HSA 6126 - Pegasus @ UCF

advertisement

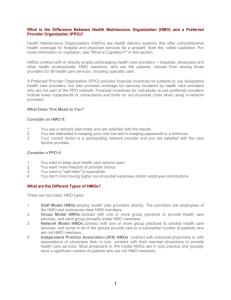

Managed Care Aaron Liberman, Ph.D. Overview of Managed Care Techniques of Managed Care vs. Organizations Performing Managed Care Functions • Techniques – Financial incentives for providers – Promotion of wellness – Early identification of disease – Patient education – Self-care – Utilization management (UR, QI, QM) Techniques of Managed Care vs. Organizations Performing Managed Care Functions • Organizations – HMO – PPO – EPO – POS Plan – Self-Insured & Experience Rated HMO – Specialty HMO – Managed Care Overlay to Indemnity Plan – PHO Stages of Managed Care • Early Years: Before 1970 – 1792 Shippers of Boston – 1910 Western Clinic of Tacoma Wash. – 1929 Baylor Hospital’s Prepaid Plan for Teachers (BCBS) – 1932 AMA Adopts Stand Anti-Prepaid Group Practices Stages of Managed Care • Early Years: Before 1970 (cont.) – 1937 – 1937 – 1944 – 1947 Kaiser Foundation Health Plans Group Health Association HIP of New York Group Health Coop of Puget Sound – 1954 First Individual Practice Association Stages of Managed Care • Early Years: Before 1970 (cont.) – Trends • Providers wanted to ensure flow of patients & revenues • Employers began using prepaid plans • Consumers sought access to improved & affordable healthcare Stages of Managed Care • Adolescent Years: 1970-1985 – 1973 HMO Act – Problems with Federal Legislation Features of the 1973 HMO Act • Grants and loans to start HMOs • State laws against HMOs overridden • Dual choice provisions – Indemnity vs. HMO – Employers with 25+ employees must offer 2 HMO plans for every indemnity plan offered Features of the 1973 HMO Act • Process to become federally qualified – Minimum benefit package – Adequate provider network – QA system in place – Standards of financial stability – Enrollee grievance system 1973 HMO Act: Importance of Federal Qualification • Good Housekeeping Seal – Use as a marketing tool • Dual choice = access to employer market • Preemption of state insurance oversight • Required for receipt of federal grants 1973 HMO Act: Problems with Federal Legislation • Compromise between Liberals & Conservatives in Congress – Liberals wanted National Health Insurance • Goal was to increase access to those without access – Conservatives wanted competition • Goal was to promote plans which gave physicians incentives to constrain costs 1973 HMO Act: Problems with Federal Legislation • Result of the compromise was an open enrollment & community rating system – HMOs were required to accept all enrollees without regard to their health status – Limited the ability of HMOs to relate premiums to health status 1973 HMO Act: Problems with Federal Legislation • Federal government was slow in issuing implementation regulations • Results of regulation attempts = failures of initial HMOs Stages of Managed Care • Coming of Age: 1985-Present – Innovation – Maturation – Restructuring Innovation • PHO as a Contracting Vehicle – Increased negotiating power of providers • Development of Carve Outs – Separated the reimbursement of specific specialized services • Advances Computer Technology – Increased efficiency • i.e. generation of reports, processing of claims Maturation • HMO & PPO growth – Increased enrollment • External Quality Oversight – NCQA (most credible), URAC, AAAHC, JCAHO • Report Card System – Performance measurement systems • i.e. quality, outcomes, etc. • Focus on Cost Management Restructuring • Interplay between managed care & delivery system • Dominance of primary care physicians • Consolidation Health Care Reform Factors Driving Health Policy Formation • • • • U.S. Budget & Deficit / Surplus Medicare Trust Fund Shortfall State Budget Shortfalls Business Profits & Growth – Excessive • Public Demand & Appetite for Change Medicare Payment Policies • Packaged Pricing – Case rate method = DRGs – APCs vs. RBRVS • Risk Based Contracting – Fixed monthly amount • Provider Sponsored Organization (PSO) – Provider-based integrated delivery system Medicaid Payment Policies • Medicaid Managed Care Plans – PCCM • Summary of Principal Efforts – Arizona effort – Virginia effort Ethics in Managed Care (Fraud, Abuse & Emergence of Federal Legislation) • Relationship to Managed Care • Who are Managed Care Stakeholders • Historical Perspective on Federal Legislation Historical Perspective: Federal Legislation • Hill Burton Act 1946 • First National Mental Health Commission • CMHC Acts 1963 • Social Security Act 1965 (PL 89-97) – Medicare (Title 18) – Medicaid (Title 19) Historical Perspective: Federal Legislation • • • • • • CHP (PL 89-749) RMPs (PL 89-239) PSROs 1972 (PL 92-603) HMO Act 1973 (PL 92-222) NHRPD Act 1974 (PL 93-641) ERISA 1974 Historical Perspective: Federal Legislation • OBRA 1981 – Medicare & Medicaid HMOs • TEFRA 1983 – PPS – DRGs • Peer Review Improvement Act 1982 – PSROs – PROs Historical Perspective: Federal Legislation • DRGs 1985 • COBRA 1985 – Anti-dumping of patients • HCQIA 1986 – National Health Practitioners Data Bank • OBRA 1987 – Nursing home quality care Historical Perspective: Federal Legislation • TEFRA 1988 – Medicare catastrophic coverage • Expanded Parts A & B • CLIA 1988 – Lab standards classifying the complexity of labs • Medicare Coverage Repeal Act 1989 – Congressional back peddling Historical Perspective: Federal Legislation • OBRA 1989 – Physician Payment Reform – Resource Based Relative Value Scales (RBRVS) • HIPAA 1996 – Portability of coverage – Restrictions on use of preexisting condition limits – Establishment of MSAs Contemporary Realizations • • • • • • Limits on material resources Limits on health expenditures Limits on life saving devices Choices must be made Oregon legislation Honest business practices required Compliance: Federal Statutory Requirements • Purposes of Compliance Programs – Detect & prevent violations – Identify areas of vulnerability – Reduce vulnerability Compliance: Federal Statutory Requirements • Objectives of Compliance Program – Decrease risk of culpable actions by employees – Reaffirm key organization themes • Quality • Superior Service • Cost effectiveness – Meet legal & statutory requirements Compliance: Federal Statutory Requirements • Seven Key Steps for Compliance Programs – Establish compliance standards & procedures – Appoint a Corporate Compliance Officer – Delegate discretionary authority – Monitoring, auditing, & reporting • Use of employee hot line Compliance: Federal Statutory Requirements • Seven Key Steps for Compliance Programs (cont.) – Communicate standards to employees – Consistent appropriate disciplinary procedure – Consistent appropriate responses to violations Excesses of Managed Care Organizations as Reflected in State Actions to Limit Powers • 14 States: • • • • 37 States: 33 States: 20 States: 10 States: • 13 States: Guaranteed issue & renewal for individual insured Guaranteed I & R group market Restrict pre-ex limits Authorized MSAs Laws increasing consumer access to ER services Require range of added services Excesses of Managed Care Organizations as Reflected in State Actions to Limit Powers • 15 States: • 17 States: Prohibit Gag Rules Direct access to OB/GYNs What About the Immediate Future • Legislation on Patient Bill of Rights • Personal Responsibility of Insureds • Individual Ethical Code Types of Managed Care Organizations HMO • Both an Insurer & a Delivery System • Primary point of differentiation among HMOs: – How the HMO relates to its physicians HMO • Staff HMO – Doctors are employees • Form a closed panel – Advantage: • Easier to control – Disadvantages: • Costly & expensive • Limited choice of doctors • Productivity problems HMO • Group Practice HMO – Contracts with groups of doctors to provide all services to members • Doctors are not employees of the HMO – Captive vs. Independent Model • Captive = doctors provide services exclusively for the HMO • Independent = doctors provide services for both HMO & non-HMO patients HMO • Group Practice HMO (cont.) – Advantages: • Easier to conduct UM • Lower capital needs than Staff Model – Disadvantages: • Limited choice • Limited locations • Perception of inferior care HMO • Network HMO – Contracts with more than one practice to provide services – Advantage: • Broader physician participation – Disadvantage: • Still limited choice HMO • Individual Practice Association (IPA) – Contracts with an association of doctors – Advantages: • Less capital requirements • Broad choice of doctors • Marketing advantages – Disadvantages: • IPA becomes a de facto union for doctors • UM is difficult because doctors have remained in private practice HMO • Direct Contract HMO – Works directly with large number of doctors – Advantage: • Eliminates possibility of physician bargaining unit by contracting directly with each doctor – Disadvantages: • May assume too much financial risk on behalf of doctors • Difficult to recruit doctors because no clear cut leader PPO • Common Characteristics of PPOs – Select provider panel – Negotiated payment rates • Typically discounted 20-60% – Rapid payment terms – Utilization management • Failure to comply with plan requirements = financial penalty to physician – Consumer Choice • Higher cost sharing if choose non-panel physician or hospital PPO • Advantages: – Independence of providers & consumers – Flexibility of plan • Disadvantages: – Little cost control – Lack of provider concern for fiscal integrity of purchaser EPO • Like PPO except patients may only use panel providers • Advantage: – Control over provider behavior • Disadvantages: – Potentially greater liability exposure for EPO – Disaffection of plan providers POS Plans • Uses primary care physician as gatekeeper • Primary care physicians are capitated • Withhold is prominently used • Member can use non-panel provider but will pay much higher deductible POS Plans • Advantage: – Choice accorded patients • Disadvantages: – Added cost to patients – Lack of cost & underwriting control for POS Plan Self-Insured & Experience Rated HMOs • Fixed payments for period of time • Followed by a settlement process • Advantage: – Significant cost control • Disadvantages: – Failure to reserve for IBNR – Failure to underwrite conservatively – Uncontrolled aggregate losses Specialty HMOs • Dental & Vision • Also called Single Specialty HMOs • Advantage: – Low cost • Disadvantages: – Generally disinterested providers – Poor quality care Managed Care Overlays • Utilization management for general & specialty services • Large case management for shock loss • WCN utilization management PHO • Simple vs. complex PHOs • Advantages: – Greater negotiating clout – Provided vehicle for risk sharing – Clearinghouse for credentialling & utilization management – Organized approach for physicians & hospitals to work together PHO • Problems: – Difficulty competing against large MCOs – Large MCO making money with utilization management & do not want to capitate as way of laying off risk to PHO while UM is profitable Integrated Healthcare Delivery Systems (IDS) Three Categories of IDS • Only physicians are integrated – Individual Practice Association – Physician Practice Management Organization – Group Practice Without Walls – Consolidated Medical Group Three Categories of IDS • Physician & hospital integration – Physician Hospital Organization – MSOs – Foundation Model – Physician Ownership Model – Virtual Integration • Full integration of physicians, hospitals, & insurance Individual Practice Association (IPA) • Negotiates fees on behalf of members • Advantages: – Greater ability to share risk than PHO – Easily understood – Requires less startup capital – Greater motivation to participating physicians Individual Practice Association (IPA) • Disadvantages: – Unwieldy – Unable to change physician behavior – Cannot accept high degree of risk without being classified as an insurance company & without having to be licensed – Too many specialists creates upward utilization & cost pressures Physician Practice Management Organization • Provides management of all support services • Advantages: – Purchasing power – Specialists in managing practices – Provide greater sense of ownership Physician Practice Management Organization • Disadvantages: – Too often focused on the next deal • e.g. Phycor, Medpartners – Not always engaged fully in essentials of the business Group Practice Without Walls • Leverages negotiating strength with MCOs & hospitals • Key Advantage: – Income is a function of group performance • Key Disadvantage: – Physicians remain as independent practitioners Consolidated Medical Group • True group practice with income sharing • Advantages: – Economies of scale – Negotiating leverage – Can actually influence physician behavior – Investment required of physicians serves as an exit barrier Consolidated Medical Group • Disadvantages: – Inflated opinion of worth – Rigid & unable to change – Utilization patterns reflecting overhead pressures on group Physician Hospital Organization (PHO) • Actively manages relationship of principals – Ownership should be equally balanced between physicians & hospitals Physician Hospital Organization (PHO) • Advantage: – Can negotiate effectively on behalf of principals • Disadvantage: – Often fails to achieve needed improvements in contracts Management Service Organizations (MSOs) • Service bureau • Advantage: – Binds physician closer to hospital • Disadvantage: – Physician remains too independent Foundation Model • Can either own provider organizations or contract for services • Governed by Board & not dominated by any provider group • Advantages: – High level of structural integration – Exerts considerable influence over providers – Has resources to recruit & compensate needed providers Foundation Model • Disadvantages: – Primary: physicians only linked indirectly to mission of Foundation – Conflicts frequently occur between Foundation & providers – Non-profit status of Foundation • Must constantly prove it is a benefit to community to retain non-profit status Physician Ownership Model • Physicians hold significant portion of ownership • Functions like an MSO & a Staff Model HMO • Advantage: – Total alignment of goals of the group & the IDS • Disadvantage: – Amount of resources required to develop & operate the system Virtual Integration • Independent parties pretending to be integrated to maximize reimbursement potential • Advantage: – “Virtually” none • Disadvantage: – Conflicts & dishonesty – “Virtually” non-existent relationship Assuming An Insurance Function • IDS becomes both a provider & a licensed payer (insurer) • Can employ capitation &/or negotiated rates • Advantage: – “One stop shopping” Assuming An Insurance Function • Disadvantage: – May not possess insurance experience • Potentially disastrous – Anti-trust implications – Must maintain licensure – Regulated by State Government’s Insurance Department Medical Practice Organization Integration Potentials TYPE OF PRACTICE INTEGRATION POTENTIAL Individual Practice Individual Practice w/Shared Overhead PPO IPA PHO Group Practice w/o Walls Single Specialty Group Multi-Specialty Group Practice Management Association None Partial Partial Partial Partial Partial Full Full Full Governance & Management Control Functions of the Governing Board • Stakeholder v. Shareholder • Fiduciary Duty of For-Profit vs. Not For Profit Governing Board – The Stern Case (1963) • Board members diverted hospital funds to finance their own business venture – Duty of trust • Not for profit governing board has a higher duty of trust Functions of the Governing Board • Special duties of MCO governance – Quality management – Employment of CEO Functions of the Governing Board • Essential committee functions – Operations – Personnel – Planning – CQI – Compliance – Pharmacy & therapeutics • Liability Exposures of MCOs Primary Care In Open & Closed Panel Plans Definition of Primary Care • • • • Internal medicine Family practice Pediatrics OB/GYN – Represents a hybrid between primary & specialty care Sources of Candidates for Open & Closed Panel Plans • Personal Relationships • Physicians with privileges at panel authorized hospitals • Physicians working for competitors • Local/County Medical Society Sources of Candidates for Open & Closed Panel Plans • Yellow Pages • Health Claims Data to Eliminate Docs With Undesirable Traits –i.e. overbilling, double billing, excess billings Types of Contracting Situations • Individual Physician – Most common in open panels – Advantages: • Direct relationship with physicians • Loss of 1 physician not consequential Types of Contracting Situations • Small Group – Advantage: • Efforts net multiples of physicians – Disadvantage: • Ending relationship costs multiple losses of physicians –Particularly sticky with groups having several competent physicians & 1 incompetent physician Types of Contracting Situations • Multi Specialty – Advantage: • Obtain expertise in several areas – Disadvantage: • Costs of retaining usually high Types of Contracting Situations • Individual Practice Association – Advantage: • Large number of physicians can be secured in one effort – Disadvantages: • Functions as a bargaining unit • Often have to accept some less adequate physicians Types of Contracting Situations • IDS – Advantage: • Have network in rapid order – Disadvantage: • Goals of physicians often not consistent with IDS Types of Contracting Situations • Medical School Faculty Practice Plans – Advantage: • Practice top quality medicine – Disadvantages: • Less cost effective • Use of interns, residents, & medical students • Not adept at case management Reasons For Dissatisfaction Of Physicians In Open & Closed Panel Plans • Autonomy Issues • Stress of dealing with demanding Patients • High demands for productivity • On-call requirements • Spousal unhappiness Reasons for Removing Physicians From Panels • Physician unable to work within system • Panel too large • Costly practice style • Practices poor medicine Compensation of Physicians Reasons To Capitate • From standpoint of MCO – Puts physician at risk • Most powerful reason – Eliminates FFS incentive to overutilize – Easier & less costly to administer Reasons To Capitate • From standpoint of provider – Ensures cash flow • Most powerful reason – Profit margin under capitation often greater – Eliminates fee disagreements Problems With Capitation • Adverse selection – Most common problem • Perception that capitation income is “passive income” • Inappropriate underutilization Determination Of Fees • Percentage of usual, customary, & reasonable rates – Advantage: • Easy to obtain – Disadvantage: • Physicians can greater fees by same percent • Relative Value Scales • Global Fees Determination Of Fees • APGs/APCs • FFS – Losing ground due to churning & upcoding Determination Of Fees • Incentives – Bonus based on production • Most common method – Advantages: • Rewards productive physician • Helps modify bad habits • Documents low productive capacity – Disadvantages: • Illegal & unethical behavior (churning, buffing, turfing, upcoding, phantom billing, unbundling) Contracting With Hospitals Types of Reimbursement Arrangements • • • • • % of charges Discounts Per Diems Sliding Scales Differential as a function of # of days in hospital • DRGs Types of Reimbursement Arrangements • Service type differential – Simple vs. Complex • • • • Case Rates Capitation % of premium revenue Bed leasing – Distinct part Types of Reimbursement Arrangements • Periodic Interim payments • Performance based incentives – Withholds – Quality incentives • Outpatient procedures – APGs/APCs – Bundled rates – Discounts Managed Care in Academic Health Centers External Challenges To Academic Health Centers • Changes in market mechanisms – Managed care has rendered AHCs noncompetitive – PPS (DRGs) has cut into revenue base • Employers now select health plans as a function of cost External Challenges To Academic Health Centers • Diminished revenues as a function of failed health reform in 1993 • Loss of federal support for residency training Internal Challenges To AHCs • Traditional culture – Physician is main focus which is at odds with managed care which emphasizes extenders – AHCs de-emphasize primary care – AHCs are contra-positioned to outcomes-based treatment decisions – AHCs do not emphasize sound business practices – “Quality” patient care is a battle cry Internal Challenges To AHCs • Transition market – AHCs see themselves as a revenue producer – Manage care sees AHCs as a cost center Internal Challenges To AHCs • Information structure – Dearth of contemporary cost information is a barrier to competitiveness – Cannot assume financial risk because costs largely are not controlled Learning From The Few Successful AHCs • Must find ways to maintain patient base – Network with non-academic hospitals – Develop cost effective primary care programs – Tie specialty services as support to primary care Learning From The Few Successful AHCs • Transform traditional culture – Physicians must be held accountable – Identify & compete for funding streams – Centralize capital allocations • Autonomy failed – Develop outcomes based treatment Learning From The Few Successful AHCs • Reestablish education & research – Maintain cost effectiveness as a requirement – Network with MCOs • Linking point could be outcomes research • Tertiary care Learning From The Few Successful AHCs • Reestablish education & research (cont.) – Network with traditional health insurance carriers • Development competitive treatment programs • Form specialty treatment networks Managing Basic MedicalSurgical Utilization Purpose of Managed Care Manage utilization & thereby reduce health care costs Methods To Achieve Control Of Physician Services • Single visit authorizations • Prohibit secondary referrals & authorizations • Review reasons for referrals • Control self referrals by plan members Methods To Achieve Control Of Physician Services • LCM by specialty physicians – LCM process & relationship to specific stop loss • Compensation & financial incentives for specialists Methods Of Decreasing Utilization • Precertification – Notice to concurrent review system case occurring – Ensure care occurs in most appropriate setting – Capture data for financial accruals • Preadmission testing & same day surgery Methods Of Decreasing Utilization • Concurrent review – UM nurse: case manager – Primary care physician – Hospitalier • Retrospective review – After case is concluded Methods Of Decreasing Utilization • Alternatives to acute care hospitalization – SNF – Intermediate Nursing Facility – Subacute Facility Disease Management Goals of DM • • • • Control cost of care per episode Reduce morbidity Improve functional status of patient Improve patient & physician satisfaction • Acquire more meaningful outcome data Goals of DM • Develop improved ability to accept financial risk • Control cost Candidates for DM • • • • • • • Asthma Diabetes (Type 1) AIDS CA Behavioral care ESRD Hypertension Steps In The Start Up Process For DM • Prioritize disease selection – Benchmarking • Flowchart care processes – Case finding & preventive efforts – Education & morbidity reduction – Management of emergencies – Hospitalization – Ambulatory care follow-up Steps In The Start Up Process For DM • Determine patient needs & preferences • Discover cost drivers – Benchmarking • Identify clinical outcome measures – Benchmarking Steps In The Start Up Process For DM • Conduct value optimization studies to document evidence – Benchmarking • Prepare for major information system investment • Define episode duration – Benchmarking Steps In The Start Up Process For DM • Use data to motivate & train physicians – Benchmarking • Restructure financial incentives for physicians as deemed appropriate Managing Utilization of Emergency & Ancillary Services Two Types Of Ancillary Services • Diagnostic • Therapeutic Emergency Services • Importance of emergency room services to a hospital Managed Behavioral Care Services Special Challenges Posed by BCS • Destigmatization – #1 on most lists • Erosion of Social Support System • Increased Societal Complexity & Stress • Advances in Medication & Psychotherapeutic Methods Special Challenges Posed by BCS • Proliferation of Private Hospitals • Tightening of Public Sector BCS Funding • Use of BCS for Personal Development 4 Key Principles of Clinical Treatment • Finding Alternatives to Psychiatric Hospitalization – PHP (day, night, & weekend programs) • Finding Alternatives to Restrictive Treatment of Substance Abuse – PHP & intensive outpatient care Key Principles of Clinical Treatment • Goal Directed Psychotherapy – Cognitive therapy • Crisis Intervention – EAP Key Services in Community Based Programs • Acute inpatient services • Outpatient therapy services – Non-physician directed • Day treatment services – Also evenings & weekends • Emergency services – Triage & referral Key Services in Community Based Programs • Medication clinics – Physician directed • Halfway (3/4) house residential services Key Risk Determinants • Sufficiency of information • Extent of services demand – Degree of chronicity • Large claim risk factors – Adverse selection of group Major Risk Factors In BCS Capitation • Restricted access = underservice • Cost shifting – From BCS to medical • Preparedness to handle capitated care model – Case management • Lack or insufficiency of information – Ill-prepared for capitation • Substandard quality of care Method Of Developing BCS Provider Network • Establish size & scope of network • Assess & determine fees & reimbursement rates • Identify targeted providers • Contact providers • Obtain needed biographical information via applications Method Of Developing BCS Provider Network • Conduct site visits & interviews • Select providers for network Emerging Issues In BCS • Horizontal integration to achieve comprehensive service structure • Develop data to validate service necessity • Legal & ethical values must be established • Control of costs is essential to acceptance Emerging Issues In BCS • Financial incentives adjusted to promote cost effective & quality services • Services accessible to persons of all cultures