Chapter 5 - Vanderbilt Business School

advertisement

Chapter 5: Investment Decisions

I. Introduction

Hi, this is Luke Froeb of Vanderbilt University’s Owen School of Management. I am

the author of Managerial Economics: A Problem Solving Approach, along with Brian

McCann. This lecture is designed to supplement Chapter 5: Investment Decisions.

(Pause to create separation.)

II. Opening Anecdote:

In the summer of 2007—before the credit bubble burst Bert Mathews thought

about purchasing a 48-unit apartment building in downtown Nashville.

At the time, the building was 95% occupied and generated $550,000 in annual

profit. His investors were expecting a 15% return on their capital and the bank had

offered to loan him 80% of the purchase price at an interest rate of 5.5%.

Bert had to figure out if purchasing the building was a good idea. He did this by

determining how much he could afford to pay, and still give his investors a decent

rate of return. So, he computed his cost of capital as a weighted average of equity

and debt << 0.2 x (15%) + 0.8 x (5.5%) = 7.4%. >>

<<INSERT GRAPHIC OF EQUATION with WEIGHTED AVERAGE OF BANK RATE AND

EQUITY RATE, SHOW VISUALLY WHERE THE WEIGHTS AND THE RATES COME

FROM>>

With a capital cost equal to 7.4%, Bert could afford to pay $7.4 million for the

building. In other words, the profit earned by the apartment, $550,000, equals 7.4%

of the $7.4 million purchase price. (Add a visual equation in the video: $550,000/$7.4

Million=7.4%)

At this point, Mr. Mathews decided not to buy the building. In retrospect, the

summer of 2007 was not a good time to invest in real estate.

A year later, the building’s occupancy had fallen from 95% to 90% and annual profit

fell from $550,000 to $500,000. It was also harder to get a loan. Now the bank was

willing to loan him only 65% of the purchase price, and at a rate of 7.5%. This

raised his cost of capital to 10.125% (show equation on screen as 0.35 x (15%) + 0.65

x (7.5%) = 10.125%) which meant he could only offer $4.5 million. The owners

rejected his offer as too small.

What does this story mean? Beyond the obvious effect of the interest rates on real

estate prices, it also illustrates the relevant costs and benefits of investment

decisions, the topic of chapter 5.

III. How to determine whether investments are profitable

Let’s start by trying to figure out which investments are profitable. At the most

basic level, all investments offer a trade-off between current sacrifice and future

gain. In economics, we use the term “discount rate” to describe the price at which

you are willing to trade current for future dollars. If you require a high return to

entice you to invest in a project, you have what we call a “high discount rate.“

You have encountered this tradeoff before: when you put money in a savings

account, it grows at a compound rate of interest. If the interest rate is 10%, then

one dollar invested today will be worth $1.10 after a year, worth $1.21 after two

years, and worth $1.33 after three years, and so on.

$1 (1.10)= $1.10

$1 (1 .10)3= $1.21

$1 (1 .10)3= $1.33

There is a useful rule of thumb here called the 10-7 rule. At a ten percent rate of

interest, your money will double after seven years; and at a seven percent rate of

interest, you money will double after ten years.

Discounting is the opposite of compounding. If someone offers to pay you $1.10

after one year, the current or present value of that promise depends on your

discount rate. If it is 10%, then $1.10 next year is worth $1 this year. Similarly, the

present value of $1.21 after two years is $1, as is the present value of $1.33 after

three years; and so on.

$1 = $1.10/(1.10)

$1 = $1.21/(1 + 0.10)2

$1 = $1.33/(1 + 0.10)3

Discounting payoffs that occur k periods in the future can be computed recursively,

by discounting future payoffs one period at a time, until you get to the present. The

formula which represents this discounting is simple,

Present value=future value/(1+r)k

To illustrate how we use discounting to determine whether a project will earn

enough money to cover the cost of capital, let’s consider two projects, both of which

require an initial investment of $100. Project 1 returns $115 at the end of the first

year. Project 2 returns $60 at the end of the first year and $60 at the end of the

second year. So which project should you invest in? Looking at total return—which

is like looking at accounting profit instead of economic profit—you might be

tempted to choose project 2.

But this would be wrong. What you want to do is compute the present discounted

value of each project. To do this we discount all future inflows and outflows to the

present. This is the equivalent of expressing costs (which occur in the present) and

benefits (which occur in the future) in equivalent units so we can compare them.

Lets say that your cost of capital is 14%. We discount the future payouts at 14% to

compare their value to the initial investment. This means that the inflow after year

1 must be divided by 1.14 and the inflow after year 2 must be divided by 1.14

squared. Applying this to both projects shows that only the first project earns a

positive profit.

INSERT THE TABLE FROM THE BOOK. {use some moving graphics to show the

algebra}

The NPV rule tells you whether an investment project will earn enough to cover the

cost of capital. Projects with positive NPV create economic profit, which means

they earn a return higher than the company’s cost of capital. The bottom line is that

you should invest only in projects with a positive NPV.

<<INSERT Graphic of NPV RULE from BOOK>>

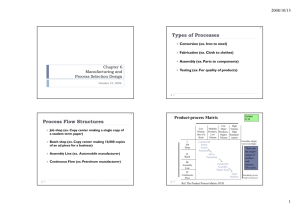

IV. Break-even analysis

In your finance courses you will learn that NPV analysis is the “correct” way to

evaluate investment decisions. But many managers use short cuts, like break-even

analysis. In fact, in a recent study, over half of CFOs used payback periods as their

decision tool. To evaluate the profitability of investments, CFOs calculate how many

months it would take for an investment to break even, or payback the initial

investment.

Break-even analysis is easier to do than NPV analysis and it produces simple,

intuitive answers. So here is how it works. When considering an investment,

instead of asking whether it has a positive NPV, you instead ask “Can I sell enough to

break even?” If you can sell more than the break even amount, then it’s a profitable

investment. And if you can’t, it’s not. It’s that simple.

How do we determine the break-even quantity? Well, first we have to distinguish

between marginal costs which vary with quantity, and fixed costs, which don’t.

The break even quantiy is the fixed cost divided by the contribution margin (price

minus marginal cost). (Show Q = FC/(P-MC) in video.) If you sell the break-even

quantity, your profit is exactly zero. But if you sell more, your earn money.

<<GRAPHIC FOR THIS EXAMPLE?>> To see how this works, consider Nissan’s 2008

redesign of its Titan pickup truck. The Titan had only two years left on its eight-year

product life cycle and Nissan had to decide whether to redesign it. Nissan managers

used a rough break-even calculation to evaluate their investment alternatives.

It would cost $400 million to design and build a new truck from the bottom up. At a

12% cost of capital, the investment would cost Nissan about $48 million per year.

Since they earned only $1,500 per truck, they would have to sell at least 32,000

trucks each year to break even.

However, with only a 3% share of a shrinking U.S. market, Nissan predicted they

would sell only 12,000 Titan trucks each year, not enough to break even. Instead

they decided to explore other options, like outsourcing a new truck from Chrysler.

<<INSERT GRAPHIC OF SHILLER’e P/E ratio, below>>

50.00

Price/Earnings Ratio of U.S. Stocks, 1881-2010

(Using 10-Year, Inflation-Adjusted Earnings)

45.00

40.00

35.00

30.00

25.00

P/E

20.00

15.00

Average:

10.00

5.00

0.00

Year

Data and concept: Prof. Robert J. Shiller, Yale University,

http://www.econ.yale.edu/~shiller/data.htm Graph: Shayne & Co., LLC. The graph shows the

monthly value of the general U.S. stock market, as measured by the S&P 500 (and comparable

You can also think of stock market valuations in break-even terms. If you purchase

a stock for, say $30, and the stock earns, on average, $1.50/share, then it takes 20

years to pay back the initial investment. In the graph above, we see that the

aggregate P/E ratio for the stock market was about 20 in June, 2010. This is above

its historical average of about 16, so some “value investors” would currently

consider the stock market over-valued.

Note that smaller, private companies typically trade at much lower P/E ratio’s,

around 6, for example.

VI. Shutdown decisions and break-even prices

When looking at shutdown decisions, we work with break-even prices rather than

quantities. Let’s think about what happens when you shut down. You lose your

revenue, but you get back your avoidable costs. If revenue is less than avoidable

cost, or equivalently, if price is less than average avoidable cost, then shut down.

The break-even price is the average avoidable cost <<graphic to illustrate shut down

decision>>.

The challenge of break-even analysis is deciding which costs are avoidable, and for

that we use the Cost Taxonomy (show chart 5-1 from page 57 in video). You can see

that in the short run, only marginal cost is avoidable. In the long run, fixed costs

become avoidable. So let’s say fixed costs are $100, marginal costs are $5, and

you’re producing 100 units per year. In the short run, the shutdown price is equal

to the marginal cost, <<INSERT GRAPHIC SHOWING MC IS SHUT DOWN PRICE AT

$5>>. In the long run, the shutdown includes average fixed cost and rises to $6.

When does the transition between short run and long run occur? Think of the fixed

costs as a one-year renewable lease. When the lease comes up for renewal, it is

relevant to the shutdown decision because it is avoidable. But until the lease comes

up for renewal—during the short run—it is unavoidable and should not be

considered when deciding whether to shut down.

VII. Sunk costs and post-investment hold-up

Sunk costs are relevant only before you incur them. But after you incur them, they

become irrelevant, and this can make you vulnerable to what economists call “postinvestment hold-up.”

Consider the case of a magazine, National Geographic, trying to negotiate with a

regional commercial printer to print its magazine. Using a network of regional

printers saves the magazine shipping costs, but they must convince each printer to

buy a $10 million printing press in order to produce a high-quality magazine.

If the marginal cost of printing a single copy is $1 and the printer expects to print

one million copies per year over a two-year period, the average cost of printing the

magazine over two years is $6, computed as the average fixed cost of the

investment, (graphic of $6= $10 million divided by 2 million copies, plus the

marginal cost, which is $1 per copy). This is the break-even price for the printer and

represents her bottom line in negotiations with the magazine. Before they are

incurred, sunk costs are relevant to the negotiation.

Once the printer purchases the press, however, the profit calculus changes—if the

cost of the press is sunk. In this case, the magazine can hold up the printer by

renegotiating terms of the deal. Since the cost of the press is unavoidable, the

printer’s break-even price does not include it, and therefore it falls to the marginal

cost of printing the magazine, which is $1.

If the commercial printer anticipates hold-up, he will be reluctant to buy the printer

without some assurance. Hold-up then becomes a problem not just for the printer,

but for the magazine as well.

There are several things the printer and magazine can do to consummate the

transaction. One option is a long-term contract, but contracts are often difficult and

costly to enforce. A better solution is to make the magazine purchase the press and

lease it back to the printer. This circumvents the post-investment hold-up problem

because the printer has incurred no sunk costs.

This leads to another maxim: <<GRAPHIC OF MAXIM contracts should encourage

both investment and trade>>.

VIII. Solutions to the hold-up problem

Anytime that one person makes a relationship-specific investment, meaning one

that is sunk or lacks value outside a trading relationship, he can be held up by his

trading partner. This gives parties incentives to take actions to reduce the risk of

hold-up, like signing long term contracts, or merging together, sometimes called

vertical integration.

We are going to close the chapter by taking a contractual view of marriage.

Marriages are vulnerable to hold up in much the same way that commercial

relationships are. The stereotypical story is that a woman accuses a man of taking

“the best years of her life,” and then trading her in for a younger model. If a woman

anticipates hold up, then she will be reluctant to make long term investments, like

children. And like any commerical contract, the marriage contract is designed to

restore the incentives of parties to make relationship specific investments.

When an economist and his fiancée were receiving pre-marital counseling from a

priest, the priest asked the economist why he wanted to get married.

The economist answered “Long-term contracts induce higher levels of relationshipspecific investment.”

The priest looked as if he didn’t understand, so he added “you know, the kind of

investments that differentiate a marriage from a series of meaningless spot-market

transactions.”

On their first anniversary, the economist’s wife gave him a card declaring that her

“relationship-specific investment was covering her cost of capital.”