Capital Structure PowerPoint Presentation PowerPoint Presentation

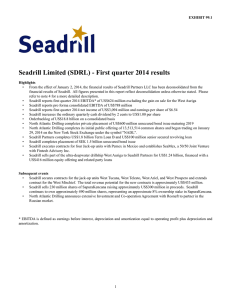

advertisement

Seadrill Partners LLC (SDLP) Ari Lazar, Jessica Kan, Sai Poddutur , Gongsheng Wang New Company Presentation 3/17/15 1 Introduction Oil drilling company that rents rigs to large oil companies in exchange for daily payments. jack-up rigs, tender rigs, semi-submersible rigs, and drill ships Long term contracts with average duration of 3.3 years Customers: BP, Exon Mobile, Chevron, Tullow Oil Locations: 10 Oil Rigs in Canada, the US Gulf of Mexico, southeast Asia and West Africa Major Competitors: Atwood Oceanics, Teekay Offshore Partners, Ocean Rig UDW, Hercules Offshore Inc Business Phase: Growth Price: $11.70 P/E Ratio: 7.77 52 Week Range: $11.52 - $36.07 2 Sources: SDLP 2014 Investor Presentation and Yahoo Finance on 3/15/15 Macroeconomic Review Price of oil decreasing drastically in the past few months Decline in price that Seadrill can charge on new contracts Close relationship between oil price, rig count, and revenue Historic Oil Price 2500 Historic Rig Count 2000 1500 1000 500 1/7/2000 7/21/2000 2/2/2001 8/17/2001 3/1/2002 9/13/2002 3/28/2003 10/10/2003 4/23/2004 11/5/2004 5/20/2005 12/2/2005 6/16/2006 12/29/2006 7/13/2007 1/25/2008 8/8/2008 2/20/2009 9/4/2009 3/19/2010 10/1/2010 4/15/2011 10/28/2011 5/11/2012 11/21/2012 6/7/2013 12/20/2013 7/3/2014 1/16/2015 0 3 Source: trading economic website, Relevant Stock Market Prospects Long Term Contracts Average duration of 3.3 years Seadrill plans to extend existing contracts at slightly lower prices All contracts are legally enforceable Unlike Diamond Offshore (DO) who is losing contracts 9 out of 10 contracts are locked in at pre oil crash prices until at least 2017 If price of oil rises, SDLP will likely increase as well Acquisitions and Expansion Recently purchased new rig in November for $900 Million Management is committed to future expansion New, advanced floaters compared to the aging old floaters 17.30% Dividend Yield 4 Based on current price Management has promised to maintain or raise dividends throughout 2015 Operating agreement forces them to distribute all excess cash Source: SDLP Q4 2014 earnings call transcript Business Overview- Portfolio 5 Sources: SDLP 2014 Investor Presentation Business Overview – Portfolio Changes West Vela Recently purchased West Vela rig on November 6th for $900 Million $525,000 day rate from BP with contract locked until November 2020 West Vencedor 6 Contract expires at the end of Q1 2015 with a day rate of $218,000 Future contracts for this rig are still being explored Only contract that expires before 2017 Source: SDLP Q4 2014 earnings call transcript Business Overview - Management CEO: Graham Robjohns In office since June 2012 Previous experience: CEO and CFO Golar LNG Partners Nov 2009-July 2011 Under his management stock saw over 200% returns Management Goals and Outlook 7 See themselves to be in a challenging macroeconomic environment Committed to expansion and future acquisitions Maintaining excellent customer service Sustaining or raising dividends 47% of stock held by Seadrill Limited (SDRL) High incentive for highest possible dividends Source : Capital IQ and SDLP 2014 Q4 earnings call transcript Business Overview - Risks Price of Oil If Oil prices do not increase new contracts will see a decrease in price West Vencedor rig is a “tender situation” because new contract expires at the end of this quarter and no agreement has been reached yet on a new contract One time Expenses Had 36.4 million dollar investing expense for hedging floating rate interest but remains as a fully non cash movement unless swap is terminated 10 year swap and will directly increase net income if interest rates rise Natural Disasters Hurricanes or other storms could potentially cause damage to equipment Alternative Energy Alternative energy may decrease demand for oil in the future Debt Obligations 8 Very high debt levels which have lead to recent negative outlooks from Moody’s No long term debt due until the end of 2016 98% of debit is locked in at 2.5% + Libor and fully hedged with an interest rate swap Source: SDLP Q4 2014 earnings call transcript Porter 5 Analysis Threat of Substitutes - Moderate Threat of New Entrants - Low Supplier Bargaining Power – Low Customer Bargaining Power – Moderate/High Rivalry Within Industry - Moderate 9 SWOT Analysis Strengths Long-term, legally enforceable contracts Attractive rates paid daily in cash High dividend pay out rates Weaknesses Tender situation with West Vencedor rig Opportunities Contract length extensions with current customers at slightly lower day rates Acquisitions of new rigs Threats 10 Challenging macroeconomic environment especially with oil prices Recent Earnings (Q4 2014) Revenue of $380.6 Million 34.8% Increase year over year Beat Analyst Expectations by $27.04 Million Net Income of $70.1 Million Before minority interest Slightly lower than Q4 2013 EPS of $0.86 11 Outperformed analysts expectations of $0.76 Source: SDLP Q4 2014 earnings call transcript Recent Returns 12 Source: Google Finance Capital Structure Cash $243 million in cash $200 million in undrawn revolvers Used to Finance Dividends Capital Structure Debt No debt due until 2016 $4,302 million Used to finance expansion Equity $2,044 million 47% of company held by Seadrill ltd (SDRL) 13 Source: SDLP Q4 2014 earnings call transcript Cash Debt Equity Technical Analysis Current Price Below 20 day and 200 day moving averages 14 Strong bearish signal Source: bigcharts.marketwatch.com Financial Analysis 15 Source: Capital IQ Financial Projections - Revenue 16 Financial Projections 17 Discount Rate 18 DCF 19 Price Target Sensitivity Analysis Change in Oil Price Discount Rate 20 Comparable Analysis 21 Source: Capital IQ Comparable Analysis Large difference in comparable implied price and market price Levered ratios vs. Unlevered ratios Seadrill has more debt than competitors 22 Source: Capital IQ Comparable Stats 5 4 3 2 1 Seadrill Partners LLC Comparables Average 0 -1 23 Recommendation Current Price: $11.70 DCF Implied Price: $30.83 Comparable Analysis Implied Price: $32.98 Average Projected Price of $31.90 Technical Analysis Conclusion: Sell We recommend adding SDLP to watch list 24 Should be reconsidered if macroeconomic conditions improve