Macroeconomics * Problem Set 1

advertisement

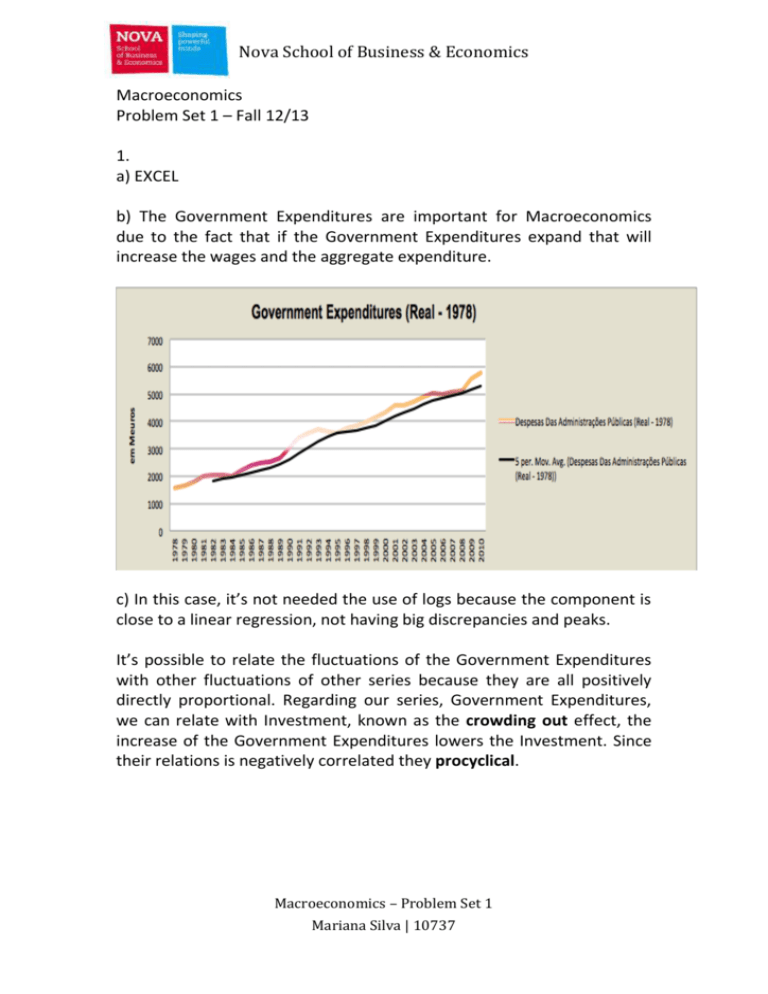

Nova School of Business & Economics Macroeconomics Problem Set 1 – Fall 12/13 1. a) EXCEL b) The Government Expenditures are important for Macroeconomics due to the fact that if the Government Expenditures expand that will increase the wages and the aggregate expenditure. c) In this case, it’s not needed the use of logs because the component is close to a linear regression, not having big discrepancies and peaks. It’s possible to relate the fluctuations of the Government Expenditures with other fluctuations of other series because they are all positively directly proportional. Regarding our series, Government Expenditures, we can relate with Investment, known as the crowding out effect, the increase of the Government Expenditures lowers the Investment. Since their relations is negatively correlated they procyclical. Macroeconomics – Problem Set 1 Mariana Silva | 10737 Nova School of Business & Economics 3. a) Logarithms can help to analyze data, such as an economic time series that exhibit growth. For instance, the per capita real GDP. General example: Given Yt: per capita real GDP in year t And given g: growth rate from period t-1 to t Such as, 𝑌𝑡 gt= − 1. 𝑌𝑡−1 And if x is a small number, then x≈ ln (1 + x) ; and if gt is a small number: 𝑌𝑡 gt≈ ln (1 + gt) gt≈ ln ( ) gt≈ lnYt – lnYt-1 𝑌𝑡−1 Due to the fact that lnYt – lnYt-1 is the slope of the graph of the natural logarithm of the Yt between t-1 and t, and the slope of the graph of the natural logarithm of a time series Yt is a good approximation to the growth rate of Yt when the growth rate is small. On conclusion, one of the advantages of the logarithms is to make the trend linear, making it easier to identify the economic cycles. b) This rule is known as the rule of 70, which is in a few words, used with an annual compound interest rate to quickly determine how long it would take to double your money. The rule of 70 states that in order to estimate the number of years for a variable to double, take the number 70 and divide it by the growth rate of the variable. For example, at a 10% annual growth rate, doubling time is 70 / 10 = 7 years. Similarly, to get the annual growth rate, divide 70 by the doubling time. For example, 70 / 14 years doubling time = 5, or a 5% annual growth rate. Macroeconomics – Problem Set 1 Mariana Silva | 10737 Nova School of Business & Economics 4. a) b) When , we don’t have to compensate the consumer so much as in because since they are complements, when we take one unit of leisure we have to compensate it much more in order to go back to the same unity level. c) Macroeconomics – Problem Set 1 Mariana Silva | 10737