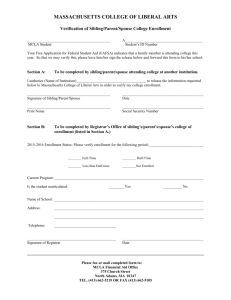

Country Bankers Life Insurance

advertisement

Geraldine Desiderio-Garcia SVP & General Manager Bakit COUNTRY BANKERS? 47 years in servicing the countryside established by rural bankers, JOSE E. DESIDERIO, SR and ALFREDO MONTELIBANO Niche market: farmers, market vendors, teachers, small & medium entrepreneurs, MFIs Pioneered in Creditor’s Group Life, loan-based insurance and the first to have an approval to sell microinsurance Personalized service Best known in fast settlement of claims 100% Filipino BOARD OF DIRECTORS MA. VICTORIA G. GUINGONA Chairperson DAVID M. CONSUNJI (DMCI) ALFREDO ALEX S. CRUZ III ERNESTINE D. VILLAREAL-FERNANDO GERALDINE DESIDERIO-GARCIA DENNIS H. LOCSIN ROBERTO L. MONTELIBANO AGNES S. DESIDERIO ANTOLIN T. NAGUIAT MANUEL Y. PETINES ROMEO G. VELASQUEZ ERNEST JULIUS D. VILLAREAL Ai Ai endorses Country Bankers C5 Road Pasig Where we are now (as of JUNE 2012) RB partners Lives protected (principal + dependents) 118 375,973 MFI partners (non-RB) Lives protected (principal + dependents) 134 902,834 Total Lives Protected Total Claims paid 1,278,807 64M+ PARTNER-AGENT MODEL INSTITUTIONAL OPTIONS FOR MICROINSURANCE main provider reinsurer Why it works for MFIs Trim down their level of risk (insurance is not their core competence) Give better service to their members without additional admin costs Devote more on their main facility: credit & savings Enjoy lower premium rate because of economies of scale by the insurance partner Share in the growth (incentives for the MFI) We do not want MI members to fall back into poverty because of unwanted events or hardships nor do we want MFIs to empty out CB KALINGA the microinsurance product for everyJuan dela Cruz and his family BENEFITS ① Natural Death Benefit ② Accidental Death ③ Permanent Disability Benefit ④ Accidental Medical Reimbursement ⑤ Daily (Hospital) Confinement Benefit ⑥ Instant “Abuloy” (in addition to benefits) ⑦ Financial Assistance due to Fire or Natural Calamity seven (7) BENEFITS in 1 family package/unit COVERAGE MARRIED SINGLE Principal member Principal member Spouse Parent/s 3 Children 2 Siblings or Children MARRIED member BENEFITS PRINCIPAL SPOUSE CHILD 1 CHILD 2 CHILD 3 Natural Death 25,000 25,000 5,000 5,000 5,000 Accidental Death + 25,000 + 25,000 + 5,000 + 5,000 + 5,000 Permanent Disability 25,000 25,000 5,000 5,000 5,000 2,500 (max) 2,500 (max) 500 (max) 500 (max) 500 (max) 200/day 100/day (max 30 days) (max 30 days) ___ ___ ___ Accidental Medical Reimbursement Daily Confinement Benefit SINGLE member BENEFITS PRINCIPAL PARENT 1 PARENT 2 CHILD 1 / SIBLING 1 CHILD 2 / SIBLING 2 Natural Death 25,000 25,000 25,000 5,000 5,000 Accidental Death + 25,000 + 25,000 + 25,000 + 5,000 + 5,000 Permanent Disability 25,000 25,000 25,000 5,000 5,000 2,500 (max) 2,500 (max) 2,500 (max) 500 (max) 500 (max) 200/day 100/day 100/day (max 30 days) (max 30 days) (max 30 days) ___ ___ Accidental Medical Reimbursement Daily Confinement Benefit plus INSTANT ABULOY 10,000 - Principal 2,500 - Spouse/Parent 1,250 - Child/Sibling FINANCIAL ASSISTANCE due to FIRE or NATURAL CALAMITIES 5,000 ANNUAL PREMIUM Php 280.00 per package (only .77 centavos per day) • 1 FAMILY PACKAGE = 1 UNIT of CB KALINGA • Maximum of 8 UNITS may be availed per member FEATURES & CONSIDERATIONS Age at enrollment: 18-70 (principal, spouse, parent) 1 day old - 21 (child, sibling) Common law spouse is accepted Suicide is compensable Each principal member gets a Confirmation of Coverage (CoC) Dependents’ coverage will not stop in case of principal’s demise Package/coverage is adaptable to your needs OUR COMMITMENT CLAIMS paid in 5 days INSTANT ABULOY given within 24 hours, without documents CLAIMS experience 375 families lost their homes to SENDONG… All were insured under CB Kalinga. All got their financial assistance benefit without any documents submitted two days after the tragedy. Our… just PARTNERS to name a few ARDCI (Catanduanes) CARE FOUNDATION (General Santos) FIRST ISLAND MULTI-PURPOSE COOPERATIVE (Marinduque) KCDI (Manila) KMBI (Manila) LIFEBANK FOUNDATION (Iloilo) MEMPCO (Zamboanga) MILAMDEC (Cagayan de Oro) SHED (Manila) Rural Banks and Coop Banks, Cooperatives (nationwide) MICRO CGL loan-based insurance that protects the MFI In the event of the member/borrower’s untimely death during the term of her/his loan it will become the obligation of COUNTRY BANKERS LIFE to pay his/her principal loan to your Institution “insurance as a collateral” Non-Medical Coverage Limit for the loans up to Php 200,000.00 for each borrower, 18 - 70 years old “wala ng medical” Premium rate is lower than regular CGL rate NUMBER OF MONTHS PREMIUM RATE PER 1,000 1 MONTH 1.15 2 MONTHS 1.15 3 MONTHS 1.65 4 MONTHS 2.00 5 MONTHS 2.75 6 MONTHS 3.15 12 MONTHS 6.00 For all other RISKS: Money, Securities & Payroll (MSP) Fidelity Bonds Electronic Equipments Insurance (EEI) Fire Insurance Motor Vehicle NONLIFE, since 1960 We are not in the business of marketing insurance, what we really sell is peace of mind Bakit COUNTRY BANKERS? Bakit hindi? Maraming salamat po! Thank you!