Monetary Policy Slides

advertisement

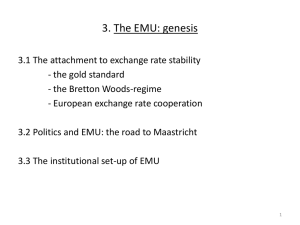

The Monetary policy of Portugal & European Monetary Union (EMU) Is the EMU an effective source in securing Portugal’s economy with respects to other members in the EMU? Brief Introduction • The purpose of this power point is talk about the role of Portugal in the European monetary union. Taken that Portugal is part of the EMU, the discussion on EMU and Portuguese monetary policy are interrelated. I must stress that on the limitations of the power point slides and on this discussion, it is almost impossible to cover everything between these mentioned Monetary policy’s within this presentation. Furthermore, it is important to discuss the role of the EMU and its purpose to the many countries involved in this agreement. Finally, conclusive results will show that the power of the European Monetary Union was to establish a centralized policy, in which it forms a combined effort to create sustainable economic growth, harmonization and unification of the European communities. EMU Brief introduction • As of January 1998, 15 of the 27 countries that form the European Union agreed to have a common currency, the euro, and a common monetary policy. Portugal along 14 other countries agreed to the standards and processes in which they must agree on to be part of this union. First and foremost, the foundations of EMU were set in discussion in December of 1991 when the Maastricht Treaty was put forward for approval by the membered countries. This treaty was adopted in November 1992, although, a currency crisis was in affect. The essence of the treaty was based on the formality of the European Union and to adopt a primary, single currency. This common currency, the euro, would be distributed and issued by the European Central Bank (ECB) and the ECB would conduct the monetary policy for the countries using the common currency. As a result, the countries were required to give up their control over the monetary policy. Finally, the members of the EMU, like Portugal, had to have met the four convergence criteria's of the Maastricht Treaty; Fiscal deficits, price stability, interest rates, exchange rate. This will be discussed further in the presentation. In addition, it is required that there be legal compatibility for the central bank to join the monetary union in the form of freedom from political interference and factors of compatibility, such as; balance of payments, integration of markets, and unit labor cost without setting specific numerical goals. The final decision is strictly political. Then the EMU was formally launched on January 1, 1999 with 11 countries. Greece joined two years later. The Maastricht criteria • 1. Fiscal deficits: Government deficit must not exceed 3% of country’s GDP and total government debt must not exceed 60% of GDP. Declining debt level is acceptable. • 2. Price stability: Inflation rate of country over the previous year must not exceed by more than 1 1/2 percentage points the average inflation rates of the 3 member states with the lowest inflation rates. • 3. Interest rates: Long-term nominal interest rate must not exceed by more than 2 % points the average of long-term interest rates of the 3 member states with the lowest interest rates • 4. Exchange Rate: must have remained within the fluctuation margin (± 15 percent since 1992-93 Exchange rate crisis) and must not have faced severe tensions for at least the last 2 years before entry. Effects of EMU • Improved economic efficiency – Introduction of one currency has eliminated risk associated with exchange rate changes within the euro area – Reduced transaction costs associated with conversions of currencies. – Taking advantage of inflationary rates and the effects of rising prices. Effects of EMU • Use of one currency has encouraged development of integrated financial markets – In 2008, volume of bonds denominated in euros exceed that of dollar bonds for the first time ever – Share of euro in international reserves held by countries has increased over the past decade – The monetary system main main objective was to reduce the volatility of exchange rates between the currencies of the European economic community. Effects of EMU • Disadvantages – Loss of independence of monetary policy – Lacking ability to implement different monetary policies in the absence of full factor mobility may lead to loss of a country's international competitiveness. This is indeed is the case for Greece, Spain, Italy, and Portugal in the 2008 crisis. Transmission mechanism of monetary policy of the EMU • The central bank, as the sole issuer of banknotes and sole provider of bank reserves, is the monopoly supplier of the monetary base. Credit institutions need base money in order to meet the public demand for currency, to clear interbank balances (Cheque’s, transfers, etc.) and to fulfill minimum reserve requirements. The base money can be traded by the credit institutions within the interbank money market: those having excess funds lend to those who have a shortage of funds, at a given interest rate. • By virtue of this monopoly, the central bank sets the conditions at which banks borrow from it. • A change in money market interest rates induced by the central bank ultimately influence developments in output variables and prices. The role of the European central bank and the euro • The treaty creating the monetary union establishes price stability as the primary objective in the euro area. The governing council of the ECB adopted a quantitative definition of price stability in 1998. • Bank notes and coins were introduced on January 1, 2002 • The collapse of the economy in 2008 led to a rethinking of monetary policy frameworks. • The ECB acceded to the people’s demand for economic security by delivering stable prices, in a context of steady income progression and moderate real fluctuations. • Decision-making body for monetary policy • Distributes the Euro to countries that need it and excess reserves from countries are distributed to countries that have low reserves or low money supply. • With the EMU, all existing central banks had become instruments of ECB. Portugal’s influence • Part of the EMU and EU • In 1998, joined the EMU, and the euro begin circulating in January 2002. Before they had used escudos, which was traded at poor exchange rates. • At the turn of the millennium , the economy appeared to falter, with a widening gap in GDP per capita. • The budget deficit increased to 6% in 2005 • The private sector, traditional goods, business services, and technology was growing at a higher sustainable pace in 2007 Portugal’s monetary policy & eurosystem • The Banco de Portugal is an integral part that aims to maintain price stability within the euro system. Thus protecting the purchasing power of the euro, as it was said in the treaty of Maastricht, was established within the European community. • Contribute to community objectives that include high level of employment and sustainable and non-inflationary growth. Current economic crisis in Portugal • • • • • • Due to the stagnating growth of debt from the euro zone (i.e. Portugal, Greece, Italy, Spain, and Ireland), created large amounts of money supply in what they call, a European debt crisis. There is high demand for cash circulation however the markets are responding with hesitation because of the notion that they can’t pay back their recent debts. A bailout was issued by private sector investors. Due to the contagion effect, it was imperative that the EU focused there efforts on Portugal. Portugal signed a $110 bailout agreement with the EU and IMF. The EMU had committed its efforts to rebuild the debt crisis in Portugal by cutting salaries for public sector workers. The EMU places a huge role from diverting an domino effect on the other countries involved in the EMU. The financial soundness is growing within Portugal and the EMU as higher levels of risk starts to panic the markets. The bailout plan may cause moral hazard problems in the case that the bailout money is used insufficiently. Mentioned earlier, the political aspect is essentially in creating the best possible choices for the economy. The Essence of the EMU with Portugal • Economic integration – Common currency allows for easier trading links – Faster movements of goods, services, capital, and labor – In economic downturns, Portugal gains supports from its European neighbors in contrast provides economic wealth. – The benefits of the euro causes free trading and stable exchange rates. This provides a greater effort for Portuguese businesses to be seen in the markets today. That said, free trade agreements account for 90% of the economic integration with the countries involved in the EMU. The Essence of the EMU with Portugal • Because the Portuguese economy is connected with the European Union, source of funding and trade have provided a great deal of attention within the markets. • Portugal's current economy is facing the first stage of the economic domino-slinky effect of a steady European debt crises. With the bailout plan for Portugal, a lot of economic decisions are made to continuing prospering economically. • The process of the EU is the most highly integrated regional entity with the greatest wealth and intra-system trade. The intended function of the EU is to create a uniform system, including currency, that facilitates the most frictionless and efficient transfer of goods, services, people, and factors of production while limiting the risks of currency conversion and fluctuations arising from vastly different countries. • Essentially, with respect to the debt as a percentage of GDP, unemployment levels, tax rates and industrial policies change frequently during the current European crisis. Final Conclusions • • • • • • • Portugal’s economy requires the essence of the EMU. This protection provides stability and unification with its trade partners in the euro zone. Essentially, the euro, has provided an easier access for the Portuguese economy to grasp to current movements of trades and to keep up with the markets. I would say the process of EMU is effective however, the political aspect is solely based on the decisions of Portugal. Currently, Portugal is in a tight struggle to cut salaries and withdraw its efforts from the current European debt crisis. This could have been diverted, if decisions within the economy were chosen correctly. However, the efforts of the EMU stands as an appropriate fixture to Portugal’s economic well-being and to provide an efficient method to creating stability, unification, and opportunity. The creation of the EMU creates enormous opportunities that Portugal possibly couldn’t have reached in its lifetime. Essentially, the euro helped rebuild a tighter economic integration system that refaced the image of Europe's future. Future economic slowdown depends on the combined efforts of each individual neighbor. When they instituted the euro, many countries realized that they didn’t have money when the conversion rate decreased the overall money supply in country. This was the case in Portugal when there original currency, the Escudo, had diminishing returns with the euro, and as a result, overall money supply decreased. Bailing out is bad policy, however, a lot of social outburst had occurred because of cutting spending's, as it did in Greece. Germany’s inflation rate is lower compared to Greece’s inflation rate of 13% and the two economy’s use the same currency which has the same monetary value. The German economy is much more stable and carries large amounts of money supply but yet they have to abide by equal inflationary expectations. This is an ineffective procedure in monetary policy that members of the EMU must face/ Other side of the coin • • • • • Monetary policy is ineffective in regards to all the members as a whole. Having the same optimum currency with similar speeds of money creation can burden the bigger economic countries like Germany and France. Modernization is different in Portugal as it is in Germany. Portugal’s economy rests on the creation of small businesses and not laundering of large sums of money supply, whereas, in Germany, purchasing of bonds is much higher and therefore due to the higher creation of businesses in Germany, large amounts of money (the euro in particular) is being circulated. Furthermore, in this case, monetary policy shouldn’t be equally distributed if more money supply is carried in one country than another. Germany, in this case, faces the burden of financial crisis from other countries, as it did in the recent debt crisis. Due to the infrequent changes in prices, theoretically, Portugal should obtain a higher rate of inflation then Germany. Essentially, we see that a loop hole in the monetary policy of the EMU. Countries who circulate large sums of money supply, should yield a lower rate of inflation with respects to small changes in price level. If you examine Portuguese prices, they are much lower with a low supply of money circulating the economy after the hyper exchange of escudos to euros. Theoretically, Portugal's prices should be higher to prove that the monetary policy of the EMU is effective. Consequently, the European Central bank of the EMU controls monetary policy, and on the basis of unification, and harmonization, the bank issues one standardized policy. Germany being one of the leading founders of the EMU refuses to lower the inflation rate due to the historical incidents that occurred in post world war one. Which resulted in one of the worst hyperinflation in German history. To fix this problem, Germany had to increase inflation and increase Money supply which comes into conflict with the members of the EMU. This is on the basis of empirical work. Bibliography Online Database: • Jain, Arvind K. "European Monetary Union." Encyclopedia of Business In Today's World. 2009. SAGE Publications. 1 Dec. 2011. <http://sage-ereference.com/view/businesstoday/n357.xml>. • Weatherston, Jamie. "Portugal." Encyclopedia of Business In Today's World. 2009. SAGE Publications. 1 Dec. 2011. <http://sage-ereference.com/view/businesstoday/n747.xml>. • Demirbas, Dilek. "Economic Union." Encyclopedia of Business In Today's World. 2009. SAGE Publications. 1 Dec. 2011. <http://sage-ereference.com/view/businesstoday/n325.xml>. Website source: • http://www.bportugal.pt/en-US/PoliticaMonetaria/Pages/default.aspx • http://www.ecb.int/pub/pdf/scpwps/ecbwp1336.pdf • http://news.stanford.edu/news/2011/november/portugal-president-silva-111511.html