Klein_pres - Viessmann European Research Centre

advertisement

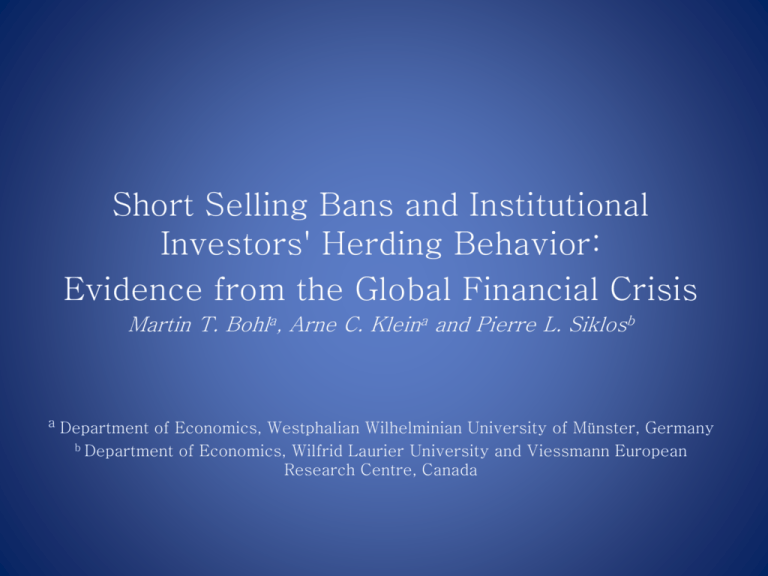

Short Selling Bans and Institutional

Investors' Herding Behavior:

Evidence from the Global Financial Crisis

Martin T. Bohla, Arne C. Kleina and Pierre L. Siklosb

a Department of Economics, Westphalian Wilhelminian University of Münster, Germany

b

Department of Economics, Wilfrid Laurier University and Viessmann European

Research Centre, Canada

Testable Hypotheses

• Does herding become more relevant during a

financial crisis? In other words, are regulators

desired to displace SS during a crisis because

herding is exacerbated during falling markets?

– YES? Herding implies investors’ difference of

opinion is relatively small

– NO? Divergences of opinion increase during a

crisis. Therefore, adverse herding is a possibility

• SENTIMENT plays a role

• Is the evidence for/against herding similar

across countries?

Contribution to the literature

• Do short sales constraints (SSC) have a significant

impact on herding behavior?

Contribution to the literature

• Do short sales constraints (SSC) have a significant

impact on herding behavior?

• The answer, in turn, entails important information for

stock market regulators

Contribution to the literature

• Do short sales constraints (SSC) have a significant

impact on herding behavior?

• The answer, in turn, entails important information for

stock market regulators

• and deepens insights into institutional investors’ trading

behavior

Markets under consideration

Setting and Data: Short Sale Constraints in

The United States

• 07/15/2008 – 08/12/2008

Naked short sales in (18) selected stocks

United Kingdom

• 09/19/2008 - 01/16/2009

All economic short positions in (32) selected stocks

Germany

• 09/22/2008 – 01/31/2010

Naked short sales in (10) selected stocks

Markets under consideration

France

• 09/22/2008 – 01/31/2010

Short Sales in (12) selected stocks

South Korea

• 09/30/2008

All short sales

• 06/01/2009

Lifted for non-financials

Markets under consideration

Australia

• 09/22/2008

Naked short sales

• 11/19/2008

Lifted for non-financials being member of the

S&P/ASX 200 and APRA-regulated business

• 05/24/2009

Ban expires

Markets under consideration

US

UK

GER

FR

ROK

AUS

No. Stocks

banned

(N)

18

29

10

12

16

44

No. Stock

Control

group

18

29

10

12

16

44

T

17

83

343

347

317

127

Markets under consideration

Institutional investors holdings

GDP

• US & UK > 200%

• GER, FR, AUS > 100%

• ROK ≈ 90%

In 2007 (Gonnard (2008))

Literature Review

• Miller (1977), Diamond and Verrecchia (1987)

• Short selling bans

Miller (1977)

• Divergence of opinion

Miller (1977)

• Divergence of opinion

• SSC deter pessimists from expressing their beliefs

Miller (1977)

• Divergence of opinion

• SSC deter pessimists from expressing their beliefs

• therefore, market prices are build upon optimists’

valuation

Miller (1977)

• Divergence of opinion

• SSC deter pessimists from expressing their beliefs

• therefore, market prices are build upon optimists’

valuation

Overvaluation

Diamond and Verrecchia (1987)

SSC reduce informational efficiency:

new information is impounded into prices with a delay

Diamond and Verrecchia (1987)

SSC reduce informational efficiency:

new information is impounded into prices with a delay

• this holds for both positive and negative news

Diamond and Verrecchia (1987)

SSC reduce informational efficiency:

new information is impounded into prices with a delay

• this holds for both positive and negative news

• but the effect is stronger for negative information

Crisis related Bans

Previous literature on the short selling bans reports strong

evidence for deteriorations in market quality and liquidity

• Bris (2008), Boulton and Braga-Alves (2010) and

Kolanski et al. (2010) for the July/August ban in the US

•

Boehmer et al. (2009) and Kolanski et al. (2010) for the

September/October ban in the US

Crisis related Bans

• Marsh and Payne (2010) for the UK

• Helmes et al. (2010) for Australia

• A broad international perspective incl. 30 countries is

given in Beber and Pagano (2011)

Beber and Pagano (2011)

• Their results for 30 countries underscore negative

effects on market liquidity

Beber and Pagano (2011)

• Their results for 30 countries underscore negative

effects on market liquidity

• In addition, they find increased autocorrelations in the

residuals of market model regressions

Empirical Approach

• We aim at identifying the impact of short sale

constraints on herding behavior

Empirical Approach

• We aim at identifying the impact of short sale

constraints on herding behavior

1. A measure of herding is needed

Empirical Approach

• We aim at identifying the impact of short sale

constraints on herding behavior

1. A measure of herding is needed

2. Control for the effects of the crisis per se is

needed

Empirical Approach

• We aim at identifying the impact of short sale

constraints on herding behavior

1. A measure of herding is needed

2. Control for the effects of the crisis per se is

needed

3. Robust inference based on small/medium size

samples

Measure of Dispersion

Measure of Dispersion as an

input to evaluate Herding: details

Measure of Dispersion

• St = dispersion: captures

a key characteristics of

herd behavior

– N = number of stocks,

– T = number of

observations

– rit = return, stock i, time

t;

– rmt = cross-sectional

weighted average of

returns in a ‘portfolio’ of

N stocks

NOT an

E(r)

Average deviation of a stock from the market

proxies how investors discriminate between stocks

Christie and Huang (1995)

Rational Pricing

Herding

Adverse Herding

Methodology: Regression Form

(2)

> 0

under rational

Asset pricing;

{e.g., changing

may be one

reason}

BANNED CONTROL

IMPLIES SSR have

an effect

0 means

deviation from rational

Asset pricing

Proxies variance since

2

2

2

mt

E (rmt

) E (rmt )2 E (rmt

)

Chang et al. (2000)

Autocorrelation:

Schwert’s criterion

From max to min,

use a 10% criterion

Matching

•

Matching variables: Market capitalization, trading

volume and market beta (all standardized)

Matching

•

•

Matching variables: Market capitalization, trading

volume and market beta (all standardized)

Matching metric: Sum of squared differences in those

three variables (Euclidean distance)

Interpretation

In general, evidence supporting an effect of short sale

constraints is found if the estimate for

significantly differs between test and control

groups

Interpretation

In particular, support for regulators’ point of view is

given in case of a dampening effect of SSC on herding

which, in turn, is found if is significantly negative

for the control group while being equal to zero for the

banned stocks.

Control

0

Test

0

Interpretation

By contrast, evidence in line with a amplifying effect

of SSC on herding, is found if is negative for the

test group but equal to zero for the control stocks.

Control

0

Test

0

Bootstrap

A bootstrap algorithm

• enables us to draw reliable inference from small and

medium samples

Bootstrap

A bootstrap algorithm

• enables us to draw reliable inference from small and

medium samples

• allows us to directly test the H0 of Rational Asset

Pricing (i.e., CAPM-type)

Bootstrap

We generate data by the following processes

1.

r r

i ,t

i

i m ,t

i ,t

Bootstrap

We generate data by the following processes

r r

1.

2.

i ,t

i

i m ,t

i ,t

r r SMB HML

i ,t

i

i m ,t

i

i

i ,t

Further empirical issues

• Persistently rising vs falling markets

may make a difference: sort St, by

length of runs l {1,2}

Further empirical issues

• Persistently rising vs falling markets

may make a difference: sort St, by

length of runs l {1,2}

• Threshold effects?

Further empirical issues

• Persistently rising vs falling markets

may make a difference: sort St, by

length of runs l {1,2}

• Threshold effects?

• Small cap versus large cap: former

exhibit more herding than latter;

former lag latter in terms of

correlation of returns

Empirical Results

Recall that we bootstrap deviations from Rational

Asset Pricing

Empirical Results

Recall that we bootstrap deviations from Rational

Asset Pricing

• Significance does not mean significantly different

from zero

Empirical Results

Recall that we bootstrap deviations from Rational

Asset Pricing

• Significance does not mean significantly different

from zero

• but significantly different from the value implied by

the asset pricing model

Empirical Results

Adverse Herding!

Herding

Empirical Results

Empirical Results

• Almost no herding (either adverse or regular) in

case of unbanned stocks

Empirical Results

• Almost no herding (either adverse or regular) in

case of unbanned stocks

• strong evidence for adverse herding for the stocks

subject to the constraints for some countries

Interpretation

• It is well known in the literature that short sale

constraints create uncertainty about fundamental asset

values

Interpretation

• It is well known in the literature that short sale

constraints create uncertainty about fundamental asset

values

• The work of Hwang and Salmon (2004, 2009) suggests

that during such turmoils investors loose trust in the

market consensus and come back to fundamental based

pricing

Interpretation

• It is well known in the literature that short sale

constraints create uncertainty about fundamental asset

values

• The work of Hwang and Salmon (2004, 2009) suggests

that during such turmoils investors loose trust in the

market consensus and come back to fundamental based

pricing

• This may show up in adverse herding, via an increased

dispersion of returns

Thank you for your attention!