Solutions to End-of-Chapter Three Problems

3-1

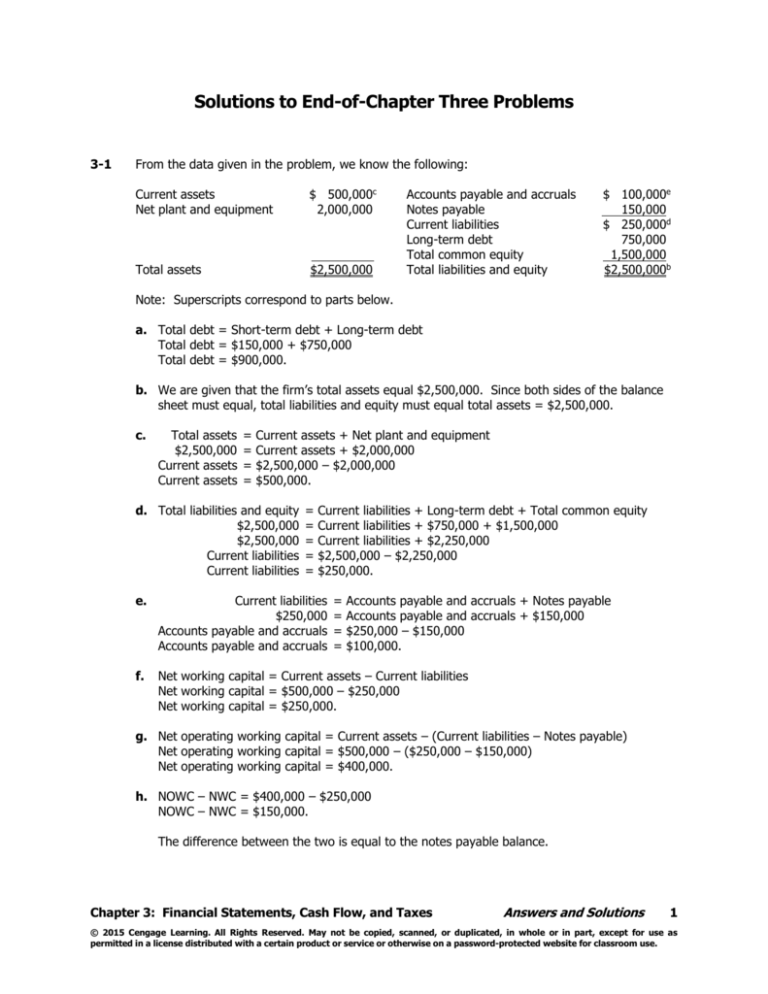

From the data given in the problem, we know the following:

Current assets

Net plant and equipment

$ 500,000c

2,000,000

Total assets

$2,500,000

Accounts payable and accruals

Notes payable

Current liabilities

Long-term debt

Total common equity

Total liabilities and equity

$ 100,000e

150,000

$ 250,000d

750,000

1,500,000

$2,500,000b

Note: Superscripts correspond to parts below.

a. Total debt = Short-term debt + Long-term debt

Total debt = $150,000 + $750,000

Total debt = $900,000.

b. We are given that the firm’s total assets equal $2,500,000. Since both sides of the balance

sheet must equal, total liabilities and equity must equal total assets = $2,500,000.

c.

Total assets

$2,500,000

Current assets

Current assets

=

=

=

=

Current assets + Net plant and equipment

Current assets + $2,000,000

$2,500,000 – $2,000,000

$500,000.

d. Total liabilities and equity

$2,500,000

$2,500,000

Current liabilities

Current liabilities

=

=

=

=

=

Current liabilities + Long-term debt + Total common equity

Current liabilities + $750,000 + $1,500,000

Current liabilities + $2,250,000

$2,500,000 – $2,250,000

$250,000.

e.

Current liabilities

$250,000

Accounts payable and accruals

Accounts payable and accruals

=

=

=

=

Accounts payable and accruals + Notes payable

Accounts payable and accruals + $150,000

$250,000 – $150,000

$100,000.

f.

Net working capital = Current assets – Current liabilities

Net working capital = $500,000 – $250,000

Net working capital = $250,000.

g. Net operating working capital = Current assets – (Current liabilities – Notes payable)

Net operating working capital = $500,000 – ($250,000 – $150,000)

Net operating working capital = $400,000.

h. NOWC – NWC = $400,000 – $250,000

NOWC – NWC = $150,000.

The difference between the two is equal to the notes payable balance.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

1

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3-2

NI = $3,000,000; EBIT = $6,000,000; T = 40%; Interest = ?

Need to set up an income statement and work from the bottom up.

EBIT

Interest

EBT

Taxes (40%)

NI

$6,000,000

1,000,000

$5,000,000

2,000,000

$3,000,000

EBT =

$3,000,000 $3,000,000

(1 T)

0.6

Interest = EBIT – EBT = $6,000,000 – $5,000,000 = $1,000,000.

3-3

EBITDA

Depreciation

EBIT

Interest

EBT

Taxes (40%)

NI

$7,500,000

2,500,000

$5,000,000

2,000,000

$3,000,000

1,200,000

$1,800,000

3-4

NI = $50,000,000; R/EY/E = $810,000,000; R/EB/Y = $780,000,000; Dividends = ?

R/EB/Y + NI – Div

$780,000,000 + $50,000,000 – Div

$830,000,000 – Div

$20,000,000

=

=

=

=

(Given)

Deprec. = EBITDA – EBIT = $7,500,000 – $5,000,000

EBIT = EBT + Int = $3,000,000 + $2,000,000

(Given)

$1,800 ,000 $1,800 ,000

(1 T)

0.6

Taxes = EBT × Tax rate

(Given)

R/EY/E

$810,000,000

$810,000,000

Div.

= (P0 Number of common shares) BV of common equity

= $60X $500,000,000

= $60X

= 10,500,000 common shares.

3-5

MVA

$130,000,000

$630,000,000

X

3-6

Book value of equity = $35,000,000.

Price per share (P0) = $30.00.

Common shares outstanding = 2,000,000 shares.

Market value of equity = P0 × Common shares outstanding

= $30 × 2,000,000

= $60,000,000.

MVA = Market value of equity – Book value of equity

= $60,000,000 – $35,000,000

= $25,000,000.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

2

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3-7

After -tax %

Total

cost of

EVA = EBIT(1 – T) – invested

capital

capital

EVA = $3,000,000(0.6) – [$20,000,000 × 0.08]

EVA = $1,800,000 – $1,600,000

EVA = $200,000.

3-8

Statements b and d will decrease the amount of cash on a company’s balance sheet.

Statement a will increase cash through the sale of common stock. Selling stock provides cash

through financing activities. On one hand, Statement c would decrease cash; however, it is also

possible that Statement c would increase cash, if the firm receives a tax refund for taxes paid in

a prior year.

3-9

Ending R/E= Beg. R/E Net income Dividends

$278,900,000 = $212,300,000 Net income $22,500,000

$278,900,000 = $189,800,000 Net income

Net income = $89,100,000.

3-10

Tax rate

After-tax % cost of capital

Total invested capital

35%

9%

$15,000,000

Sales

Operating costs (including depreciation)

EBIT

$22,500,000

18,000,000

$ 4,500,000

EVA =

=

=

=

3-11

(EBIT)(1 – T) − (Total invested capital)(After-tax % cost of capital)

$4,500,000(0.65) – ($15,000,000)(0.09)

$2,925,000 − $1,350,000

$1,575,000.

a. From the statement of cash flows the change in cash must equal cash flow from operating

activities plus long-term investing activities plus financing activities. First, we must identify

the change in cash as follows:

Cash at the end of the year

– Cash at the beginning of the year

Change in cash

–

$25,000

55,000

-$30,000

The sum of cash flows generated from operations, investment, and financing must equal a

negative $30,000. Therefore, we can calculate the cash flow from operations as follows:

CF from operations CF from investing CF from financing = in cash

CF from operations $250,000 $170,000 = -$30,000

CF from operations = $50,000.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

3

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

b. Since we determined that the firm’s cash flow from operations totaled $50,000 in Part a of

this problem, we can now calculate the firm’s net income as follows:

Increase in

Increase in

accrued A/R and

liabilitie s

inventory

NI + $10,000 + $25,000 – $100,000

NI – $65,000

NI

NI Depreciati on

3-12

I.

3-13

=

CF from

operations

= $50,000

= $50,000

= $115,000.

Statement of Cash Flows

Operating Activities

Net income

Depreciation

NWC

Net cash provided by operating activities

$5,000,000

450,000

0

$5,450,000

II. Long-Term Investing Activities

Additions to property, plant, and equipment

Net cash used in investing activities

($5,500,000)

($5,500,000)

III. Financing Activities

Increase in long-term debt

Payment of common dividends

Net cash provided by financing activities

$1,000,000

(750,000)

$ 250,000

IV. Summary

Net increase in cash (Net sum of I., II., and III.)

Cash at beginning of year

Cash at end of year

$ 200,000

100,000

$ 300,000

a. NOWC2013 = Total CA – (Current liabilities – Notes payable)

= $59,000 – ($20,150 – $5,150)

= $44,000.

NOWC2014 = $72,125 – ($25,100 – $6,700)

= $53,725.

b. FCF2014 = [EBIT(1 – T) + Deprec.] – [Capital expenditures + NOWC]

= [$39,000(1 – 0.4) + $5,000] – [$8,000 + $9,725]

= $10,675.

Note: To arrive at capital expenditures you add depreciation to the change in net FA, so

Capital expenditures = $5,000 + $3,000 = $8,000.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

4

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

c.

Balances, 12/31/13

2014 Net income

Cash dividends

Addition (Subtraction)

to retained earnings

Balances, 12/31/14

Statement of Stockholders’ Equity, 2014

Common Stock

Retained

Shares

Amount

Earnings

5,000

$50,000

$20,850

22,350

(11,175)

5,000

$50,000

Total Stockholders’

Equity

$70,850

11,175

$82,025

$32,025

d. From Bailey’s 2014 financial statements, you can determine EBIT = $39,000 and Tax rate =

40%. NOWC2014 was calculated in Part a.

Total invested capital2014 = Notes payable + Long-term debt + Common equity

= $6,700 + $15,000 + $82,025

= $103,725.

After-tax % cost of capital = 10% (given in problem)

EVA = EBIT(1 – T) – (Total invested capital)( After-tax % cost of capital)

= $39,000(0.6) – ($103,725)(0.10)

= $23,400 – $10,372.50

= $13,027.50.

e. MVA = (P0 × Number of shares outstanding) – BV of common equity

MVA = ($20 × $5,000) – $82,025

MVA = $100,000 – $82,025

MVA = $17,975.

3-14

Working up the income statement you can calculate the new sales level would be $12,681,482.

Sales

Operating costs (excl. Deprec.)

Depreciation

EBIT

Interest

EBT

Taxes (40%)

Net income

3-15

a.

Balances, 12/31/13

2014 Net income

Cash dividends

Addition to RE

Balances, 12/31/14

$12,681,482

6,974,815

880,000

$ 4,826,667

660,000

$ 4,166,667

1,666,667

$ 2,500,000

S – 0.55S – Deprec. = EBIT

$12,681,482 0.55

$800,000 1.10

$4,166,667 + $660,000

$600,000 1.10

$2,500,000/(1 0.4)

$4,166,667 0.40

Common Stock

Shares

Amount

100,000,000

$260,000,000

Retained

Earnings

$1,374,000,000

372,000,000

(146,000,000)

100,000,000

$1,600,000,000

$260,000,000

Total Stockholders’

Equity

$1,634,000,000

226,000,000

$1,860,000,000

The retained earnings balance on December 31, 2014 is $1,600,000,000. To arrive at this

statement, you must work up the retained earnings column because you don’t know the

12/31/13 retained earnings balance.

b. $1,600 million. (Look at retained earnings balance.)

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

5

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

c. Cash + Equivalents = $15 million.

d. Total current liabilities = $620 million.

3-16

a.

Net operating

= Current assets – (Current liabilities – Notes payable)

working capital 2013

= $360,000,000 – ($201,500,000 – $51,500,000)

= $360,000,000 – $150,000,000 = $210,000,000.

Net operating

working capital 2014 =$372,000,000 – ($247,000,000 – $67,000,000)

= $372,000,000 – $180,000,000 = $192,000,000.

b. FCF2014 =

=

=

=

=

[EBIT(1 – T) + Deprec.] – [Cap. expend. + NOWC]

[$150,000,000(0.6) + $30,000,000] – [$80,000,000 – $18,000,000]

[$90,000,000 + $30,000,000] – [$80,000,000 – $18,000,000]

$120,000,000 – $62,000,000

$58,000,000.

Note that depreciation must be added to Net P&E to arrive at capital expenditures.

c. The large increase in dividends for 2014 can most likely be attributed to a large increase in

free cash flow from 2013 to 2014, since FCF represents the amount of cash available for

payment to stockholders after the company has made all investments in fixed assets, new

products, and working capital necessary to sustain the business.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

6

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Solutions to End-of-Chapter Problems

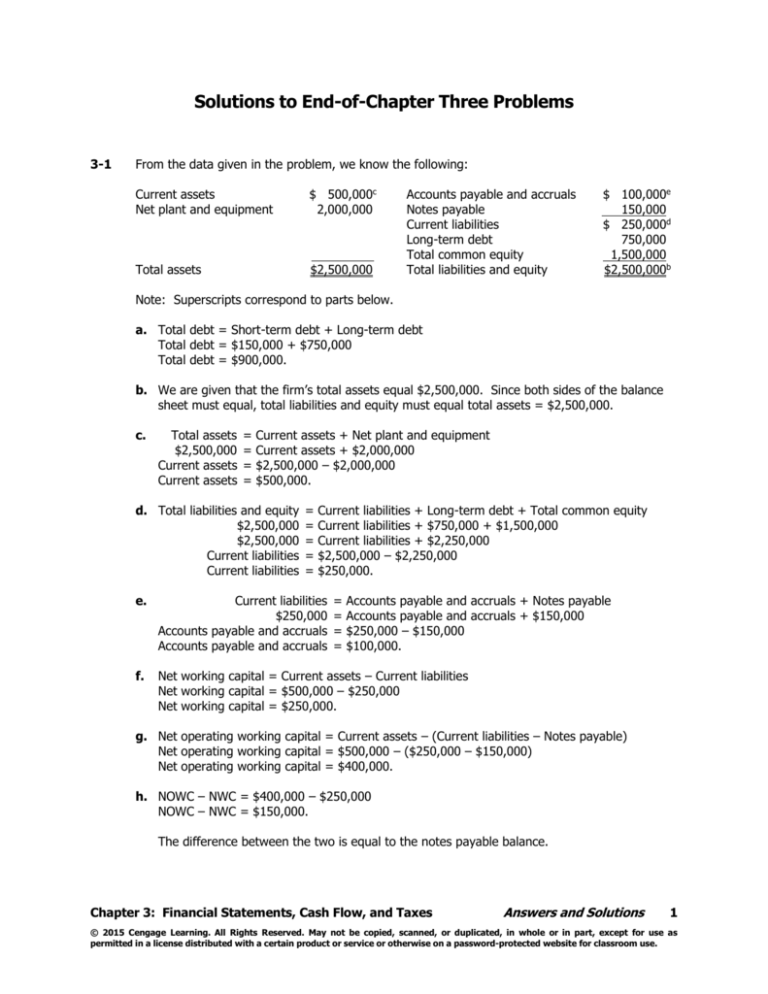

3-1

From the data given in the problem, we know the following:

Current assets

Net plant and equipment

$ 500,000c

2,000,000

Total assets

$2,500,000

Accounts payable and accruals

Notes payable

Current liabilities

Long-term debt

Total common equity

Total liabilities and equity

$ 100,000e

150,000

$ 250,000d

750,000

1,500,000

$2,500,000b

Note: Superscripts correspond to parts below.

a. Total debt = Short-term debt + Long-term debt

Total debt = $150,000 + $750,000

Total debt = $900,000.

b. We are given that the firm’s total assets equal $2,500,000. Since both sides of the balance

sheet must equal, total liabilities and equity must equal total assets = $2,500,000.

c.

Total assets

$2,500,000

Current assets

Current assets

=

=

=

=

Current assets + Net plant and equipment

Current assets + $2,000,000

$2,500,000 – $2,000,000

$500,000.

d. Total liabilities and equity

$2,500,000

$2,500,000

Current liabilities

Current liabilities

=

=

=

=

=

Current liabilities + Long-term debt + Total common equity

Current liabilities + $750,000 + $1,500,000

Current liabilities + $2,250,000

$2,500,000 – $2,250,000

$250,000.

e.

Current liabilities

$250,000

Accounts payable and accruals

Accounts payable and accruals

=

=

=

=

Accounts payable and accruals + Notes payable

Accounts payable and accruals + $150,000

$250,000 – $150,000

$100,000.

f.

Net working capital = Current assets – Current liabilities

Net working capital = $500,000 – $250,000

Net working capital = $250,000.

g. Net operating working capital = Current assets – (Current liabilities – Notes payable)

Net operating working capital = $500,000 – ($250,000 – $150,000)

Net operating working capital = $400,000.

h. NOWC – NWC = $400,000 – $250,000

NOWC – NWC = $150,000.

The difference between the two is equal to the notes payable balance.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

7

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3-2

NI = $3,000,000; EBIT = $6,000,000; T = 40%; Interest = ?

Need to set up an income statement and work from the bottom up.

EBIT

Interest

EBT

Taxes (40%)

NI

$6,000,000

1,000,000

$5,000,000

2,000,000

$3,000,000

EBT =

$3,000,000 $3,000,000

(1 T)

0.6

Interest = EBIT – EBT = $6,000,000 – $5,000,000 = $1,000,000.

3-3

EBITDA

Depreciation

EBIT

Interest

EBT

Taxes (40%)

NI

$7,500,000

2,500,000

$5,000,000

2,000,000

$3,000,000

1,200,000

$1,800,000

3-4

NI = $50,000,000; R/EY/E = $810,000,000; R/EB/Y = $780,000,000; Dividends = ?

R/EB/Y + NI – Div

$780,000,000 + $50,000,000 – Div

$830,000,000 – Div

$20,000,000

=

=

=

=

(Given)

Deprec. = EBITDA – EBIT = $7,500,000 – $5,000,000

EBIT = EBT + Int = $3,000,000 + $2,000,000

(Given)

$1,800 ,000 $1,800 ,000

(1 T)

0.6

Taxes = EBT × Tax rate

(Given)

R/EY/E

$810,000,000

$810,000,000

Div.

= (P0 Number of common shares) BV of common equity

= $60X $500,000,000

= $60X

= 10,500,000 common shares.

3-5

MVA

$130,000,000

$630,000,000

X

3-6

Book value of equity = $35,000,000.

Price per share (P0) = $30.00.

Common shares outstanding = 2,000,000 shares.

Market value of equity = P0 × Common shares outstanding

= $30 × 2,000,000

= $60,000,000.

MVA = Market value of equity – Book value of equity

= $60,000,000 – $35,000,000

= $25,000,000.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

8

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

3-7

After -tax %

Total

cost of

EVA = EBIT(1 – T) – invested

capital

capital

EVA = $3,000,000(0.6) – [$20,000,000 × 0.08]

EVA = $1,800,000 – $1,600,000

EVA = $200,000.

3-8

Statements b and d will decrease the amount of cash on a company’s balance sheet.

Statement a will increase cash through the sale of common stock. Selling stock provides cash

through financing activities. On one hand, Statement c would decrease cash; however, it is also

possible that Statement c would increase cash, if the firm receives a tax refund for taxes paid in

a prior year.

3-9

Ending R/E= Beg. R/E Net income Dividends

$278,900,000 = $212,300,000 Net income $22,500,000

$278,900,000 = $189,800,000 Net income

Net income = $89,100,000.

3-10

Tax rate

After-tax % cost of capital

Total invested capital

35%

9%

$15,000,000

Sales

Operating costs (including depreciation)

EBIT

$22,500,000

18,000,000

$ 4,500,000

EVA =

=

=

=

3-11

(EBIT)(1 – T) − (Total invested capital)(After-tax % cost of capital)

$4,500,000(0.65) – ($15,000,000)(0.09)

$2,925,000 − $1,350,000

$1,575,000.

a. From the statement of cash flows the change in cash must equal cash flow from operating

activities plus long-term investing activities plus financing activities. First, we must identify

the change in cash as follows:

Cash at the end of the year

– Cash at the beginning of the year

Change in cash

–

$25,000

55,000

-$30,000

The sum of cash flows generated from operations, investment, and financing must equal a

negative $30,000. Therefore, we can calculate the cash flow from operations as follows:

CF from operations CF from investing CF from financing = in cash

CF from operations $250,000 $170,000 = -$30,000

CF from operations = $50,000.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

9

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

b. Since we determined that the firm’s cash flow from operations totaled $50,000 in Part a of

this problem, we can now calculate the firm’s net income as follows:

Increase in

Increase in

accrued A/R and

liabilitie s

inventory

NI + $10,000 + $25,000 – $100,000

NI – $65,000

NI

NI Depreciati on

3-12

I.

3-13

=

CF from

operations

= $50,000

= $50,000

= $115,000.

Statement of Cash Flows

Operating Activities

Net income

Depreciation

NWC

Net cash provided by operating activities

$5,000,000

450,000

0

$5,450,000

II. Long-Term Investing Activities

Additions to property, plant, and equipment

Net cash used in investing activities

($5,500,000)

($5,500,000)

III. Financing Activities

Increase in long-term debt

Payment of common dividends

Net cash provided by financing activities

$1,000,000

(750,000)

$ 250,000

IV. Summary

Net increase in cash (Net sum of I., II., and III.)

Cash at beginning of year

Cash at end of year

$ 200,000

100,000

$ 300,000

a. NOWC2013 = Total CA – (Current liabilities – Notes payable)

= $59,000 – ($20,150 – $5,150)

= $44,000.

NOWC2014 = $72,125 – ($25,100 – $6,700)

= $53,725.

b. FCF2014 = [EBIT(1 – T) + Deprec.] – [Capital expenditures + NOWC]

= [$39,000(1 – 0.4) + $5,000] – [$8,000 + $9,725]

= $10,675.

Note: To arrive at capital expenditures you add depreciation to the change in net FA, so

Capital expenditures = $5,000 + $3,000 = $8,000.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

10

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

c.

Balances, 12/31/13

2014 Net income

Cash dividends

Addition (Subtraction)

to retained earnings

Balances, 12/31/14

Statement of Stockholders’ Equity, 2014

Common Stock

Retained

Shares

Amount

Earnings

5,000

$50,000

$20,850

22,350

(11,175)

5,000

$50,000

Total Stockholders’

Equity

$70,850

11,175

$82,025

$32,025

d. From Bailey’s 2014 financial statements, you can determine EBIT = $39,000 and Tax rate =

40%. NOWC2014 was calculated in Part a.

Total invested capital2014 = Notes payable + Long-term debt + Common equity

= $6,700 + $15,000 + $82,025

= $103,725.

After-tax % cost of capital = 10% (given in problem)

EVA = EBIT(1 – T) – (Total invested capital)( After-tax % cost of capital)

= $39,000(0.6) – ($103,725)(0.10)

= $23,400 – $10,372.50

= $13,027.50.

e. MVA = (P0 × Number of shares outstanding) – BV of common equity

MVA = ($20 × $5,000) – $82,025

MVA = $100,000 – $82,025

MVA = $17,975.

3-14

Working up the income statement you can calculate the new sales level would be $12,681,482.

Sales

Operating costs (excl. Deprec.)

Depreciation

EBIT

Interest

EBT

Taxes (40%)

Net income

3-15

a.

Balances, 12/31/13

2014 Net income

Cash dividends

Addition to RE

Balances, 12/31/14

$12,681,482

6,974,815

880,000

$ 4,826,667

660,000

$ 4,166,667

1,666,667

$ 2,500,000

S – 0.55S – Deprec. = EBIT

$12,681,482 0.55

$800,000 1.10

$4,166,667 + $660,000

$600,000 1.10

$2,500,000/(1 0.4)

$4,166,667 0.40

Common Stock

Shares

Amount

100,000,000

$260,000,000

Retained

Earnings

$1,374,000,000

372,000,000

(146,000,000)

100,000,000

$1,600,000,000

$260,000,000

Total Stockholders’

Equity

$1,634,000,000

226,000,000

$1,860,000,000

The retained earnings balance on December 31, 2014 is $1,600,000,000. To arrive at this

statement, you must work up the retained earnings column because you don’t know the

12/31/13 retained earnings balance.

b. $1,600 million. (Look at retained earnings balance.)

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

11

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

c. Cash + Equivalents = $15 million.

d. Total current liabilities = $620 million.

3-16

a.

Net operating

= Current assets – (Current liabilities – Notes payable)

working capital 2013

= $360,000,000 – ($201,500,000 – $51,500,000)

= $360,000,000 – $150,000,000 = $210,000,000.

Net operating

working capital 2014 =$372,000,000 – ($247,000,000 – $67,000,000)

= $372,000,000 – $180,000,000 = $192,000,000.

b. FCF2014 =

=

=

=

=

[EBIT(1 – T) + Deprec.] – [Cap. expend. + NOWC]

[$150,000,000(0.6) + $30,000,000] – [$80,000,000 – $18,000,000]

[$90,000,000 + $30,000,000] – [$80,000,000 – $18,000,000]

$120,000,000 – $62,000,000

$58,000,000.

Note that depreciation must be added to Net P&E to arrive at capital expenditures.

c. The large increase in dividends for 2014 can most likely be attributed to a large increase in

free cash flow from 2013 to 2014, since FCF represents the amount of cash available for

payment to stockholders after the company has made all investments in fixed assets, new

products, and working capital necessary to sustain the business.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

12

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Chapter 3: Financial Statements, Cash Flow, and Taxes

Answers and Solutions

13

© 2015 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.