3.1 D Investment appraisal

advertisement

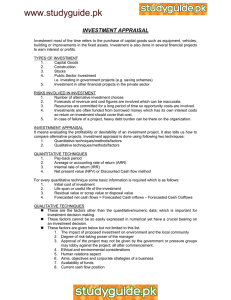

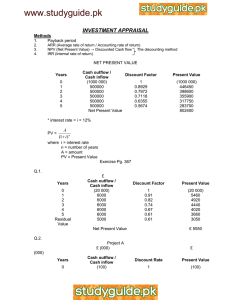

Investment Appraisal What is Investment? Investment refers to the purchase of capital goods or any other use of retained profits that is likely to earn a return in the future. Investment is not the same as saving money in a bank or buying shares to try to earn dividends. Investment is the purchase of productive capacity. For example, buying equipment or a new factory to increase capacity, meaning to increase the amount that can be produced. This will lead to consumer demand being met and sales revenue being generated. One of the main reasons why businesses invest is because they have to. Most firms use plant, machinery, equipment, vehicles, tools and other capital goods. Considerable investment is necessary when a business is being set up, however even when a business is established investment will continue. Eventually capital goods will have to be replaced. Further investment is made to help achieve the objectives of the business. Some examples are: Marketing, if the business wants to increase its market share Research and development (R&D) New technology, to minimise costs or improve quality New capacity, if the business wishes to diversity into new products or locations Acquisition of other businesses in order to expand or to buy out a rival firm Investment Appraisal This is the process of evaluating the profitability or desirability of an investment project. It is a means of assessing whether or not the project is worthwhile. Investment appraisal assesses the cost of the investment against the income streams it will generate. Every investment decision has an opportunity cost. It is essential that firms evaluate investment options. The consequences of poor investment could include: Cash flow/liquidity problems that could in the worst scenario lead to insolvency Reduced profitability Loss of shareholder confidence leading to a devaluation of shares Under-utilisation of a new resource Reduced productivity/efficiency Loss of competitive advantage Damage to brand caused by negative publicity Lack of consumer and employee trust and loyalty Investment appraisal requires the following quantitative information: Initial capital costs of the investment Estimated life expectancy of the asset The expected residual value of the asset (additional return from the sale of the asset at the end of its useful life) Page 1 Forecasted net returns or net cash flows from the project (expected returns less running costs) Non-financial factors affecting investment In addition to applying an Investment Appraisal formula to assess an investment option, management should consider other issues, such as: Corporate objectives ~ does the investment meet corporate objectives of the business? A long-term profit goal may allow investments with long payback periods, but if the business is facing a cash flow crisis they may prefer shorter payback period Capacity for risk taking ~ is the benefit worth the risk? Operations ~ current production capacity? Will quality standard be maintained? Links and relationships with suppliers? State of the economy ~ the current and forecast state of the economy will have a significant effect on investment decisions The extent to which future cash flows can be measured accurately The need to factor in the effects of inflation Methods of Investment Appraisal 1 2 3 Payback method Average/accounting rate of return Net present value PAYBACK PERIOD Definition Advantages Disadvantages Formula: Payback = Example Calculation Result The length of time it takes for net cash inflows to repay the original capital costs of the investment A quick and easy calculation Focus is on cash which is normally scarce Emphasis is on the speed of return Makes assumptions about interest rates Days/weeks/months x initial investment Total cash received A new machine will cost $600,000 and will take three years (36 months) to repay. It is estimated that the annual income stream from the investment will be $255,000 p.a. ($765,000 over the three years) 36 x 600,000 = 21,600,000 765,000 28.23 months AVERAGE/ACCOUNTING RATE OF RETURN Page 2 Definition Advantages Disadvantages Formula: ARR = Example Calculation Result Measures the annual profitability of an investment as a percentage of the initial investment Provides a percentage return which can be compared to targeted return Focus is on profit which is the main goal of most business decisions Easily understood Doesn’t take into account time value of money Doesn’t take into account timing of the cash flow Average annual return or annual profit Initial cost of investment Investment is expected to earn cash flows of $10,000 annually for the next five years ($50.000). Investment initially cost $20,000. Therefore profit is $30,000 and annual profit is $6,000. 6,000 20,000 x 100 30% Factors in assessing ARR percentage value The ARR on other projects (the opportunity costs) The minimum expected return set by the business The annual interest rates on loans. ARR needs to be greater than the interest costs on borrowing. Even if the firm doesn’t need to borrow for the investment, there’s always an opportunity cost of interest foregone by keeping the money in the bank. NET PRESENT VALUE or Discounted Cash Flows The two methods above, payback period and average rate of return, may both be applied to a potential investment and give conflicting results. For example, project X is estimated to be paid back in three years with an ARR of 15%. Is this better than project Y that will take four years to pay back but will give an ARR of 18%. Net Present Value considers the size of the cash flows and the timing of them. It does this by discounting cash flows. NPV takes into account the time value of money. The present value of a future sum of money depends on two factors: The higher the interest rate, the less value future cash in today’s money The longer into the future cash is received, the less value it has today. Definition Advantages Disadvantages Measures today’s value of the estimated cash flows resulting from an investment Takes into account the fact that money values change with time Takes into account time value of money Makes assumptions about interest rates Calculating discounted cash flow is the most complex of the three methods. The following example, which uses smaller example figures!, is from the site: Mathsisfun.com http://www.mathsisfun.com/money/net-present-value.html - NetPresentValue Page 3 There are some excellent YouTube clips that explain NPV well, for example ones entitled: Net present value explained What is NPV? Net present value ~ NPV. Page 4