Conducting Space Surveys

advertisement

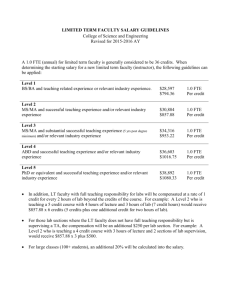

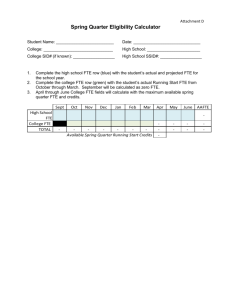

Conducting Space Surveys Leading Excellence in Research Costing Practices Conference October 13 - 15, 2015 Presenters Mike Director, Costing Policy and Analysis University of California, Davis Nick Legrand Schulte Manager, F&A Cost Recovery Huron Consulting Group 2 Agenda Facility Costs and Guiding Regulations Space Surveys Alternative Methods to the Space Survey Salary and Wage Full Time Equivalents (FTE) Conclusion – Selecting a Method 3 Facility Costs and Guiding Regulations 4 The Importance of Space Surveys F&A cost recovery dollars are unrestricted funds for the Institution F&A rate calculations are based on: Facilities costs (F) Administrative costs (A) Administrative costs are legislatively capped at 26% Therefore ALL increase in F&A rate over 26% comes from the Facilities portion of the calculation Space Survey are used to allocate the Facilities costs This is why SPACE SURVEYS are so important 5 2 CFR 200 (Uniform Guidance) A. General 2. Criteria for Distribution d. Selection of distribution method. (1) Actual conditions must be taken into account in selecting the method or base to be used in distributing individual cost groupings. The essential consideration in selecting a base is that it be the one best suited for assigning the pool of costs to cost objectives in accordance with benefits derived; with a traceable cause-andeffect relationship; or with logic and reason, where neither benefit nor a cause-andeffect relationship is determinable. (2) If a cost grouping can be identified directly with the cost objective benefitted, it should be assigned to that cost objective. (3) If the expenses in a cost grouping are more general in nature, the distribution may be based on a cost analysis study which results in an equitable distribution of the costs. Such cost analysis studies may take into consideration weighting factors, population, or space occupied if appropriate. Cost analysis studies, however, must (a) be appropriately documented in sufficient detail for subsequent review by the cognizant agency for indirect costs, (b) distribute the costs to the related cost objectives in accordance with the relative benefits derived, (c) be statistically sound, (d) be performed specifically at the institution at which the results are to be used, and (e) be reviewed periodically, but not less frequently than rate negotiations, updated if necessary, and used consistently. Any assumptions made in the study must be stated and explained. The use of cost analysis studies and periodic changes in the method of cost distribution must be fully justified. (continued on next page) 6 2 CFR 200 (Uniform Guidance) A. General 2. Criteria for Distribution (continued from previous page) (4) If a cost analysis study is not performed, or if the study does not result in an equitable distribution of the costs, the distribution must be made in accordance with the appropriate base cited in Section B, Identification and assignment of indirect (F&A) costs, unless one of the following conditions is met: (a) It can be demonstrated that the use of a different base would result in a more equitable allocation of the costs, or that a more readily available base would not increase the costs charged to Federal awards, or (b) The institution qualifies for, and elects to use, the simplified method for computing indirect (F&A) cost rates described in Section D, Simplified method for small institutions. (5) Notwithstanding subsection (3), effective July 1, 1998, a cost analysis or base other than that in Section B must not be used to distribute utility or student services costs. Instead, subsections B.4.c Operation and maintenance expenses, may be used in the recovery of utility costs. 7 2 CFR 200 (Uniform Guidance) B. Identification and Assignment of Indirect (F&A) Cost 2. Depreciation b. In the absence of the alternatives provided for in Section A.2.d, Selection of distribution method, the expenses included in this category must be allocated in the following manner: (1) Depreciation on buildings used exclusively in the conduct of a single function, and on capital improvements and equipment used in such buildings, must be assigned to that function. (2) Depreciation on buildings used for more than one function, and on capital improvements and equipment used in such buildings, must be allocated to the individual functions performed in each building on the basis of usable square feet of space, excluding common areas such as hallways, stairwells, and rest rooms. (continued on next page) 8 2 CFR 200 (Uniform Guidance) B. Identification and Assignment of Indirect (F&A) Cost 2. Depreciation (continued from previous page) (3) Depreciation on buildings, capital improvements and equipment related to space (e.g., individual rooms, laboratories) used jointly by more than one function (as determined by the users of the space) must be treated as follows. The cost of each jointly used unit of space must be allocated to benefitting functions on the basis of: (a) The employee full-time equivalents (FTEs) or salaries and wages of those individual functions benefitting from the use of that space; or (b) Institution-wide employee FTEs or salaries and wages applicable to the benefitting major functions (see Section A.1) of the institution. 4. Operation and Maintenance Expenses b. In the absence of the alternatives provided for in Section A.2.d, the expenses included in this category must be allocated in the same manner as described in subsection 2.b for depreciation. 9 Facility Cost Allocation Options Space Survey •Industry standard used and typically results in highest calculated rate •Requires a significant amount of judgment •Requires the most time and effort Salary and Wages •Considered the default method , •Doesn’t require a space survey •Doesn’t require detailed space information •Accepted at face value by Government FTE •Default method under A-21 •Doesn’t require a space survey •Doesn’t require detailed space information •Doesn’t require Academic judgments 10 Space Surveys 11 Space Survey Pros and Cons Pros Space survey should lead to the highest rate calculation Most detailed way to document the exact rooms / costs used for Organized Research Common practice accepted by government Cons Labor intensive / expensive Extra unwanted work for campus participants Arbitrary nature leads to negotiation risk 12 Space Survey Reality Space surveys are resource intensive (systems, labor, etc.) Space surveys are not intuitive Space surveys are often done only for the F&A process (if they are done for other purposes, the concept of “functionalization” may be different) Department personnel already have a lot to do! Therefore finding a way to make the survey easy and valuable becomes very important…… 13 High Level Decisions Central Administration decides: WHICH Buildings and Departments are involved in the base year’s space survey WHEN will the survey will be conducted. Research-intensive rooms and departments All rooms, research intensive departments All rooms, all departments 14 Space Survey – When Preparation Time Needed Conducting Space Surveys during Base Year Begins (and presumably completes) the process earlier Space survey participants are thinking about the current base year Not all data is complete Conducting Space Surveys after completion of Base Year Fiscal Year Data is complete – Account and Occupant Space survey participants must think back upon prior year Key personnel may be away from the Institution 15 Space Survey – Who The following people must be identified early and also must understand the importance of the survey: Facilities/Campus Services contacts IT (those who support the survey) Administrative liaisons at the school (Medicine, Arts & Sciences, Engineering) level Contact person (and ideally a back-up) for each department who will be filling out the survey….watch out for inevitable turnover. 16 Space Survey – What Maintain an accurate physical inventory including department and room type assignments in a format than can easily be downloaded (or uploaded) to the space survey system. An update of the physical space should be done annually, regardless if it is the institution’s base year. This inventory should include all buildings on campus that are owned or leased centrally by the institution. Building and room numbers should be used consistently across the institution. 17 Space Survey – What What “tools” are needed in completing the space survey Listing of rooms, this could include floor plans Funding sources (accounts) Personnel paid in the department, this could include effort reports Mechanism to collect the required documentation A21 functions, accounts and people (paid and unpaid). Discussion – what “tools” have been provided or utilized at your institution? 18 Space Survey – How Develop and communicate concrete directions in steps Step 1: Verify physical inventory Step 2: Identify and record the PI assigned to the survey space Step 3: Identify and record the people (paid & unpaid) working in that PI’s space Step 4: Identify and record the funding sources used to support the activities in that survey space Step 5: Assign A21 functions, in percentage terms, to the survey space based upon how the room was used Step 6: Review all information recorded for accuracy, including pay and funding sources 19 Space Survey – How Super simple, right? Should the steps above be divided and completed at various times throughout the FY instead of all at once? Requirements for a well-documented space survey Should all sources of funds be recorded? Should all occupants – paid and unpaid be recorded? Should all rooms be examined against blueprints for accuracy? 20 Space Survey – How Concept of “chunking” or “clustering” or “grouping” Simplify the approach by identifying a group of survey rooms (lab and lab service) utilized by a PI and his/her occupants and funding sources. Assign A21 functions for a PI and extrapolate the functional coding, accounts, and occupants to the series of survey rooms utilized by the PI’s group. 21 Space Survey – Analysis Ratio: Dollars/SF Comparisons across institutions and within institutions (across years) % Space coded to Research vs. % Dollars coded to Research Expectation that dollar % < space %, within a reasonable threshold If space % < dollar %, there is opportunity Check for each department Did folks filling out the survey pay attention to occupants and their sources of income? Is there too much of a match….making it a S&W model? 100% Rooms Audit red flag No flexibility for other activities Flat coding E.g., all labs in a department are 90/10 or 95/5. Each room should be examined independently. Information on all occupants Are occupants identified? How are they funded? 22 Possible Government Review Questions Question #1 I have selected the following five departments for our on-site research space review. By Principal Investigator (PI) or other responsible person, please provide a listing of all research rooms by building for these depts. Each room should be classified by ASF by functional area (OR, INSTR, etc.). If possible, please subtotal this ASF by PI. The total departmental ASF for all PIs should tie into the department totals given in your Report for FY, “Summary of Space by Department .” 23 Possible Government Review Questions Question #2 For (PIs) from the [previous] departments. For each room that was assigned to these PIs during the FY, please provide the following: All funding accounts from all functional areas (OR, IDR, OSA). Assigned people to those rooms with titles. This should include anyone that would have worked or spent time in the space during the FY, whether they received any compensation or not. All compensation paid to the PI and these staff during FYE from all funding sources, as described above. Please include all stipends paid, where applicable. All Effort Reports for the PIs only 24 Alternative Methods to the Space Survey 25 Facility Cost Allocation Options Space Survey •Industry standard used and typically results in highest calculated rate •Requires a significant amount of judgment •Requires the most time and effort Salary and Wage •Considered the default method , •Doesn’t require a space survey •Doesn’t require detailed space information •Accepted at face value by Government FTE •Default method under A-21 •Doesn’t require a space survey •Doesn’t require detailed space information •Doesn’t require Academic judgments 26 Salary and Wage Allocations 27 Salary and Wage Pros and Cons Pros Least time consuming / lowest cost method Negotiation with government will be calculation Good method for institutions based that do not have high-priced research buildings Cons Most likely a lower rate calculation than a Space Survey or an FTE allocation Does not maximize the allocation to Organized Research for high-priced research buildings 28 Salary and Wage Methods Allocate Facility Costs by department to all functions Determine space in each building by department Allocate each room within a single department by the department S&W statistic Allocate Facility Costs by total institution to major functions (OR, IDR, OSA, OIA) Must first allocate single function buildings Joint use buildings allocated by institution wide S&W statistic Allocating to just the major functions can raise the facility calculation and lower the administrative calculation 29 FTE Allocations 30 FTE Pros and Cons Pros Less time consuming than Space Survey Most likely a higher rate calculation than S&W method Negotiation with government will be calculation based Good method for institutions that have high-priced faculty Cons Most likely a lower rate calculation than a Space Survey Does not maximize the allocation to Organized Research for highpriced research buildings / rooms Government negotiators are less familiar Can sometimes be difficult to get reliable FTE data 31 FTE Methods Allocate Facility Costs by department to all functions Allocate Facility Costs by Room or “PI Cluster” Determine space in each building by department Allocate each room within a single department by the department FTE statistic Collect information on space occupants Use occupants to calculate FTE statistic Can be done on a room by room basis or a “PI Cluster” basis PI Cluster – allocate all space belonging to an individual PI using the same FTE statistic based upon occupant information collected Use FTE allocation for “Joint Use” space Usually on a department wide basis Can produce better results than typical S&W joint use allocation 32 Example S&W vs. FTE Calculation FTE typically calculates a higher Research percentage than S&W Employee Professor Asst. Professor Post Doc GTA 1 GTA 2 Dept Admin Grand Total Percents Salaries and Wages General Fund Research Grants 120,000 10,000 60,000 15,000 40,000 20,000 20,000 50,000 250,000 85,000 74.6% 25.4% Total 130,000 75,000 40,000 20,000 20,000 50,000 335,000 100.0% Full Time Equivalents General Fund Research Grants 0.69 0.06 0.80 0.20 0.00 1.00 0.50 0.00 0.00 0.50 1.00 0.00 2.99 1.76 63.0% 37.0% Total 0.75 1.00 1.00 0.50 0.50 1.00 4.75 100.0% High salaried faculty are counted at a maximum of 1.0 FTE (and maybe even less) Faculty typically have a lower percentage of time charged to research grants FTE method is closer to space survey results 33 Considerations for S&W and FTE Methods Information needed from Departments How to account for unpaid Students? How to account for unpaid “Other” users (Visiting Professors, Professor Emeriti, etc.)? Faculty treated as 0.75 FTE for 9 months of work Dependent on methodology Summer work increases them to 1.0 FTE Part-time and partial year employees Cost Sharing DCE adjustment for Department Administration Service Centers Animal Facilities 34 Conclusion Selecting a Method 35 Selecting a Method Type of Institution Rate Considerations Amount of Research at Institution Amount of Grants with Full Indirect Cost Rate Medical School Salaries of Faculty High Cost Research Buildings Current Negotiated Rate Desired Rate Likely Calculated Rate with each method Cost / Time Constraints Other Considerations Past negotiations with government Current environment of institution Changes at institution (recent or future) 36 Contact Information Mike Legrand Director, Costing Policy and Analysis University of California, Davis mrlegrand@ucdavis.edu 530-752-4621 Nick Schulte Manager, F&A Cost Recovery Huron Consulting Group nschulte@huronconsultinggroup.com 530-902-7812 37