Bank Reserves to Total Deposits Ratio

advertisement

INTRODUCTION TO

ISLAMIC BANKING &

FINANCE

By

Muhammad Ayub

(Former) Head, Islamic Banking, NIBAF

State Bank of Pakistan

Presented at

AlHuda CIBE Workshop at Lahore

1

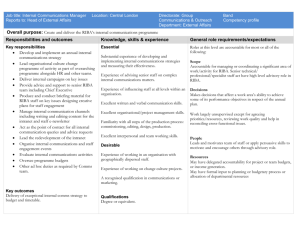

Topics to be Discussed

Why Islamic Banking?

The Prohibition and Concept of Riba

Key Misconceptions – General Myths

Features of an Islamic Bank – Overview

Overview of Islamic finance Modes

Shirkah – Musharakah and Mudarabah

Murabaha

Ijarah

Diminishing Musharakah

2

Islamic Banking?

Banking encompassing Islamic injunctions

To avoid:

Riba –Earning returns from loans and debts or

Selling debt contracts at discount

Gharar – Absolute Risk or Excessive uncertainty

in contracts, Gambling and chance-based

games (Qimar)

General Prohibitions

unethical practices

Shariah Compliance & Prudent Banking

3

Riba Prohibition

All revealed religions

Severe Prohibition in Quran $ Sunnah

Unanimity on Riba Prohibition;

Problem then?

Interpretation

Consensus

4

Quran Guides on Def of Riba

Financial Liability:

Qard (Loan) : to give anything in ownership of other

by way of virtue - same or similar amount of that

thing would be paid back on demand or at the

settled time.

Dayn (Debt) : Incurred by way of trade or rent or any

other credit transaction - ought to be returned at

the settled time without any profit.

Verse 2: 279 guides that whatever is over and above

the principal of loans or debts is Riba.

5

Riba?

All increases in wealth or benefits accruing

to a person without any labour, risk, or

expertise.

One who wishes to earn profit on his

monetary investment must bear the loss or

damage accruing to the business where his

money capital is to be used.

Nature of transaction important.

Trading- Bai- Risk taking, value addition

Leasing – Ijarah - Risk taking, value addition

Exchange transaction – Monetary transactions

Lending – a virtuous act; not a business

Hand to hand exchange of currencies

6

Misconceptions - Myths

Any Return on deposits is Riba;

Any prefixed return – Riba

Islamic banking: cost-less money

available – Approach of Businesses

Repayment of loans not a serious issue

–be waived of

Trade profit similar to interest on loans /

debts

7

Reality

Differentiating:

Trading, loaning and

leasing

Return by way of pricing of goods and their

usufruct needs to be fixed: permissible.

Islamic banking is also a business, It does

not mean availability of cost free money.

Repayment of debts is must.

Time value of money is accepted to the

extent of pricing of goods but not in the

form of conventional opportunity cost

concept.

8

Riba - Unanimity

Banu Thaqif of Taif, not to forego

interest on their receivables; Banu Amr

ibnal Moghirah refused to pay interest;

Referred to the H Prophet, the

Revalation came:

“O you who believe. Fear Allah, and give up the Riba

that remains outstanding if you are (in truth)

believer”. (11:278).

9

Riba - Unanimity (Contd)

“If you do not do so, then be sure of

being at war with Allah and his

Messenger. But, if you repent, then

you have your principal”. (11:279)

10

And if you repent, then you have your

principal. Wrong not, and you shall not be

wronged ”. {without inflicting or receiving

injustice}

11

And fear the day when you shall be brought back

to Allah.

Then shall every soul be paid what it earned

and none shall be dealt with unjustly.

12

Riba versus Bai

Those who protested and argued that lending on

interest was like an act of trade, were

admonished through revelation that while ‘trade’

was permitted, ‘riba’ was forbidden and in loan

transactions they were entitled to their principal

sums only.

13

Some other Myths

Credit and cash market prices of a

commodity must be same

Profit margin on credit sale by banks

resembles Riba.

Sharing vs. Non Sharing instruments:

Permissibility & Priority two

different aspects

Money can be rented like other assets

14

Reality

Profit margin that Islamic banks charge in their

trade operations is permissible if trading principles

given by Islam are properly taken care of.

PLS modes have preference but Debt creating

modes also permissible; Banks can use any modes

keeping in view the Risk Profile of the investors

and nature of business and cash flow of

entrepreneurs.

Money cannot be rented

15

They used to say that it is all equal whether we

increase the price in the beginning of the sale,

or we increase it at the time of maturity. It is

this objection which has been referred to in the

verse by saying “They say that the sale is very

similar to Riba.” (Ibn-Abi-Hatim)

16

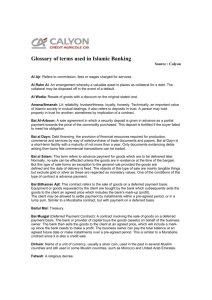

Types of Riba

Riba Al-Fadl - sale transactions,

Quality premium in exchange of low

quality with better quality goods of same

kind; prohibited e.g. dates for dates,

wheat for wheat etc.

Riba Al-Nasia - loan transactions.

Riba Al-Nasia (Riba Al-Ouran) involved in

credit/delay; modern banking transactions

falls under Riba Al-Nasia,

17

Overall Consensus

Council of Islamic Ideology (CII): Preliminary Work

CII Report on Elimination of Interest from the

Economy (June, 1980) – Unanimously Endorsed

Representation of all Muslim sects in Pakistan

Justice Dr. Tanzil-ur-Rahman (J Afzal Cheema)

Mawlana Zafar Ahmad Ansari

Mufti Sayyahuddin Kakakhel

Khawaja Qamruddin Siyalvi

Mawlana Muhammad Taqi Usmani

Mawlana Muhammad Hanif Nadvi

Allama Syed Muhammad Razi

Mr. Khalid M Ishaq

18

Other Prohibitions

Compensation-based restructuring of debts

Selling debt contracts at discount Excessive

uncertainty in contracts (Gharar)

Gambling and chance-based games

Forward foreign exchange transactions

19

Gharar

Excessive uncertainty regarding subject matter

and the price;

Inadequacy and Inaccuracy of Information Uncertainty - lack of adequate value-relevant

information – Transparency and disclosure .

Any bargain in which the subject matter / result of

it is hidden; settlement risk / counterparty risk

involved

Only exception: "Salam” (forward sale with

prepayment)." and “Istisna´a” (order to

manufacture)

Rationale of this exemption.

20

Gambling

Maysir (game of chance) :getting something

too easily or getting a profit without

working for it.

Qimar includes every form of gain or

money, acquisition of which depends purely

on luck and chance.

All Lottery based prize Schemes covered

under the definition of gambling and Maysir.

21

Encouragements

Benevolence

Transparency and disclosures

Purification of income

Comprehensive and universal ethical

approach

Documentation

22

Welfare Economy Framework

Socio-economic Justice

Distributive Justice

Ethics and value system

Functioning of the Market & Role of the State:

Right of ownership, freedom of enterprise, over

seeing role of the State.

Transparency and disclosures

Competitive price mechanism

Creating additional value and sharing gains

Closer linkage between real economy & finance

Society happy both materially and spiritually.

23

Businesses / Modes of Arabs

Trading, Muzara’ah, Musaqat (Gardening with

Shirkah), Services (Ujrah and Ijarah) – The

Main businesses;

Barter and the Money based transactions;

Individual Businesses, with self capital or

arranged on Riba;

Loans, Debts (Credit /Future contracts –

Salam/Salf

Partnership

24

Impact of contracts

Bai: Definite transfer of ownership of goods against

payment of price-spot, delayed and forward; Profit

permissible

Ijarah (leasing): Transfer of usufruct of goods. Any

thing which cannot be used without consuming its

corpus, or whose corpus changes its form in the

process of its use, cannot be leased out like money,

edibles, fuel, etc. Rental permissible

Riba: Exchange transactions involving temporary

transfer of ownership of assets against payment. Any

return prohibited.

Qadr Hassan / Tabarrue: Temporary transfer of

ownership of goods/assets free of any payment;

25

What Islamic Banking?

Banking encompassing Islamic injunctions

To avoid:

Riba –Earning returns from a loan contract or

Selling debt contracts at discount

Gharar – Absolute Risk or Excessive uncertainty in

contracts, Gambling and chance-based games

(Qimar)

General Prohibitions

unethical practices

Shariah Compliance & Prudent Banking

Achieving the goals and objectives of an Islamic

economy.

26

A Paradigm Shift!

Conventional

Borrowing on

interest

Lending on

interest

Money – the

Subject matter

Services against

wages or

commission

Islamic

Trading- Shariah

Rules

Leasing

Doing other real

sector businesses

through sole

proprietorship or

Shirkah

Services against

wages or

commission

27

Principles of Islamic Finance

Lending a virtuous act – Not a business.

Prohibition of Riba and Gharar; permission of

trading.

All gains to principal not prohibited.

Deciding Factor: nature of transaction.

Profit to be earned by sharing risk and

reward of ownership through pricing of

goods, services or benefits.

Time has value that can be discounted only

through price; not in the form of interest,

sometimes negative value as well.

28

Profit linked with Liability

Ownership cannot be separated from the risk

of its loss

Al Kharaj Bil daman

The above implies that entitlement to return

from an asset is intrinsically linked to the

liability of loss of that asset

What that implies for the attitude towards

risk?

What that implies for time value of money?

in loans

in deferred sales

29

Cardinal Principles

(Contd)

Ability to cause ‘value addition’.

Differentiating: Trading, loaning and leasing

Ownership Transfer in: Sale of assets, Loans and

Leasing;

Any thing which cannot be used without consuming

its corpus, cannot be leased out like money, edibles,

fuel, etc.

Taking rent on leasing of asset permissible while rent

on loan is prohibited.

Repayment of loan- Must.

Husan al qada: Repaying a loan in excess of the

principal.

Debt contracts cannot be sold at discount.

30

Cardinal principles

Risk and return / rights and liabilities must go

side-by-side;

The subject of exchange has to be valid and

should not involve Gharar;

Notional assets stand no where in Islamic

finance;

Non-existing assets can become the subject

matter of exchange with the conditions

applicable to Salam;

The main objective of exchange transactions

has to be completion of the exchange process

from the both sides.

31

Alternative Financing Principles

Participation and sharing principle

Deferred trading principle

Interest free loans

Combination of contracts

32

Wealth and trading rules

Forms of

Wealth (Mal)

Goods, durable

assets, shares

of companies

Classification

Non-debts

Trading rule

Market prices

Services

Pooled assets

are traded in

accordance

with the rule of

the dominant

assets

Usufructs

Money, gold

and silver

Debts

Money

Pure debts

Sarf

Hawala al

dayn

33

Exchange Rules

Different for different contracts and types of wealth:

Goods, Durable assets, Shares representing pool

of assets - Market based pricing

Gold silver or any monetary units (Athman) –

Rules of Bai al Sarf

Usufruct and services (Leasing/ Services)

Loans/Debts – Repayment or Assignment of the

same amount.

Well-Known Injunction on exchange of six

commodities: Gold, Silver, Wheat, Barley, Dates and

Salt.

34

Exchange Rules (Nawawi)

Illah (Effective Cause of prohibition): Unit of value

and Edibility

When underlying illah is different, short fall/excess

and delay both are permissible, e.g. sale of gold for

wheat.

When commodities of exchange are similar, excess

and delay both are prohibited, e.g. gold for gold or

wheat for wheat, Rupee for Rupee, etc.

When commodities of exchange are heterogeneous

but the illah is same, as in the case of gold for silver

(medium of exchange) or wheat for rice (edibility),

then excess/deficiency is allowed, but delay in

exchange is not allowed.

35

Exchange of Currencies

Contd)

Special rules for exchange of monetary

values.

Currency Futures: Some scholars forbid them

while others distinguish between the two

cases:

First, where one currency is delivered on spot and

the other is delayed - forbidden.

Second, permitted, involves the future exchange of

both currencies at the previously agreed rate.

36

Banking - A Business

Banking or Benevolence ?

Principle of Islamic banking business: Sharing of

profit and loss on post facto basis arising from:

i. (Deferred) Trading– profit margin for the

seller

ii. Rentals on leased assets

iii. PLS

iv. Combination of contracts

Return free (loans)

37

Main Financial Contracts

A. Debt creating Modes (Low Risk Category)

1. Qard Al-Hasan (interest-free loan)

2. Bai Muajjal (Price deferred sale)

3. Murabaha and Musawama

4. Salam (Commodity sale)

5. Istisna´a ((Order to Manufacture)

B. Semi-debt Modes

1. Ijara

C. Sharing or Non-debt Modes (Full Risk

Category)

1. Musharaka (Close to Venture Capital)

2. Specific Purpose Mudaraba

3. General Purpose Mudaraba

38

conditions for Valid sale

General Rule:

Commodity should have come into

existence.

It should be in ownership of the seller.

The commodity should also be under

physical or constructive possession of

the seller.

Two exceptions to this rule- Salam & Istisna´a

39

Contract of Valid Bai

Valid Bai

Price

Thaman

Subject Matter

(Mabe'e)

Delivery/Conveyance

(Qabza)

Known

(Maloom)

Existent/

existable

Physical

(Haqiqi)

Certain

Muta'ayyan

Valid for

Ownership/

Possession

Constructive

(Hukmi)

Ownership/

risk of

seller

Valuable

Useable

(not prohibited

in Shariah)

40

Principles of Credit Sale

Installments Sale permissible, even if the deferred

price exceeds the spot price.

Deferred prices can vary so long as price not

finalised.

Sale cannot take place until the parties agree to a

particular price & mode of payment.

Not permissible to fix the spot price on cash basis,

then to charge interest expressly tied with different

periods.

Commercial

papers

are

lawful

types

of

authentication of a debt by putting it down in writing;

- Treated by Shariah near to mandatory.

41

Two main prohibited Sales

Bai al inah – Buy-back arrangement

Creditor purchasing assets from debtor

on cash and selling back to him on credit

• Bai al Dayn - sale of debt

• Trading of debt securities

• On face value- Hawalah - Permissible

• On premium or discount – Not

permissible

42

Rules in Murabaha

Basic concept: Sale on mutually agreed profit margin

on the known cost of goods; payment of sale price is

deferred.

Real, tangible goods to be traded and not papers of

debt or credit documents.

Murabaha cannot be used as mode in case no

commodity is purchased by the client.

Buy-back arrangement: not allowed.

MUAJJAL; Credit price may include margin of mark-up,

taking into consideration the deferred payment. As a

debt, no return can be charged on the amount of

43

Note/Bill.

MURABAHA

Contd

Seller having a good title

physical / constructive possession.

Defaulter: different punishments, penalty for

charity.

Solatium through court (out of penalty).

Client as Agent to the Bank;

Better to have a third party as agent;

Roll-over.

Asset price Risk or commodity risk ( client

might not take delivery);

Market risk,

Credit risk,

Reputational Risk

44

Rules in Musawamah

A general kind of sale: Price bargained without any

reference to the price paid or cost incurred.

Seller not obliged to reveal his cost.

Different from Murabaha in pricing formula only.

Musawamah can be used for big single deals.

45

Salam and Parallel Contracts

(Future Sale)

Prepayment of price in full for goods to be delivered in

future.

Allowed by Holy Prophet (SAW) himself to meet

farmers’ money need.

Banks will receive contracted commodities, not money.

Parallel Salam: a bank can sell a commodity purchased

through Salam for even the same date of delivery or the

quantity;

As long as the two contracts are not made

conditional on each other.

46

Purpose of Salam

To meet the need of farmers who need money

to grow their crops and to look after their family

up to the time of harvest.

To finance someone who is in need to grow something

or acquire something for further sale.

To meet the need of traders for import and

export business.

The buyer also enjoys a lower purchase price, since he

pays in advance.

Acceptance of Time. Value of Money through pricing of

goods

47

Salam Conditions

Fungible – homogeneous goods

not where delivery has to be simultaneous,

e.g. Gold, silver or currencies.

Date and place of delivery must be specified

in the contract.

In case of a number of commodities, the

amount and delivery period should be

separately fixed.

48

Salam Conditions Contd…

The bank can sell the Salam Commodity

through a parallel contract of Salam for the

same date of delivery.

For a parallel Salam, the two contracts should

be independent and separately enforceable.

Bank can also obtain a unilateral ‘promise to

purchase’ from a third party.

Agency

To sell anywhere in the market

49

Istisna’a (Order to Manufacture)

Istisna’a, an agreement for order to manufacture,

culminating into a sale at an agreed price;

The things to be manufactured must be known and

specified to the extent of removing any ignorance

or lack of knowledge of its kind, type, quality, and

quantity.

Price be known in advance that can be readjusted

only by mutual consent of the parties.

50

Istisna’a

(Contd)

Prepayment not necessary in Istisna’a

Not

necessary

for

seller

to

manufacture the commodity himself

Parallel Istisna’a contract; without any

condition attached to the original

Istisna’a contract.

51

Salam, Istisna Differentiated

ISTISNA’

The subject on which

transaction of Istisna’

is based, is always a

thing which needs to

be manufactured.

Price must be fixed,

but need not to be

paid in advance

SALAM

Subject can be

anything; Agri

produce,

Manufactured goods

all units of which are

normally of the same

.

Price has to be paid

in full in advance

52

Salam, Istisna Differentiated

ISTISNA’

Time of Delivery

does not have to be

fixed ; can be

delivered before the

settled time.

The contract can be

cancelled before the

manufacturer starts

working.

SALAM

Time of delivery is an

essential part of the

sale

The contract cannot

be cancelled

unilaterally.

53

Distinction of Istisna

Penalty on default

Shart-e-Jazai

54

Ijarah Rules

Subject Matter:

The corpus of the leased asset should exist till the

expiry of lease period;

The corpus of the leased asset should remain in

the ownership of the lessor during the whole

period of lease; in case of Shirkah pro-rata

ownership.

The lessor must accept responsibility of any

defect in leased asset (without negligence of the

lessee) which hinders the intended use of asset.

Sale – Separate and independent contract

55

Flexibility in Ijarah

Fixed Vs. variable / floating return

Time of execution of the contract

Potential in Sukuk Issue

56

Shirkah - Partnership

Commingling by two or more persons

either their money or work or obligations

to earn a profit or a yield or appreciation in

value and to share the loss if any

according

to

their

proportionate

ownership.

Musharakah, Mudarabah, Diminishing

Musharakah

57

Types of Partnership

Musharakah: All partners provide funds not

necessary equally, and all have right to wok;

Shirkatulmilk: Partnership in Ownership

Automatic –compulsory

Arranged - Optional

Shirkatulaqd: General / Commercial

partnership – for joint business

Musharakah – general contractual

partnership

One party provides capital and the other

management

58

Profit / Loss Sharing

Profit distribution: as per agreed ratio;

Loss: in proportion to the investment of

each party.

Profit allocation: in percentages of earning

(profit) and not a sum of money or a percentage

of the capital or investment.

No guarantee of the capital

Loss?

59

Structures of Musharakah

Permanent Musharakah: partners can sell - as in

case of Shares of Joint Stock Companies.

Temporary (Redeemable) Musharaka: for limited

time period, e.g. PTCs or Musharakah based

TFCs; After agreed time period(s),

Diminishing Musharakah: one partner promises to

buy the share of the other partner gradually until

the title to the property is completely transferred to

him.

60

Reference Rates

Reference rates needed for executing and pricing the

contracts.

Different scales

contracts.

for

different

kinds

of

financial

For Conventional finance: Only one reference rate

(interest rate),

Islamic finance: debt/semi-debt contracts and non-debt

(equity) contracts,

Therefore, two reference scales are needed:

• Price mark up/rent reference scale

• Share ratio reference scale, through the Central

Bank Mudaraba ratio or Interbank Mudaraba ratio.

61

Challenges

Parallel Functioning of the two systems – the

greatest challenge

Creating Awareness

Catering to the education and training needs.

Development of Shariah compliant financial

instruments - for SLR, Govt. Financing.

Changes in legal and taxation structure.

Responsibility of advising, coordination and

leadership by any institution/authority for the

transformation process.

Commitment at all levels.

Ultimate Objective: To establish banks that are

Shari’ah compliant, enjoy depositors’ confidence,

and are efficient and stable!

62

Key Areas in Future Direction

Justifiable profit distribution mechanism

Focusing asset management

Potential scope of Shari’ah complaint

financial engineering

Financial stability

Shari’ah complaint risk management tools

Corporate governance, transparency and

disclosures requirements

63

Thanks

64