Week 12 Chapter 5

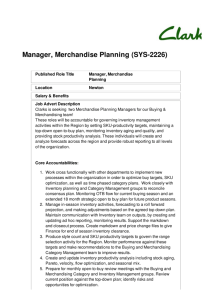

advertisement

Accounting for Merchandising Activities CHAPTER 5 Part 1 Learning Objectives 1. 2. 3. 6-2 Describe merchandising and identify and explain the important income statement and balance sheet components for a merchandising company. (LO1) Describe both periodic and perpetual merchandise inventory systems. (LO2) Analyze and record transactions for merchandise purchases and sales using a perpetual system. (LO3) Learning Objectives 4. 5. 6. 6-3 Prepare adjustments for a merchandising company. (LO4) Define, prepare, and use merchandising income statements. (LO5) Prepare closing entries for a merchandising company. (LO6) Learning Objectives 7. 8. 6-4 Record and compare merchandising transactions using both periodic and perpetual inventory systems. (Appendix 5A) (LO7) Explain and record Provincial Sales Tax (PST) , Goods and Services Tax (GST) and Harmonized Sales Tax (HST). (Appendix 5B) (LO8) Merchandising Activities Merchandiser: A company that earns net income by buying and selling merchandise. Wholesaler: A company that buys products from manufacturers or other wholesalers and sells them to retailers or other wholesalers. LO 1 6-5 Inventory Products a company owns for the purpose of selling to customers. • It is often referred to as Merchandise Inventory. • Is classified as a current asset. LO 1 6-6 Merchandise inventory is: A) Reported on the balance sheet under plant and equipment. B) Products a company owns for resale to customers. C) Reported on the income statement as an expense. D) Includes supplies. E) Included on a service company's balance sheet. Computing Net Income Service Company Revenues Merchandiser Net Sales Cost of Goods Sold Gross Profit Operating Expenses Operating Expenses Net Income Net Income LO 1 6-8 Cost of Inventory? Cost of the goods But also: Shipping costs (Freight In) Any other costs required to make goods ready for sale LO 1 6-9 Merchandising Cost Flow Beginning Merchandise Inventory Net cost of Purchases Merchandise available for sale Ending Merchandise inventory Cost of goods sold LO 1 6-10 Practice Exercise 5-1 Flashcards 6-11 Merchandise Inventory Systems Perpetual Provides a continuous record of: • The amount of inventory on hand • Cost of goods sold to date Periodic Requires a physical count of goods to determine: • The amount of merchandise inventory on hand • Cost of goods sold LO 2 6-12 Perpetual System – Example Purchases Nov. 2 Merchandise Inventory 1,200 Accounts Payable 1,200 Purchased merchandise inv. on account Purchase Returns and Allowances Nov.5 Accounts Payable 300 Merchandise Inventory 300 Purchase return re: debit memo Merchandise Inventory 1,200 300 900 Accounts Payable 1,200 300 900 LO 3 6-13 Prompt Payment Discounts A deduction from the invoice price granted to induce early payment of the amount due. Example – 2/10, n30 Credit Period = 30 days Terms Discount Period = 10 days Time Nov.12 Nov.2 Due (Full amount minus 2% discount) due between Nov.2 and Nov.12 Purchase or Sale 6-14 Dec.2 Full amount due anytime between Nov.13 and Dec.2 LO 3 Perpetual System–Example Purchase Discounts- Assume the purchase on November 2 was on the terms 2/10,n30. Case 1-Discount taken How much will we have to pay? Accounts Payable 1,200 300 900 LO 3 6-15 Perpetual System–Example Purchase Discounts- Assume the purchase on November 2 was on the terms 2/10,n30. Now being paid on November 12. Case 1-Discount taken Nov.12 Accounts Payable 900 Cash Merchandise Inventory 2% x (1,200 - 300) = 18 882 18 Case 2-Discount not taken Nov.12 Accounts Payable Cash Accounts Payable 1,200 300 900 900 900 900 LO 3 6-16 Z-Mart uses the perpetual inventory system and recorded the following journal entry: Accounts Payable 2,500 Merchandise Inventory 50 Cash 2,450 The transaction was: A) A purchase B) A return C) A return and payment of the account payable. D) A payment of the account payable and recognition of a cash discount taken E) A purchase and recognition of a cash discount taken Perpetual System–Example Transportation Nov.24 Merchandise Inventory Cash 75 75 Paid freight charges on purchased merchandise. $75 Our Supplier Us Our Customer LO 3 6-18 Transportation Charges: Who Pays? Seller Goods FOB “Shipping Point” (Buyer pays shipping charges) Carrier (shipping company) Buyer FOB “Destination” (Seller pays for shipping charges) LO 3 6-19 This entry: Nov.24 Merchandise Inventory Cash 75 75 Paid freight charges on purchased merchandise. Is a/an: A) Adjusting entry B) Reversing entry C) Closing entry D) Regular journal entry E) Cannot be determined Perpetual System–Example Sale of Merchandise Nov.12 Accounts Receivable 1,000 Sales 1,000 Sold merchandise on terms 2/10,n60 Cost of goods sold 600 Merchandise Inventory 600 To record cost of merchandise sold Merchandise Inventory 1,200 300 900 600 LO 3 6-21 Perpetual System–Example Customer Payment Case 1-Customer pays in 60 days Jan.11 Cash 1,000 Accounts receivable 1,000 Received payment for Nov. 12 sale Case 2-Customer pays in 10 days Nov.22 Cash 980 Sales discounts 20 Accounts receivable 1,000 Received payment less the discount LO 3 6-22 Perpetual System–Example Sales Returns and Allowances Nov.6 Sales Returns & Allowance 800 Accounts Receivable 800 Customer returned merchandise Merchandise Inventory 600 Cost of Goods Sold 600 Returned goods to merchandise inventory LO 3 6-23