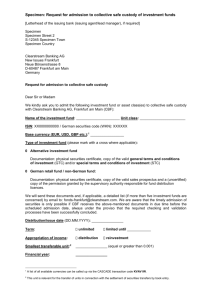

Musteranschreiben Zulassung zur GS, Investmentfonds

Specimen: Request for admission to collective safe custody of shares (equities)

[Letterhead of the issuing bank (issuing agent/lead manager), if required]

Specimen Bank

Specimen Street 2

S-12345 Specimen Town

Specimen Country

Clearstream Banking AG

New Issues Frankfurt

Neue Börsenstrasse 8

D-60487 Frankfurt am Main

Germany

Request for admission to collective safe custody

Dear Sir or Madam

We kindly ask you to admit the following shares (equities) to collective safe custody with Clearstream

Banking AG, Frankfurt am Main (CBF):

Name of the company :

ISIN : XX0000000000 / WKN : XXXXXX

Please select and/or give the required information:

Type of shares: ordinary shares

bearer shares

preference shares

registered shares

Type of securitisation (physical evidence):

No-par value shares / accounting value: EUR 1 (change/adjust accounting value as required)

Par value (nominal value) shares at EUR 1 nominal (change/adjust par/nominal value as required)

Quantity of shares:

Securities certificate numbers: from no. sequential no. to no.

Financial year :

Profit participation: as from

Type of securities certificate: fixed-amount global certificate

‘up to’ global certificate (variable amount)

interim global certificate (scrip)

Individual physical securities certificates: excluded acc. to general terms and conditions

not excluded acc. to general terms and conditions

Coupon sheet: has been issued has not been issued

The request refers to the admission of a newly issued securities class to collective safe custody.

The request refers to the admission of new shares out of a capital increase to collective safe custody; detailed information on the type of capital increase is given below.

Entry in the commercial register: has been completed is scheduled for

Stock exchange listing: Regulated Market

Stock exchange(s)

Admission to listing granted on

First day of quotation on

Open Market (Regulated Unofficial Market) No listing planned

Tax treatment: standard procedure special procedure (please explain)

.

The delivered securities will be credited to CBF account no.:

Page | 1

Specimen: Request for admission to collective safe custody of shares (equities)

We confirm that

the global certificate(s) of the above company has/have been duly and legally signed by [Mr or

Ms A] and [Mr and Ms B];

any endorsement in blank on the back of the global certificate(s) bears (a) legally binding signature(s) of the company;

all formal requirements connected with the above global certificate(s) (to be) delivered have been fulfilled; and

a standard banking compliance check on the issuer (including a ‘know your customer’ (KYC) audit regarding anti-money laundering (AML), terrorism financing and/or (capital market) fraud has been carried out.

Furthermore we declare that

we have an account connection with CBF [no. XXXX] and assumed the function of issuing bank (agent/lead manager) for the securities issue in question;

the following aspects have been duly taken into consideration in the case of contingent capital being evidenced: marking up and marking down of the nominal value in accordance with the currently issued volume will be instructed and settled via this CBF account;

we will act as the principal paying agent for all issue-related transactions carried out via CBF through our CBF account [no. XXXX]; all payments due in connection with the above securities will be settled through this account.

Or alternatively:

[XY bank] will act as the principal paying agent for all issue-related transactions carried out via

CBF through this bank’s CBF account [no. XXXX]; all payments due in connection with the above securities will be settled through this account; separate written confirmation of assumption of the paying agent function will be provided.

Please find enclosed the following documents:

1. a certified excerpt from the commercial register issued after entry of the current capital increase of the company (in chronological order);

2. a copy of the current version of the company’s articles of association.

Yours faithfully

[legally binding signature] [legally binding signature]

[First name and surname of signatories in block letters or stamp]

Page | 2