Macroeconomics in the Global Economy

advertisement

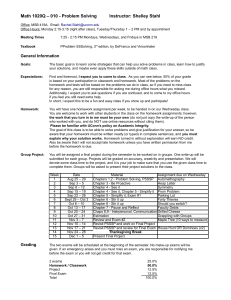

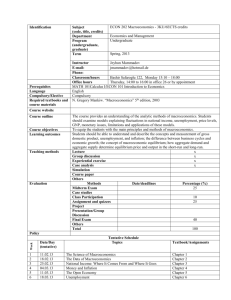

1 NUS Business School National University of Singapore BMA5011 Macroeconomics in the Global Economy Semester 1, AY2014/2015 Instructor: Prof. Kim Sun Bae (bizsbk@nus.edu.sg) Teaching Assistant: Zhou Yingke (a0059199@nus.edu.sg) Course objective This course has two objectives. The first is to introduce MBA students to the basic tools (“core models”) of macroeconomics and international economics. The course begins with the short run analysis of business cycle dynamics (how output, employment, interest rate and price are determined) and the role of stabilization policy. It then moves on to the long run analysis of what drives economic growth. The final segment of the course extends these analyses to the open economy. Key issues covered here include the determination of exchange rate in the short- and the long run, the effectiveness of monetary and fiscal policy under high capital mobility, how economic “shocks” are transmitted internationally and what policy can achieve in response. The second objective of the course is to link the basic insights of the “core models” to “real life” or case studies, with special focus on Asia. The aim here is to demonstrate that economics can be a powerful tool to understand and, possibly anticipate, key macroeconomic events and developments and their feedback mechanism to policy and financial markets. How to Do Well and Get the Most out of this Course This course covers a lot of ground - Course materials often builds cumulatively - Difficult to cram last minute Work smartly and efficiently: “Preview”, “Review”, “Do” “Preview” lecture notes - Keep sight of the “big picture” - Keep track of the roadmap--where we came from, where we’re going - You’ll get a lot more out of the lectures having previewed the material - This will be especially important for those lectures not covered in textbook “Review” lecture notes - This will help cement your understanding “Do” - Get your hands dirty with problem sets - Read supplementary material - Ask questions This is an “applied” course - That is why we do “case studies” - You will be expected to be able to apply macro thinking/analysis to real life cases 2 Tutorials Schedule to be announced. Office Hours (BIZ1 #6-7) Mondays and Thursdays, 3-5pm, or by appointment In either case, please give me a heads up by e-mail at least a day in advance Assessment method Class participation (15%) Assignments (15%) In-class exams (70%) o Exam 1 (30%): Feb. 17, 2014 o Exam 2: (40%): Apr. 14, 2014 Please be aware: o Plagiarism and other forms of academic transgression will be dealt with sternly… o …As they have been in the past Required text Olivier Blanchard, Macroeconomics, Global Edition 6/E (2013), Pearson Other reading A significant part of the materials covered in this course is not covered in textbooks. I have therefore compiled a set of reading materials culled from a wide range of sources, including: Financial press Investment bank and fund management research Economics and finance blogs Academic journals Central bank research International organization (e.g. IMF, BIS, ADB) Students are encouraged to read the assignment materials (as well as the lecture notes) before each lecture. 3 Schedule Week 1 (Aug. 14) 1. Course Introduction 2. Business Cycles: Background 3. Keynesian Multiplier Model Week 2 (Aug. 21) 4. IS-LM Model: Part 1 5. IS-LM Model: Part 2 Week 3 (Aug. 28) 6. Aggregate Demand—Aggregate Supply Model: Part 1 7. Aggregate Demand—Aggregate Supply Model: Part 2 Week 4 (Sep. 4) 8. The Great Recession 9. Fiscal Policy Week 5 (Sep. 11) 10. Monetary Policy 11. Inflation Week 6 (Sep. 18) 12. Growth Accounting 13. Perspectives on Asia’s Growth Recess Week (Sep. 20-28) Week 7 (Oct. 2): Mid-term Week 8 (Oct. 9) 14. Neoclassical Growth Model 15. The Rise of BRICs Week 9 (Oct. 16) 16. Exchange Rate in the Short Run 17. Mundell-Fleming Model & International Transmission of Shocks Week 10 (Oct. 23—reschedule?) 18. Exchange Rate in the Long Run 19. Policies for Internal & External Balance & Global Imbalance Week 11 (Oct. 30) 20. Real Exchange Rate Adjustments 21. Twin Crisis Week 12 (Nov. 6) 22. Singapore exchange rate policy framework 23. International Monetary System & Optimal Exchange Rate Regime 4 Week 13 (Nov. 13): 24. Review 25. Taking Stock of Macro Nov. 20: In-class final Exam