Share of HG firms

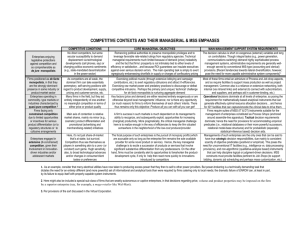

advertisement

Distribution and determinants of high-growth firms in Portugal International Workshop “High-Growth firms: Local policies and local determinants” 28th March 2012 Copenhagen Elsa Sarmento Catarina Figueira Universidade de Aveiro Cranfield University (esarmento@ua.pt) (catarina.figueira@cranfield.ac.uk ) Introduction Target: Employer Enterprise Population (enterprises with more than one paid worker according the registrars of the Portuguese Social Security System), using the entrepreneurship dataset obtained from Quadros de Pessoal. Methodology: The compilation of this dataset follows the methodology applied by Eurostat and OECD (2007) on the classification of what constitutes a High Growth or Gazelle firm. Dataset: The derived dataset from the application of this methodology consists of an annual average of 215,903 active employer enterprises, with an annual average of 36,803 births and 23,743 enterprise deaths over the period 19852007. In 2007, there were 354.920 employer enterprises employing 3.205.372 workers. Population of Enterprises with Ten or More Employees High-Growth Enterprises (as Measured by Turnover) Gazelle Enterprises (as Measured by Turnover) Gazelle Enterprises (as Measured by Employment) High-Growth Enterprises (as Measured by Employment) Gazelle enterprises are a subset of High Growth enterprises which consist of employer enterprises that during a period of at least 5 years have had an annual average growth in turnover or employment, respectively, greater than or equal to 20 % per year. Growth can be measured either by the number of employees or by turnover. Observed factors about firm dynamics in Portugal Taxa de natalidade (Business demography statistics Eurostat) hazard ratio >1: Survival Table for Employer Enterprise Births by NUTII region, 1987-2005 EntrantsBirths and Firm exiters average firm size, by NUTII 2005 2006 an increase in Size Distribution in 1987, 1997 and 2007 External factors the given Smoothed hazard estimate Broad Economy 18,3 Population and birth rate of active-Employer enterprises explanatory Lisboa e Vale 1987 Time Nortefirm size ofCentro Alentejo Algarve Açores Madeira Average entrants Average firm size of exiters 18 do Tejo variableNormal 16,2 16,1 15,9 Election year Norte Lisboa Alentejo Açores Madeira Portugal Norte Algarve Centro Lisboa Alentejo Açores Madeira Portugal increases the 410000 35 16 Algarve 14,9 85,6% 1 14,6 Centro 87,4% 85,5% 85,8% 85,6% 85,1% 86,1% 1997 14,2 probability of 7.9 6.3 6.0 6.8 5.7 3.1 7.0 6.8 1985 13,7 Election year 13,3 14 2 13,2 2007 75,1% 75,1%12,3 13,1 75,5% 75,5% 74,2% 12,977,7% 12,8 7.5 5.7 6.0 6.1 6.3 3.7 9.1 76,0% 6.5 1986 exit. 360000 12,3 12,2 30 11,9 11,9 11,8 8.4 6.2 12 34.7 5.2 66,5% 5.1 4.5 70,1% 3.6 6.9 5.4 5.1 5.9 6.3 5.2 3.3 8.1 6.7 1987 11,5 67,0% 67,7% 67,0% 68,3% 11,1 67,0% 11,0 QCA 10,4 10,44.9 1990 6.1 4.1 5.3 6.3 4.3 3.0 4.8 5.7 II 7.7High 5.7 6.1 4.6 3.4 7.1 6.4 turbulence 9,9 9,8 9,7 310000 9,4 9,4 64,0% 60,5% 60,4% 61,2% 59,9% 61,3% 9,3 1991 6.2 10 44.4 5.3 59,8% 6.8 4.0 2.8 6.2 5.8 8.0 4.1 6.3 6.7 4.4 2.7 4.5 6.625 QCA I 9,0 8,7 8,8 8,7 QCA III 8,4 Empresa 8,3 1992 5.6 4.6 54,1% 5.5 4.2 58,9% 3.4 4.4 5.1 7.6 54,9% 4.5 5.9 55,8% 6.3 4.9 54,5% 3.28,3 5.9 56,2% 6.4 7,8 54.0 55,0% na 7,3 7,1Hora 7,1 8 3.8 7,0 260000 1993 4.9 5.1 6.5 6,4 6,8 4.1 4.4 5.0 5.2 7.6 year 4.6 6.1 12.4 5.4 3.6 5.4 8.2 6,7 Election 6,5 6,5 Decreasing firm average size Birth 49,4% rate 8.6 6 50,4% 5.9 4.1 4.5 4.3 54,5% 3.8 5.4 6.1 6.5 50,7% 3.8 4.6 51,1% 5.5 3.9 50,5% 4.0 4.3 51,6% 5.420 1994 6 4.6 3.6 4.3 3.3 2.8 5.2 4.1 6.4 3.6 4.6 Introduction 4.9 4.3 3.1 3.2 5.2 1995 21000073.4 Euro 45,3% 50,7% 46,6% 46,9% 47,2% 46,7% 47,5% 1996 4.3 4 3.3 3.8 4.5 3.9 2.4 4.7 4.1 5.5 3.4 4.6 5.0 3.9 2.4 4.5 4.9 dynamics 15 Hint3.5 at size dependence of growth Maastricht criteria 83.4Firm 43,2% 1997 4.5 3.5 41,7% 4.4 3.6 47,5% 2.5 3.8 4.1 5.9 43,4% 4.3 44,2% 5.6 3.9 43,7% 2.1 3.7 44,6% 5.1 160000 1998 4.6 2 3.3 Active 3.4 5.1 3.3 3.2 4.4 4.3 6.0 3.0 4.1 4.8 3.2 2.5 3.4 4.8 and employer 9 38,7% 44,5% 40,2% 40,5% 41,1% 41,2% 41,7% 1999 4.2 3.4 enterprises 3.6 4.8 3.6 2.6 4.0 4.1 6.4 3.2 4.0 6.1 3.5 2.9 5.6 5.410 Economic 0 Less survival ability 110000 recession 2000 102.9 performance 37,6% 4.0 3.1 35,8% 6.6 3.1 41,9% 3.9 4.3 4.3 5.2 37,7% 3.1 4.3 38,5% 5.7 3.0 38,9% 3.0 4.3 38,6% 4.8 2001 4.6 3.4 3.7 4.6 3.3 4.1 4.8 4.2 5.0 4.1 4.2 5.7 3.6 3.3 4.9 4.8 11 33,0% 39,5% 35,1% 35,2% 36,2% 36,3% 36,6% 2002 4.160000 3.2 3.3 4.4 3.3 3.9 4.4 3.9 5.0 3.0 3.8 4.8 3.4 3.2 3.9 4.45 IES Growth of employer Significant disparities among regions 2003 4.2 12 3.3 enterprises 3.3 30,5% 4.6 3.1 37,4% 3.5 I 3.6 4.0 2.9 3.3 34,0% 5.0 2.8 33,9% 3.3 3.2 34,3% 4.0 32,8% QCA QCA II4.2 33,0% QCA III 2004 3.8 3.3 3.3 4.5 3.2 3.9 4.2 3.8 3.9 2.9 3.0 4.5 3.0 3.7 3.2 3.7 10000 0 133.5 28,1% 35,3% 30,8% 31,0% 32,0% 31,3% 31,7% 2005 3.9 3.8 4.9 3.5 3.3 3.3 4.0 3.5 2.9 3.3 4.4 2.6 3.0 4.0 0 1 2 3 4 5 6 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 20073.6 Effect growth 29,4% in survival 29,9% rates Firm Size (Log10) 2006 3.4 14 3.2 2.9 26,4% 3.8 2.9 33,4% 3.3 4.1 3.4 29,0% 29,3% industry 30,2% 0 5 10 15 20 kernel = gaussian, bandwidth = 0.5000 2007 3.4 3.0 2.7 3.9 3.1 3.5 3.7 3.4 analysis time 15 24,8% 31,8% 27,4% 27,8% 29,0% 28,2% 28,2% Source: Sarmento, E. de Morais and A. Nunes (2012), “The dynamics of employer enterprise creation in Portugal over the last two decades: a 23,2% 30,4% 26,1% 26,2% 27,8% function 26,4% 26,9% Source:16 Sarmento and Nunes (2010). 95% CI Smoothed hazard size, regional and sectoral perspective”, Notas Económicas. Based on: Eurostat, Statistics Portugal for Portugal INE (EIP) data and own calculations based on Quadros de Pessoal GEP, MTSS for Portugal QP (Eurostat/OECD)and 17 Demography 21,9% 28,9% 24,6% 24,9% 25,4% 25,4% 26,6% SDBS Business Indicators from the OECD (EIP). Notes: Preliminary version of 2005 for Bulgaria, Romania, Portugal and Slovenia. 20,7% 27,4% methodology,22,9% 23,9% 23,8% 25,4% * 18 Employer enterprises according to the Eurostat/OECD based on Quadros de 23,2% Pessoal. QP 0 ** Statistics Portugal data, for enterprises with more than 1 paid employee (employer enterprises). % pr e Ch i áq u ia lia Itá Es lov Portugal joined EMS Fr an ça Hu ng ria Es lov én ia Re p. Ch ec a Fi nlâ nd ia Áu str ia Ro (E mé US nia TA T/ Po OE rtu CD ga l IN )* E (E IP )** P Po or tu rtu ga ga l lW BG ES Re ino Un ido Di na m ar ca Bu lgá r ia Le tón Lu ia xe m bu rg o E Es stó pa nia nh a ( Es EI pa P) *** nh a (D IR CE ) Es Es pa pa nh nh a a (W BG ES ) Ho lan da Rendimento Mínimo Garantido Su éc ia .1 .2 .3 .4 .5 .6 .7 .8 .9 Number of employer enterprises Digital delivery QP (compuslory > 10 employees) from July 04 Po rtu ga l % 1 20 High-Growth and Gazelle enterprises (by employment) Dados de base High-growth and Gazelle Enterprises by Employment (enterprises) High-growth enterprises by employment (enterprises) Gazelle enterprises by employment (enterprises) High-growth enterprise rates by employment (enterprises) Gazelle rates by employment (enterprises) 4,5 4,18 3,84 2.000 3,54 3,38 3,32 3,36 3,5 3,30 2,99 2,74 1.500 2,97 2,83 2,73 2,79 2,56 3,0 2,82 2,67 2,58 2,5 % Number of enterprises 4,0 3,72 2,0 1.000 1,5 1,13 0,91 1,00 0,92 500 0,72 0,78 0,99 0,75 0,73 0,82 0,79 0,68 0,74 0,76 0,78 0,68 1,0 0,5 0,0 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Source: GEE based on Quadros de Pessoal, GEP, Ministério do Trabalho e da Solidariedade Social Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. High-Growth and Gazelle enterprises (by turnover) High-growth and Gazelle Enterprises by Turnover (enterprises) Dados de base High-growth enterprises by turnover (enterprises) Gazelle enterprises by turnover (enterprises) High-growth firm rates by turnover (enterprises) Gazelle rates by turnover (enterprises) 14.000 30 24,6 25 22,1 12.000 20,4 20 17,4 13,9 Number of enterprises 10.000 11,9 8.557 8.000 7.885 4,3 6.405 3,4 2,6 2.000 12,4 12,5 12,0 15 11,5 9,9 2,6 2,3 5.177 3,3 5.150 3,2 5.422 2,6 2,6 2,8 9,4 8,7 9,8 9,5 3.880 1.726 1.574 1.254 963 836 2,7 3,7 10 2,2 5 5.127 4.858 5.079 0 2,7 3,0 5.737 5.894 5.723 4.586 4.412 4.000 12,5 7.556 4,7 6.000 11,7 10,5 4.878 4.271 -5 1.011 1.353 1.392 1.211 1.272 1.402 1.310 1.336 1.918 -10 1.532 1.186 0 -15 -20 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Source: GEE based on Quadros de Pessoal, GEP, Ministério do Trabalho e da Solidariedade Social Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Number of employees in high-growth firms according to the employment criteria, by NUTII (1997, 2004 and 2007) 0 a 5000 5001 a 50000 > 50000 Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Number of employees in gazelles according to the employment criteria, by NUTII (1997, 2004 and 2007) 0 a 1000 1001 a 6000 > 6000 Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Share of High-Growth firms in 10+ employees firms (by employment and turnover) Only 9,5% of all Portuguese employer enterprises (with more than ten employees) have a turnover that is in line with that of High Growth firms. If we consider the growth according to the number of employees instead, then ShareofofHigh High-Growth employees enterprises, the percentage Growth Enterprises firms dropsinto10+ just 3 %. by employment and turnover Share of High-growth enterprises in 10+employ enterprises (by employment) 30 25 Share of High-growth enterprises in 10+employ enterprises (by turnover) 24,6 22,1 20,4 Average size 20 17,4 15 13,9 12,5 11,9 11,7 12,4 12,5 12,0 11,5 10,5 9,9 10 5 8,7 4,2 3,8 3,3 2,7 2,7 2,8 3,0 3,4 3,4 3,5 2,6 1993 1994 1995 1996 1997 1998 1999 2000 3,7 3,3 9,8 9,4 9,5 2,8 2,7 2,6 2,8 3,0 2003 2004 2005 2006 2007 0 1990 1991 1992 2001 2002 Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Share of High-Growth employment in 10+ employees firms (by employment and turnover) Over time, we can observe a narrowing gap between the two measurement criteria, for both HG and Gazelles. Share of High-Growth Employment in 10+ employees enterprises, by employment and turnover Share of High-growth employment in 10+employ enterprises 30 Share of High-growth employment in 10+employ enterprises 26,9 25,4 24,4 25 19,6 Average size 20 16,6 15,2 15 14,8 13,9 13,4 12,5 12,4 9,9 6,0 6,4 6,3 1994 1995 9,2 9,6 8,2 7,9 7,2 10,6 9,9 8,9 7,4 12,4 11,6 10,0 10 13,1 7,0 7,0 7,3 7,2 10,0 7,6 6,2 5,3 5 0 1990 1991 1992 1993 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. 2007 Average firm size in HG firms and Gazelles and total population of firms, births and deaths The average HG firm size is higher by an average of 18 employees than that of a Gazelle. The growth in average size registered until 1999 was not maintained during the following years. In line with the overall population of firms, HG and Gazelles average size have also decreased from 2000 onwards. Average Firm Size HG and Total population of firms Average HG enterprise size - by employment (nº HG emp/nº HG ent) Average firm size births (employment) Average firm size active pop firms (employment) Average firm size deaths (employment) Average Gaz enterprise size - by employment (nº G emp/nº G ent) 140 130,8 119,1 120 114,4 Nº employees 92,5 96,6 89,7 116,7 105,2 92,0 100,0 93,2 116,7 113,3 106,9 100 121,2 118,9 113,8 103,5 109,1 101,1 102,1 102,1 97,8 95,9 80 104,3 109,88 101,3 101,8 93,66 86,3 81,2 60 67,9 66,0 14,3 13,4 69,0 40 20 15,7 15,1 12,0 11,6 11,3 11,0 10,8 10,6 10,0 10,0 9,4 9,3 9,3 9,0 9,0 9,0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 0 1990 1991 1992 1993 Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Share of HG firms (by employment) by size class The majority of HG firms and Gazelles are SMEs. Share of High-Growth Enterprises (employment) by size class 10 to 19 20 to 49 50 to 249 250 or more 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. 100% Share of HG and Gazelles (by employment) by NACE There is a shift in the distribution of both High Growth firms over the period of analysis, away from manufacturing (34% in 1995, down to 20% in 2007) to services and commerce (39% in 1995 up to 56% in 2007) as well as construction (15% in 1995, up to 20% in 2007). A similar pattern is observed for Gazelles. Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Distribution of employment: HG and Gazelles (employ) by NUTII regions More than half of HG firms are concentrated around the area of Lisbon and Distribution of HG (empl) by NUT II regions another quarter in employment the North. Distribution of employment in Gazelles (empl) by NUT II regions 1990 2000 2007 1992 2000 2007 70 60 54,9 60 50 57,3 56,1 46,7 50 41,8 44,3 40 40 30 % % 33,1 32,8 26,9 33,3 30 25,0 25,6 20 15,8 20 12,7 11,4 13,0 10 4,4 3,0 2,2 2,9 1,9 2,6 0,9 1,5 1,1 1,1 1,4 1,1 Açores Madeira 0 Lisboa e Vale do Tejo Norte Centro 10,2 10,2 10 Alentejo Algarve 2,2 1,7 3,1 4,6 3,0 3,6 1,3 2,1 0,8 1,3 0,7 0,6 Açores Madeira 0 Lisboa e Vale do Tejo Norte Centro Algarve Alentejo Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Share of HG (employ) in total employment in enterprises +10 employees by NUTII regions The share of employment in HG firms is higher in Lisbon, which was in 2007, more than twice the share of the second most important region, the North. Share of HG (Empl) employment in total employment in enterprises + 10 employees 5,0 4,6 1990 4,5 2000 2007 4,2 4,0 3,5 3,3 3,1 % 3,0 2,4 2,5 2,0 2,0 1,5 1,2 1,0 1,3 0,9 0,5 0,3 0,3 0,2 0,2 0,2 0,2 0,1 0,1 0,1 0,0 Lisboa e Vale do Tejo Norte Centro Alentejo Algarve Açores 0,0 0,0 0,0 Madeira Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. Share of HG (employ) employment in each NUTII regions 'employment (+10 employees) In 1990, the Algarve had the biggest share of regional employment in HG firms. But the situation reversed and in 2007, with Lisbon leading the regional ranking. Share of HG (Empl) employment in each regions´employment (+10 employees) 14,0 2000 1990 11,9 12,0 2007 12,1 10,5 10,2 10,0 8,0 9,5 9,4 7,9 7,6 7,9 7,7 7,5 % 7,0 6,6 6,1 6,0 6,0 5,2 6,1 6,0 5,2 4,0 4,0 3,9 2,0 0,0 Lisboa e Vale do Tejo Norte Centro Alentejo Algarve Açores Madeira Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. UK comparison Share of High Growth firms in total firms and employment Non High Growth High Growth 100% 2,6 2,8 3,0 3,4 3,4 3,5 3,7 3,3 2,8 2,7 2,6 2,8 3,0 4,2 3,8 3,3 2,75,3 2,7 6,4 6,3 7,0 7,9 7,0 7,3 6,2 7,2 7,6 7,4 7,2 6,0 8,9 10,0 9,9 9,9 8,2 95% 90% 85% 80% 75% 70% 65% 60% 55% ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP ENT EMP 50% ENT EMP Between 2005 and 2008, the UK High Growth firms tripled, on average, the number of employees. In Portugal, firms have experienced a sustained decrease in the number of employees. Furthermore, High Growth firms account for 6% of the total population of UK firms in terms of employment growth (NESTA, 2009), which is the double of what the evidence shows for Portugal. When Portuguese firms are compared with their UK counterparts, it is noticeable that: • on average High Growth firms in the UK have been more successful at creating employment than the Portuguese • Portuguese High Growth firms tend to display a higher degree of volatility. 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. 16 UK comparison A significant number of High Growth firms in Portugal operate in the Construction sector, which has been particularly affected by variations in the business cycle. 40 1995 Manufacturing 1996 1997 1998 36 Share of enterprises and employees in the construction sector, 1995-2006 1999 34 14 2000 2002 14 32 2001 2001 2004 13 2002 30 2005 2003 13 2004 28 2005 26 2006 24 13 14 15 16 17 18 19 20 Share of enterprises, % 12 12 2000 21 11 11 61 2006 1998 1997 1999 1996 10 2005 Services 59 Share of employees, % 2003 2006 Share of employees, % Share of employees, % 38 1995 2004 10 2003 9 57 10 2002 11 12 13 14 15 16 Share of enterprises, % 2001 55 2000 53 1999 1998 1997 51 1996 49 1995 47 64 65 65 66 66 67 67 68 Share of enterprises, % Source: Own calculations, based on "Quadros de Pessoal", GEP, Ministério do Trabalho e da Solidariedade Social and the OECD/Eurostat´s (2007) methodology. 17 Determinants of HG and Gazelles performance Firm turbulence (excessive creative destruction?) Short-term factors (business cycle) Possible determinants of performance Sectoral (and not regional) Servicisation of the economy Quality of entrepreneurs Agglomeration effects Share of HG and Gazelles closed during 2000-2009 High growth does not grant better survival chances in Portugal. Gazelles seem more prone to dying than HG, showing that rapid growth based on short-run factors does not grant longevity or sustained growth. From the 87% microfirms in BP´s Central de Balanços, only 10 grew into large firms (2000-2009). Structure Total Universe of non financial firms High-Growth Gazelles 23,8% 25,8% Microfirms 83,6% 23,6% 26,5% SMEs 16,2% 20,0% 21,9% 0,2% 14,6% 18,8% Lisbon 29,7% 25,9% 28,2% Porto 17,4% 24,6% 26,3% Other locations 52,9% 22,4% 24,3% Limited liability companies 94,3% 23,6% 25,5% By juridical nature Public limited companies 3,1% 17,7% 21,2% Other 2,6% 38,9% 43,9% Agriculture and Fisherires 2,7% 19,1% 22,2% 13,7% 26,6% 28,9% 0,3% 12,7% 14,7% Construction 14,8% 23,2% 25,5% Commerce 28,4% 28,4% 30,2% Other Services 40,1% 20,3% 21,8% By dimension Large firms By district Manufacturing By sector Electricity and Water What is the maximum size attained by HG firms and Gazelles throughout their life? Microfirms: 1991-2009 Dimension HG firms Gazelles Microfirms 86,4% 87,8% SMEs 13,6% 12,2% Large firms 0,0% 0,0% Source: Bank of Portugal, based on Central de Balanços data and the Eurostat/OECD´s (2007) methodology. 19 Policy assessment Support assessement for HG firms and Gazelles No targeted support policies: One size fits all (CSF support, financing schemes, venture capital, business angels, incubators) Few policy synergies: Innovation & Internationalization & Entrepreneurship/SME policies. Weak involvement with the regional administration Obstacles and rigidities Access to capital, Labour Bureaucracy Market, Regulation, Red tape and 20 Main (slide) bibliography Bank of Portugal (2010), “Estrutura e dinâmica das sociedades não financeiras em Portugal” Lisbon. Cabral, L. (2007), “Small firms in Portugal: a selective survey of stylized facts, economic analysis and policy implementation”, Portuguese Economic Journal, 6(1), 65-88. Eurostat; OECD (2007), “Eurostat-OECD Manual on Business Demography Statistics”, Paris, OECD Publishing. Instituto Nacional de Estatística [INE] (2009), “O empreendedorismo em Portugal. Indicadores sobre a demografia das empresas 2004-2007”, Destaque INE, Lisboa. NESTA (2009), “The vital 6 per cent, How high-growth innovative businesses generate prosperity and jobs”, Research summary of October 2009. NESTA (2011), “Vital growth: the importance of high-growth business to the recovery”, Research summary, March 2011. Nunes, A. and E. de Morais Sarmento (2012) “Business Demography Dynamics in Portugal: A NonParametric Survival Analysis”, in Bonnet, J. et al. (eds.) The Shift to the Entrepreneurial Society: A Built Economy in Education, Sustainability and Regulation, Edward Elgar (Chapter 18). Nunes, A. and E. de Morais Sarmento (2011), “Sobrevivência de empresas – o caso da região Norte de Portugal” in Rui Nuno Baleiras (Coord.), Livro de Casos de Desenvolvimento Regional, Principia. OECD (2008), “Measuring entrepreneurship: A digest of indicators”, OECD-Eurostat Entrepreneurship Indicators Programme, OECD Statistics Directorate. OECD (2009), “Measuring entrepreneurship: a collection of indicators”, 2009 Edition, OECD-Eurostat Entrepreneurship Indicators Programme, OECD Statistics Directorate. Sarmento, E. de Morais and A. Nunes (2012), “Getting smaller: size dynamics of employer enterprises in Portugal” in Bonnet, J. et al. (eds.) The Shift to the Entrepreneurial Society: A Built Economy in Education, Sustainability and Regulation, Edward Elgar. Sarmento, E. de Morais and A. Nunes (2010), “Entrepreneurship performance indicators for active employer enterprises in Portugal”, Temas Económicos nº 9, Ministério da Economia, da Inovação e do Desenvolvimento, Lisboa.