Economic Considerations for West Virginia Hemp

Economic Considerations for West Virginia Hemp Production

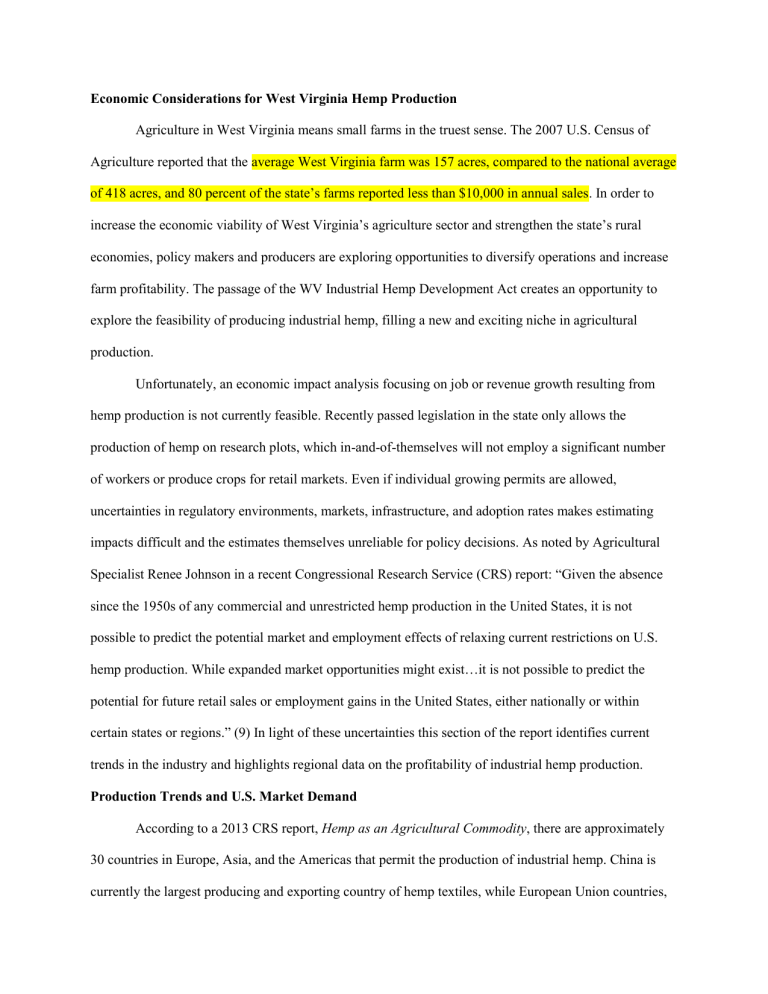

Agriculture in West Virginia means small farms in the truest sense. The 2007 U.S. Census of

Agriculture reported that the average West Virginia farm was 157 acres, compared to the national average of 418 acres, and 80 percent of the state’s farms reported less than $10,000 in annual sales. In order to increase the economic viability of West Virginia’s agriculture sector and strengthen the state’s rural economies, policy makers and producers are exploring opportunities to diversify operations and increase farm profitability. The passage of the WV Industrial Hemp Development Act creates an opportunity to explore the feasibility of producing industrial hemp, filling a new and exciting niche in agricultural production.

Unfortunately, an economic impact analysis focusing on job or revenue growth resulting from hemp production is not currently feasible. Recently passed legislation in the state only allows the production of hemp on research plots, which in-and-of-themselves will not employ a significant number of workers or produce crops for retail markets. Even if individual growing permits are allowed, uncertainties in regulatory environments, markets, infrastructure, and adoption rates makes estimating impacts difficult and the estimates themselves unreliable for policy decisions. As noted by Agricultural

Specialist Renee Johnson in a recent Congressional Research Service (CRS) report: “Given the absence since the 1950s of any commercial and unrestricted hemp production in the United States, it is not possible to predict the potential market and employment effects of relaxing current restrictions on U.S. hemp production. While expanded market opportunities might exist…it is not possible to predict the potential for future retail sales or employment gains in the United States, either nationally or within certain states or regions.” (9) In light of these uncertainties this section of the report identifies current trends in the industry and highlights regional data on the profitability of industrial hemp production.

Production Trends and U.S. Market Demand

According to a 2013 CRS report, Hemp as an Agricultural Commodity , there are approximately

30 countries in Europe, Asia, and the Americas that permit the production of industrial hemp. China is currently the largest producing and exporting country of hemp textiles, while European Union countries,

especially the United Kingdom, Romania, and Hungary are active in the production of hurds (coarse fibers and refuse), seeds, and fibers. In 2011, global acreage was reported at 200,000 acres with production of nearly 200 million pounds of fiber and seed (see Figure X).

Figure X. Hemp Fiber and Seed, Global Production, 1999-2011

Source: FAOSTAT, http://faostat.fao.org/site/567/default.aspx#ancor

The increase in hemp seed production roughly follows upward trends in U.S. imports of hemp seed and seed oils which increased 123 percent between 2008 and 2011, from $4.4 million to $9.8 million. (Figure

X). However, in spite of these increases the market for hemp products is extremely small, totaling less than $12 million in 2011. Market size adds to the difficulty in predicting economic impacts as small increases in production could easily result in oversupply and depressed prices.

Figure X. Value of U.S. Imports of Hemp Product, 2000-2011

$12 000

$10 000

$8 000

$6 000

$4 000

$2 000

$0

2000 2005 2007 2008 2009 2010 2011

Seeds Oil & Fractions Oilcake Fabrics Yarn Raw

Source: U.S. International Trade Commission (USITC), http://dataweb.usitc.gov

Production Profitability

Returns from industrial hemp production are highly speculative given market and legislative unknowns. Likewise, data on crop yields and production budgets are largely nonexistent as little research has been conducted in the U.S. For the Mid-Atlantic region, recent research from the University of

Kentucky’s Department of Agricultural Economics provides the best estimates of yields per acre for different production systems (Tables X and Y).

Table X. Hemp Fiber Production, Estimated Net Returns per Acre

(tons/year)

4.0

6.0

8.0

Yield

Net Returns/Acre (does not include land cost)

Hemp Fiber Production Only

$50/ton

Fiber Price

$75/ton

Fiber Price

$100/ton

Fiber Price

-$376

-$359

-$342

-$276

-$209

-$142

-$176

-$59

$58

$125/ton

Fiber Price

-$76

$91

$258

10.0 -$325 -$75 $175 $425

Notes: Costs include labor and depreciation/overhead but not land costs. $3.50/gal fuel;

N, P, and K at $0.50/unit; 50 miles one-way trucking to market.

Source: Economic Considerations for Growing Industrial Hemp: Implications for Kentucky’s Farmers and

Agricultural Economy, July 2013

The table above shows returns per acre for hemp fiber production at various yields and prices.

Returns are negative until fiber prices reach $100 per ton. Even with high productivity and high yields returns are modest. For comparison, Extension specialists at West Virginia University estimate average production of 130 bushels of corn per acre. At 2013-2014 prices of $4.50/bushel farmers could expect approximately $140 per acre returns.

Production of hemp seed produces more attractive results. Medium productivity systems generate over $180/acre, and high productivity systems can generate nearly $400 per acre at $0.70/lb prices.

Table X. Hemp Seed Production, Estimated Net Returns per Acre

Net Returns/Acre (does not include land cost)

Hemp Seed Production Only

Yield (lbs/year)

600

800

1000

$0.50/lb

Seed Price

$11

$102

$192

$0.60/lb

Seed Price

$71

$182

$292

$0.70/lb

Seed Price

$131

$262

$392

$0.80/lb

Seed Price

$191

$342

$492

Notes: Costs include labor and depreciation/overhead but not land costs. $3.50/gal fuel;

N, P, and K at $0.50/unit; 50 miles one-way trucking to market.

Source: Economic Considerations for Growing Industrial Hemp: Implications for Kentucky’s Farmers and

Agricultural Economy, July 2013

The results above suggest that the economic impacts from hemp production will be limited, at least in its initial stages, and that the production of hemp seed will be most profitable. However, given that West Virginia’s hemp production legislation emphasizes research, university faculty and growers have an opportunity to conduct studies focused on improving yields, harvest techniques, and value-added processes, especially for fiber. Developing an expertise in research and application, experienced growers, and state regulatory programs could give the state a competitive advantage and provide an incentive for the recruitment of value added processors (soaps, paper, textiles, biofuels, and industrial materials), further strengthening the industry and enhancing its likelihood of profitability and success.

Johnson, R. (2013, June 24). Hemp as an Agricultural Commodity . CRS Report for Congress RL32725.

Retrieved from https://www.fas.org/sgp/crs/misc/RL32725.pdf

Robbins, L., W. Snell, G. Halich, L. Maynard, C. Dillon, and D. Spalding . (2013, July). Economic

Considerations for Growing Industrial Hemp: Implications for Kentucky’s Farmers and Agricultural

Economy . Department of Agricultural Economics, University of Kentucky. Retrieved from http://www2.ca.uky.edu/cmspubsclass/files/EconomicConsiderationsforGrowingIndustrialHemp.pdf

U.S. Department of Agriculture, National Agricultural Statistics Service. (2007). Census of Agriculture .

Retrieved from http://www.agcensus.usda.gov/