A373ch10

advertisement

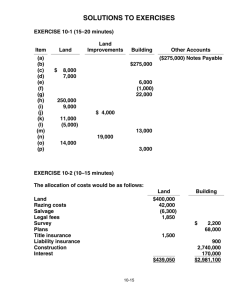

ACCT373 Intermediate Accounting II Otto H. Chang Professor of Accounting Acquisition of Property, Plant, & Equipment • PPE defined: L-T fixed assets used in normal business operation (c.f. investment or other assets) • Recorded at historical cost when acquired: measured by cash or cash equivalent price of obtaining the asset and bringing to the location and condition necessary for its intended use. Specific Examples • Cost of Land: includes costs for removal of old building and special assessment for local improvement such as pavement, lights • Cost of land improvement: improvements with limited lives should be separated from land. • Cost of land held for investment: includes capitalized annual taxes and insurance costs Self-Constructed Assets • Should fixed overhead be allocated? If so, on what basis? On the basis of resource usage or the cost of lost production? What happened if costs exceeds FMV? • How to treat interest expenses incurred? – As financing expense (no capitalization) – Capitalize interest incurred during construction – Capitalize all costs of funds, including imputed SFAS #34 Capitalization of Interest Cost • Interest cost should be capitalized for qualifying assets during the capitalization period at an amount equal to the lesser of actual interest incurred or avoidable interest • Qualifying assets: assets requiring a period of time to complete (if for sale, they must produced as discrete projects, e.g., ships or real estate developments) Capitalization Period • A period when the following three conditions are present: – Expenditures for the asset have been incurred – Construction activities are in process – Interest cost is being incurred • Interest capitalization continues as log as the three conditions are present Amount to Capitalize • Limited to the lower of actual interest incurred in the period or avoidable interest • Actual interest incurred during the period: includes interest cost from all debts (maximum amount to capitalize) • Avoidable interest: interest costs that could have been avoided if the project was not taken Avoidable Interest • Avoidable interest = Weighted-Average Accumulated Expenditures x interest rates • Interest rates to be used: – When WAAE is less than or equal to the construction loan, use construction loan rate – For excess WAAE, use weighted-average interest rate from all other debts Weighted-Average Accumulated Expenditures • Excludes expenditures require no interest payments such as accounts payable • includes capitalized interest cost