Chapter 8

advertisement

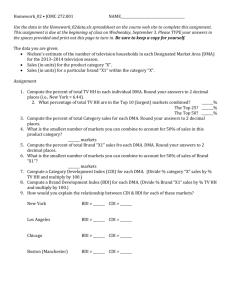

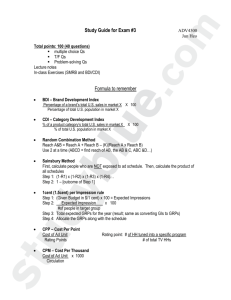

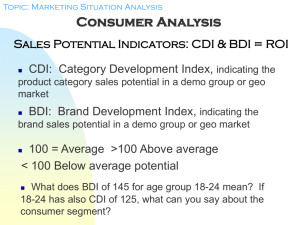

Chapter 8 Media Planning and Buying 1 Learning Objectives Learn about major decisions involved in media planning. Understand fundamental terms of media planning. Learn how to calculate media measures. Learn to use secondary data frequently used in media planning. 2 Media Planning “I know half the money I spend On advertising is wasted, but I Can never find out which half.” (JW) What is media planning? --The process of designing a course of action that shows how advertising time and space will be used to contribute to the achievement of marketing objectives. 3 Problems in Media Planning Insufficient information Inconsistent terminologies Time pressures Difficulty measuring effectiveness Staging a Media Plan A Media Plan is a Written Document that Summarizes the Recommended Objectives, Strategies, and Tactics Pertinent to the Placement of a Company’s Advertising Messages. Background and Situation Analysis Discusses Media Options, Opportunities and Target Audience. Media Objectives & Aperture Opportunities Goal or Task that Media Can Accomplish Based on Aperture Opportunities. Strategy: Selection of Media Explains Why a Single Medium or Set of Media is Appropriate. Flow Chart Scheduling & Budgeting Media Buyers Convert Objectives and Select, Negotiate, & Contract for Media Space. 5 Consumer Attitudes Toward Media (abbreviated) Authoritative Influential 2% 3% 9% 5% 3% 11% 20% 81% 57% 9% Television Newspapers Radio Magazines Don’t know Changes in Percentage of Network Commercial by Length Other 100% 60 80% 30 60% 15 40% 20% 0% 1965 1975 1985 1987 1988 1990 1992 7 Setting Media Objectives The Basic Goals That Direct Media Strategy Typically Focus on: Whom to Advertise To Which Geographic Areas to Cover When to Advertise What the Duration of the Campaign Should Be What the Size or Length of the Ad Should Be 8 Specifying Media Objectives 1. What proportion of the target audience should be exposed to our message “Reach” 2. How often should the target audience be exposed to our message? “Frequency” -- “Motivational frequency” -- “Effective reach and frequency” 9 Threshold Frequency a. S-shaped response curve Response Response Advertising Response Curves Frequency b. Convex response curve When high frequency is required A new brand A smaller, less known brand A low level of brand loyalty Relatively short purchase and use cycle With less involved (motivated and capable) target audiences With a great deal of clutter to break through (Joseph Ostrow at Y & R, JAR, 11 1984) Specifying Media Objectives (cont’d) 3. How much total advertising is necessary to achieve the reach and frequency objective? “Weight” (GRPs/TRPs, Gross Impressions) - FCB research: no awareness with <1000 GRPs 4. How to schedule the advertising campaign? “Scheduling” or “Continuity” - Continuous scheduling - Pulsing - Fighting 12 Three Methods of Media Scheduling Continuity Flighting Pulsing Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 13 Specifying Media Objectives (cont’d) 5. What is the least expensive way to accomplish media objectives? “Cost”: Absolute and relative costs - CPM or CPP: Measures cost efficiency 6. Other considerations -- Geographic coverage -- Qualitative media environment -- Recall research * Confusing terms 14 EXH 9-11 15 How to Use Reach and Coverage Use Reach To express a whole number or percentage of different people actually exposed only once to a media vehicle to combination of vehicles. Example: Television program X reaches 9 million men aged 18-34 within a four-week period. Example: Magazine Y has a reach of 25 percent of men aged 18-34 with an average issue. 16 How to Use Reach and Coverage Use Coverage To express the potential audience of a broadcast medium or the actual audience of a print medium exposed only once. Example: A network television program may have a coverage of 95 percent of TV homes in the U.S. Example: Magazine Y has 25 percent coverage of men aged 18-34. (Means same as reach.) 17 Some Basic Terms Used in Media Planning •Gross impressions: the sum of the audience of all media vehicles used within a designated time period –Jeopardy: 3,270,000 x 4 messages =13,080,000 –People: 8,620,000 x 2 messages = 17,240,000 –Time: 1,700,000 x 2 messages = 3,400,000 –---> 33,720,000 gross impressions 18 Relative Cost: CPM = Cost of ad space X 1,000 /number of readers Number of readers: 4.0 MM Newsweek Per-page cost: $144,000 Number of readers: 3.1 MM CPM: $156,000X1,000/ CPM: $144,000X1,000/ Time Per-page cost: $156,000 4.0 MM =$39.00 3.1 MM =$46.45 19 Relative Cost:CPRP = Cost of ad time/Program rating Drew Carey Cost per spot ad: $3,500 Survivor Cost per spot ad: $4,000 Rating: 11 Rating: 15 CPRP: $3,500/11 CPRP: $4,000/15 =$318.18 =$266.64 20 Super Bowl Options Scenario 1 ($891,000; one 30-second spot on one primetime show each night of the week) Scenario 2 ($895,000; a 30-second prime-time “roadblock” on Sunday and Monday nights) Monday: Murphy Brown (CBS) Tuesday: Coach (ABC) Wednesday: 48 Hours (CBS) Thursday: Wings (NBC) Friday: Picker Fences (CBS) Saturday: The Commish (ABC) Sunday: CBS Sunday Night Movie Sunday: ABC Sunday Night Movie CBS Sunday Night Movie NBC Sunday Night Movie Married …With Children (Fox) Monday: Day One (ABC) Dave’s World (CBS) Blossom (NBC) Fox Movie Comparison with Super Bowl XXVШ Rating point: +64% Reach: +25% Comparison with Super Bowl XXVШ Ratings points: +48% Reach: +6% Source: N. W. Ayer (1994) Notes: Ratings points/reach comparisons are based on adults 18-49. Reach is based on actual delivery of each schedule from the week of November 15, 1993. Nielsen’s cumulative audience data were used for this analysis. Costs were based on October Media Watch figures. A single Super Bowl commercial (30 seconds) cost $900,000 in 1994. 21 Some basic terms used in media planning (cont’d) GRPs: the sum of the total exposure potential of a series of media vehicles as a % of the audience population -- GRPs = Reach x Average frequency TRPs: ….. As a % of the target audience population 22 U.S. Main Media Volume (in percentage), Analyzed by Media Groups Total Newspaper Magazine Television Radio Outdoor 1978 100.0 43.5 14.0 30.8 10.1 1.6 1997 100.0 37.6 8.9 40.1 12.1 1.3 SOURCE: reprinted with permission from Advertising Age, various dates. Copyright Crain Communications Inc., 1998. 23 Using Electronic Media Types of Television Advertising Network Advertising Spot Advertising Syndication -Sponsorship -Paticipation -National and Local - Off-network syndication v. first-run syndication -Straight cash v. barter system 24 Using Electronic Media Rating/Share/HUTS CDI and BDI 25 Rating Total HHs tuned to a program Total HHs with TV set at home 100 Share Total HHs tuned to a program Total HHs with TV set on 100 26 HUT = Total HHs with TV set on Total HHs with TV set at home ×100 Rating = Share ×HUT 27 CDI and BDI The Brand Development Index (BDI) helps marketers factor the rate of product usage by geographic area into the decision process. BDI = percentage of brand to total U.S. sales in the market Percentage of total U.S. population in market ×100 The Category Development Index (CDI) is computed in the same manner as the BDI, except it uses information regarding the product category (as opposed to the brand) in the numerator. CDI = Percentage of product category total sales in market Percentage of total U.S. population in market ×100 28 Using CDI and BDI to determine market potential CDI = Percentage of product category sales in Utah/Idaho Percentage of total U.S. population in Utah/Idaho ×100 2% 100 1% 200 BDI = percentage of total brand sales in Utah/Idaho Percentage of total U.S. population in Utah/Idaho ×100 1 .2 % 100 1% 120 29 Using BDI and CDI Indexes v High BDI Low BDI High CDI High market share Good market potential Low market share Good market potential Low CDI High market share Monitor for sales decline Low market share Poor market potential High BDI and high CDI This market usually represents good sales potential for both the product category and the brand. High BDI and low CDI The category is not selling well, but the brand is; probably a good market to advertise in but should be monitored for declining sales. Low BDI and high CDI The product category shows high potential but the brand is not doing well; the reasons should be determined. Low BDI and low CDI Both the product category and the brand are doing poorly; not likely to be a good place for advertising. 30 Using Printing Media Newspaper rate -- SAUs (Standard Advertising Unites) in 1984 -- Flat rate v. open rate -- Run-of-paper v. preferred position rate -- Combination rate: several nps as a group -- National advertisers pay much more for newspaper space 31 Using Print Media Magazine circulation Primary circulation (in-home readers): Subscription + news stand (a single copy circul.) A basis for rate structure Secondary circulation (out-of-home readers) Paid circulation v. controlled circulation Guaranteed circulation v. verified circulation ABC (Audit Bureau of Circulations) Total audience=readers per copy x circulation of an average issue 32 SMRB/MRI Reading Base: Female Homemakers Top Row: There are 86,474,000 female homemakers in the U.S. Column A: 77,418,000 female homemakers use breakfast cereals. Column B: All female homemakers using breakfast cereals is equal to 100% (i.e., base). Column C: 89.5% of the total female homemakers use breakfast cereals . 77,418,000 100 89.5% 86,474,000 33 Second Row: There are 3,925,000 female homemakers who read the magazine, Money. Column A: 3,448,000 readers of Money use breakfast cereals. Column B: 4.5% of all users of breakfast cereals read Money. 3,448,000 77,418,000 100 4.5% Column C: 87.8% of Money readers are users of breakfast cereals 3,448,000 3,925,000 100 87.8% Column D: Money readers are 2% less likely to use breakfast cereals than all U.S. female homemakers . 87.8 100 98 89.5 34 Review Learn about major decisions involved in media planning. Understand fundamental terms of media planning. Learn how to calculate media measures. Learn to use secondary data frequently used in media planning. 35