Margin Management Policy

advertisement

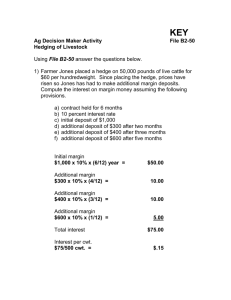

Securing Forward Profit Margins The Margin Management Policy 1 Margin Management Policy What is a Margin Management Policy? A Margin Management Policy states the company’s views regarding transactions in cash (physical) contracts, futures contracts and option contracts to protect profitability in a forward time period. Benefits of a Margin Management Policy include: • Promotes discipline throughout the organization • Allows for Executive Management oversight and review • Delegates administrative duties and management decisions • Defines responsibilities and accountabilities • Provides direction to everyone involved in margin management Margin Management Policy The Margin Management Committee The committee may consist of one or two individuals, it may involve several individuals depending on the size/structure of the company. Their function includes: • Writing, implementing, and periodically reviewing the Margin Management Policy Who should or could be included? • Executive Management • Finance/Treasury • Accounting • Purchasing (Feed/Input Expenses, Marketing (Livestock/Crop Sales) Basic Components of a Margin Management Policy 1. Approve the specific commodities and quantities to be hedged example: Hogs, Cattle (# of head), Milk (lbs. of production), Soy meal (tons consumed), Corn (bushels consumed or produced), etc… 2. Identify Margin Risk in conjunction with time example: We will monitor margin risk looking forward 4 quarters or one crop year beyond the current period. 3. Determine responsibilities example: Identify who or what team is responsible for each step of the process and list those responsibilities and authorities. 4. List approved types of Margin Management Strategies example: Flat Price, Basis, Forward, Futures, Options…Identifying limits in conjunction with time. Basic Components of a Margin Management Policy 5. Identify forms of strategy execution example: Identify who or what team can execute approved strategies and what entities the strategies can be executed with…address counter-party risk 6. Establish Internal Reporting Procedures Who should be informed and kept informed; How should they be informed? 7. Establish on-going review procedures Daily review, weekly review, monthly review. 8. Establish accounting procedures Follow accepted practices. 5 Margin Management Policy – Sample Hog Farm Mission Statement: Our objective is to actively monitor and manage forward profit margins in an effort to reduce or eliminate the effect of adverse commodity prices on our hog farm’s profitability. Overall Goal: To identify an acceptable range of margin or margin percentiles to either protect above-average historical margins, and/or reduce the effect of adverse market conditions. Approved Commodities: Corn, Soybean Meal, Hogs Identification of Range of Margin and/or Margin Percentiles: The margin management team will utilize several resources to identify margin opportunities including internal staff and outside advisors. A margin model will be employed to project and rank forward profit margin opportunities from a historical perspective. These historical margin percentiles will form the basis of our plan to establish coverage levels based upon an acceptable range. Sample Margin Management Plan Historical Margin Percentile Incremental Coverage Cumulative Coverage 70 10% 10% 75 15% 25% 80 15% 40% 85 15% 55% 90 15% 70% 95 15% 85% 100 10% 95% Margin Management Policy – Sample Responsible Parties: The Margin Management Team is responsible for monitoring forward profit margins and has the authority to make margin management commitments for up to 100% of purchases/sales in the current quarter, 75% in the next quarter, 50% in the following quarter, and 25% in any deferred quarter. The team will report and recommend price management strategies to the owners and report positions to the accounting department and lender if required. 8 Margin Management Policy – Sample Internal Reporting Procedures: The Margin Management Team will maintain a position record reflecting the net long and short positions of the company. The position report will reflect both feed purchases and hog sales in the cash market as well as any open derivative positions on the exchange. The report will be forwarded to the owners upon completion. The MM Team will notify the owners if a margin management decision is executed. The MM Team will provide the owners with recommendations for margin management strategies for time periods and volumes beyond the MM Team’s authority for their consideration. The Team will also make sure to notify the accounting department (and/or lender) of all transactions (if required). Accounting Procedures We will follow commonly accepted practices of accounting including: the allocation of futures and options gains or losses to the appropriate physical market transactions. Company auditors will be asked to provide guidelines. Margin Management Best Practices and Notes Execute a Margin Management Policy – determine contracting alternatives to use in both the cash and futures market, time horizon, budget, and responsibilities across the organization. Establish a plan to both execute and offset positions – initiate protection based on margin percentile, net return, etc. as well as remove positions against physical marketings or transactions in the cash market. Determine in advance potential adjustments to initial hedge positions, and under what circumstances strategies should be modified (margin calls, exhausting range of protection, change in market conditions, etc…) Schedule a periodic reconciliation timetable (monthly, quarterly, etc.) to recapitalize operating line with hedge gains or hedge line with revenue from cash sales against losses on hedging transactions. Periodically review practices to measure effectiveness of margin management program and to make sure that all available tools are being used appropriately to protect profitability of operation. Practical Applications Hedging Hogs: A Margin Management Case Study Using Futures Contracts 11 Practical Applications A hog producer in Southern Minnesota is planning on marketing 22,248 hogs for 3rd quarter 2012 or roughly 4,620,000 pounds of pork. The producer’s open market margin for 3rd quarter 2012 marketings on September 16, 2011 is $8.18/cwt. (assuming zero basis), just at the 70th percentile over the last 10 years and decides to execute hedges to lock in that level on 25% of production, keeping with his policy. The producer decides to execute three hedges: 1. A long futures position representing 60,000 bushels in September 2012 corn to protect the risk of prices rising between now and the time when the corn is purchased from the feed mill. 2. A long futures position representing 400 tons in September 2012 soybean meal to protect the risk of prices rising between now and the time when the meal is purchased. 3. A short futures position in July Lean Hog futures, August Lean Hog futures, and October Lean Hog futures to protect the risk of prices declining between now and the time when the hogs are sold to the packer. 12 Practical Applications On September 16, 2011 September 2012 Corn Futures are trading at $6.63/bushel. The operation executes its hedge and buys 12 September 2012 Corn futures which represents 60,000 bushels. On September 16, 2011 March Soybean Meal Futures are trading at $354.10/ton and the operation executes its hedge and buys 4 September 2012 Meal futures which represents 400 tons. On September 16, 2011 July Lean Hog futures are trading at $97.35/cwt, August Lean Hog futures are trading at $96.40/cwt, and October Lean Hog futures are trading at $86.25/cwt. The operation executes its hedge and sells 5 July Lean Hog futures, 10 August Lean Hog futures and 14 October Lean Hog Futures which represents 5,562 animals or 25% of total 3rd quarter production. Upon execution of these hedges, the operation locks in a positive margin of $8.177/cwt (assuming a zero basis for the period). 13 Practical Applications 14 Practical Applications On September 16, 2011 September 2012 Corn Futures @ $6.63 15 Practical Applications On September 16, 2011 September 2012 Soybean Meal Futures @ $354.10 16 Practical Applications On September 16, 2011 July 2012 Lean Hog Futures @ $97.35 17 Practical Applications On September 16, 2011 August 2012 Lean Hog Futures @ $96.40 18 Practical Applications On September 16, 2011 October 2012 Lean Hog Futures @ $86.25 19 Practical Applications Margin Reconciliation: Corn: $6.63/bu x 60,000 bu. Meal: $354.10/ton x 400 tons Other Feed Cost: Non-Feed Cost: Total Expense: -$ -$ -$ -$ -$ July Hogs: August Hogs: October Hogs: Total Revenue: $ 194,700.00 $ 385,600.00 $ 483,000.00 $1,063,300.00 $97.35/cwt x 200,000 lbs. $96.40/cwt x 400,000 lbs. $86.25/cwt x 560,000 lbs. 397,800.00 141,640.00 100,000.00 331,579.00 971,019.00 25% of 3rd Quarter Marketing: $ 92,281.00 Profit Per Animal: $ 16.59 Profit Margin: $ 8.177/cwt 20 Practical Applications The producer’s open market margin for 3rd quarter 2012 marketings on September 23, 2011 is $10.49/cwt. (assuming zero basis), just at the 80th percentile over the last 10 years and decides to execute hedges to lock in that level on 25% of production, keeping with his policy. The producer decides to execute three hedges: 1. A long futures position representing 60,000 bushels in September 2012 corn to protect the risk of prices rising between now and the time when the corn is purchased from the feed mill. 2. A long futures position representing 400 tons in September 2012 soybean meal to protect the risk of prices rising between now and the time when the meal is purchased. 3. A short futures position in July Lean Hog futures, August Lean Hog futures, and October Lean Hog futures to protect the risk of prices declining between now and the time when the hogs are sold to the packer. 21 Practical Applications On September 23, 2011 September 2012 Corn Futures are trading at $6.08 ½/bushel. The operation executes its hedge and buys 12 September 2012 Corn futures which represents 60,000 bushels. On September 23, 2011 March Soybean Meal Futures are trading at $334.80/ton and the operation executes its hedge and buys 4 September 2012 Meal futures which represents 400 tons. On September 23, 2011 July Lean Hog futures are trading at $96.90/cwt, August Lean Hog futures are trading at $95.45/cwt, and October Lean Hog futures are trading at $84.62/cwt. The operation executes its hedge and sells 5 July Lean Hog futures, 10 August Lean Hog futures and 14 October Lean Hog Futures which represents 5,562 animals or 25% of total 3rd quarter production. Upon execution of these hedges, the operation locks in a positive margin of $10.49/cwt (assuming a zero basis for the period). 22 Practical Applications 23 Practical Applications Margin Reconciliation: Corn: $6.08 ½/bu x 60,000 bu. Meal: $334.80/ton x 400 tons Other Feed Cost: Non-Feed Cost: Total Expense: -$ -$ -$ -$ -$ July Hogs: August Hogs: October Hogs: Total Revenue: $ 193,800.00 $ 381,800.00 $ 473,900.00 $1,049,500.00 $96.90/cwt x 200,000 lbs. $95.45/cwt x 400,000 lbs. $84.62/cwt x 560,000 lbs. 25% of 3rd Quarter Marketing: 365,100.00 133,920.00 100,000.00 331,579.00 930,599.00 $ 118,901.00 Profit Per Animal: $ 21.38 Profit Margin: $ 10.532/cwt 24 Practical Applications The producer’s open market margin for 3rd quarter 2012 marketings on November 18, 2011 is $13.33/cwt. (assuming zero basis), just at the 90th percentile over the last 10 years and decides to execute hedges to lock in that level on 25% of production, keeping with his hedge policy. The producer decides to execute three hedges: 1. A long futures position representing 60,000 bushels in September 2012 corn to protect the risk of prices rising between now and the time when the corn is purchased from the feed mill. 2. A long futures position representing 400 tons in September 2012 soybean meal to protect the risk of prices rising between now and the time when the meal is purchased. 3. A short futures position in July Lean Hog futures, August Lean Hog futures, and October Lean Hog futures to protect the risk of prices declining between now and the time when the hogs are sold to the packer. 25 Practical Applications On November 18, 2011 September 2012 Corn Futures are trading at $5.83/bushel. The operation executes its hedge and buys 12 September 2012 Corn futures which represents 60,000 bushels. On November 18, 2011 March Soybean Meal Futures are trading at $311.60/ton and the operation executes its hedge and buys 4 September 2012 Meal futures which represents 400 tons. On November 18, 2011 July Lean Hog futures are trading at $98.90/cwt, August Lean Hog futures are trading at $97.45/cwt, and October Lean Hog futures are trading at $85.80/cwt. The operation executes its hedge and sells 5 July Lean Hog futures, 10 August Lean Hog futures and 14 October Lean Hog Futures which represents 5,562 animals or 25% of total 3rd quarter production. Upon execution of these hedges, the operation locks in a positive margin of $13.33/cwt (assuming a zero basis for the period). 26 Practical Applications 27 Practical Applications Margin Reconciliation: Corn: $5.83/bu x 60,000 bu. Meal: $311.60/ton x 400 tons Other Feed Cost: Non-Feed Cost: Total Expense: -$ -$ -$ -$ -$ July Hogs: August Hogs: October Hogs: Total Revenue: $ 197,800.00 $ 389,800.00 $ 480,480.00 $1,068,080.00 $98.90/cwt x 200,000 lbs. $97.45/cwt x 400,000 lbs. $85.80/cwt x 560,000 lbs. 25% of 3rd Quarter Marketing: 349,800.00 124,640.00 100,000.00 331,579.00 906,019.00 $ 162,061.00 Profit Per Animal: $ 27.15 Profit Margin: $ 13.337/cwt 28 Practical Applications The producer’s open market margin for 3rd quarter 2012 marketings on November 21, 2011 is $15.58/cwt. (assuming zero basis), at the 95th percentile over the last 10 years and decides to execute hedges to lock in that level on the remaining 25% of production, keeping with his hedge policy. The producer decides to execute three hedges: 1. A long futures position representing 60,000 bushels in September 2012 corn to protect the risk of prices rising between now and the time when the corn is purchased from the feed mill. 2. A long futures position representing 400 tons in September 2012 soybean meal to protect the risk of prices rising between now and the time when the meal is purchased. 3. A short futures position in July Lean Hog futures, August Lean Hog futures, and October Lean Hog futures to protect the risk of prices declining between now and the time when the hogs are sold to the packer. 29 Practical Applications On November 21, 2011 September 2012 Corn Futures are trading at $5.69/bushel. The operation executes its hedge and buys 12 September 2012 Corn futures which represents 60,000 bushels. On November 21, 2011 September Soybean Meal Futures are trading at $302.70/ton and the operation executes its hedge and buys 4 September 2012 Meal futures which represents 400 tons. On November 21, 2011 July Lean Hog futures are trading at $99.30/cwt, August Lean Hog futures are trading at $97.92/cwt, and October Lean Hog futures are trading at $86.00/cwt. The operation executes its hedge and sells 5 July Lean Hog futures, 10 August Lean Hog futures and 14 October Lean Hog Futures which represents 5,562 animals or 25% of total 3rd quarter production. Upon execution of these hedges, the operation locks in a positive margin of $15.58/cwt (assuming a zero basis for the period). 30 Practical Applications 31 Practical Applications Margin Reconciliation: Corn: $5.69/bu x 60,000 bu. Meal: $302.70/ton x 400 tons Other Feed Cost: Non-Feed Cost: Total Expense: -$ -$ -$ -$ -$ July Hogs: August Hogs: October Hogs: Total Revenue: $ 198,600.00 $ 391,700.00 $ 481,600.00 $1,071,900.00 $99.30/cwt x 200,000 lbs. $97.92/cwt x 400,000 lbs. $86.00/cwt x 560,000 lbs. 25% of 3rd Quarter Marketing: 341,400.00 121,080.00 100,000.00 331,579.00 894,059.00 $ 177,841.00 Profit Per Animal: $ 31.97 Profit Margin: $ 15.331/cwt 32 Practical Applications FUTURES PERFORMANCE BOND CORN ($5.69/bu on November 21, 2011): September 16: Bought 12 CU $6.63 September 23: Bought 12 CU $6.085 November 18: Bought 12 CU $5.83 November 21: Bought 12 CU $5.69 Total Futures Maintenance Requirement: Total Futures Initial Requirement: $ (56,400.00) $ (23,700.00) $ (8,400.00) $ 0.00 $ (88,500.00) $ (96,000.00) FUTURES PERFORMANCE BOND MEAL ($302.70/ton on November 21, 2011): September 16: Bought 4 SMU $354.10 September 23: Bought 4 SMU $334.80 November 18: Bought 4 SMU $311.60 November 21: Bought 4 SMU $302.70 Total Futures Maintenance Requirement: Total Futures Initial Requirement: $ (20,560.00) $ (12,840.00) $ (3,560.00) $ 0.00 $ (36,960.00) $ (32,000.00) Total Performance Bond Requirement on Feed: $ (253,460.00) 33 Practical Applications Futures Performance Bond July Hogs ($99.30/cwt. on November 21, 2011): September 16: Sold 5 LHN $97.35 September 23: Sold 5 LHN $96.90 November 18: Sold 5 LHN $98.90 November 21: Sold 5 LHN $99.30 Total Futures Maintenance Requirement: $ (3,900.00) $ (4,800.00) $ (800.00) $ 0.00 $ (9,500.00) Futures Performance Bond August Hogs ($97.925/cwt. on November 21, 2011): September 16: Sold 10 LHQ $96.40 $ (6,100.00) September 23: Sold 10 LHQ $95.45 $ (9,900.00) November 18: Sold 10 LHQ $97.45 $ (1,900.00) November 21: Sold 10 LHQ $97.92 $ 0.00 Total Futures Maintenance Requirement: $ (17,900.00) Futures Performance Bond October Hogs ($86.00/cwt. on November 21, 2011): September 16: Sold 14 LHV $86.25 $ 1,400.00 September 23: Sold 14 LHV $84.62 $ (7,700.00) November 18: Sold 14 LHV $85.80 $ (1,120.00) November 21: Sold 14 LHV $86.00 $ 0.00 Total Futures Maintenance Requirement: $ (7,420.00) Total Maintenance Requirement: Total Initial Requirement: $ (34,820.00) $ (121,800.00) 34 Practical Applications Total Performance Bond Requirement Corn: Total Performance Bond Requirement Meal: Total Performance Bond Requirement Hogs: $ (184,500.00) $ (68,960.00) $ (156,620.00) Total Performance Bond Requirement: $ (410,080.00) Performance Bond Requirement per Animal: (22,248 head) Performance Bond Requirement per cwt: (4,620,000 lbs.) $ 18.43 $ 8.88/cwt. Performance Bond Maintenance Requirement: $ (160,280.00) Maintenance Requirement per cwt: $ 3.47/cwt. (Current Open Market Margin @ $15.33/cwt. minus Performance Bond Requirement @ $3.47/cwt. = Net Profit Margin @ $11.86/cwt.) 35 Practical Applications Reconciling Net Margins Reconciling Open Market Margin Reconciling Futures’ Hedges 36 Practical Applications NET MARGIN RECONCILIATION: September 16 Margin: September 23 Margin: November 18 Margin: November 21 Margin: Net Profit Margin: $8.177/cwt $10.532/cwt $13.337/cwt $15.331/cwt $ 92,281.00 $ 118,901.00 $ 162,061.00 $ 177,841.00 $ 551,084.00 Profit Per Animal: $ 24.77 Profit Margin: $ 11.84/cwt 37 Practical Applications 38 Practical Applications On August 16, 2012 September 2012 Corn Futures @ $7.97 ¾ 39 Practical Applications On August 16, 2012 September 2012 Soybean Meal Futures @ $516.50 40 Practical Applications July 2012 Lean Hog Futures Expire @ $97.07 41 Practical Applications August 2012 Lean Hog Futures Expire @ $91.80 42 Practical Applications On August 16, 2012 October 2012 Lean Hog Futures @ $75.62 43 Practical Applications OPEN MARKET MARGIN RECONCILIATION: Corn: $7.98/bu x 241,552 bu. Meal: $515.50/ton x 1600 tons Other Feed Cost: Non-Feed Cost: Total Expense: July Hogs: August Hogs: October Hogs: Total Revenue: $97.07/cwt x 800,000 lbs. $91.80/cwt x 1,600,000 lbs. $75.62/cwt x 2,240,000 lbs. 3rd Quarter Marketing: -$1,927,585.00 -$ 824,800.00 -$ 400,000.00 -$1,326,315.00 -$4,478,700.00 $ 776,600.00 $1,468,800.00 $1,694,000.00 $3,939,400.00 -$ 539,300.00 Profit Per Animal: -$ 24.24 Profit Margin: -$ 11.537/cwt 44 Practical Applications FUTURES RECONCILIATION CORN ($7.98/bu on August 16, 2012): September 16: September 23: November 18: November 21: Hedge Gain: Bought 12 CU $6.63 Bought 12 CU $6.085 Bought 12 CU $5.83 Bought 12 CU $5.69 $ 81,000.00 $ 113,700.00 $ 129,000.00 $ 137,400.00 $ 461,100.00 FUTURES RECONCILIATION MEAL ($515.50/ton on August 16, 2012): September 16: September 23: November 18: November 21: Hedge Gain: Bought 4 SMU $354.10 Bought 4 SMU $334.80 Bought 4 SMU $311.60 Bought 4 SMU $302.70 Hedge Gain on Feed: $ 64,560.00 $ 72,280.00 $ 81,560.00 $ 85,120.00 $303,520.00 $764,620.00 45 Practical Applications Futures Reconciliation July Hogs (Settled @ $97.07): September 16: September 23: November 18: November 21: Hedge Loss: Sold 5 LHN $97.35 Sold 5 LHN $96.90 Sold 5 LHN $98.90 Sold 5 LHN $99.30 $ -$ $ $ $ 550.00 350.00 3,650.00 4,450.00 8,300.00 Futures Reconciliation August Hogs (Settled @ $91.80): September 16: Sold 10 LHQ $96.40 $ 18,400.00 September 23: Sold 10 LHQ $95.45 $ 14,600.00 November 18: Sold 10 LHQ $97.45 $ 22,600.00 November 21: Sold 10 LHQ $97.92 $ 24,500.00 Hedge Gain: $ 80,100.00 Futures Reconciliation October Hogs (Last @ $75.62): September 16: Sold 14 LHV $86.25 $ 59,500.00 September 23: Sold 14 LHV $84.62 $ 50,400.00 November 18: Sold 14 LHV $85.80 $ 56,980.00 November 21: Sold 14 LHV $86.00 $ 58,100.00 Hedge Gain: $224,980.00 Hedge Gain on Hogs: $313,380.00 46 Practical Applications Open Market Margin: Corn Hedge Gain: Meal Hedge Gain: Hog Hedge Gain: Realized Net Margin: -$ 539,300.00 $ 461,100.00 $ 303,520.00 $ 313,380.00 $ 538,700.00 Profit per Animal: (22,248 head) Profit per cwt (4,620,000 lbs.) $ 24.21 $ 11.57/cwt 47 Commodity & Ingredient Hedging, LLC Adding insight, innovation and strategic value to your price management decisions 175 W. Jackson Blvd. Suite. 1760 Chicago, IL 60604 Telephone: 312-596-7755 Email: mail@cihedging.com Internet: www.cihedging.com The information contained in this publication is taken from sources believed to be reliable, but is not guaranteed by Commodity & Ingredient Hedging, LLC as to accuracy or completeness, and is intended for purposes of information and education only. Nothing therein should be considered as a trading recommendation by Commodity & Ingredient Hedging, LLC. The rules and regulations of the individual exchanges should be consulted as the authoritative source on all contract specifications and regulations. There is a risk of loss in all futures and options trading.