South equip shed – 60x104x17, pole frame, concrete floor, no insulation or heat, colored steel exterior. North equip shed – 60x160x17, pole frame, gravel floor, no insulation or heat, colored steel exterior. 23 Inspection of the facility. 50x70x18 heated shop & office. 24 Inspection of the facility. South equipment shed – 60x104x17. 25 Inspection of the facility. North equipment shed – 60x160x17. 26 Inspection of the facility. Bins: (1) 30’; (1) 33’ & (2) 36’ diameter Sioux bins, 65,000 bu total capacity, full floor aeration, filled by u-trough auger (filled from receiving leg), portable auger reclaim. (2) 48’ diameter Sioux bins, 100,000 bu capacity each, full floor air, (2) centrifugal fans per bin, filled from legs, auger reclaim, short concrete stem walls, auger conveyors back to receiving pit. 27 Inspection of the facility. Larger bins – note side draws. 28 Inspection of the facility. Bins: (2) 60’ diameter 150,000 bu Brock bins, full floor aeration, auger unload, filled from legs, (2) centrifugal fans per bin, short concrete stem wall (1) 12,000 bu hopper bin used as “wet” holding bin for dryers (1) OH 5,000 bu Friesen hopper bin over driveway for load-out. Larger bins have sidedraws for truck loading. 29 Inspection of the facility. Bin facility – row of smaller bins (L) & larger bins (R). 30 Inspection of the facility. Grain Handling Equip: Legs include a 10,000 bph rec. leg & 7,000 bph leg (serves as “wet” & “dry” leg for dryer). Valves are used to direct grain to bins. 10x10x150 tower supports legs & spouting. Receiving pit is shallow w/10,000 bph drag conveyor to rec. leg. (2) SuperB dryers (1,000 & 1,200 bph) used for corn drying – “heat only”. 12,000 gallon LPG tank inc. in drying system. Private water well and septic sewer system. Good farm storage but not commercial quality. 31 Inspection of the facility. Receiving leg & pit. Receiving pit area; 5,000 bu OH bin and dryers 32 Results of inspection. Improvements Structure Size Eff Age Shop SF 5,660 10 G G Equip Shed (SF) 6,240 10 G G Equip Shed (SF) 9,600 10 G G Gr. Bin (bu) 835,000 10 G G Hopper Bins (bu) 17,000 10 G G Dryer (bph) 2,200 10 G G Con. Util 33 Cost Approach Improvements RCN Structure Size $/Unit Total Shop SF 5,660 $ 22.97 $ 130,000 Equip Shed (SF) 6,240 $ 9.62 $ 60,000 Equip Shed (SF) 9,600 $ 6.25 $ 60,000 Gr. Bin (bu) 835,000 $ 1.50 $ 1,250,000 Hopper Bins (bu) 17,000 $ 2.94 $ Dryer (bph) 2,200 $ 68.18 50,000 $ 150,000 $ 1,700,000 Calculating RCN’s for buildings, bins, grain handling/drying equipment 34 Cost Approach Improvements Structure Size Dep % Dep Rate Shop SF 5,660 46% 4.6% Equip Shed (SF) 6,240 58% 5.8% Equip Shed (SF) 9,600 42% 4.2% Gr. Bin (bu) 835,000 49% 4.9% Hopper Bins (bu) 17,000 40% 4.0% Dryer (bph) 2,200 50% 5.0% Abstracting depreciation rates from the sale. (Total accrued deprecation rates.) 35 Cost Approach Improvements Structure Size Annual Dep Rate Physically Dep RCN Shop SF 5,660 2.86% $ 92,300 Equip Shed (SF) 6,240 2.86% $ 42,600 Equip Shed (SF) 9,600 2.86% $ 42,600 Gr. Bin (bu) 835,000 3.33% $ 837,500 Hopper Bins (bu) 17,000 3.33% $ Dryer (bph) 2,200 5.00% $ 75,000 $ 1,123,500 33,500 Calculating physical depreciation in the sale. (Individual causes of deprecation.) 36 Cost Approach Calculation of Economic Obsolescence: RCN $ 1,700,000 Phy. Depr 34% $ 576,500 Phy. Depr'd RCN $ 1,123,500 Func. Obsol. 0% $ - Phy. Func. Depr'd RCN $ 1,123,500 Building Contribution $ 870,000 Economic Obsol. 22.56% $ 253,500 Economic obsolescence of 23% is indicated by this sale. 37 Sales Comparison Approach Improvements Cont. Value $/Unit Total Structure Size Shop SF 5,660 $ 12.37 $ 70,000 Equip Shed (SF) 6,240 $ 4.01 $ 25,000 Equip Shed (SF) 9,600 $ 3.65 $ 35,000 Gr. Bin (bu) 835,000 $ 0.76 $ 635,000 Hopper Bins (bu) 17,000 $ 1.76 $ 30,000 Dryer (bph) 2,200 $ 34.09 $ 75,000 38 Income Approach Income: (Estimated Lease Rate) Grain Storage (3) Shop Bldgs. Total Income 835,000 bu x $0.15/bu 12 mo x $1,000/mo = $ 125,250 = $ 12,000 $ 137,250 39 Income Approach Expenses: Insurance R.E. Taxes Maintenance Management Reserve for Rep. (8% of gross income) (6% of gross income) (3% of gross income) = = = = = $ $ $ $ $ Total Expenses $ NOI = OAR 7,000 10,000 11,000 8,000 4,000 40,000 $97,250 $97,250 / $900,000 = 0.1081 or 10.81% 40 Conclusion Only appraise these special use facilities if you’re willing to invest the time to become truly competent. This brief overview is not enough to make you competent in the appraisal of this type of facility. 41 42