IRS_Fresno_PC_10-09-

advertisement

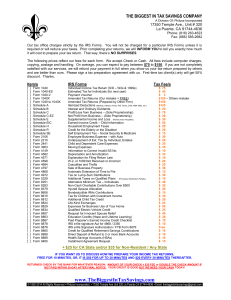

IRS-Fresno Processing Center Author Myra J. Thompson EA 1 3/14/2016 Agenda 2 Did you know? AUR (Automated Under Reporter) Unit Receipt & Control Unit Notice Review Unit More on Receipt & Control Unit Data Conversion Unit Code & Edit Unit Error Resolution System Questions 3/14/2016 Did you know…? 3 This was the first public tour since 9/11 In 1972 the Fresno campus was opened without computers, handled CA & AZ only Nine states will move to a different Submission Processing site in 2010. Only 4 sites will remain Atlanta, Austin, Fresno, and Kansas City. Then in 2012 these will be reduced to 3 processing centers in US, Fresno, Austin and Kansas City. Fresno is currently receiving mail from 24 states Dogs specially trained to sniff out drugs and explosives go over mail twice before it enters the building 5,000 employees during peak season October 2008 thru June 2009 Fresno campus received $91.7 billion in revenue; they refunded or abated $70 billion 3/14/2016 Did you know…? (cont.) 4 IRS is currently looking at paid preparers more aggressively In 2009 more than 60% of the returns were prepared by paid preparers 63-64% electronically filed for 2008 To obtain a photocopy of an entire original return the cost is $57 per return, order on form 4506T, originals are stored in TN Request for transmittal, income and wage or line by line is free When available always use mailing labels Approximately 9 million gallons of water is used each year 14 million watts electricity used monthly, bill over $200,000 per mo 3/14/2016 Did you know…? (cont.) 5 Café is open for breakfast, lunch and dinner, 17 hrs per day Full time credit union and nursing staff on site Bank and PO available in main facility 29 bathrooms Several bombs were launched onto the roof from outside the parking lot of facility in 1991, one exploded The main building covers 540,000 square ft, there are 9 total buildings located on the 47 acre campus Buildings located on 13 of these acres, 10 free acres and 2698 parking spaces Many other buildings are separated by walls, side by side as one building. They use zone numbers to identify where a problem is within the 540,000 sq ft building 3/14/2016 AUR Unit (Automation Underreported) 6 If need larger envelop than one supplied by IRS cut area with name/address/bar code and scotch tape to our envelope to speed process Always place notice on top of explanations revised forms or supporting documentation If you miss Notice of Deficiency date ask for reconsideration 3/14/2016 Receipt and Control Unit 7 Has 1500 seasonal employees Payment goes on top of return, correspondence or voucher Automation – matches each form 1099 (do not lump different institution together) if lumped it is looked at very quickly) but if you have say 2 or 3 form 1099’s from same institution you can lump (combine) on one line. Do not combine interest with Dividends, use separate lines Schedule D transactions, can use form DI or attachment, either one including brokers statement to match 1099B’s ASFR – Automated substitute for Tax Return – once a return is filed the statute of limitations begins, collection starts when Substitute for return is issued. (No statute of limitation (no matter how many years have passed) if only a substitute return was established and no actual return was filed by taxpayer. 3/14/2016 Receipt and Control Unit (cont.) 8 Any extremely thick tax returns over 1 ½ inches are handled manually All correspondence to IRS needs taxpayer’s name, SSN, year, etc Checks stay with document, tax return or correspondence until applied to taxpayer’s account All mail received on 4/16 and after - the envelope also stays attached and is date stamped Imperfect checks need research (no SSN, tax year, etc.) Returns mailed with Return Receipt (RR) are delivered last by PO, the RR’s are stamped by PO, other part of cards delivered to IRS in stacks, not with each return or letter –Green cards are sent back by PO, waste of time for us to use - correspondence or return is last to be delivered to IRS by PO. (Suggestion: write receipt number on check and at the top of page of tax return or notice if insist on using RR’s) Extremely important for quick processing to mail before 4/15 when possible, clearly identify all payments and correspondence and use correct IRS address with all 9 digits, when available 3/14/2016 Receipt and Control Unit (cont.) 9 One can request an acknowledgement of receipt – need to supply an envelope with our return address and include postage, IRS will comply IRS centers will not accept photocopy of taxpayer signature but OK for photocopy of preparer signature “Write in Amts” must have statement attached, write amounts on line rather than “S/A” but leave the statement in, this helps to process the return much faster In 2008 approximately 360,000 EIC cases worked Exam initiated a new universal toll free telephone number January 2006 (866)897-0177, calls go to one of 5 W&I call sites. Call for information regarding Notice of Deficiency, wait 3 days to call for confirmation of information faxed Information requested on a CP2000 can be e-faxed to IRS, this began 5/09 - Next year we will also be able to fax information needed directly to examiners desks. 3/14/2016 Receipt and Control Unit (cont.) 10 CP2000 inquiries, best to call between 7 and 8pm PST IRS working on My Account website – input shared secrets to get information and transcripts Audit Reconsideration 1(866)897-3370 if a Notice of Deficiency has been issued because failed to respond to 90 day letter, call and ask for reconsideration and submit return, etc. Send return to automated substitute for tax return, ASFR. If Schedule A, line 21, is over $2,000 (amount on line) always send in form 2106 for unreimbursed EE expense Starting 2012 IRS will be using the XML system – this will enable us to e-file old returns (prior years) Write telephone number on signature line or for 3rd party for examiner to call if needed 3/14/2016 Notice Review Unit 11 All correspondence review completed in 1 week 90 EE’s peak of season Notices, tax adjustments, transferred to other units They research misapplied funds 3/14/2016 Receipt and Control Unit 12 581 examiners open mail during peak season (2) 15 min breaks and ½ hr for lunch if work 8 hrs Stay in seat except for bathroom trips, breaks, and lunch (2) 11hr shifts during peak season If any EE’s goals are not met they are termed After mail is slit open on one side by machines, very noisy room, it goes to another unit for sorting of contents They have received in the mail: guns, coins, handbags, etc. for payment, all are sent back to taxpayer After contents of envelope removed the envelopes are scanned to ensure nothing left in envelope No books, purses, CD’s, headphones, lunch bags, only see through pouch with few items Each badge has clearance for elective units 3/14/2016 Additional information 13 If a return is signed by us on behalf of taxpayer they do look for the POA 25 returns are manually transcribed an hour No bulky clothing, if take off sweater cannot throw over their arm All mail is sorted using what is named a Tinkle table to sort and bundle all incoming entity requests Need to place pages of return in sequence order otherwise return is unstapled, big delays and pages may be lost All dual status returns need Dual Status written on top of return, if not causes big delays, Dual Status returns are sent to another processing campus (Ogden) Checks – if FTB written as payee and caught IRS crosses out wording FTB and writes or stamps in IRS if the amount matches balance due, they are cashed. The FTB cannot do the same if they receive a check payable to IRS 3/14/2016 Additional information (cont.) 14 303,000 tons of paper goes through the campus each day during peak season POA’s for collection communication – they will accept POA with only one signature when married, but for installment sale arrangements IRS will only set up payments for T/P have signature of Practitioner Priority service unit cannot see vouchers Checks submitted with a voucher or with a return (meaning if perfect) are posted the day they are received even though Practitioner Priority Representatives tell you differently Payment checks cashed but we are told the bill is still outstanding because IRS did not credit to the taxpayers account, have to be found by the service center, IRS never stops searching for payment as the FTB does 3/14/2016 Data Conversion Unit 15 Data transcribers Full time 400 EE’s in Fresno Each year they hire 800 new employees in this unit alone Use white paper with black ink, even forms from IRS mailed to T/P in booklet form have white right hand side column to use black ink in this area 2 sided tax return pages are accepted to save paper 3/14/2016 Code and Edit Unit 16 1040X - 1.1 million 1040X’s were received from Jan thru June and manually entered Processing goal is 20 an hour by new people and Jeeda (a new program implemented to reduce research which will improve productivity (Jee/da it works) Allowed 12 days to be completed, if all OK the taxpayer’s account is updated, adjustments are entered into computer within 21 days or sent to accounts management to work 16 week time frame ideally to receive refund, can take up to 9 months if return needs to be shipped to another site, dependent upon issues Amended returns are processed all year 1040X needs forms to support changes, changes to page 1&2 unless an involved position is taken then a wordy explanation may be necessary: 3/14/2016 Code and Edit Unit (cont.) 17 Line 21 change on Schedule A, attach Schedule A and if SS tax only send SE form not entire return, (forms to support changes) computer will change schedule A for medical, unreimbursed employee business expenses, AMT, etc. (can send page 1&2 of original, labeled “Originally Filed” and pages 1&2 “As Amended” but other than that just attach forms that start the change. Write brief explanation except when explanation for position taken, ex: following paragraph used for some amended returns for FTC carry backs:. the taxpayers’ foreign source income was earned in calendar year ____ but the taxes, which accrued on this same income, were fixed and determinable in calendar year ____. We filed the original _____ return with a form 1116 to calculate excess limitation. The amount accrued was $0 since the taxes were accrued in the subsequent year, ____. We then carried the tax back to ____, the year with the income that related to the tax. Attach page 1&2 of 1040X 3/14/2016 Code and Edit Unit (cont.) 18 Attach page 1&2 of “Originally Filed”, and clearly marked as such, red is good color for stamp Attach page 1&2 of “As Amended”, clearly marked as such, red is good color for stamp Form to support change, such as; if a change to Schedule A attach Schedule A, if change to Schedule B attach Schedule B, if change to Schedule C attach Schedule C, and if change to form 2106 attach form 2106, etc. 3/14/2016 ERS (Error Resolution System) 19 Error Resolution System/Rejects/ Unpostables/Notice Review/Document Retention 868 employees Each shift of 325 employees corrected 98,000 returns each day which included e-file errors (fall 0ut) Fresno – 430,000 returns were returned to sender for missing info out of 13 million filed, of these 261,000 were prepared by professional preparers Others Errors – cannot read the name or SSN on check voucher and/or return (or notice may have gone somewhere else after separated from the check 3/14/2016