Homeownership Rate, 2000-10 - Delaware State Housing Authority

advertisement

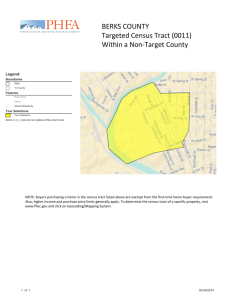

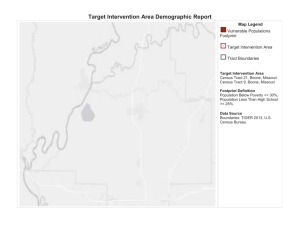

Homeownership Trends & Outlook 2012 Governor’s Conference on Housing Dover, DE October 11, 2012 Keith Wardrip Community Development Studies & Education FEDERAL RESERVE BANK OF PHILADELPHIA Disclaimer: The views expressed here are those of the presenter and do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System. Mid-Decade Shift in Household Growth from Homeowners to Renters Year-to-year change in the number of occupied units by tenure (thousands) 2,000 Owner-occupied units Renter-occupied units 1,500 1,000 500 0 -500 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Note: Data from 2010 and 2011 are not directly comparable to prior years because they are based on updated estimates of the housing unit inventory. Source: 2nd Quarter 2012, Current Population Survey/Housing Vacancy Survey, Series H-111: Historical Table 7a. Prepared by the U.S. Census Bureau. 2 Homeownership Gains Mostly Eroded Annual homeownership rate compared to rate in 1994 6% 5% 4% 3% 2% U.S. 1% Family income >= median family income Family income < median family income 0% Note: Data are from the second quarter of each year. In 2010, the Census Bureau began imputing income for households that did not provide their income on the survey. For consistency, all of the values in this chart exclude households that did not report their income. For the second quarters of 2010, 2011, and 2012, these figures were pulled from the press releases. In 2012, including these respondents increases the homeownership rate to 80.5% from 80.0% for households at or above the median income and to 50.6% from 48.4% for households below the median income (not shown on chart). Source: 2nd Quarter 2012, Current Population Survey/Housing Vacancy Survey, Series H-111: Historical Table 17. Prepared by the U.S. Census Bureau. 3 Waxing and Waning of Home Purchase Loans and Government Participation Millions of home purchase loans for 1- to 4-family properties 8.0 Conventional loan Nonconventional loan (FHA, VA, etc.) 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Note: Loans classified as “nonconventional” are insured by the Federal Housing Administration or backed by the Department of Veterans Affairs, the Farm Service Agency, or the Rural Housing Service. Source: Robert B. Avery, Neil Bhutta, Kenneth P. Brevoort, and Glenn B. Canner, “The Mortgage Market in 2011: Highlights from the Data Reported under the Home Mortgage Disclosure Act,” Table 4, Federal Reserve Bulletin (forthcoming). 4 Variable Rates of Decline for Home Purchase Loans (% change from 2010 to 2011) Total High-income tract Middle-income tract Moderate-income tract Low-income tract -7% -3% -7% -15% -19% Tract 80-100% minority Tract 50-79% minority Tract 10-49% minority Tract <10% minority High-income borrower Middle-income borrower Moderate-income borrower Low-income borrower Non-Hispanic White Hispanic White Native Hawaiian/Pacific Islander Black or African American Asian American Indian/Alaska Native -10% -14% -7% -5% -3% -8% -10% -9% -6% -5% -13% -15% -13% -16% Note: Data include first lien home purchase loans for one- to four-family properties and manufactured housing, owner-occupied only. Source: Robert B. Avery, Neil Bhutta, Kenneth P. Brevoort, and Glenn B. Canner, “The Mortgage Market in 2011: Highlights from the Data Reported under the Home Mortgage Disclosure Act,” Table 14, Federal Reserve Bulletin (forthcoming). 5 Factors Influencing Homeownership Demand Household Income Median of $58,800 in Delaware in 2011; substantially higher than in the U.S. ($50,500) Only $800 above 2008 levels in Delaware in current dollars Unemployment 6.9 percent in Delaware in August 2012; markedly lower than in the U.S. (8.1 percent) Roughly double the 2006 and 2007 rates in Delaware Household Formation Average of roughly 600,000 new households annually from 200711 in the U.S., down by half compared to 2000-05 Delaware added only 44,000 households from 2000 to 2010, compared to 51,000 during the prior decade Availability of Mortgage Credit Source for household income: American Community Survey, Table B19013. Prepared by the U.S. Census Bureau. Source for unemployment rates: Current Population Survey and Local Area Unemployment Statistics. Prepared by the U.S. Bureau of Labor Statistics. Source for household formation: The Joint Center for Housing Studies of Harvard University , The State of the Nation’s Housing 2012. (Cambridge, MA: President and Fellows of Harvard College, 2012); 1990, 2000 ,and 2010 census, prepared by the U.S. Census Bureau. 6 Homeownership Rate More Stable in Delaware Than in U.S. Share of Household Growth, 2000-10 45% 30% Renter-occupied units Owner-occupied units 55% 70% Homeownership Rate, 2000-10 U.S. Delaware 72.3% 72.1% 66.2% Source: 2000 census, Table H004; 2010 census, Table H4. Prepared by the U.S. Census Bureau. 2000 65.1% U.S. 2010 Delaware 7 Sales Prices Rebounding in U.S., Lagging in Delaware 15% U.S. Delaware 10% 5% 0% -5% -10% -15% 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Four-quarter percent change in purchaseonly house price index (seasonally adj.) 20% Note: Last point plotted is 2012:Q2. Data include conforming, conventional single-family mortgages financed by Fannie Mae and Freddie Mac. Source: 2nd Quarter 2012, House Price Index: Seasonally-Adjusted Purchase-Only Index, % Change Over Previous 4 Quarters. Prepared by the Federal Housing Finance Agency. 8 National Housing Market Indicators A. Inventories of existing and new homes are down considerably from 2011 levels. In August 2012, the median “days on the market” for existing units was roughly 24% lower than last year. B. Compared to a year ago, existing home sales in August were up by more than 9%, and sales of new homes were up almost 28%. C. Housing starts were up 29% in August 2012 versus last year. D. The interest rate on a conventional, conforming 30-year fixed-rate loan has been below 4.0% since November 2011. Source for existing home sales: National Association of Realtors, “August Existing-Home Sales and Prices Rise,” news release (September 19, 2012). Source for new home sales: U.S. Census Bureau and U.S. Department of Housing and Urban Development, ”New Residential Sales in August 2012,” press release (September 26, 2012). Source for housing starts: U.S. Census Bureau and U.S. Department of Housing and Urban Development, “New Residential Construction in August 2012,” press release (September 19, 2012). Source for interest rate statistic: Primary Mortgage Market Survey Archives. Prepared by Freddie Mac. 9 National Housing Market Indicators (cont’d) E. After falling by nearly half from 2006 to 2010, aggregate home equity showed signs of rebounding in the first two quarters of 2012. F. “Distressed sales” as a percentage of all sales transactions fell to 22% in June 2012 compared to 27% one year before. G. While lower than one year ago, mortgage delinquency rates remain high, and more than 3.6 million borrowers were seriously delinquent or in foreclosure in July 2012. H. Roughly 11.1 million homeowners are “under water” on their mortgages. Source for home equity: 2nd Quarter 2012, Flow of Funds Accounts of the United States. Prepared by the Board of Governors of the Federal Reserve System. Source for distressed sales and delinquency data: U.S Department of Housing and Urban Development, U.S. Department of the Treasury, August 2012 National Scorecard: The Obama Administration’s Efforts to Stabilize the Housing Market and Help American Homeowners (Washington, DC, 2012). Source for underwater statistic: The Joint Center for Housing Studies of Harvard University, The State of the Nation’s Housing 2012 (Cambridge, MA: President and Fellows of Harvard College, 2012). 10 Concluding Remarks On the one hand... “The evidence is overwhelming that the housing market has turned. No one should expect prices to return to the bubble peaks of 2006, but the general direction of house prices is upward. And construction should be returning to more normal levels over the rest of 2012 and 2013.” - Dean Baker, Housing Market Monitor, August 28, 2012 On the other hand, just like politics and the weather, all housing is local. 11 Questions? Keith Wardrip Community Development Research Specialist Federal Reserve Bank of Philadelphia Ten Independence Mall Philadelphia, PA 19106 www.philadelphiafed.org/community-development/ (215) 574-3810 keith.wardrip@phil.frb.org 12